Medicare Part B In 2018

| If you earned (single tax filing): | If you earned (joint tax return): | You’ll pay: |

| Up to $85,000 | Up to $170,000 | $134 a month |

| Over $85,000 to $107,000 | Over $170,000 to $214,000 | $187.50 a month |

| Over $107,000 to $160,000 | Over $214,000 to $320,000 | $267.90 a month |

| Over $160,000 to $214,000 | Over $320,000 to $428,000 | $348.30 a month |

How much does Medicare cost at age 65?

In 2021, the premium is either $259 or $471 each month ($274 or $499 each month in 2022), depending on how long you or your spouse worked and paid Medicare taxes. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

How much does Medicare cost per month?

- $1,556 deductible

- Days 1 â 60: $0 coinsurance

- Days 61 â 90: $389 coinsurance

- Days 91+: $778 coinsurance per âlifetime reserve day,â which caps at 60 days

- Beyond lifetime reserve days: You pay all costs

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How to pay for Medicare?

was ordered Wednesday by a San Antonio federal jury to pay $8.1 million in damages for allegedly submitting thousands of false claims to the United States Medicare Program. The original amount awarded, $2.7 million, was mandatorily tripled under the False ...

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the average monthly cost for Medicare?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

How much does Medicare cost for the average 65 year old?

Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year. Deductibles for Medicare Part B benefits are $198.00 as of 2020 and you pay this once a year.

Does everyone pay the same monthly amount for Medicare?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much do most seniors pay for Medicare?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

How much does the average retiree pay for Medicare?

According to an AARP report released in December 2021, retirees with traditional Medicare ended up spending an average of $6,168 per year on covering the costs of insurance premiums and medical services.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How can I reduce my Medicare premiums?

How Can I Reduce My Medicare Premiums?File a Medicare IRMAA Appeal. ... Pay Medicare Premiums with your HSA. ... Get Help Paying Medicare Premiums. ... Low Income Subsidy. ... Medicare Advantage with Part B Premium Reduction. ... Deduct your Medicare Premiums from your Taxes. ... Grow Part-time Income to Pay Your Medicare Premiums.

Why is Medicare Part B so expensive?

Why? According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.

Why is my first Medicare bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

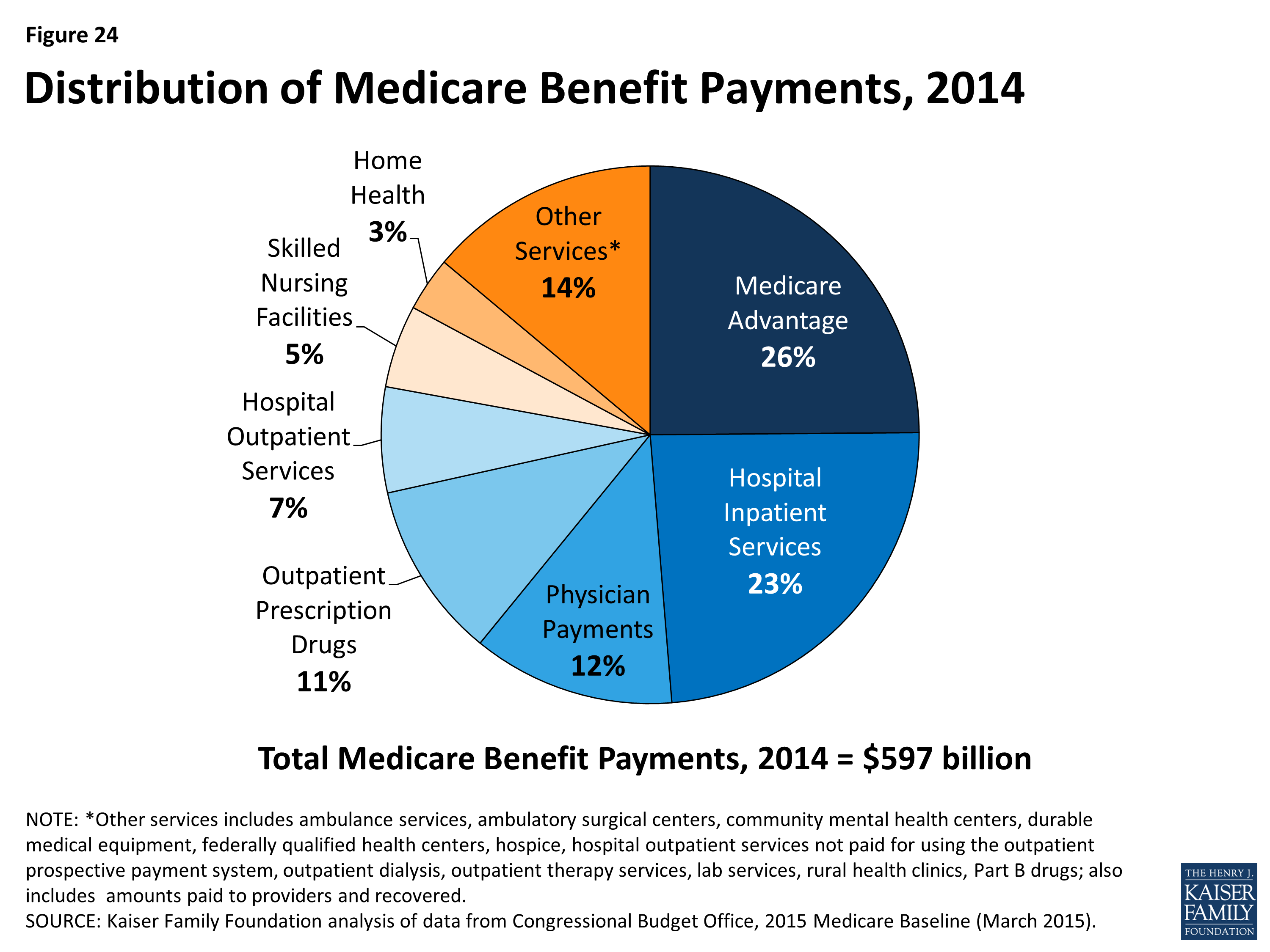

What is Medicare Advantage?

