Do I really need a Medicare supplement?

You need a Medicare supplement to provide you peace of mind, knowing that if the unexpected happens, you won’t have your credit ruined because of unpaid medical bills. Medicare supplements take care of things like co-payments, deductibles, and coinsurance that you are responsible for, and some plans even cover you if you travel outside of the United States.

How much would 'Medicare for all' cost taxpayers?

- Americans spend 160% more on drugs vs. the Netherlands, and about 36% more than the next-highest-spending countries (Japan and Canada). ...

- The US has a big obesity problem, ranking first in the world. 28.7% of Americans are obese versus 11.8% of people in the Netherlands. ...

- Hospital costs in the US are the highest in the world at $10,300 per stay. ...

What is the average cost of a Medicare supplement plan?

What is the average cost of Medicare Supplement Insurance (Medigap)? The average premium paid for a Medicare Supplement Insurance (Medigap) plan in 2019 was $125.93 per month. 3 It’s important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

How much will a Medicare supplement insurance plan Save Me?

What is a Medicare Supplement insurance plan? Medicare Supplement (also known as Medigap) insurance plans are offered by private insurance companies. Whether they may save you money, and how much money they might save you, depends on a number of details. Medicare Supplement insurance plans may help you pay for out-of-pocket costs for services covered under Medicare Part A and Part B.

How much do Medicare Supplement plans usually cost?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles.

Why are Medicare Supplement plans so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

Does Medicare Supplement cost increase with age?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Is Plan F better than Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

How much does AARP Medicare Supplement Plan G cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (1)$173Plan K$70Plan L$136Plan N$1676 more rows•Jan 24, 2022

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is Medicare Part G deductible for 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, helps cover the cost of some of the out-of-pocket expenses required by Original Medicare (Medicare Parts A and B) such as deductibles, copayments, coinsurance and more.

What happens if you apply for Medicare Supplement?

If you apply for a Medicare Supplement Insurance plan during your Medigap Open Enrollment Period, you will have guaranteed issue rights. That means an insurance company is not allowed to use medical underwriting to charge you a higher rate for your coverage.

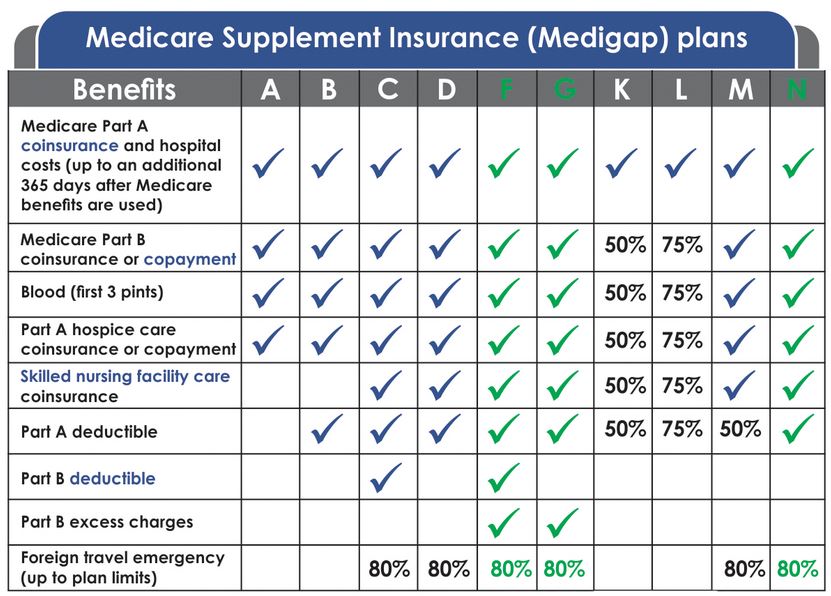

How many Medigap benefits are there?

One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided. There are nine benefit areas covered by the 10 standardized Medigap insurance plans that are available in most states. The coverage of each plan is standardized by the federal government and remains consistent across every carrier in every state.

Why are women's Medicare premiums lower?

Because women have a longer life expectancy, they are sometimes granted lower premiums for Medicare Supplement Insurance plans.

Why do we need supplemental insurance?

Because the whole purpose of supplemental insurance is to help you save money, it’s natural to wonder how much these plans cost so you can get a better understanding of their true value .

Is more coverage more expensive?

Plans offering more coverage can sometimes be more expensive than plans with more basic coverage.

Does Medicare Supplement Insurance offer discounts?

It’s not uncommon for insurance companies to offer discounts on Medicare Supplement Insurance plans. Discounts are often available for non-smokers, married couples and other criteria. Be sure to ask your insurance agent or insurance carrier about any potential discounts that may be available.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is designed to help Original Medicare beneficiaries pay their out-of-pocket expenses, like copays and deductibles.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What is the coinsurance amount for Medicare Part B?

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

How much can you spend on Medicare Part C?

After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage can’t exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

How much does Medicare cost in 2021?

