What is the monthly premium for AARP Medicare Supplement?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

Does AARP Medicare Supplement cover deductible?

AARP Medicare Supplement Plan B Plan B covers each of the benefits offered under Plan A. Additionally, it covers 100% of your Medicare Part A deductible. In 2020, the Part A deductible is $1,408.Jan 4, 2022

What is the cost of AARP Medicare Advantage plan?

About 7 out of 10 of AARP's Medicare Advantage plans offer $0 premiums. Of AARP plans that have a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $112.

What is the difference between AARP Medicare Complete and AARP Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What does AARP supplemental cover?

It pays 50 percent of mental health services and 100% of some preventive services. Medigap plans cover all or part of your share of these services – 20 percent of the Medicare-approved amount for doctor services and 50 percent for mental health services.

Does AARP cover Medicare copay?

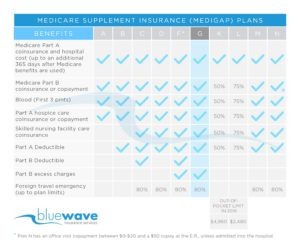

Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, and deductibles. Each plan varies in terms of coverage and cost.

What is the difference between Medicare Plan C and Plan G?

The only difference between Plan C and Plan G is coverage for your Part B Deductible.Jan 26, 2022

Why does AARP recommend UnitedHealthcare?

From our long-standing relationship with AARP to our strength, stability, and decades of service, UnitedHealthcare helps make it easier for Medicare beneficiaries to live a happier, healthier life.

Why does AARP endorse UnitedHealthcare?

What is AARP Medicare Supplement insurance? AARP Medicare Supplement plans are insured and sold by private insurance companies like UnitedHealthcare to help limit the out-of-pocket costs associated with Medicare Parts A and B.

Which two Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.Jun 2, 2021

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the biggest disadvantage of Medicare Advantage?

The primary advantage is the monthly premium, which is generally lower than Medigap plans. The top disadvantages are that you must use provider networks and the copays can nickel and dime you to death.Dec 12, 2021