How much money does the government owe Social Security?

Medicare recipients may be surprised to learn that payroll taxes accounted for only 36%; the federal government’s general fund, 43%; and premiums, a mere 15%. The remaining revenue came from transfers from states, Social Security benefit …

How much does the government spend on Medicare each year?

· DI - $139,145,000,000. So, that's almost $2.6 trillion for the Old-Age and Survivors Insurance trust fund, plus an additional $140 billion or so for the Disability Insurance trust fund. Ouch. Source: SSA.gov - Status of the Social Security and Medicare Programs.

How much will Medicare take out of my social security check?

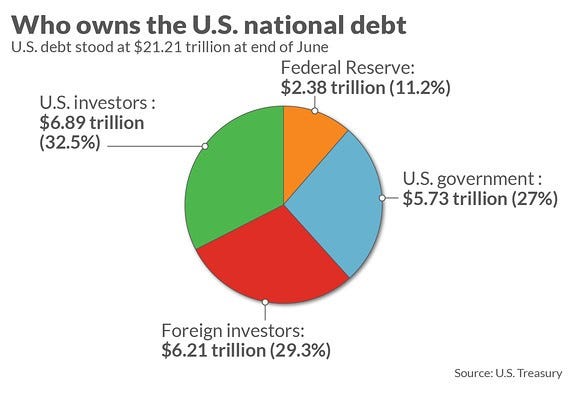

The government has borrowed about $22 trillion from various sources ranging from individuals with savings bonds to banks with surplus cash to corporations seeking to invest surplus cash to social security and medicare surpluses to foreign governments with excess dollars they want to store in a safe place.

How much does the Social Security Administration really cost?

Those who paid Medicare taxes for 30 to 39 quarters will pay $274 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social …

How much has the federal government borrowed from Social Security?

The total amount borrowed was $17.5 billion.

Which president started borrowing from Social Security?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

When did Congress start borrowing from Social Security?

Where the idea comes into play that Congress stole from Social Security is, during this 1968 to 1990 period (1990 is when Social Security was completely off-budget again), it's believed that lawmakers commingled Social Security's asset reserves (i.e., its aggregate annual net-cash surpluses built up since inception) ...

Did Congress borrow from Social Security?

The fact is that Congress, despite borrowing $2.9 trillion from Social Security, hasn't pilfered or misappropriated a red cent from the program. Regardless of whether Social Security was presented as a unified budget under Lyndon B.

What did Reagan do to Social Security?

In 1981, Reagan ordered the Social Security Administration (SSA) to tighten up enforcement of the Disability Amendments Act of 1980, which resulted in more than a million disability beneficiaries having their benefits stopped.

Does Social Security increase the national debt?

It means that Social Security loans its surplus money to the federal government, and the federal government uses the money to pay off someone else it owes money to. Again, the key point to realize is that there is no effect on Social Security. Also, in this instance, there is no effect on the national debt.

Why will Social Security run out?

Over the next ten plus years, the Social Security administration will draw down its reserves as a decreasing number of workers will be paying for an increasing number of beneficiaries. This is due to a decline in the birth rate after the baby boom period that took place right after World War II, from 1946 to 1964.

What will happen when Social Security runs out?

Reduced Benefits If no changes are made before the fund runs out, the most likely result will be a reduction in the benefits that are paid out. If the only funds available to Social Security in 2033 are the current wage taxes being paid in, the administration would still be able to pay around 75% of promised benefits.

Why is the Social Security surplus declining?

The portion of that $22 trillion that has been borrowed from the social security and medicare surplusses will vary each year and has been declining recently because those surplusses are being spent down due to longer life expectancies and the relatively large number of retiring baby boomers.

How much money has the government borrowed?

The government has borrowed about $22 trillion from various sources ranging from individuals with savings bonds to banks with surplus cash to corporations seeking to invest surplus cash to social security and medicare surpluses to foreign governments with excess dollars they want to store in a safe place. In this sense, the government acts like a large bank. The dollars are not just created arbitrarily. There are complex rules in place because arbitrary generation of dollars would devalue the dollar and result in rampant inflation. (Many people fail to understand this and seem to believe that money is just generated when needed. Not true.)

