When someone enrolls into Medicare, they’ll receive a letter from the Social Security Administration with essentially the message of “welcome to Medicare, your rate will be $170.10”. First, please note that this is a per person, per month charge. There are no family rates with Medicare.

Full Answer

How much does Medicare cost per month?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty. How much is the Part A late enrollment penalty?

Does Medicare have a family plan?

Dec 01, 2021 · Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount (IRMAA), meaning if you make more, you’ll pay more.

How much does a skilled nursing facility cost under Medicare?

Feb 15, 2022 · If you pay a premium for Part A, your premium could be up to $499 per month in 2022. If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 …

How much does Medicare Part a cost after you turn 65?

Nov 19, 2021 · If you had a shorter marriage and didn’t qualify for premium-free Part A through your own work history, you’ll pay either $274 or $499 for your monthly premiums in 2021, depending on how long you or your former spouse worked. Medicare Part B

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much can you spend on Medicare Part C?

After that limit, your Medicare Part C plan will pick up all the remaining cost of covered health care services. The out-of-pocket limit for Medicare Advantage can’t exceed $7,550 a year for in-network services. That means you could save more money if you have a lower out-of-pocket expenses limit. The limit is $11,300 for out-of-network services.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is designed to help Original Medicare beneficiaries pay their out-of-pocket expenses, like copays and deductibles.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What is the coinsurance amount for Medicare Part B?

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much will Medicare pay for 2021?

In 2021, you’ll also pay $203 for your Part B deductible before your some of your Part B benefits kick in. After paying this amount, you’ll typically pay 20% of the Medicare-approved amount for medical expenses covered by Part B, including: Most doctor services. Outpatient therapy.

How long do you have to be married to qualify for Medicare?

You had Medicare-covered government employment. You have been married to someone with a qualifying work history for at least 12 months. You may also qualify for premium-free Part A at an earlier age if: You have received Social Security or Railroad Retirement Board disability payments for 24 months.

What to do if you are divorced and have Medicare?

If you’re divorced or recently widowed, you’ll need to budget for your Medicare Advantage plan or Medicare Part D plan premiums, deductibles and copays. Shop around for the best plan for your needs and budget, as coverage and premium prices vary between providers.

What is Medicare Part B premium?

This higher Part B premium amount is called the Medicare income-related monthly adjustment amount, or IRMAA. The higher your combined annual income, the more your Medicare Part B premiums will ...

How much is Part A insurance in 2021?

If you or your spouse don’t qualify for premium-free Part A, you can pay for your Part A benefits instead. In 2021, Part A premiums cost $259 or $471 each month. Prices vary depending on how long you or your spouse worked and paid taxes.

How many seniors are married in the US?

More than half of all Americans aged 65 or over are married, according to data from the U.S. census. In some states, such as Wyoming, Idaho and Utah, more than three in five seniors age 65 and above have tied the knot. If you’re considering getting married or are already living in wedded bliss, you may wonder how much Medicare plans will cost you.

Do married people pay Medicare premiums?

Most married Medicare beneficiaries don’t pay monthly premiums for Medicare Part A. You’ll qualify for premium-free Part A at 65 if any one of the following applies to you:

