The deductible for Part B is $183 per year. You're responsible for paying that amount out of your own pocket before Medicare starts providing coverage, and after that, Medicare typically covers 80% of most services that Part B covers, leaving you with the remaining 20%.

Full Answer

What is the maximum premium for Medicare Part B?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

What is the current cost of Medicare Part B?

Apr 16, 2021 · How much does Medicare Part B coverage cost? Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing. Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021.

What services are covered by Medicare Part B?

May 06, 2021 · Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies. You’ll usually need to pay a deductible ($203 in 2021). You pay coinsurance or copayment amounts in most cases. Under Part B, the coinsurance amount is usually 20% of the Medicare-approved amount.

Does Medicaid pay for Medicare Part B?

Sep 24, 2021 · Read Also: Does Medicare Cover Oxygen At Home. How Much Does Medicare Part B Coverage Cost. Medicare Part B generally pays 80% of approved costs of covered services, and you pay the other 20%. Some services, like flu shots, may cost you nothing. Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021.

Does Medicare Part B cover 80 %?

You will pay the Medicare Part B premium and share part of costs with Medicare for covered Part B health care services. Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%.

How much does Medicare cover for Type B expenses?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Part B Good For?

Learn about what Medicare Part B (Medical Insurance) covers, including doctor and other health care providers' services and outpatient care. Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare Part A and B cover 100 percent?

All Medicare Supplement insurance plans generally pay 100% of your Part A coinsurance amount, including an additional 365 days after your Medicare benefits are used up.

How much does Medicare take out of Social Security?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Does Medicare Part B pay for prescriptions?

Medicare Part B (Medical Insurance) includes limited drug coverage. It doesn't cover most drugs you get at the pharmacy. You'll need to join a Medicare drug plan or health plan with drug coverage to get Medicare coverage for prescription drugs for most chronic conditions, like high blood pressure.

Does Medicare Part B cover dental and vision?

Original Medicare (Medicare Part A and Part B) does not cover routine dental or vision care. There are certain circumstances under which Original Medicare may provide some coverage for dental or vision care in an emergency setting or as part of surgery preparation.Dec 7, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Which of the following is not covered by Medicare Part B?

But there are still some services that Part B does not pay for. If you're enrolled in the original Medicare program, these gaps in coverage include: Routine services for vision, hearing and dental care — for example, checkups, eyeglasses, hearing aids, dental extractions and dentures.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What do Medicare Parts A and B cover?

Part A (Hospital Insurance): Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care. Part B (Medical Insurance): Helps cover: Services from doctors and other health care providers.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Medicare Part B?

Medicare Part B is medical insurance. Along with Medicare Part A (hospital insurance), it makes up Original Medicare, the federal health insurance program. Here’s something important to know about Medicare Part B: you need this coverage if you decide to sign up for a Medicare Advantage plan, or buy a Medicare Supplement insurance plan.

How much is Medicare Part B 2021?

Most people pay a monthly premium for Medicare Part B. The standard premium is $148.50 in 2021. You could pay more than that if your income is higher than a certain amount, and less if you qualify for state-based help if your income is lower than a certain amount. A Part B deductible applies to some covered services.

What happens if you don't sign up for Medicare Part B?

However, when that coverage ends, be aware that if you don’t sign up for Medicare Part B within a certain period of time, you might face a Part B late enrollment penalty. Here’s one reason you might want to sign up for Medicare Part B. Suppose you decide you’d like to buy a Medicare Supplement insurance plan.

How much is the Part B deductible for 2021?

A Part B deductible applies to some covered services. The annual Part B deductible is $203 in 2021. After you pay your deductible, you generally pay a 20% coinsurance (as mentioned above) for most covered services.

Does Medicare cover long term care?

If the only care you need is custodial, meaning help with tasks such as bathing and dressing, Medicare doesn’t generally cover it .

Is a hospital inpatient covered by Medicare?

Hospital inpatient care, such as a semi-private room, meals, and more. These are usually covered under Medicare Part A. Doctor visits in the hospital may still be covered under Part B. Some tests and services that your doctor might order or recommend for you.

Do you have to pay Medicare Part B premium?

Please note that even if you decide to get your Original Medicare benefits through a Medicare Advantage plan, you still have to pay our monthly Medicare Part B premium. Of course, if the Medicare Advantage plan charges a premium, you’ll need to pay that as well. Some Medicare Advantage premiums are as low as $0.

What type of insurance is used for Medicare Part A and B?

