If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Full Answer

What is the average cost of Medicare per person?

The type of Medicare will determine your monthly costs. In 2022, A Medicare Advantage plan can cost an average of $33 per month. Medicare Part B usually costs $170.10 per month, and a Medicare Part D plan for prescription drugs costs an average of $42 per month.

Does Medicare Cost you Anything?

Premiums for Medicare Part A are $0 if you’re getting or are eligible for federal retirement benefits. It’s also premium-free if you’re under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease.

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Does Medicare coverage cost money?

What you pay for Medicare depends on how much you earn each year and how much care you need. You pay a separate amount for each part of Medicare. Part A is your hospital coverage. Premium costs. If you or your spouse worked for at least 10 years and paid Medicare taxes, you won't pay any monthly fee, called a premium, for Part A.

How much is Medicare insurance every month?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

Does Medicare plan a cost money?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the general cost of Medicare?

What is the average cost of Medicare Part D in 2022 by state?StateAverage PremiumAverage DeductibleCalifornia$55.82$357.20Colorado$51.70$354.00Connecticut$49.63$362.38Delaware$42.53$385.2447 more rows•Feb 15, 2022

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is Medicare Part B worth the cost?

Is Part B Worth it? Part B covers expensive outpatient surgeries, so it is very necessary if you don't have other coverage coordinating with your Medicare benefits.

How much will Social Security take out for Medicare in 2022?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the cheapest Medicare plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Does Medicare have an out-of-pocket max?

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

How long does Medicare Part A last?

Medicare Part A is the inpatient benefit and is available to eligible recipients without a monthly premium as long as you paid 40 quarters of Medicare taxes while working.

How much is Medicare Part B 2020?

This deductible typically changes each year, and for 2020, the deductible is $1,048. Medicare Part B is the inpatient benefit, and it does require a monthly premium payment in order for benefits to apply.

Why is it important to discuss your needs with a qualified, licensed Medicare agent?

This is why it’s important to discuss your needs with a qualified, licensed Medicare agent in order to take advantage of the right benefits while avoiding overpayment for services you don’t need.

How much is the deductible for Part D?

The deductible for Part D coverage in 2020 is $435, and the standard base premium is $32.74 per month.

What is Part B insurance?

Recipients who opt into Part B coverage may also be responsible for additional charges for some services in the form of co-pays, so if you have part B coverage, you will want to discuss your plan with your provider to reduce the chances of facing out-of-pocket expenses.

Does Medicare cover out-of-pocket costs?

Medicare is a program designed to help seniors and other eligible Americans access quality healthcare at an affordable price; however, taking part in Medicare will include some out-of-pocket costs. While there are some state-sponsored healthcare and wellness programs available at no cost, including Medicaid and the Supplemental Nutrition Assistance ...

Does Medicare Advantage have the same benefits as Original Medicare?

Medicare Advantage plans provide the same Part A and Part B benefits found in Original Medicare, but they are offered through private insurers and may come with additional benefits and savings. Costs and coverage between plans can vary, so compare your options before enrolling.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What does Medicare Part B cover?

This is a very broad category that covers medical office visits, non-emergency ambulance transportation, durable and disposable medical supplies and certain outpatient treatments.

Is Medicare Part D a private insurance?

Since 2006, Medicare-eligible seniors have had the option to enroll in Part D, Medicare’s prescription drug benefit. Unlike Part A and Part B, Medicare Part D prescription drug benefits are provided through a private insurance company that has been approved for the program.

Does Medicare cover coinsurance?

Many Medicare beneficiaries find that the gaps in their coverage – such as Medicare deductibles, coinsurance, copays and more – can leave them having to pay significant out of pocket costs. Medicare supplemental policies can pick up some of the coinsurance and co-payment requirements for each part of Medicare.

How much does Medicare typically cost?

Medicare protects people aged 65 and older and younger people with disabilities from financial hardship by providing health insurance. But it comes with out-of-pocket costs. How much Medicare costs depends on how each individual uses it and the choices they make about coverage.

How much does the average Medicare beneficiary spend out of pocket?

What you spend out of pocket may be totally different than what a family member or friend with Medicare pays. But, on average, people spend more than $5,000 out of pocket annually — or more than $400 per month — on their Medicare costs, according to the Kaiser Family Foundation (KFF).