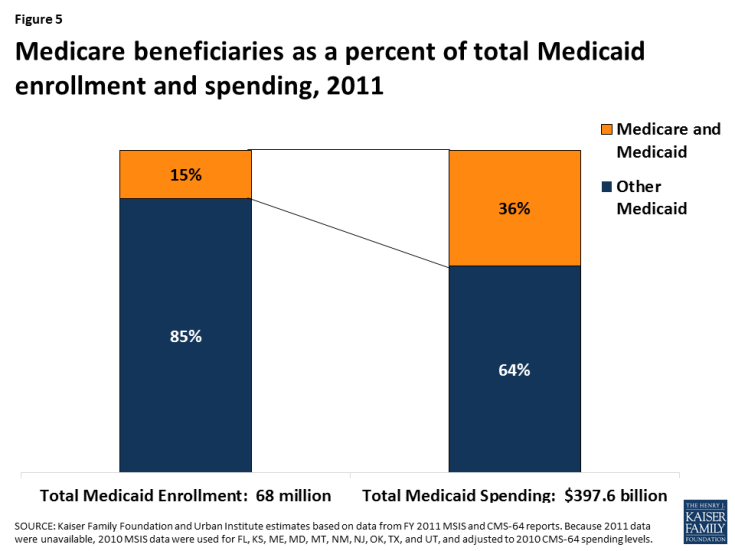

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

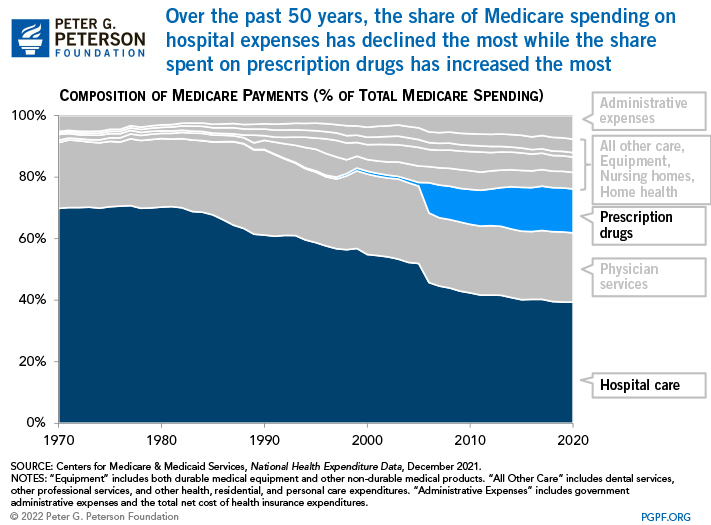

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much does Medicare cost a month?

Depending on the number of quarters worked, the monthly premiums can range from $252 a month for an individual who have worked 30 to 39 quarters, and up to $458 a month for an individual who worked less than 30 quarters. Medicare Part B.

How long does it take to get Medicare if you are 65?

Individuals under the age of 65 that are receiving Social Security Disability Income or Railroad Retirement Board Disability income have a two year , sliding scale, waiting period to qualify for Medicare insurance beginning at age 62.

What is the income basis for Part B?

The income basis for Part B premiums allows for individual and family programs. For example, an individual with annual earnings of $87,000 or less and a married couple with annual earnings of $174,000 or less will have the same monthly premium cost of $144.60. The monthly premiums with the extra fees will increase at various levels based on the higher income of individuals or couples up to a maximum monthly premium of $491.60.

What age do you have to retire without health insurance?

If someone retires without a continuing employer-provided health insurance plan, they will need to purchase an individual or family health plan that will meet their medical expectations until reaching the qualifying age of 65 . Medicare Coverage Due to Disease or Disability. Disease Eligibility.

When was Medicare signed into law?

Medicare was signed into law by President Lyndon B. Johnson in 1965 . The program was designed to provide insurance coverage of hospital expenses through Part A, and of medical costs through Part B. Medicare covers senior citizens aged 65 and older and younger individuals with specific disabilities. Medicare is available for legal permanent residents that have met the qualifying number of years worked. Those eligibilities remain in effect today.

Is Medicare Part A premium free?

Cost of Medicare. Medicare Part A. Individuals are provided premium-free Medicare Part A Hospital Insurance if the individual or a spouse paid the payroll Medicare tax for a defined period of time while working. If someone does not qualify for the premium-free Part A, they may be able to purchase Part A for a monthly premium, ...

Does Medicare Part B change?

The monthly premiums for Medicare Part B are subject to change from one year to another. There is a standard monthly premium. If an individual’s modified adjusted gross income exceeds the standard income bracket, that person will pay an extra charge for Part B that is calculated on the amount of the additional income.

How often does Medicare adjust income?

This amount and the income limits Medicare set can both change every year.

What is the maximum amount you can pay for Medicare in 2021?

In 2021, people with tax-reported incomes over $88,000 (single) and $176,000 (joint) must pay an income-related monthly adjustment amount for Medicare Part B and Part D premiums. Below are the set income limits and extra monthly costs you could pay for Medicare Part B and Part D based on your tax-reported income.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is Part B insurance in 2021?

The IRMAA is based on your reported adjusted gross income from two years ago. For 2021, your Part B premium may be as low as $148.50 or as high as $504.90.

Do you have to factor in Medicare tax?

When you become eligible for Medicare and look at how much to budget for your annual health care costs, you’ll need to also factor in your tax-reported income.

How much money do I need to qualify for SSI?

You need to have less than a certain amount of money to qualify for SSI.

What is a medical savings account?

Medicare Medical Savings Accounts are available through private health insurers who contract with Medicare. The Medical Savings Account plan will set you up with a medical savings account you can use to pay your health-care costs. These high-deductible plans let you designate a beneficiary.

What agencies do you check into for a loved one's funeral?

To help pay for a loved one’s funeral expenses, you might also want to check into any survivor benefits from any of these agencies as appropriate: Social Security Administration. Railroad Retirement Board. United States Department of Veterans Affairs. Your state insurance department.

Can you use leftover money from a medical savings account to pay for funeral expenses?

Depending on when the funds were deposited into your account, a portion of them may go to your beneficiary when you die. If you enroll in a Medical Savings Account plan, you can ask your beneficiary to use any available leftover funds to pay for your funeral expenses.

Can Medicare help with funeral expenses?

There are many types of Medicare plan options; some of them may help you reduce health-care costs so that you can set aside more money for your funeral expenses. If you’d like me to help you find a suitable Medicare plan option, I invite you to start by reviewing my profile–just click on the “View profile” link below.

Can you deduct funeral expenses on your taxes?

Are you planning ahead and need to know if you can deduct funeral expenses from your taxes? Funeral expenses, burial expenses, and death benefits aren’t typically part of Medicare coverage. However, there’s a type of Medicare Advantage plan called a Medicare Medical Savings Account (MSA) that you may be able to set up to help pay for your funeral expenses.