Full Answer

How much does Medicare cost per month?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A.

What if I don’t qualify for Medicare Part A?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare

Do I have to pay for Medicare as I get It?

Mar 24, 2022 · If you do not meet one of the above requirements, you’ll have to pay a premium for Medicare Part A. In 2022, that premium is as much as $499 per month. 4 Deductibles

How much do you pay for Medicare after deductible?

Mar 08, 2020 · You are eligible for Medicare and premium-free Part A, if you or your spouse paid federal taxes for 40 quarters. If you do not have 40 quarters, you may be eligible to purchase Part A coverage. This costs $458.00 per month if you have less than 30 quarters. If you paid federal taxes for 30 – 39 quarters, the monthly premium for Part A is $252.00.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How much is Part A deductible for 2020?

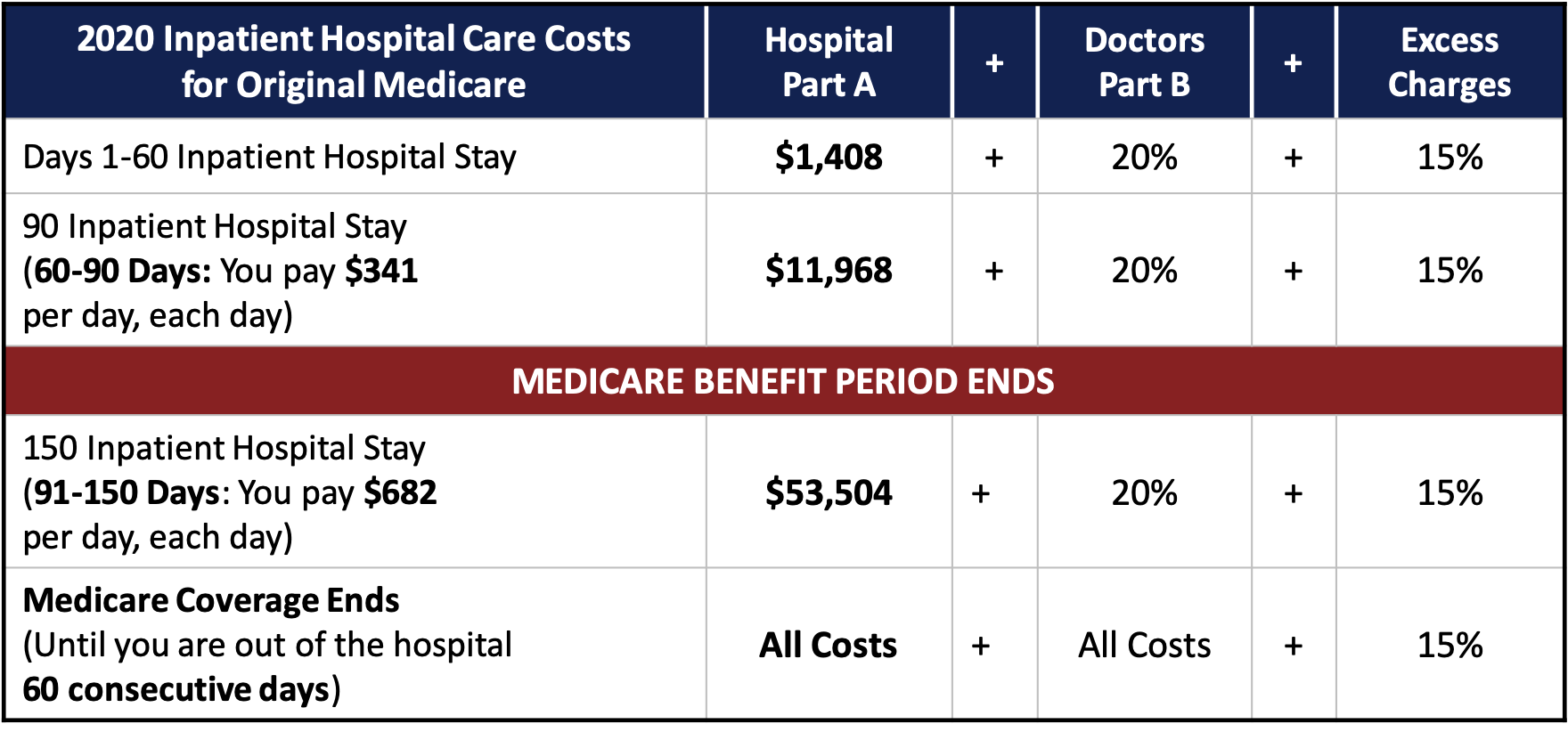

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

What does Part C cover?

These policies are sold by private insurance companies. Part C covers everything that Original Medicare Parts A and B cover plus some additional coverage. Most plans include prescription drug coverage too. The amount you pay for your monthly premium depends on the coverage it has and the state where you live.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

What is copay in Medicare?

Copay : A flat fee you pay for covered services. Coinsurance : The percentage of costs you pay after reaching your deductible. Knowing how these expenses work is essential to understanding the costs of Medicare. Learn more about about health insurance premiums, deductibles, copayments, and coinsurance.

Do you have to pay penalties for Medicare if you don't sign up?