Does the government have to pay taxes to spend money?

The US government creates the nation’s money when it spends, which means that the government does not require taxes in order to have money to spend. Almost all money exists as electronic entries on spreadsheets at the Federal Reserve. The physical dollars we hold amount to about 10% of all currency give or take a few percent, the rest exists as electronic balances in our bank accounts or other electronic forms.

Can the government save money?

In our economy today there is no other possible - reasonable - answer to this question. The government can’t “save” US dollars either by not spending or setting aside money.

Can the federal government borrow from itself?

I’m not sure that the term “borrowed” would be a valid way to think about this question. Just as you can’t “borrow” from yourself, the federal government can’t borrow from itself. It can create liabilities for itself, however.

Is Social Security a drain on income tax?

The assertion that Social Security and Medicare entitlements are huge drains on the revenue stream from income taxes is true, but this assertion is also fundamentally dishonest.

Is it a problem that the government has borrowed money from Social Security?

A key point is that it is NOT a problem that the government has “borrowed” this money from the social security and medicare surplusses. They could easily borrow it elsewhere if needed. The real problems are these:

How much will Medicare premiums be in 2022?

If you paid Medicare taxes for under 30 quarters, the Part A premium is $499 in 2022. Those who paid Medicare taxes for 30 to 39 quarters will pay $274 per month in premiums. Please note that, if you have to pay monthly Medicare premiums, you cannot qualify for Social Security benefits. In that case, you will not have to worry about money being taken out for now.

How to find out if Social Security is taking out?

If you want to find out for sure whether this applies to you, your best bet is to contact the Social Security Administration (SSA). They will look up your current status to determine whether payments will be taken out automatically.

Does Medicare Part D cover prescriptions?

Medicare Part D plans help pay for prescription drug costs. This coverage is not included with Original Medicare (Medicare Parts A and B). However, some Medicare Advantage plans also provide drug coverage. If you join a Medicare Advantage Prescription Drug plan (MA-PD), you cannot also join a standalone Part D plan.

Does Medicare Advantage vary in price?

Medicare Advantage premiums vary in price just like other private insurance plans. This means that there is no way to say how much you will pay without getting a quote.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of insurance provided by private insurance companies that contract with Medicare. Private insurance companies manage the plans but have to work within guidelines provided by the federal government. They are only available to people who are eligible for Original Medicare.

Is Medicare Part B premium free?

There is no premium-free version of Medicare Part B. If you are enrolled in Part B and receive Social Security benefits, then your Medicare Part B premiums are deducted automatically. If you are enrolled in Part B but do not receive Social Security benefits, you have to pay your monthly premium online or by check.

How is Part A paid?

Part A is paid for through income taxes that you pay for while you work. This is why the amount of years that you paid this tax is used to determine how much you pay in premiums.

What is Medicare and Social Security?

Medicare is a public healthcare program for people over 65, as well as those enrolled in Disability Insurance and those with end-stage renal disease.

What is the difference between Medicare and Social Security?

Social Security provides cash benefits to retirees and those unable to work due to disability . Medicare is a public healthcare program for people over 65 , as well as those enrolled in Disability Insurance and those with end-stage renal disease.

Is healthcare a political issue?

From health insurance to prescription drug prices, the cost of healthcare has been a political issue for decades.

When will the rules change for Social Security?

And it will change the rules again sometime around 2020. Congress is a unique risk to which private retirement accounts are largely immune.

Does Social Security give back money?

That is true, but it turns out that it was only part of the truth. While the law requires Social Security to invest its surplus in Treasury Bills, the law does not require Social Security to give taxpayers their money back. At any point Congress can change the rules of the game.

Is Social Security privatized?

Expect to see it soon. For decades, economists have called for Social Security to be privatized. Opponents said that privatization would be foolish because financial markets are risky while Social Security is safe because the Social Security trust fund invests only in U.S. Treasury Bills.

How much money does the government need to make to make good on its promises to retirees?

