Full Answer

How long does the enrollment process for Medicare take?

How long does it take to enrollwith Medicare?Medicare typically completesenrollment applications in 60 – 90 days. This varieswidely by intermediary (by state). We see some applicationsturnaround in 15 days and others take as long as 3months.. Then, how long does a Medicare application take to process?

How much does it cost to have Medicare?

You are eligible for Medicare and premium-free Part A, if you or your spouse paid federal taxes for 40 quarters. If you do not have 40 quarters, you may be eligible to purchase Part A coverage. This costs $458.00 per month if you have less than 30 quarters. If you paid federal taxes for 30 – 39 quarters, the monthly premium for Part A is $252.00.

What to do during Medicare open enrollment?

• Screening for income guidelines, being mindful of programs that might help you pay for your Medicare, and helping with fraud and general complaints. • Talking to Medicare on your behalf. • Providing enrollment help when you first come onto Medicare and annually during open enrollment. • Making referrals to other agencies and programs.

Should you enroll in Medicare?

Most people should enroll in Medicare Part A when they turn 65, even if they have health insurance from an employer. This is because most people paid Medicare taxes while they worked and therefore do not pay a monthly premium for Part A. However, some people may want to consider delaying Medicare Part A until a later date, such as people who contribute to a Health Savings Account (HSA) or those who have to pay a premium for Part A.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

What is the average monthly cost for Medicare?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

How much does Medicare cost each year?

How much does Medicare cost?PlanPremium (2022)Deductible (2022)Medicare Part A$0, or $274 or $499 if you claim it early$1,556 per benefit periodMedicare Part B$170.10 and up$233 per yearMedicare Part CVariesVariesMedicare Part D$33.37 and upVaries1 more row•Dec 1, 2021

What is the cheapest Medicare plan?

What's the least expensive Medicare Supplement plan? Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

What is an average Social Security check?

Social Security offers a monthly benefit check to many kinds of recipients. As of March 2022, the average check is $1,536.94, according to the Social Security Administration – but that amount can differ drastically depending on the type of recipient.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

How much does Medicare Part D cost in 2021?

If your filing status and yearly income in 2019 was:File individual tax returnFile joint tax returnYou pay each month (in 2021)above $170,000 and less than $500,000above $340,000 and less than $750,000$71.30 + your plan premium$500,000 or above$750,000 and above$77.90 + your plan premium4 more rows

What is the cost of Medicare Part B for 2022?

$170.10 forMedicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

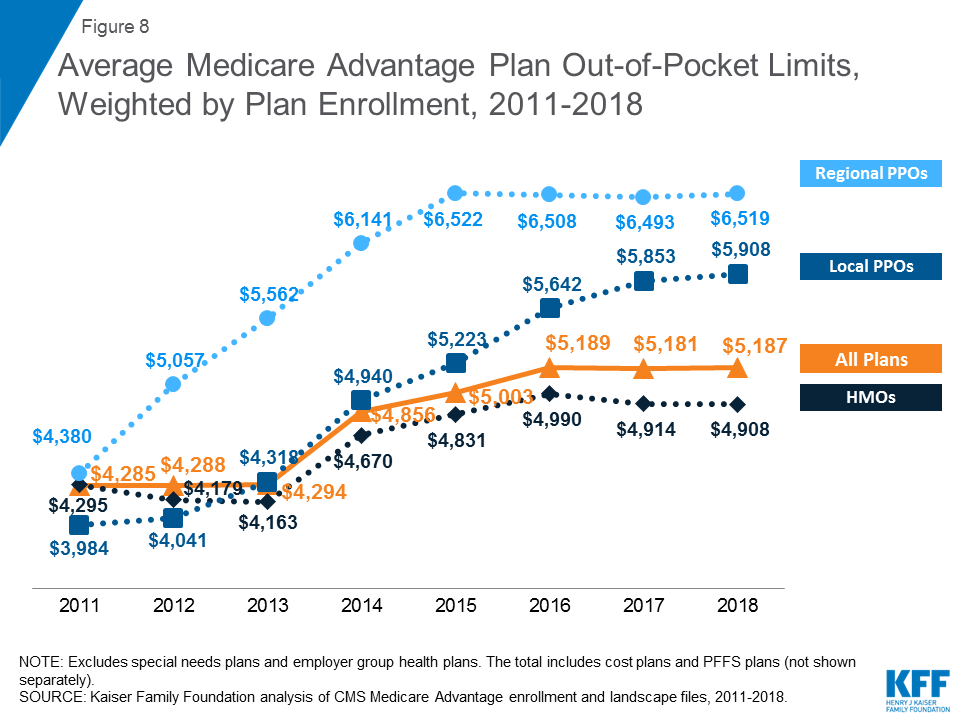

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

How much is Medicare Part B 2020?

