Do I have to pay Medicare tax After retirement?

Jul 02, 2020 · For Medicare’s 62.4 million or so beneficiaries, the program generally covers about two-thirds of health-care costs. The amount you could need to cover premiums and out-of-pocket prescription drug...

How much will Medicare cost me when I retire?

Mar 08, 2020 · You are eligible for Medicare and premium-free Part A, if you or your spouse paid federal taxes for 40 quarters. If you do not have 40 quarters, you may be eligible to purchase Part A coverage. This costs $458.00 per month if you have less than 30 quarters. If you paid federal taxes for 30 – 39 quarters, the monthly premium for Part A is $252.00.

Do I pay for Medicare when I retire?

Mar 14, 2022 · The 2022 standard monthly premium for Medicare Part B coverage is $170.10, (up from $148.50 in 2021). 13 Most people pay the standard monthly premium, but some individuals pay more if their annual...

How can life insurance help cover medical costs in retirement?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance: You pay: $1,556 deductible for each benefit period

How much do retirees pay for Medicare?

Most people pay $144.60 per month for Medicare Part B in 2020, but high earners pay more. If you're single and your adjusted gross income plus tax-exempt interest income is more than $87,000, or more than $174,000 and you're married filing jointly, then you may have to pay from $202.40 to $491.60 each month.

Do you pay Medicare premiums after retirement?

Because you pay for Medicare Part A through taxes during your working years, most people don't pay a monthly premium. You're usually automatically enrolled in Part A when you turn 65 years old. If you're not, it costs nothing to sign up.

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

Does Medicare cost more as you age?

Everyone pays the same amount for their monthly premium. With an Issue-Age Rated plan, your premium is based on your age when you purchase, or are issued, the policy. Generally, premiums cost less when you are younger. Premiums for these types of policies do not increase with age.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Is Medicare based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

Do Medicare Supplement premiums increase every year?

Medicare supplement rate increases usually average somewhere between 3% and 10% per year. And sometimes Medicare supplement rate increases even happen twice in the same year! Years of costly rate increases can be an economic hardship, to say the least.4 days ago

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How much is Part A deductible for 2020?

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

What does Part C cover?

These policies are sold by private insurance companies. Part C covers everything that Original Medicare Parts A and B cover plus some additional coverage. Most plans include prescription drug coverage too. The amount you pay for your monthly premium depends on the coverage it has and the state where you live.

How long does Medicare enrollment last?

Your initial enrollment period for Medicare (all four parts) begins three months prior to the month you turn 65 and lasts until the end of the third month after your birthday month—a total of seven months.

How long do you have to enroll in Medicare after 65?

In general, the SEP requires that you enroll in Medicare no later than eight months after your group health plan or the employment on which it is based ends (whichever comes first). One important exception to SEP rules: If your group health plan or employment on which it is based ends during your initial enrollment period, you do not qualify for a SEP. 10

What does it mean to retire at 65?

Eligibility at age 65 means that health insurance becomes more affordable. When you retire, it’s important to understand how Medicare works and how you can get the best and most cost-effective coverage. Many retirees wonder how to determine ...

How long does it take for Medicare to open?

When you're first eligible for Medicare, the open enrollment period lasts roughly seven months and begins three months prior to the month of your 65th birthday.

When is the open enrollment period for Medicare?

There is also a new annual Medicare Advantage open enrollment period, from January 1st to March 31st , during which you can switch to traditional Medicare from an MA plan and join a Medicare prescription drug plan to add drug coverage. 9

Who is eHealth Medicare?

If you qualify for Medicare and are ready to look at plans, eHealth Medicare, an independent insurance broker and partner of Investopedia, has licensed insurance agents at <833-603-0946 TTY 711> who can help connect you with Medicare Advantage, Medicare Supplement Insurance, and Prescription Drug Part D plans.

Does Medigap cover prescriptions?

Medigap plans, however, do not provide prescription drug coverage. So if you have a Medigap policy, you may also need Part D. 6 . A one-time Medigap open-enrollment period lasts six months and begins the month you turn 65 (and are enrolled in Part B).

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.

What are the parts of Medicare?

What Are the Four Parts of Medicare? Medicare consists of four parts: Medicare Part A, which is your hospital insurance, Medicare Part B, which is your regular medical insurance, Medicare Part C (or Medicare Advantage), which is an alternate way to receive benefits, and Medicare Part D, which covers prescription drugs.

What is Part B insurance?

Part B is the coverage of medical supplies and services that are necessary to treat you . These include outpatient care, preventative services, rehabilitation, ambulatory services, and medical equipment. To receive Part B’s benefits, you must enroll and pay a premium, which we will discuss below.

What is the difference between Part C and Part D?

Part C is a combination of parts A and B, but usually administered privately and often covers additional items. Part D is your prescriptions. Part D’s monthly costs are based on your income and are on top of the Part B premium costs. These range from $0 extra to an additional $77.10 per month.

How old do you have to be to donate to a charity?

As the account holder, you should never have the money in your possession. You must be at least 70 1/2 years of age. The charitable organization cannot be private. They must be a qualifying charity.

When do you get Medicare?

