If you work for an employer, you and your employer each pay a 6.2 percent Social Security tax on up to $142,800 of your earnings and a 1.45 percent Medicare tax on all earnings. If you’re self-employed, you pay the combined employee and employer amount, which is a 12.4 percent Social Security tax on up to $142,800 of your net earnings and a 2.9 percent Medicare tax on your entire net earnings. If your earned income is more than $200,000 ($250,000 for married couples filing jointly), you must pay 0.9 percent more in Medicare taxes.

How much is Social Security and Medicare tax?

Mar 15, 2022 · Social Security and Medicare Withholding Rates The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What percentage is Social Security and Medicare?

Aug 09, 2021 · Employer payroll tax rates are 6.2% for Social Security and 1.45% for Medicare. If you are self-employed, you must pay the entirety of the 15.3% FICA tax, plus the additional Medicare tax, if applicable (and we’ll get to that in a minute).

Who is exempt from Social Security and Medicare withholding?

Nov 30, 2020 · So employees pay 6.2% of their wage earnings up to the maximum wage base, and employers also pay 6.2% of their employee's wage earnings up to the maximum wage base, for a total of 12.4%. This 12.4% figure does not include the Medicare tax, which is an additional 2.9% divided between employee and employer.

How do you calculate Medicare taxes?

Social Security Payroll Tax is One Part of the FICA Payroll Tax. In addition to the Social Security payroll tax, there is also a Medicare payroll tax of 1.45% and an Additional Medicare Tax for higher income taxpayers. (The combination of the Social Security tax and the Medicare tax is referred to as FICA.) The employer must match each employee's Medicare tax of 1.45% (but does not …

How much will does employer pay per pay period for Medicare and Social Security?

Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%.Jan 12, 2022

What percentage is an employer responsible to pay for Social Security tax?

Social Security is financed through a dedicated payroll tax. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $147,000 (in 2022), while the self-employed pay 12.4 percent.

What are the Social Security and Medicare tax rates for 2020?

7.65 percentThe FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Who pays Medicare and Social Security taxes?

Employees, employers, and self-employed persons pay social security and Medicare taxes. When referring to employees, these taxes are commonly called FICA taxes (Federal Insurance Contributions Act).

How do I calculate employer payroll taxes?

Current FICA tax rates The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employee's wages.Mar 30, 2022

Is employer portion of Social Security capped?

Employer's Social Security Payroll Tax for 2021 exceed $142,800, the amount in excess of $142,800 is not subject to the Social Security tax. Hence, the maximum amount of the employer's Social Security tax for each employee in 2021 is $8,853.60 (6.2% X $142,800).

What is the maximum employee Social Security tax?

Social Security Tax Limits Any income you earn beyond the wage cap amount is not subject to a 6.2% Social Security payroll tax. For example, an employee who earns $165,000 in 2022 will pay $9,114 in Social Security taxes ($147,000 x 6.2%).

Does employer pay additional Medicare tax?

An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status.Feb 18, 2022

What is the tax rate for employees?

Payroll Tax Rates That means that combined FICA tax rates for 2021 and 2022 are 7.65% for employers and 7.65% for employees, bringing the total to 15.3%.Jan 13, 2022

Do employers pay Social Security and Medicare?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

Does employer pay half of Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Do employers match Medicare?

Employers also are required to match paycheck withholding amounts for Social Security and Medicare. This “match” means your employer pays the same amount you do every pay period for Social Security and Medicare withholding.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Social Security Tax Rates

The Social Security tax functions very much like a flat tax. A single rate of 12.4 percent is applied to wages and self-employment income earned by...

The Math Behind The Social Security Tax

All wages and self-employment income up to the Social Security wage base in effect for a given year are subject to the Social Security tax. Here's...

What Is The Social Security Tax for?

Unlike income taxes, which are paid into the general fund of the United States and can be used for any purpose, Social Security taxes are paid into...

There was A Special Rate Reduction in 2011 and 2012

The Social Security tax rate paid by employees was only 4.2 percent in 2011 and 2012. Employers still paid the full 6.2 percent rate, but employees...