Medicare Advantage insurance bundles together Medicare Part A and Medicare Part B coverage, and it usually also includes coverage for healthcare services that are traditionally uncovered by Part A and Part B, such as hearing aids and drugs. In 2018, retirees have to pay the Part B insurance premium plus $30, on average, for their Medicare Advantage coverage. However, because these plans are sold by private insurers and each plan may provide slightly different coverage beyond the Part A and Part B requirements, their premiums can vary considerably.

Is Medicare Part A free for retirees?

A common misperception is that healthcare insurance is free for retirees. That's true of Medicare Part A for most Americans, but it's not true for Medicare Part B, Medicare Advantage, Medicare Part D, or Medigap plans.

Can I combine Medicare and Medigap?

It's also possible that retirees will combine their Medicare coverage with Medigap plans that are also sold by private insurers. As a refresher, Medigap plans help cover deductibles and other cost-sharing requirements when Part A and Part B Medicare falls short. There's a slate of different Medigap coverage levels, and premiums differ from plan to plan and level to level, but in my home state of New Hampshire, the monthly premiums for someone in good health range between $108 to $357. You can get a good idea of how much these plans cost in your home state by using this Medicare plan search tool.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much is Medicare premium in 2018?

In 2018, the premium for those with 30 to 39 quarters of coverage will be $232 per month, up $5 from 2017's figure. If you have fewer than 30 quarters, then the monthly premium is $422, up $9 from last year. 2018 will also see higher deductibles and coinsurance payments for hospital coverage under Part A. You can see the increases in the table ...

How much does Medicare Part A cost?

However, if you don't qualify, then you can still get Part A coverage as long as you pay a monthly premium. In 2018, the premium for those with 30 to 39 quarters of coverage will be $232 per month, up $5 from 2017's figure. If you have fewer than 30 quarters, then the monthly premium is $422, up $9 from last year.

How much did joint filers pay in 2017?

For instance, in 2017, it took $428,000 in income for joint filers to have to pay the highest $428.60 per month amount.

How much is Medicare Part B deductible?

For instance, the annual deductible for 2018 remains at $183 per year, which represents the amount you have to pay for doctor visits or other outpatient services before Part B coverage kicks in.

How many people get medicare?

About 58 million Americans get healthcare coverage through the Medicare program. Each year, healthcare costs tend to rise, and that typically results in increases in many of the costs Medicare recipients have to pay.

Is Medicare Part B flat?

It can be difficult for retirees to handle even small increases in living expenses, so the flat premiums for many Medicare Part B recipients are good news. Yet with the hold-harmless provision finally undoing its positive impacts over previous years, many retirees will nevertheless have to figure out how to deal with seeing more of their hard-earned money go toward Medicare in 2018.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Standard Medicare costs include monthly premiums, deductibles, and co-insurance

Medicare health insurance costs, like costs associated with any type of insurance, vary widely. Like other insurance plans, Medicare plans use out-of-pocket fees like annual deductibles, copays, and coinsurance fees, in addition to monthly premiums. Some of these costs will be more regular than others, and some may only arise once in a while.

The Four Types of Medicare Costs

Before we get into the details for each part of Medicare, it will be useful to understand the types of costs that you can incur as a Medicare beneficiary. Medicare plans have four types of possible costs. These are:

Medicare Premiums

Premiums are the costs that you will pay to your insurance company each month. These will not vary from month to month. There are standard rates that you’ll pay for Original Medicare, while private Medicare plans can vary more widely.

Part C (Medicare Advantage) Premiums

Medicare Advantage health plans, also known as Part C plans, have premiums that function in a slightly different way from Original Medicare (Medicare Parts A and B). Medicare Part C is offered by private insurance companies, rather than the federal government. For this reason, the premiums can vary, while Original Medicare premiums are standard.

Medicare Part D Prescription Drug Plans

Like Part C plans, Part D plans are also offered by private insurance companies. Part D plans offer prescription drug coverage, and you can purchase them if you have Original Medicare or a Medicare Advantage plan that doesn’t cover prescription drugs.

Medicare Deductibles: What to Expect?

A deductible is simply an amount that you must pay out-of-pocket before your insurance will begin to provide you with coverage. Let’s take a look at the deductibles for each part of Medicare.

Coinsurance and Copays for Medicare: What to Expect

When it comes to this area of cost-sharing, coinsurance usually refers to a percentage-based fee, while copayment or copay refers to a fixed fee that you pay with each visit. The usage is slightly different for some parts of Medicare; let’s take a look at the details.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

How much does Medicare Part B cost in MA?

Often times, MA plans also include a drug benefit, so you also replace Part D. However, you still must pay the $148.50 monthly premium for Medicare Part B. MA premiums vary, depending on which type of plan you choose, which area you’re in, and other similar factors.

How much is coinsurance for days 21 through 100?

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $185.50 in 2021.

Is MA insurance low?

In general, MA premiums are quite low, and sometimes, they’re even $0. . While the monthly premium is very low or even $0, there are some things to consider before opting an MA plan. You can read about the pros and cons of Medicare Advantage here.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.