Medicare is a public health insurance program that you qualify for when you turn 65 years old. This might be retirement age for some people, but others choose to continue working for many reasons, both financial and personal. In general, you pay for Medicare in taxes during your working years and the federal government picks up a share of the costs.

What is Medicare Supplement?

Medicare Supplement, or Medigap, plans are optional private insurance products that help pay for Medicare costs you would usually pay out of pocket . These plans are optional and there are no penalties for not signing up; however, you will get the best price on these plans if you sign up during the initial enrollment period that runs for 6 months after you turn 65 years old.

Is Medicare mandatory?

While Medicare isn’t necessarily mandatory, it may take some effort to opt out of. You may be able to defer Medicare coverage, but it’s important to if you have a reason that makes you eligible for deferment or if you’ll face a penalty once you do enroll.

Does Medicare cover late enrollment?

Medicare programs can help cover your healthcare needs during your retirement years. None of these programs are mandatory, but opting out can have significant consequences. And even though they’re option, late enrollment can cost you.

Is there a penalty for late enrollment in Medicare Part C?

Since this is an optional product, there is no late enrollment penalty or requirement to sign up for Part C. Penalties charged for late enrollment in parts A or B individually may apply.

Do you pay for Part A insurance?

Most people don’t pay a monthly premium for Part A, but you will still have to plan to pay a portion of your inpatient care costs if you’re admitted to a hospital for care.

Do you have to sign up for Medicare if you are 65?

Medicare is a federal program that helps you pay for healthcare once you reach age 65 or if you have certain health conditions. You don ’t have to sign up when you turn 65 years old if you continue working or have other coverage. Signing up late or not at all might save you money on monthly premiums but could cost more in penalties later.

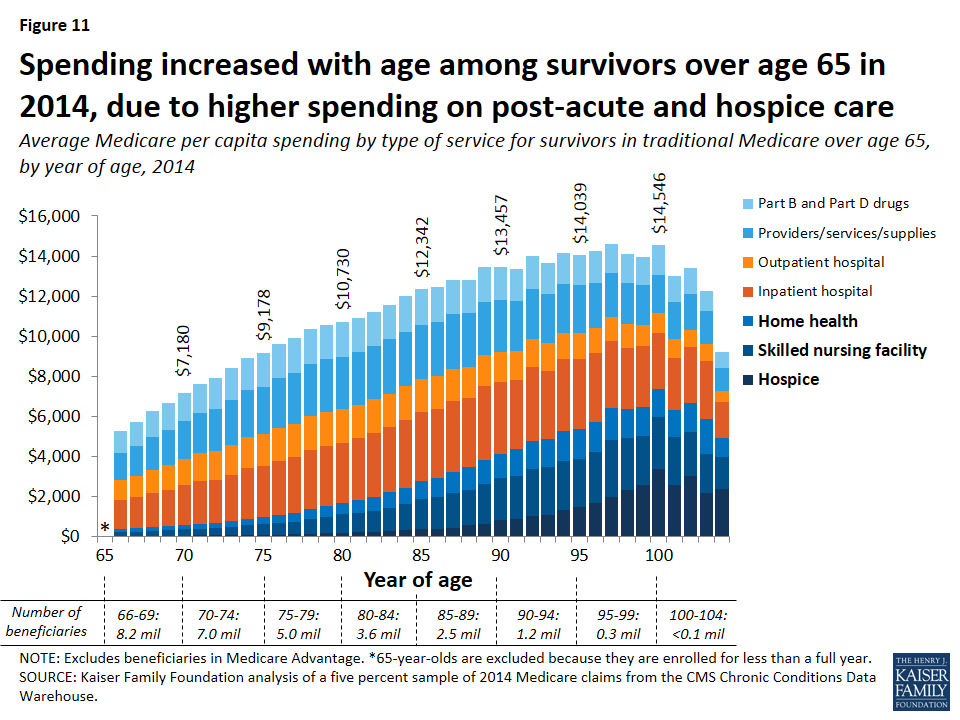

How much does Medicare cover?

In addition, you'll have out-of-pocket costs. When you factor all of this in, it is estimated Medicare will cover only about 50-60% of your healthcare needs. And, over time, premiums and out-of-pocket costs will go up.

How to avoid medical bills?

Many physicians encourage patients to lead a healthy lifestyle to avoid the burden of mounting medical bills. Take charge of your medical care. Do the research and ask questions. You will also want to have a good dentist, and go see them every six months.

Does Medicare cover prescription drugs?

Medicare Part D coverage (drug coverage) includes prescription drugs for self-administration. Drugs administered by a professional like a nurse or physician will usually fall under Medicare Part B coverage. Those covered with Part D coverage will pay a co-pay per prescription. Also, some drugs are excluded from coverage.

Does Medicare cover long term care?

Long-term care insurance premiums Medicare does not cover the majority of long-term care costs you might experience. If you want to be assured you have funds to cover these costs, consider long-term care insurance .

Is Medicare Part A free?

Although Medicare Part A, which covers some level of hospitalization, is free (assuming you worked in the U.S. long enough to qualify), the bulk of Medicare coverage is not free. You'll pay premiums for Medicare Part B, and for supplemental insurance or prescription plans. In addition, you'll have out-of-pocket costs.