How much is an AARP Medicare Supplement plan?

What are the top 3 Medicare supplement plans?

How much is the monthly premium for Medicare supplement?

Which Medicare supplement plan has the highest level of coverage?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the difference between Plan G and high deductible plan G?

Does Medicare Part G cover prescriptions?

Does Medigap have an out-of-pocket maximum?

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Do Medigap premiums vary by state?

What is the deductible for Plan G in 2022?

Do Medigap premiums increase with age?

Are Medicare supplement plans being phased out?

What is a premium?

A premium is a set amount (often monthly) you must pay for coverage.

Which costs do I share with Medicare or my plan?

Deductible:This is a set amount that you pay out of pocket for covered services before Medicare,your Medicare Advantage plan, and/or your Prescript...

Are there plans that limit out-of-pocket spending each year?

An out-of-pocket limit is also known as an out-of-pocket maximum. Whether or not there is a limit depends on which type of plan you have.Original M...

What costs can I expect for 2020?

Depending on which type of coverage you have, your costs may be different.Original Medicare:To get an idea of 2020 costs, you can visit Medicare 20...

What if I need help paying Medicare costs?

There are several programs that help pay Medicare costs. Unfortunately, many people who qualify never sign up. Don’t hesitate to apply. Income and...

Is AARP supplemental insurance good?

A supplemental insurance plan from AARP/UnitedHealthcare is a good value. It can help you reduce your out-of-pocket costs for medical care, and it...

Is AARP the same as UnitedHealthcare?

An AARP Medicare policy gives you insurance through UnitedHealthcare. There is a business agreement between the two companies where AARP provides m...

Does AARP pay the Medicare deductible?

Deductible coverage will vary based on the plan you choose. The Medicare Part A deductible is fully covered by Medigap Plan B, D, G and N, and it's...

What is AARP Medicare Supplement Plan F?

Medicare Supplement Plan F has the highest enrollment and very strong coverage, but it's only available to those who were eligible for Medicare bef...

How many kinds of costs are there for Medicare?

ON SCREEN TEXT: There are four kinds of costs you may pay with all Medicare plans.

What is Medicare Advantage?

Medicare Advantage Plans combine Part A (hospital insurance) and Part B (medical insurance) in one plan and usually include prescription drug coverage. These plans offer additional benefits beyond Original Medicare.

What happens if you miss your Medicare enrollment?

Missing your Initial Enrollment Period can be costly. Medicare Part A, Part B and Part D may charge premium penalties if you miss your initial enrollment dates, unless you qualify for a Medicare Special Enrollment Period.

What is Medicare Savings Program?

Medicare Savings Programs help pay Original Medicare (Parts A and B) premiums, deductibles, and coinsurance. You automatically qualify for the Extra Help program (see above) if you qualify for a Medicare Savings Program.

How much does Medicare Part B pay?

The amount you may be required to pay as your share for the cost of a covered service. For example, Medicare Part B pays about 80% of the cost of a covered medical service and you would pay the rest.

What is Medicare premium?

ON SCREEN TEXT: 1 Premiums A fixed amount you pay to Medicare, a private insurance company, or both. Premiums are usually charged monthly and can change each year.

How often do you have to pay the penalty for Part B?

In most cases, you have to pay the penalty every month for as long as you have Part B.

Medicare Supplement Insurance Costs In Pennsylvania Vary By 103 Percent

The difference between the least costly and most expensive Medicare Supplement insurance policy in major cities across Pennsylvania can vary by as much as 103.5 percent. Those are the findings of the 2018 Medigap Price Index published by the American Association for Medicare Supplement Insurance (AAMSI), an industry trade organization.

Find Local Pennsylvania Medicare Supplement Agents

The Association provides free access to a national Find A Local Medicare Insurance Agent online directory providing information on nearly 1,000 professionals listed by Zip Code. No information need be entered to access the director at the Association’s website, www.MedicareSupp.org.

How much does it cost to enroll in AARP?

Luckily, that’s simple and inexpensive to do — a membership costs about $16 per year. Next, pay careful attention to your enrollment period.

What is AARP insurance?

AARP is simply a different branding of UnitedHealthcare policies. AARP does get to choose what UnitedHealthcare plans feature the AARP name. Agents who offer AARP Medicare Supplement plans undergo additional training to understand beneficiaries’ needs and how to match them with the best Medicare product (AARP offers Medicare Advantage plans as well as Medicare Supplement plans). Other extra benefits AARP plan members receive include:

Why are my Medicare Supplement ratings low?

Note: Some low ratings are due to customer service issues, but many of them are coverage complaints. Since Medicare Supplement coverage limits are set by the government — not AARP or UnitedHealthcare — there’s little the insurance company can do to remedy those issues.

What is Medicare Supplement Plan?

