| People enrolled in Original Medicare | Average plan cost | Annual state spending per beneficiary |

|---|---|---|

| 1,535,135 | Plan A: $0 to $499 per month* Plan B: $170.10 per month** | $10,149 |

What is the average cost of Medicare per month?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

How much does Medicare Part B cost in Pennsylvania?

Medicare Part B In 2020, the standard premium will be $144.60/month. Most people will pay this amount.Jan 1, 2020

What is the cost of Medicare for a 65 year old?

Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year. Deductibles for Medicare Part B benefits are $198.00 as of 2020 and you pay this once a year.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

Is Medicare free in Pennsylvania?

Most people have premium-free Part A but, if you have to buy it, the cost can reach up to $499 per month in 2022. Part B costs $170.10 per month but can be more if you have higher income. There are 160 Medicare Advantage Plans in the state that are an alternative to Original Medicare.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How much do they take out of Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium.Nov 22, 2021

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How do I know if I have to pay for Medicare Part A?

Most people receive Medicare Part A automatically when they turn age 65 and pay no monthly premiums. If you or your spouse haven't worked at least 40 quarters, you'll pay a monthly premium for Part A.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

About Medicare in Pennsylvania

One of your choices as a Pennsylvania resident (as in any state) is Original Medicare, Part A and Part B, the federally-run health care program. Me...

Types of Medicare Plans in Pennsylvania

Many types of Medicare plans are only available through private Medicare-approved insurance companies. As a Pennsylvania beneficiary, here are some...

Local Medicare Resources in Pennsylvania

Medicare Savings Programs in Pennsylvania: Each state offers programs that help beneficiaries with limited income. These programs pay for some out-...

How to Apply For Medicare in Pennsylvania

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years.In Pennsylvania...

What is Medicare in Pennsylvania?

One of your choices as a Pennsylvania resident (as in any state) is Original Medicare, Part A and Part B, the federally-run health care program. Medicare Part A provides beneficiaries with inpatient hospital care while Medicare Part B includes physician services, some preventive care, ...

What are gaps in Medicare?

These plans cover “gaps” in Original Medicare coverage, such as deductibles, copayments, coinsurance, and possibly some foreign travel emergency health care coverage. Most states, Pennsylvania included, can offer up to 10 standardized Medigap policy options, each one labeled with a letter. Different Medigap plans include different coverage details, ...

How long do you have to be on Medicare to qualify for it?

You are eligible for the program before reaching age 65 if you have certain qualifying disabilities or conditions; you’re automatically enrolled in Medicare after receiving disability benefits for 24 consecutive months.

How to apply for railroad retirement?

If you have to enroll manually, you may do so through Social Security or the Railroad Retirement Board (if you worked at a railroad): 1 Visit the Social Security website. 2 Call Social Security at 1-800-772-1213 (TTY users should call 1-800-325-0778), Monday through Friday, 7AM to 7PM. 3 Apply in person at a Social Security office near you. 4 Apply through the Railroad Retirement Board if you worked at a railroad, by calling 1-877-772-5772 (TTY users call 312-751-4701), Monday through Friday, 9AM to 3:30PM.

What is the second most popular Medicare plan?

Medigap Plan G is, in fact, the second-most popular Medigap plan. 17 percent of all Medigap beneficiaries are enrolled in Plan G. 2. The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. 3.

How to contact Medicare Advantage 2021?

New to Medicare? Compare Medicare plan costs in your area. Compare Plans. Or call. 1-800-557-6059. 1-800-557-6059 TTY Users: 711 to speak with a licensed insurance agent.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What Does Medicare Supplement Plan G Cover?

Original Medicare pays for a lot when it comes to your healthcare. On top of the Medicare-approved amounts that are covered by the Federal Medicare program in the United States, you can enjoy having these additional Medicare benefits covered if you sign up for Medicare Supplement Plan G in Pennsylvania.

What is the Plan G Deductible in 2021?