There’s no simple answer to this question. Medicare Supplement plans can range from $50-$300+ in monthly premiums.

How to get accurate Medigap rates?

Your monthly premiums may be similar, but they may not. The only way to get your accurate Medigap rate quotes is to speak to an agent.

What is the letter plan on Medigap?

The letter plan itself is a factor that affects your Medigap premium rates. Less popular Medigap plans are priced differently than the top three. This is due to the lesser benefits they offer. Let’s take a look at sample rates for the rest of the Medigap plans, using Florida as the location.

What is the most popular plan for newly eligible beneficiaries?

The most popular plan for newly eligible beneficiaries is Plan G since they can no longer enroll in Plan F. It covers everything that Plan F does, except for the Part B deductible.

Which Medigap plan is the most popular?

Plan F offers the fullest coverage of all the Medigap plans, making it the most popular.

Is Medicare Supplement the same across carriers?

The benefits of a Medicare Supplement plan will be the same across carriers. However, the premiums will vary by the beneficiary.

Is Plan F deductible?

There’s also a high-deductible version of Plan F. High-Deductible Plan F offers the same benefits as standard Plan F. Premiums for this plan are lower, but there’s a higher deductible the beneficiary must reach before the plan covers all costs.

When it comes to Medicare Supplement Insurance, your monthly premium varies considerably depending on where you live

The average cost of supplemental insurance for Medicare is around $150 per month, with monthly premiums typically ranging between $50 and $450. Please note that premiums vary considerably from plan to plan. There are numerous variables that play a role in setting rates for Medicare Supplement Insurance (more commonly known as Medigap ).

How Much Does Medicare Supplement Insurance Cost?

When comparing your Medicare plan options, one of your first considerations is likely cost. That makes sense. How can you decide between Medicare Supplement Insurance and a Medicare Advantage plan if you don't have a good idea what each option costs?

What Happens If You Have a Guaranteed Issue Right?

If you have guaranteed issue rights, your Medigap application does not go through medical underwriting. You cannot be denied a Medigap policy or charged a higher premium – even if you have preexisting conditions and a history of tobacco use.

What Pricing Method Do Medigap Insurers Use?

Like most types of insurance, your Medigap premium will likely fluctuate over time. You can better estimate the long-term cost of your Supplement plan if you know what pricing method the insurance company used.

Where Do You Live?

Where you live plays an enormous role in Medigap pricing. That's nothing new – most of us are used to costs being higher in certain parts of the country. But with Medigap premiums, there's a second reason location makes a difference: state laws.

Additional Pricing Factors

There are two more items that influence pricing: age and gender. You'll usually pay less for a Medigap plan if you're a woman and under age 75.

How Much Does Medigap Plan F vs. Medigap Plan G Cost?

Thanks to its coverage of the Medicare Part B deductible, Medigap Plan F offers the most comprehensive benefits of all the Supplement plans. However, as of January 1, 2020, any Medigap plan that pays the Part B deductible is prohibited. If you already had Plan F, you may keep it.

What are the different pricing models for Medicare Supplement?

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan. Community-rated.

What are the factors that affect Medicare Supplement?

As you compare Medicare Supplement quotes, keep in mind that other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

What factors affect the cost of a Medigap plan?

Location is another factor that can affect the cost of a Medigap plan, as market competition and the local cost-of-living can affect Medigap premiums. The chart below shows the average cost of Medicare Supplement Insurance Plan F by state in 2018. State.

How long is the Medigap Open Enrollment Period?

Your Medigap Open Enrollment Period (OEP) is a 6-month period that starts as soon as you are at least 65 years old and enrolled in Medicare Part B. During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs.

What is the lowest Medicare premium?

Based on our analysis, Medicare Supplement Insurance Plan F premiums in 2018 were lowest were lowest for beneficiaries at age 64 ( $146.55 per month ) and highest for beneficiaries at age 82 ( $236.53 per month).

Why are Medicare premiums so high?

Medicare Supplement Insurance plan premiums could be more expensive for older beneficiaries for a few reasons, such as: 1 If you wait until after your Medigap Open Enrollment Period to sign up for a Medigap plan, insurance companies can charge you a higher premium based on your health.#N#Your Medigap Open Enrollment Period (OEP) is a 6-month period that starts as soon as you are at least 65 years old and enrolled in Medicare Part B.#N#During your Medigap OEP, Medicare Supplement Insurance companies cannot use medical underwriting to determine your Medigap plan costs. 2 There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates. Each type of cost model can affect the average price of a given plan.#N#Community-rated#N#With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.#N#For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.#N#Issue-age-rated#N#With issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.#N#You will typically pay less for an issue-age-rated plan if you enroll in the plan when you're younger. Your premiums also won't increase based on your age.#N#Attained-age-rate#N#Attained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Does Medicare Supplement Insurance Plan F have a high deductible?

Medicare Supplement Insurance Plan F also offers a high-deductible option (and is the only Medigap plan to do so).