Social Security

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

Medicare

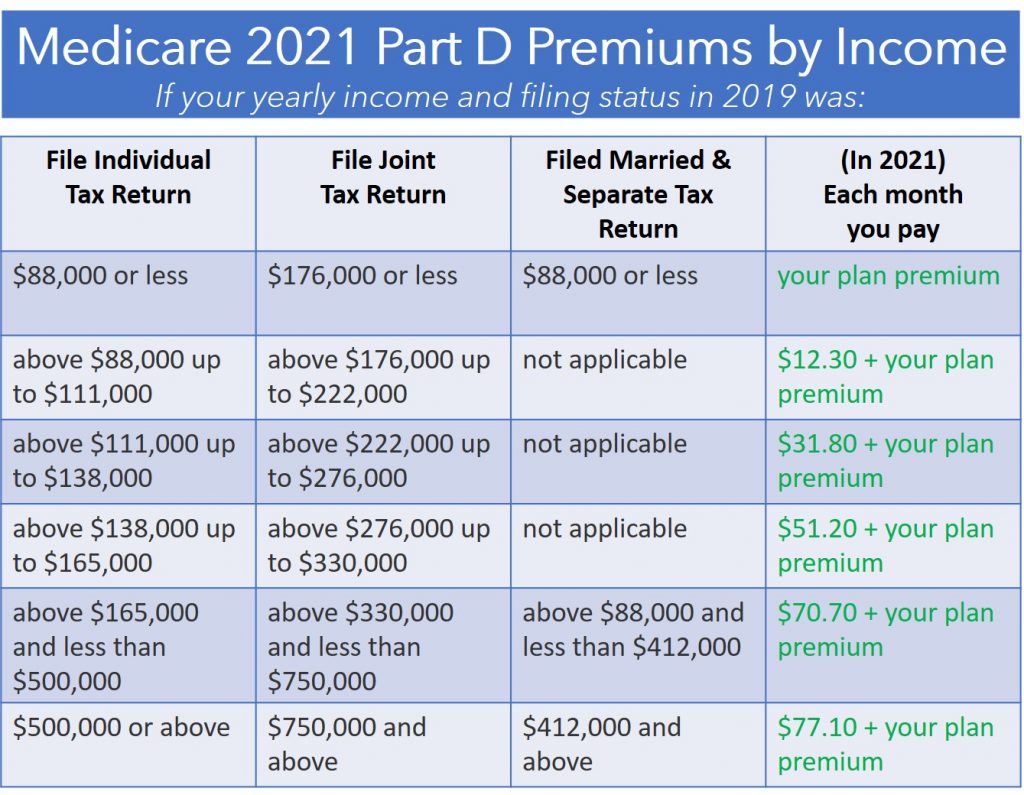

Unlike Social Security, Medicare taxes do not have a wage base. Instead, Medicare has an additional withholding tax for employees who earn more than a set amount. In 2021, this base amount is $200,000 (single). Therefore, employees who earn more than $200,000 in 2021 pay 1.45% and an additional 0.9% to Medicare.

Self-employed tax

If you are self-employed, pay the entire cost of payroll taxes (aka self-employment taxes ). And, pay the additional 0.9% Medicare tax, too, if you earn more than the threshold per year.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

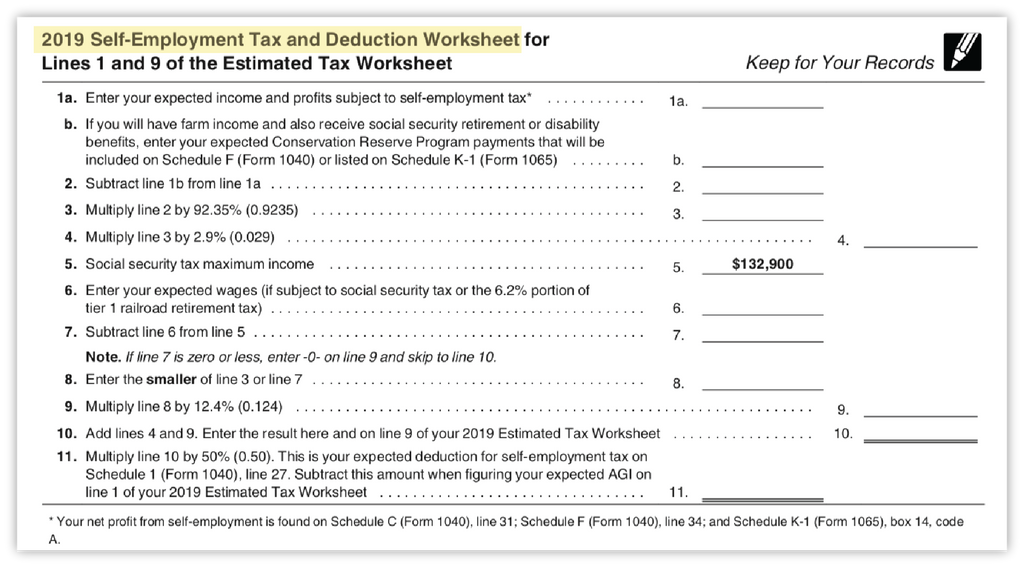

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.

How much is self employed taxed?

If you were self-employed, multiply your earnings up to this limit by 12.4% to calculate the Social Security portion of your self-employment tax. If your wages were more than $137,700 in 2020, multiply $137,700 by 6.2% to arrive at the amount you and your employer must each pay. Anything you earned over this threshold is exempt from Social Security ...

How much do you get if you work for more than one employer?

If You Work More Than One Job. Keep the wage base in mind if you work for more than one employer. If you've earned $69,000 from one job and $69,000 from the other, you've crossed over the wage base threshold.

What is the Social Security tax rate for 2021?