There is no Medicare Plan G deductible unless you select the high deductible plan. You will need to pay the Medicare Part B deductible with either plan, which is $203 in 2021.

What is the Monthly Premium for Medicare Supplement Plan G in Pennsylvania?

For the Medicare Supplement, the average cost will depend on how health insurance companies (the insurer) price the plans for that service area. Pricing is based on the following:

When can I enroll in Medicare Supplement Plan G?

The best time to enroll in a Medigap policy is within the six-month Medigap Open Enrollment period. During this time you will have better pricing and choices.

What Is the Difference Between Plan G and Plan G With a High Deductible?

In order for the coverage to kick in at 100%, a higher deductible is required. The higher deductible allows for lower Medicare Supplement Plan G rates per month.

What is the Best Medicare Supplement Plan G in Pennsylvania?

Plan G is standardized. What this means is that Plan G is the same no matter which Medicare Supplement insurance companies offer it. The only difference is the price. When shopping, see the following to help you choose the company that is right for you.

Which is better, Plan F or Plan G?

As mentioned above, when you compare the two, the only difference between the plan options is that Medigap Plan G will require you to pay the approved amount for the Part B deductible.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Who sells Medicare Advantage plans?

Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live. This guide shows the average cost of Medicare Part C plans in each state.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

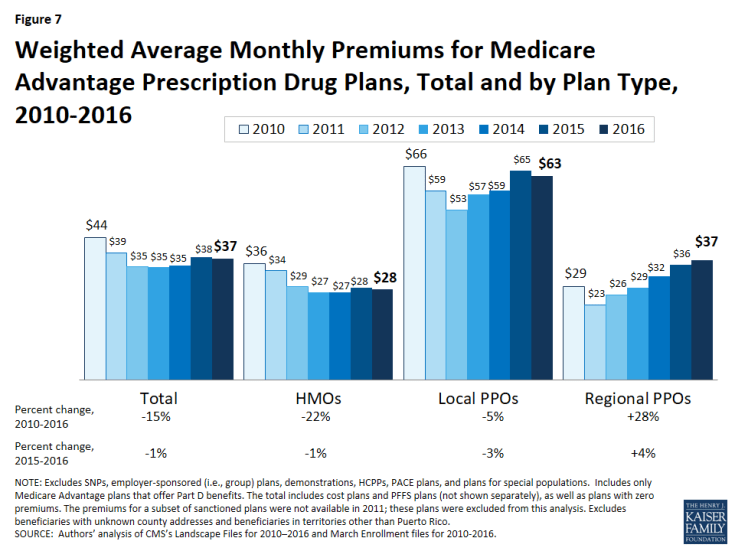

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What is the average cost of assisted living in Pennsylvania?

In these areas, the average monthly costs are approximately $4,315 – $5,550.

What is Medicaid in Pennsylvania?

Medicaid (not to be confused with Medicare) is a program that is jointly administered by the federal government and the state of Pennsylvania. Via this program, assistance is provided to low-income elderly residents. The state Medicaid plan pays for nursing home care and some personal care.

What is a CHC waiver?

A relatively new managed care waiver program, Community HealthChoices (CHC), became available statewide in January of 2020. CHC provides a broad range of home care and support services, which can enable an individual who might otherwise require nursing home care to remain living at home.

How much does adult day care cost in 2021?

Statewide, Genworth’s Cost of Care Survey 2020 indicates that in 2021, the average cost is $70 / day.

Does Medicaid cover nursing home care?

The state Medicaid plan pays for nursing home care and some personal care. However, there are also Medicaid Waivers that provide services to the elderly and disabled in their homes or community in order to prevent or delay nursing home placement. Programs and Waivers.

Does PA offer assisted living?

Pennsylvania offers a non-Medicaid assistance program, which is offered as an alternative to assisted living or home care. The PA Domiciliary Care Program, which is often referred to as PA Dom Care, pays a fixed amount to help seniors live in the homes of caregivers. Personal care assistance is covered in addition to room and board.