Long-term, the federal government will need to come up with over half a trillion dollars per year to make good on its promises to our retirees. But it won't come up with the money. Raising over half a trillion dollars in revenue would require either raising taxes by 30% or doubling the current deficit.

When will the $5 trillion end?

According to the Social Security Board of Trustees, Social Security's unbroken string of budget surpluses will come to a permanent end in 2020. From then on, not only will Washington have lost a major source of cheap financing, the money will need to start flowing in ...

Does the $5 trillion debt belong to the government?

But the bulk of that $5 trillion doesn't belong to the government. It belongs to current and future retirees. The only way this debt "doesn't count" is if the government has no intention of paying its obligations to America's retirees. That $5 trillion is going to come back to haunt us, and soon. According to the Social Security Board ...

How much money does the government borrow from Social Security?

The amount of money the federal government has borrowed from the Social Security trust fund, the Medicare trust fund and other government agencies just crossed the $5 trillion mark. Politicians downplay the number, saying it isn't really debt; it's money the government "owes itself.". But the bulk of that $5 trillion doesn't belong to ...

When does Medicare start?

Medicare starts at 65 no matter the date you were born! Make sure you apply for it a few month before you turn 65. Medicare is NOT FREE to retired people, there is a monthly payment every month, plus co-payments depending on the plan you choose. Medicare is only for people living in the USA! If you live abroad you will have to buy that country’s health insurance.

What is borrowing from Social Security?

When the rest of the budget is in deficit [that is, most years], a borrowing from Social Security has been allowing the government to borrow less from elsewhere. Since the US Federal government does not appear as to be able to resolve annual deficit spending, an on-going situation exists which could (in some sense) be described as “taking” from the SS trust fund. This apparent situation has intensified further by way of central bank practice in “buying back” U.S. Treasury securities. (Ultimately, it is the future value of the US Dollar itself that is being “taken”.)

Is Social Security owed to beneficiaries?

Social Security is owed, not the beneficiaries.

Why do baby boomers lose their savings?

Have a ROTH, work pension and savings. Many Baby Boomers have lost any savings because of health issues, drugs-alcohol, the economic situations, especially the depression of 2008, buying on credit, divorce, being idiots with money, supporting their adult children, paying for their kids’ colleges, etc.

When do you start getting more money from S.S.?

This all depends on your situation: Technically the amount you get depends on your work record - thus you are basically deciding on how to use the total sum and how it is divided monthly - after about age 80–85 the sum is used up, and you will start getting more money than what you paid into S.S. It all depends on your financial and physical mental health.

How much of your FRA is paid out at 70?

You get the most benefits paid out if you wait until you turn 70 to start getting them. It is about 120% of your FRA amount.

How to calculate retirement age?

First you need to figure out your Full Retirement age FRA: this is between 65–67. Go on the social security website and enter your birthyear - if you are born on January 1st, then you enter the year before. Since you are asking this, I assume you are under 65 and born after 1954. So from being born in 1955 it is 66 and 2 months. This rises to 67 for those born in 1960 or later. If you wait until FRA you get 100% of your benefits. REMEMBER that once the amount is decided upon, then you stay at that amount the rest of your life - NB! If you eventually qualify for Survivor benefits, then the amou

How much money does the government owe to the Social Security Fund?

Technically the government owes the Social Security fund an estimated $2.9 trillion, money that has been used and not repaid to the fund. The money is legally held in a special type of bond that by law cannot be used for any other purpose other than to put the money back into the fund.

How does Social Security work?

What many people don’t know is how Social Security actually works. There is no cash in the bank to pay out monthly benefit checks. The Congress, those keepers of the financial retirement flame, have been using Social Security taxes to fund other parts of the government because, well the money is there. Technically the government owes the Social ...

Do millennials pay taxes?

Millennials and younger generations complain they are paying their taxes in just to finance the 63 million retirees, about half who depend on their Social Security check to pay part or all of their monthly bills. But when looking at that $2.9 trillion owed to the fund, and the fact that the fund actually has more money going in than coming out, the problem clearly lies with the government’s addiction to spending. Money is the drug of choice in Washington D.C., and whoever gets elected will get their fix sooner or later.

Will Social Security be cut in 2034?