Everyone pays the same rate, regardless of how much they earn, until they hit the ceiling. As of 2021, a single rate of 12.4% is applied to all wages and self-employment income earned by a worker up to a maximum dollar limit of $142,800. 1.

When does Social Security start back up?

These are annual figures, so the Social Security tax starts right back up again on Jan. 1 until you hit the next year's Social Security wage base.

Does it matter if you have reached the wage base threshold?

It doesn't matter that individually, neither job has reached the wage base threshold. The wage base threshold applies to all your earned income. But separate employers might not be aware you've collectively reached this limit, so you'll have to notify both employers they should stop withholding for the time being.

Do self employed people pay Social Security taxes?

If You're Self-Employed. Self-employed persons must pay both halves of the Social Security tax because they're both employee and employer. They pay the combined rate of 12.4% of their net earnings up to the maximum wage base. This is calculated as the self-employment tax on Schedule SE.

How much is Social Security 2020?

If an employee's 2020 wages, salaries, etc. exceed $137,700, the amount in excess of $137,700 is not subject to the Social Security tax.

What is the payroll tax rate for 2021?

The employer's Social Security payroll tax rate for 2021 (January 1 through December 31, 2021) is 6.2% of each employee's first $142,800 of wages, salaries, etc. (This amount is identical to the employee's Social Security tax that is withheld from the employee's wages, salaries, etc.)

Is $142,800 a Social Security amount?

If an employee's wages, salaries, etc. are greater than $142,800, the amount in excess of $142,800 is not subject to the Social Security tax.

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

How much does my employer pay for Social Security?

Your employer matches your withholding amount and pays in 6.2 percent for Social Security and 1.45 percent for Medicare when it submits the taxes to the IRS. The total tax is 12.4 percent for Social Security and 2.9 percent for Medicare, half of which comes from your paycheck and half of which comes from your employer.

What is the maximum amount of Social Security tax?

For example, in 2018, the limit for taxation for Social Security was $128,400 compared with $127,200 in 2017.

What does FICA mean on a pay stub?

That mysterious entry on your pay stub every month under the description FICA represents your payment of Social Security and Medicare taxes, which were established under the Federal Insurance Contributions Act (FICA) in 1939.

How much was Social Security tax in 2017?

The maximum Social Security tax collected in 2017 was $7,886 per contributor , or 6.2 percent of $127,200, and this will rise to $7,960 in 2018. Although the percentage hasn't increased, the taxable amount has increased, and the high-earning worker is paying Social Security tax on a larger share of earnings. Advertisement.

What percentage of income is self employed?

Self-employed persons must 15.3 percent of their incomes, up to $128,400 as of 2018, as they are considered both employers and employees. Thus, they are responsible for both the employer's part and the employee's part, or 12.4 percent for Social Security plus 2.9 percent for Medicare, with no limitation.

Does Social Security pay half of FICA?

Employers collect tax from workers and send it to the Internal Revenue Service periodically. In most cases, your employer has to pay half of your tax for you.

Does my employer pay half of my taxes?

In most cases, your employer has to pay half of your tax for you. If you're self-employed or an independent contractor, the tax system considers you both an employer and an employee. Advertisement.

How to calculate employer SS tax liability?

To calculate your employer SS tax liability, multiply $2,000 by 6.2%. You must pay $124 for the employer portion of Social Security tax (and withhold $124 for the employee portion).

How much is Social Security tax for 2020?

Stop paying the 6.2% Social Security tax rate if an employee earns above the Social Security wage base. For 2020, the SS wage base is $137,700.

How does payroll tax liability vary?

Your payroll tax liability varies based on the number of employees you have, how much you pay those employees, and where your business is located. If you want to know how much your payroll tax liability is, familiarize yourself with how to calculate payroll taxes for employer share below.

What is payroll tax?

Payroll taxes are mandatory contributions that both employees and employers make. There are a number of payroll-related taxes, including: There are both employee taxes paid by employer as well as taxes paid by employees. And, there are taxes that both employees and employers pay.

What is the federal FUTA tax?

FUTA (Federal Unemployment Tax Act) tax is an employer-only tax. Unlike Social Security and Medicare taxes, you do not withhold a portion of FUTA tax from employee wages. Your federal unemployment tax rate depends on your state. FUTA tax is 6% of the first $7,000 you pay each employee during the year.

How much is a FUTA tax?

FUTA tax is 6% of the first $7,000 you pay each employee during the year. But, most employers receive a FUTA tax credit that lowers their FUTA tax rate to 0.6% on the first $7,000 employees earn. Your tax rate is 0.6% unless your business is in a credit reduction state.

Do you know what payroll taxes are paid by employer?

Do you know what the payroll taxes paid by employer are? To stay compliant with the IRS and Department of Labor, you need to know what is the employer portion of payroll taxes. Withholding the employer portion of payroll taxes from your employees’ wages is illegal. And, failing to pay your employer tax liability can lead to IRS penalties.