What do you pay with Medicare Part A?

If you go to the hospital, after paying your Part A deductible, inpatient hospital care is covered under the following conditions:

What do you pay with Medicare Part B?

Unlike Part A, qualified Medicare enrollees must pay a monthly premium for Part B.

What is observation status, and how does it affect your Medicare costs?

A confusing and potentially costly scenario that some hospitalized patients encounter is what’s called observation status. Even though you’re at the hospital, you may sometimes still be considered an outpatient for the first day or two (or longer in extraordinary cases).

What do you pay for Medicare drug coverage (Part D)?

You’ll want to consider additional coverage for medications if you don’t already have coverage of equal value. You do this to avoid the Part D late enrollment penalty. You can buy a Medicare Part D plan — while keeping Parts A and B — or a Medicare Advantage plan instead.

Medigap: Covering your out-of-pocket costs

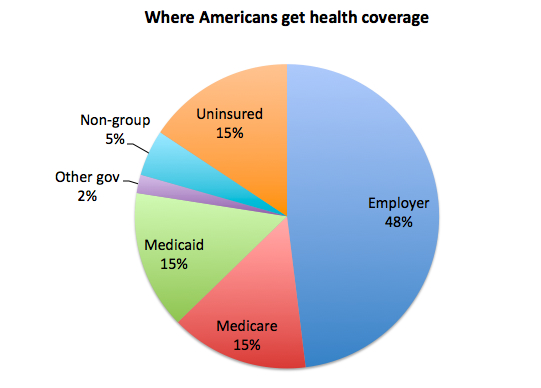

With original Medicare, there’s no annual out-of-pocket maximum. So if you need a lot of care, your out-of-pocket costs can add up. For that reason, about half of Medicare enrollees have supplemental coverage. Some get it through their employer, others have Medicaid, and many use Medicare supplement insurance known as Medigap.

Cost of Medicare Part A in 2020

You are not required to pay for Medicare Part A if you (or your spouse) have worked for 10 years paying payroll taxes. Most Medicare recipients meet this qualifying work criteria and will not need to pay for Medicare Part A.

Cost of Medicare Part B in 2020

Unlike Medicare Part A, you are required to pay a monthly premium for Medicare Part B. Most people will pay the standard monthly premium amount, but your premium could be higher if you earn more than $87,000 annually as an individual or $174,000 as a household.

Cost of Medicare Part C 2020

Medicare Part C is also known as Medicare Advantage. A Medicare Advantage plan is an alternative way of getting your Medicare benefits. These are healthcare plans that are offered by Medicare-approved private companies, and they take the place of Medicare A and B if you choose to enroll in one of them.

Cost of Medicare Part D in 2020

Just like Medicare Part B, you must pay a monthly premium for Medicare Part D plans, and the cost varies based on income. Your plan premium will be a set monthly amount depending on which Part D plan you choose, then higher income households will pay more on top of that according to their income bracket.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What is Medicare health plan?

Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan. Medicare health plans include all Medicare Advantage Plans, Medicare Cost Plans, and Demonstration/Pilot Programs.

What is original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or a.

What is the health insurance marketplace?

The Health Insurance Marketplace is designed for people who don’t have health coverage. If you have health coverage through Medicare, the Marketplace doesn't affect your Medicare choices or benefits. This means that no matter how you get Medicare, whether through.

When does Medicare Part A start?

For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday month. Once your Medicare Part A coverage starts, you won’t be eligible for a premium tax credit or other savings for a Marketplace plan. If you kept your Marketplace plan, you’d have to pay full price.

When is open enrollment for Medicare?

During the Medicare Open Enrollment Period (October 15–December 7) , you can review your current Medicare health and prescription drug coverage to see if it still meets your needs. Take a look at any cost, coverage, and benefit changes that'll take effect next year.

Does Medicare qualify for federal tax?

Important tax information for plan years through 2018. Medicare counts as qualifying health coverage and meets the law (called the individual Shared Responsibility Payment) that required people to have health coverage if they can afford it. If you had Medicare for all of 2018 (or for earlier plan years), check the box on your federal income tax ...

Is it against the law to sell Medicare?

It’s against the law for someone who knows that you have Medicare to sell you a Marketplace plan. During Medicare Open Enrollment, there’s a higher risk for fraudulent activities. Learn how to prevent, spot, and report fraud.