There is an ongoing debate about whether the Federal government and its spending policies are responsible for the current projections that by the year 2034 the outflow of payments will exceed the inflow of tax revenues to fund the social security program. The latest report of June 2018 says there it will become necessary to reduce benefit checks by as much as 21 percent to keep the fund solvent. This number could actually be higher if inflations gets out of control or a reduction in tax revenues further reduces the amount of cash available.

Is the $2.9 trillion problem the government's fault?

An odd thing is taking place in some financial and economic circles, where people are arguing that the problem of the $2.9 trillion is somehow not the government’s fault and is really not that big of a deal. The clock is running and no one seems to have a solution, yet all admit the government does owe the Social Security fund the money and that the government continues to borrow from the fund every year. Maybe many of these so-called experts won’t be around in 2034 and can act as if the problem is not really a problem. The real problem is that neither the average person or the accountants and financial planners in the government actually understand what $1 trillion is in real money. Maybe someone could make $1 trillion in dollar bill sized pieces of paper and have them delivered to the Congress. But that would cost too much.

How much does the government spend on Social Security?

The U.S. federal government spends in excess of $4 trillion a year , and at the top of the heap is Social Security, the government's largest single expense.

What is the biggest expenditure on Social Security?

As you can probably imagine, the single-biggest expenditure for Social Security is scheduled benefits. Nearly 99% of its $952.5 billion in expenditures ($941.5 billion) went to eligible beneficiaries last year. But let's break this $941.5 billion figure down a bit further, because "beneficiary" can have a lot of different meanings when it comes to Social Security.

How much was disbursed to the railroad retirement system?

Last but not least, $4.5 billion was disbursed to the Railroad Retirement financial interchange last year. During the 1930s, lawmakers in Congress set up a national retirement system for railroad workers and their families since railroad-sponsored pensions were mostly failing to meet their end of the bargain.

How much is the OASI death benefit?

The OASI also factors in the lump-sum death benefit of $255 that can be paid out to a surviving spouse or qualifying child of a deceased worker. Last year, $210 million in lump-sum death benefits were disbursed by the Social Security Administration. This covers the OASI's expenditures.

How much is the Old Age and Survivors Insurance Trust?

The Old-Age and Survivors Insurance Trust: $798.7 billion in 2017. The bulk of spending last year (nearly 85% of scheduled benefits) went to the Old-Age and Survivors Trust, or OASI. The OASI is responsible for making benefit payments to retired workers, as well as survivors of eligible workers who are now deceased.

Do disabled people get disability payments?

As you'd expect, when broken down further, an overwhelming majority of disability payments went directly to disabled workers. However, the children of these workers, and to a far lesser extent the spouses of these disabled workers, also received their share.

How much interest did Social Security collect in 2017?

Ultimately, Congress' borrowing allowed Social Security to collect $85.1 billion in interest income for 2017, and it's expected to provide $804 billion in aggregate interest income between 2018 and 2027.

How many people are receiving Social Security?

Of the nearly 63 million people currently receiving a benefit check, more than a third are being kept out of poverty as a result of the added income they're receiving from the program.

How much is the Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook. If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

Has the government taken a dime from Social Security?

The federal government hasn't pilfered a dime from Social Security. The fact is that Congress, despite borrowing $2.9 trillion from Social Security, hasn't pilfered or misappropriated a red cent from the program.

Will Social Security be cut in 2034?

Based on the estimates of the Trustees, Social Security's $2.9 trillion in asset reserves will be completely gone by 2034. Should lawmakers not find a way to raise additional revenue and/or cut expenditures by then, an across-the-board cut in benefits of up to 21% may await. That's particularly worrisome, given that 62% of retired workers rely on their benefit check to account for at least half of their income.

What are the effects of Social Security?

Ongoing demographic changes that include the retirement of baby boomers, increased longevity, lower fertility rates, and growing income inequality, are adversely impacting Social Security. According to the June 2018 report, the program is soon expected to begin paying out more money than it collects each year.

When was Social Security signed into law?

Yet for as important as Social Security is, it's also about to encounter its biggest speed bump since being signed into law back in 1935.