A Medicare Supplement plan helps you cover costs such as deductibles, coinsurance, copays, and extended hospital care. iStock. AARP has joined forces with UnitedHealthcare, one of the largest insurance providers in the country.

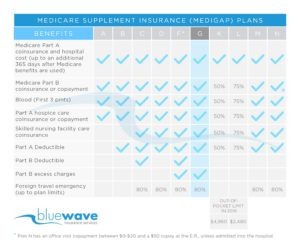

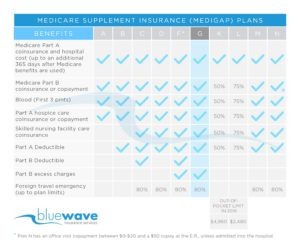

What percentage of Medicare does Plan K cover?

To offset this coverage, Plans K and L don’t cover any Medicare services at 100 percent. Plan K covers some benefits at 50 percent, and Plan L covers some benefits at 75 percent. Your travel plans can also help you narrow down your choice of Medicare Supplement plans.

What is the most comprehensive Medicare Supplement plan?

All carriers who offer Medicare Supplement plans are required to offer at least Plan A, so that will be an option for you no matter where you live. Plans C and F are the most comprehensive plans, but they are only available to beneficiaries who were eligible for Medicare prior to January 1, 2020.

When is the best time to enroll in Medicare Supplement?

Next, pay careful attention to your enrollment period. The best time to join a Medicare Supplement plan — AARP or otherwise — is during your Initial Enrollment Period (IEP). During this time, you are guaranteed to be accepted into a Medicare Supplement plan, regardless of any health problems. Your Initial Enrollment Period begins three months before your 65th birthday month, includes your birthday month, and ends three full months after your birthday month.

How much does it cost to join AARP?

Membership costs are minimal at only $16 per year.

What is AARP insurance?

An AARP Medicare policy gives you insurance through UnitedHealthcare. There is a business agreement between the two companies where AARP provides marketing and endorsement in exchange for a portion of what policyholders pay.

What is a Medigap policy?

Medigap policies give you additional benefits on top of Original Medicare (Parts A and B). These supplemental plans can reduce your out-of-pocket expenses by covering deductibles, coinsurance or other medical expenses. The level of coverage will depend on the plan you select.

Why is it so hard to compare insurance plans?

Because of the variable plan structures, it can be difficult to compare costs, and the most accurate comparison will be based on insurance quotes for your location and situation . In states where prices change as you age, the different formulas for price increases can affect your total lifetime costs. For example, a 65-year-old woman may pay more for AARP Medicare Supplement than for a similar plan from Humana or BlueCross BlueShield. However, in this case, AARP plans have slower price increases. By age 85, AARP Medigap is cheaper than Humana, Cigna and BlueCross BlueShield.

How much does Medigap increase each year?

This pricing structure is unique to AARP, and sample Medigap policies from Humana have a steady 3% increase each year.

Why do supplemental plans vary?

Costs for supplemental plans vary widely. To a large degree, this is due to state differences in pricing regulations.

Is AARP a good Medicare plan?

Despite the large price differences, AARP Medicare Supplement plans are usually a good value. For example, a 65-year-old may pay slightly more for an AARP Medigap plan, but the slower age-based price increases could mean they'll have the cheapest plan when they're in their 80s and 90s. This reduces the total lifetime spending.

What is Medicare premium?

A:A premium is the monthly amount you pay to Medicare or a private insurance plan for your health care and your prescription drug coverage. — Read Full Answer

How to determine Medicare Part B premium?

A:To determine your Medicare Part B premium or Medicare prescription drug coverage income-related adjustment amount, Social Security uses your most recent federal tax return information. — Read Full Answer

What is the deductible for Medicare Part A in 2015?

A:The 2015 deductible for Medicare Part A is $1,260 for each benefit period. — Read Full Answer

How long do you have to notify Medicare of a drug change?

A: If you are taking the drug, Medicare requires your plan to notify you 60 days prior to the change or, at the time of refill, provide you a 60-day supply, if prescribed. — Read Full Answer

What is coinsurance in Medicare?

A: Coinsurance is the amount you may be required to pay for services after you pay any deductibles. This could be a percentage (such as 20 percent) of the Medicare-approved amount or a fixed dollar amount. — Read Full Answer.

How much is the penalty for Part B?

A: Generally, a 10 percent premium penalty will be added to the Part B monthly premium for each 12-month period you could have enrolled but did not. — Read Full Answer

What is the income level for Part D?

A: If your income level is higher than $85,000 for a single person or $170,000 for a married couple filing a joint tax return, you will pay higher Part D premiums. — Read Full Answer

What is AARP Medicare Supplement?

AARP is a nonprofit, membership organization that offers Medigap plans through the UnitedHealthcare insurance company. There are eight AARP Medicare supplement plans you may be able to choose from, although not every plan can be purchased in every state or county.

How many AARP plans are there?