This deductible typically changes each year, and for 2020, the deductible is $1,048. Medicare Part B is the inpatient benefit, and it does require a monthly premium payment in order for benefits to apply.

How long does Medicare Part A last?

Medicare Part A is the inpatient benefit and is available to eligible recipients without a monthly premium as long as you paid 40 quarters of Medicare taxes while working.

Why is it important to discuss your needs with a qualified, licensed Medicare agent?

This is why it’s important to discuss your needs with a qualified, licensed Medicare agent in order to take advantage of the right benefits while avoiding overpayment for services you don’t need.

How much is the deductible for Part D?

The deductible for Part D coverage in 2020 is $435, and the standard base premium is $32.74 per month.

Does Medicare cover out-of-pocket costs?

Medicare is a program designed to help seniors and other eligible Americans access quality healthcare at an affordable price; however, taking part in Medicare will include some out-of-pocket costs. While there are some state-sponsored healthcare and wellness programs available at no cost, including Medicaid and the Supplemental Nutrition Assistance ...

Does Medicare Advantage have the same benefits as Original Medicare?

Medicare Advantage plans provide the same Part A and Part B benefits found in Original Medicare, but they are offered through private insurers and may come with additional benefits and savings. Costs and coverage between plans can vary, so compare your options before enrolling.

What does Medicare Part B cover?

This is a very broad category that covers medical office visits, non-emergency ambulance transportation, durable and disposable medical supplies and certain outpatient treatments.

Is Medicare Part D a private insurance?

Since 2006, Medicare-eligible seniors have had the option to enroll in Part D, Medicare’s prescription drug benefit. Unlike Part A and Part B, Medicare Part D prescription drug benefits are provided through a private insurance company that has been approved for the program.

Does Medicare cover coinsurance?

Many Medicare beneficiaries find that the gaps in their coverage – such as Medicare deductibles, coinsurance, copays and more – can leave them having to pay significant out of pocket costs. Medicare supplemental policies can pick up some of the coinsurance and co-payment requirements for each part of Medicare.

Which states have the lowest Medicare premiums?

Florida, South Carolina, Nevada, Georgia and Arizona had the lowest weighted average monthly premiums, with all five states having weighted average plan premiums of $17 or less per month. The highest average monthly premiums were for Medicare Advantage plans in Massachusetts, North Dakota and South Dakota. *Medicare Advantage plans are not sold in ...

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

How much is the Medicare application fee for 2021?

Application Fee Amount. The enrollment application fee sent January 1, 2021, through December 31, 2021, is $599. For more information, refer to the Medicare Application Fee webpage. How to Pay the Application Fee ⤵. Whether you apply for Medicare enrollment online or use the paper application, you must pay the application fee online:

How long does it take to become a Medicare provider?

You’ve 90 days after your initial enrollment approval letter is sent to decide if you want to be a participating provider or supplier.

How to change Medicare enrollment after getting an NPI?

Before applying, be sure you have the necessary enrollment information. Complete the actions using PECOS or the paper enrollment form.

How to get an NPI for Medicare?

Step 1: Get a National Provider Identifier (NPI) You must get an NPI before enrolling in the Medicare Program. Apply for an NPI in 1 of 3 ways: Online Application: Get an I&A System user account. Then apply in the National Plan and Provider Enumeration System (NPPES) for an NPI.

How to request hardship exception for Medicare?

You may request a hardship exception when submitting your Medicare enrollment application via either PECOS or CMS paper form. You must submit a written request with supporting documentation with your enrollment that describes the hardship and justifies an exception instead of paying the application fee.

What is Medicare Part B?

Medicare Part B claims use the term “ordering/certifying provider” (previously “ordering/referring provider”) to identify the professional who orders or certifies an item or service reported in a claim. The following are technically correct terms:

What is Medicare revocation?

A Medicare-imposed revocation of Medicare billing privileges. A suspension, termination, or revocation of a license to provide health care by a state licensing authority or the Medicaid Program. A conviction of a federal or state felony within the 10 years preceding enrollment, revalidation, or re-enrollment.

Medicare basics

Start here. Learn the parts of Medicare, how it works, and what it costs.

Sign up

First, you’ll sign up for Parts A and B. Find out when and how to sign up, and when coverage starts.

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.

If you already receive benefits from Social Security

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) starting the first day of the month you turn age 65. You will not need to do anything to enroll.

If you are not getting Social Security benefits

If you are not getting Social Security benefits, you can apply for retirement benefits online. If you would like to file for Medicare only, you can apply by calling 1-800-772-1213.

If you are under age 65 and disabled

If you are under age 65 and disabled, and have been entitled to disability benefits under Social Security or the Railroad Retirement Board for 24 months, you will be automatically entitled to Medicare Part A and Part B beginning the 25th month of disability benefit entitlement. You will not need to do anything to enroll in Medicare.