You will have to pay penalties for some parts of Medicare if you don’t sign up when you’re first eligible and don’t have a particular set of circumstances — like leaving your workplace coverage.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

How long does Medicare Part A last?

Medicare Part A is the inpatient benefit and is available to eligible recipients without a monthly premium as long as you paid 40 quarters of Medicare taxes while working.

How much is Medicare Part B 2020?

This deductible typically changes each year, and for 2020, the deductible is $1,048. Medicare Part B is the inpatient benefit, and it does require a monthly premium payment in order for benefits to apply.

Does Medicare Advantage have the same benefits as Original Medicare?

Medicare Advantage plans provide the same Part A and Part B benefits found in Original Medicare, but they are offered through private insurers and may come with additional benefits and savings. Costs and coverage between plans can vary, so compare your options before enrolling.

How much is the deductible for Part D?

The deductible for Part D coverage in 2020 is $435, and the standard base premium is $32.74 per month.

Does Medicare cover out-of-pocket costs?

Medicare is a program designed to help seniors and other eligible Americans access quality healthcare at an affordable price; however, taking part in Medicare will include some out-of-pocket costs. While there are some state-sponsored healthcare and wellness programs available at no cost, including Medicaid and the Supplemental Nutrition Assistance ...

How much does Medicare pay for outpatient services?

Outpatient hospital services: You usually pay 20% of the Medicare-approved amount for the doctor or other health care provider’s services. For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you’ll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy a car insurance?

If you don’t buy it when you’re first eligible, your monthly premium may go up 10%. (You’ll have to pay the higher premium for twice the number of years you could have had Part A, but didn’t sign up.)

How much is Part B premium?

Part B, however, does have a monthly premium. For most Americans, your Part B monthly premium (in 2020) will be $144.60. Higher income earners will have an income-related monthly adjustment.

When did Medicare start?

Well, the Medicare tax started in 1966 at a smaller rate of 0.7%, so it is a little complicated to do the math, but Medicare has already costed you in the form of payroll taxes. Between you and your employer (after 40 years of employment), the total amount paid into Medicare on your behalf might be well over $40,000.

What happens if you don't sign up for Part B?

In most cases, if you don’t sign up for Part B when you’re first eligible, you’ll have to pay a late enrollment penalty. You’ll have to pay this penalty for as long as you have Part B. Your monthly premium for Part B may go up 10% of the standard premium for each full 12-month period that you could have had Part B, but didn’t sign up for it. Also, you may have to wait until the General Enrollment Period (from January 1 to March 31) to enroll in Part B. Coverage will start July 1 of that year.

Do you have to pay monthly premiums for Medicare Advantage?

Now, in this scenario, you may not have a monthly premium for your Medicare Advantage plan, and most Advantage plans include your drug coverage as well. You will be responsible for co-pays as you use services. Every plan is different, and each service has a different co-pay.

How much will Medicare pay for 2021?

In 2021, you’ll also pay $203 for your Part B deductible before your some of your Part B benefits kick in. After paying this amount, you’ll typically pay 20% of the Medicare-approved amount for medical expenses covered by Part B, including: Most doctor services. Outpatient therapy.

What is Medicare Part B premium?

This higher Part B premium amount is called the Medicare income-related monthly adjustment amount, or IRMAA. The higher your combined annual income, the more your Medicare Part B premiums will ...

Who is Zia Sherrell?

About the author. Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelor’s degree in science from the University of Leeds and a master’s degree in public health from the University of Manchester.

What conditions are considered to be eligible for Medicare?

Even though most people on Social Security Disability Insurance must wait for Medicare coverage to begin, two conditions might ensure immediate eligibility: end-stage renal disease (ESRD) and Lou Gehrig’s disease (ALS).

How long do you have to work to qualify for Medicare?

However, even if you’re diagnosed with ESRD, you must have an employment history—typically around 10 years —to be eligible for Medicare. If your work record doesn’t meet the standard, you may still qualify if you are the spouse or child of someone with an eligible work history.

When will Medicare be available for seniors?

July 16, 2020. Medicare is the government health insurance program for older adults. However, Medicare isn’t limited to only those 65 and up—Americans of any age are eligible for Medicare if they have a qualifying disability. Most people are automatically enrolled in Medicare Part A and Part B once they’ve been collecting Social Security Disability ...

What to do if your income is too high for medicaid?

If your income is too high to qualify for Medicaid, try a Medicare Savings Program (MSP), which generally has higher limits for income. As a bonus, if you qualify for an MSP, you automatically qualify for Extra Help, which subsidizes your Part D costs. Contact your state’s Medicaid office for more information.

How long does a disability last?

The government has a strict definition of disability. For instance, the disability must be expected to last at least one year. Your work history will also be considered—usually, you must have worked for about 10 years but possibly less depending on your age.

Who is eligible for SSDI?

SSDI pays monthly benefits to people with disabilities who might be limited in their ability to work. If you are injured or have a medical condition that limits your ability to work, you may be eligible for SSDI.

Does Medicare cover ALS?

Medicare doesn’t require a waiting period for people diagnosed with ALS, but they need to qualify based on their own or their spouse’s work record. 3