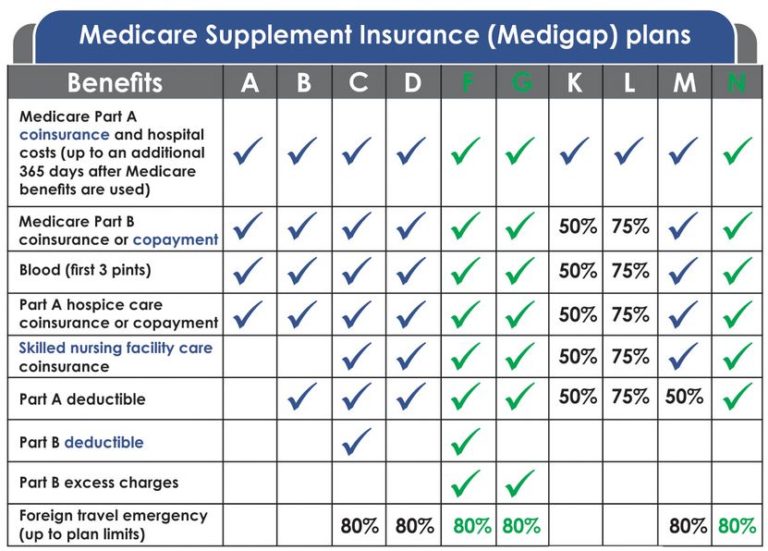

This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket costs, such as deductibles, coinsurance, and copayments.

What does Part B cover?

Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies.

How much does Medicare Supplement pay for hospital visits?

(Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.)

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

How much is coinsurance for 61-90?

Your copayment for days 61-90 is $371 for each benefit period in 2021. After you’ve spent more than 90 days in the hospital during a single benefit period, you’ll generally have to pay a coinsurance amount of $742 per day in 2021.

Does Medicare have a maximum spending limit?

Be aware that Original Medicare has no annual out-of-pocket maximum spending limit. If you meet your Medicare Part A and/or Part B deductibles, you still generally pay a coinsurance or copayment amount – and there’s no limit to what you might pay in a year.

What is Medicare Part B?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.) If you qualify to get Medicare Part A, ...

How much is Medicare Part B 2021?

For Part B, you have to pay a monthly fee (called a premium ), which is usually taken out of your Social Security payment. For 2021, this fee is $148.50 per month. But if you have a higher than average personal income (over $85,000) or household income (over $176,000), you will have to pay a higher monthly premium for Medicare Part B.

How much does Medicare pay after paying $203?

After you pay $203 yourself, your benefits kick in. After that, Medicare will pay 80% of the cost of most Part B services, and you (or your Medigap policy) pay the other 20%. Finally, it’s important to know that there's a penalty for signing up late for Part B.

What is the Medicare approved amount?

Medicare decides what it will pay for any particular medical service. This is called the Medicare-approved amount. If your doctor is willing to accept what Medicare pays and won't charge you any more, they are said to "accept assignment.".

Why do people opt out of Medicare Part B?

Some people opt out of Medicare Part B because they still have coverage through union or employer health insurance. As long as your coverage is considered “creditable” you will not pay a penalty for signing up late.

What happens if you don't sign up for Medicare Part B?

If you don't sign up for Medicare Part B when you first become eligible (and you don’t have comparable coverage from an employer), your monthly fee may be higher than $148.50. You’ll pay a lifetime 10% penalty for every 12 months you delay your enrollment. Medical and other services.

Do you have to pay a co-payment for outpatient hospital services?

You must pay a co-payment for outpatient hospital services The exact amount varies depending on the service. Home health care. Medicare Part B pays for nurses and some therapists to provide occasional or part-time services in your home.

What Is Medicare Part A (Hospital Insurance)?

Part A is hospital insurance that helps cover inpatient care in hospitals, skilled nursing facility, hospice, and home health care.

What Is Medicare Part B (Medical Insurance)?

Part B helps cover medically-necessary services like doctors' services, outpatient care, home health services, and other medical services. Part B also covers some preventive services. Check your Medicare card to find out if you have Part B.

What Is Medicare Part D (Medicare Prescription Drug Coverage)?

Medicare prescription drug coverage is insurance run by an insurance company or other private company approved by Medicare. There are two ways to get Medicare prescription drug coverage: Medicare Prescription Drug Plans.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

How Much Does Private Home Care Cost

The cost of private home care depends on several factors, in the first place, on the number of hours the designated care worker spends with you. It also depends on the kind of services and the supplies needed to assist you with your condition.

What Are The Costs

Original Medicare covers eligible home health care services at no cost to you if you meet certain requirements. But for other services, you’ll have to share the costs:

Home Health Services Covered By Original Medicare

If youre eligible for Medicare-covered home health care, services covered may include:4

How To Pay For In

There may be times when not every part of your in-home care is covered. We already know 20 percent of the durable medical equipment needed to treat you is your responsibility, but there are other services like custodial care or extra round-the-clock care that wont be covered by Medicare. This is where supplemental insurance comes in.

Iv Getting Started With Medicare

Medicare is a federal program that provides health insurance for most Americans over the age of 65, and younger adults with qualifying conditions. Like most health insurance programs, Medicare covers some, but not all, health care expenses.

Medicare Part A Coverage

Part A, in contrast, does provide home health care coverage in some situations. A hospital or skilled nursing facility stay triggers Part A. If a person has a three-day inpatient stay at a hospital or has a Medicare-covered SNF stay, Part A will cover up to 100 days of home health care.

What Does Home Health Care Include

Many people require medical assistance after the age of 65. Home health care includes medical care services in your home that you receive for illness or injury.