There are eight AARP Medigap plans available, although not every plan can be purchased in every state or ZIP code. Like all Medigap plans, AARP plans are designed to cover some of the gaps in Medicare coverage, such as copays, coinsurance, and deductibles. Each plan varies in terms of coverage and cost.

What are the different Medicare plans?

UnitedHealthcare offers eight standardized Medigap plans to AARP members: 1 Medicare Supplement Plan A. Plan A mainly helps pay for hospital and hospice coverage. 2 Medicare Supplement Plan B. Plan B offers the same coverage as Plan A but also covers your Part A deductible. 3 Medicare Supplement Plan C. Plan C is a very robust plan. It covers the Medicare Part B deductible, skilled nursing facility care, and foreign travel. This plan is available only to people who were eligible for Medicare before January 1, 2020. 4 Medicare Supplement Plan F. Plan F is the most comprehensive plan, covering the Part B excess charges in addition to all of the benefits of Plan C. This plan is also only available to those new to Medicare prior to 2020. 5 Medicare Supplement Plan G. This plan offers coverage for Part B excess charges and foreign emergency care. It is a popular plan for those who are not eligible for plans C or F. 6 Medicare Supplement Plan K. Plan K pays up to 50 percent of your costs after you meet your deductible. It also offers low monthly premiums. 7 Medicare Supplement Plan L. This plan pays up to 75 percent of your costs after you meet the deductible and also has low monthly premiums. 8 Medicare Supplement Plan N. With this plan, you’ll still have copays for Part B services, but they’ll be much lower than what you’d pay without the plan. You’ll also have coverage for hospital care, foreign travel, and more.

What is the difference between Medicare Supplement Plan K and L?

Medicare Supplement Plan K. Plan K pays up to 50 percent of your costs after you meet your deductible. It also offers low monthly premiums. Medicare Supplement Plan L. This plan pays up to 75 percent of your costs after you meet the deductible and also has low monthly premiums. Medicare Supplement Plan N.

What is Medicare Supplement Plan A?

Medicare Supplement Plan A. Plan A mainly helps pay for hospital and hospice coverage.

How many states have Medigap?

There is at least one AARP Medigap plan available for purchase in all 50 states.

How does each insurance plan vary?

Each plan varies in terms of coverage and cost. The cost you pay may be determined by your location.

How much does Medicare pay for days 61 to 90?

For days 61 to 90, the plan pays the $371 per day that Medicare does not cover. Days 91 and beyond are covered at $742 per day while using your 60 lifetime reserve days. Once the lifetime reserve days are used, Plan A continues to pay for all Medicare-eligible expenses that would not otherwise be covered by Medicare for an additional 365 days.

How much is Medicare Part A deductible?

Plan A. Hospital Services for Medicare Part A: With Plan A, you are responsible for the Part A deductible of $1,484 for the first 60 days of hospitalization. This plan includes semiprivate room and board and general nursing costs. For days 61 to 90, the plan pays the $371 per day that Medicare does not cover.

How long does it take to get Medicare if you have Social Security?

You don't have to do anything extra to be enrolled in Medicare if you receive Social Security benefits. The open enrollment period for buying a Medigap plan lasts six months. It begins the month you are enrolled in Medicare Part B and are at least 65.

What does Medicare cover for a blood transfusion?

Plan A covers the first three pints of blood you receive if you need a blood transfusion. It also covers any copay or coinsurance that Medicare may require for outpatient drugs or inpatient respite care during hospice care. 2

What is covered by Plan B after day 100?

After day 100, you are responsible for all skilled nursing care costs. Plan B also covers the first three pints of blood and, for hospice care, any co-payment and co-insurance Medicare may require for outpatient drugs and inpatient respite care. 3 .

How much does Medicare pay for hospitalization?

Hospital Services for Medicare Part A: Plan B pays the $1,484 deductible for Part A for the first 60 days of hospitalization. It then acts like Plan A. For days 61 to 90, Plan B pays the $371 per day that Medicare doesn't cover. For days 91 and beyond, Plan B pays $742 per day while using the 60 lifetime reserve days.

What is Plan K for Medicare?

Plan K. Plan K is similar to Plan C, but it pays only 50% rather than 100% of certain costs. Hospital Services for Medicare Part A: Plan K pays only 50%—or $742—of the $1,484 Part A deductible. Regarding care at a skilled nursing facility, it pays up to $92.75, instead of $185.50, per day for days 21 to 100.

Why did UHC AARP Medicare deny his doctors request to transfer to long term care?

UHC AARP Medicare denied his doctors request to transfer to long term care because "he could breath on his own". He passed away one week later.

Is Medicare Advantage a scam?

Right now they are deducting $237.55. Medicare Advantage is a nationwide SCAM....no one in DC reviews their behavior....people are sleeping at their desk in DC Medicare... Medicare advantage is perfect for people who never need to see a doctor or enter a hospital...