What is the monthly premium in Medicare Part D?

52 rows · Nov 18, 2021 · Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans …

What is the average cost of Medicare Part D?

The maximum Part D deductible is $480 in 2022. Initial Coverage Period: This period occurs after you have met your deductible and your plan begins to cover your drug costs. How much does Medicare pay for prescriptions? During this period, your plan will cover some of the drug cost and you will pay your copayment or coinsurance.

How to reduce Medicare Part D cost?

2022 Part D national base beneficiary premium— $33.37 This amount is used to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in …

How to compare Medicare Part D drug plan costs?

Oct 29, 2021 · Costs are among the first concerns many Medicare beneficiaries may have about Part D Medicare prescription drug. So how much does Medicare Part D cost? According to the Centers for Medicare & Medicaid Services (CMS), the average cost of a Medicare Part D plan in 2022 will be approximately $33 per month. That represents a 4.9% increase from the 2021 …

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

How much is Medicare Part D every month?

The national base beneficiary premium for Part D plans is $33.37 per month for 2022, according to the Centers for Medicare & Medicaid Services, which calculates this number in part by using the national average monthly bid amount submitted by private insurers.

What is the Part D premium for 2021?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.Nov 6, 2020

Can you buy Medicare Part D by itself?

You have two ways to get coverage: Buy a stand-alone Part D prescription drug plan, or sign up for a Medicare Advantage plan that combines medical and drug coverage. Private insurance companies that Medicare regulates offer both types of plans.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Who is eligible for Medicare Part D?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease.

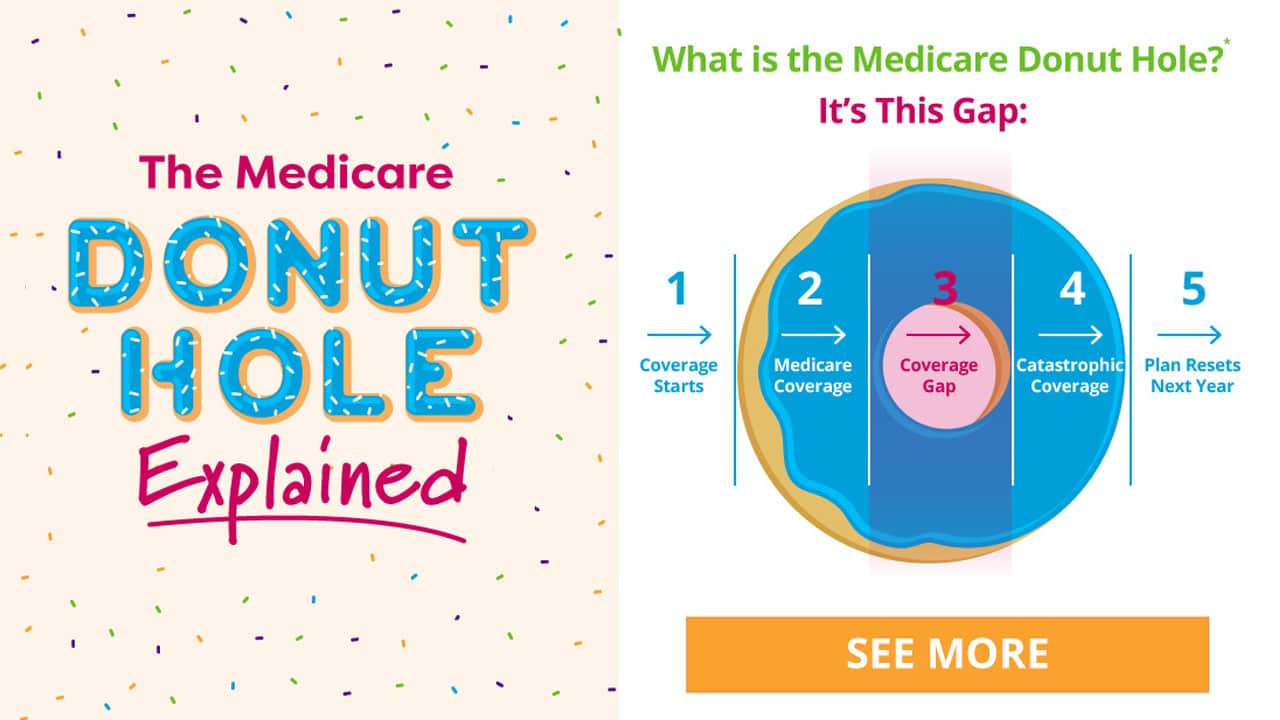

What are the 4 phases of Medicare Part D coverage?

The Four Coverage Stages of Medicare's Part D ProgramStage 1. Annual Deductible.Stage 2. Initial Coverage.Stage 3. Coverage Gap.Stage 4. Catastrophic Coverage.Oct 1, 2021

Key Takeaways

Does Medicare pay for prescriptions? Yes—drug coverage is available through Medicare Part D.

How much does Medicare Part D cost?

Medicare will pay part of the costs of prescription drug coverage for everyone who enrolls in a Part D plan. How much you pay will depend on which prescription drug plan you choose and whether or not you qualify for Extra Help that assists in covering the costs of this coverage.

Medicare Part D Deductible

Remember, a plan with a deductible will not pay for your prescriptions until you pay the deductible amount out-of-pocket. The highest deductible a plan can charge in 2022 is $480. Some plans offer $0 deductible and will pay for your prescriptions right away. Other plans may offer a deductible lower than the maximum of $480 such as $150 or $250.

Copayments and Coinsurance

A copayment, or copay, is a fixed dollar amount for your prescriptions. For example, you might have to pay $5 for a generic drug, $25 for a "preferred" brand name drug and $40 for a non-preferred brand name drug.

What are copay tiers?

Each plan places the drugs it will pay for in different levels, called tiers. Each tier has its own copay or coinsurance amount. Your drugs may be included in all the plans in your area, but they could be listed on different tiers with different copay amounts.

Phases of Part D Prescription Costs

Prescription drug costs may change throughout the year depending on which phase of Part D coverage you are in. There are four phases of Part D coverage:

When does the coverage gap end (catastrophic coverage)?

In Part D, you and the plan you join share the cost of drugs. The money that you spend is called your out-of-pocket costs. That determines if and when the catastrophic coverage begins. In 2022, the catastrophic coverage starts when you have paid $7,050 out-of-pocket.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

What are not covered prescriptions?

Not Covered Prescriptions: Drugs for cosmetic purposes. Medicines for anorexia, weight gain, or weight loss. Drugs meant to relieve colds and coughs. Medications for erectile dysfunction. Individual outpatient drugs. Over-the-counter medications. Minerals or vitamin drugs except those noted in the formulary.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

How much does Medicare Part D cost?

Since private, Medicare-approved insurance companies offer Medicare Prescription Drug Plans, how much Part D costs may vary widely from one plan to another. Some Medicare Part D costs for a stand-alone plan or a Medicare Advantage plan might include: 1 A monthly plan premium 2 An annual deductible (this amount can be no higher than $435 in 2020 3 A coinsurance or copayment for each covered prescription drug.

What is Medicare Part D?

Get My Free Guide. Summary: Medicare Part D is the prescription drug coverage “part” of Medicare. It’s optional, and available from private insurance companies that contract with Medicare. It’s important to remember that while you might get enrolled into Medicare Part A and Part B when you’re eligible, you’re generally not automatically enrolled in ...

How much is the deductible for Medicare 2020?

An annual deductible (this amount can be no higher than $435 in 2020. A coinsurance or copayment for each covered prescription drug. Please note that not every Medicare Prescription Drug Plan has a monthly premium, and some plans might not have deductibles.

When does the Medicare coverage gap close?

Although this gap officially closes in 2020, you might still need to pay a different amount after you spend past the initial coverage limit. Read more about your costs in the coverage gap. Part D IRMAA – If your income is over a certain amount, you might have to pay more for a Medicare Prescription Drug Plan.