The amount you could need to cover premiums and out-of-pocket prescription drug costs from age 65 on could be $130,000 if you’re a man and $146,000 if you’re a woman, according to one study. Sometimes, it comes as a surprise to older folks that Medicare is not free.

Full Answer

How much savings should should I have at 65?

You work because you have an X-Factor that gives you joy and purpose in life. At age 65, you should have a savings/net worth amount equivalent to at 20X -25X your annual expenses. If you want to be really aggressive, you should aim to have around 20X your average annual salary as a net worth.

What will Medicare cost me when I turn 65?

The amount you could need to cover premiums and out-of-pocket prescription drug costs from age 65 on could be $130,000 if you're a man and $146,000 if you're a woman, according to one study.

How much socail security do I receive at 65?

The Social Security earnings limit is $1,580 per month or $18,960 per year in 2021 for someone age 65 or younger. If you earn more than this amount, you can expect to have $1 withheld from your Social Security benefit for every $2 earned above the limit. For example, suppose you are 65 years old and will reach full retirement age in 2023.

Will I be automatically enrolled in Medicare at 65?

Unless you have already been receiving benefits from Social Security or the Railroad Retirement Board at least four months before you turn 65, you will not be automatically enrolled in Medicare when you turn 65. You will need to sign up for Medicare yourself by applying with Social Security.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much did Medicare cost in 2011?

Plans often charge a deductible and in 2011 you would need to spend a total of $4,550 out-of-pocket (not including premiums) before reaching catastrophic coverage. 6. Uncovered healthcare costs — In planning your budget, include costs that Medicare doesn’t cover — dental care, eye exams and eyeglasses, for example.

Why is Medicare Advantage so popular?

Medicare Advantage — Medicare Advantage (MA) plans are popular because they tend to have much lower, or even zero premiums. In addition, many MA plans offer drug coverage. These plans may have deductibles, and charge co-pays for most services, leaving you at risk of more in out-of-pocket costs when you use services.

When do you have to enroll in Medicare Part B?

That period starts three months before you turn 65, includes the month you turn 65 and ends 3 months after the month you turn 65.

What is the biggest share of healthcare costs?

Spending on Medicare and health insurance premiums comprise the biggest share of healthcare costs, nearly two-thirds of overall senior healthcare spending. Premiums and coverage details can vary enormously, but here are a few things to consider: 1. Compare plans!

How long does Medicare last?

Original, or basic, Medicare consists of Part A (hospital coverage) and Part B (outpatient and medicare equipment coverage). You get a seven-month window to sign up that starts three months before your 65th birthday month and ends three months after it.

How old do you have to be to sign up for Medicare?

While workers at businesses with fewer than 20 employees generally must sign up for Medicare at age 65 , people working for larger companies typically have a choice: They can stick with their group plan and delay signing up for Medicare without facing penalties down the road, or drop the company option and go with Medicare.

What to do if you are 65 and still working?

If you’ll hit age 65 soon and are still working, here’s what to do about Medicare 1 The share of people age 65 to 74 in the workforce is projected to reach 30.2% in 2026, up from 26.8% in 2016 and 17.5% in 1996. 2 If you work at a company with more than 20 employees, you generally have the choice of sticking with your group health insurance or dropping the company option to go with Medicare. 3 If you delay picking up Medicare, be aware of various deadlines you’ll face when you lose your coverage at work (i.e., you retire).

What happens if you delay picking up Medicare?

It’s becoming a common scenario: You’re creeping closer to your 65th birthday, which means you’ll be eligible for Medicare, yet you already have health insurance through work.

How many employees can you delay signing up for Medicare?

If you work at a large company. The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire). At that point, you’d be subject to various deadlines to sign up or else face late-enrollment penalties.

What is your 2018 income used for?

In other words, your 2018 income is used for your 2020 premiums. (There’s a form you can fill out to request a reduction in that income-related amount due to a life-changing event, such as retirement.) Roughly a third of Medicare enrollees choose to get their Parts A and B delivered through an Advantage Plan.

Can you continue taking a specialty drug under Medicare?

On the other hand, if you take a specialty drug that is covered by your group plan, it might be wise to continue with it if that drug would be more expensive under Medicare. Some 65-year-olds with younger spouses also might want to keep their group plan.

How long do you pay FICA taxes?

Workers who pay FICA taxes for forty quarters (10 years) receive hospital coverage at no additional charge. Check out our article on how Medicare works (part A) to learn more. ( FICA taxes are payroll taxes for Medicare and Social Security – roughly 15.3% of wages.

Do I have to pay for Medicare Part B?

You pay this money to the federal government – usually the government deducts it from your Social Security check. If you continue to work and postpone receiving Social Security (i.e., retirement), you’ll need to pay the government directly for Medicare Part B and Medicare prescription medicine coverage (Rx).

How much does Medicare cover?

But mid-way through the year, it’s hard to say.”. Generally speaking, Medicare only covers about two-thirds of the cost of health-care services for the program’s 62.4 million or so beneficiaries, the bulk of whom are age 65 or older. That’s the age when you become eligible for Medicare.

How much is Medicare Part A deductible?

However, Part A has a deductible of $1,408 per benefit period, along with some caps on benefits.

Is Medicare free for older people?

Sometimes, it comes as a surprise to older folks that Medicare is not free. Depending on the specifics of your coverage and how often you use the health-care system, your out-of-pocket costs could reach well into six-figure territory over the course of your retirement, according to a recent report from the Employee Benefit Research Institute. ...

Does Advantage Plan cover dental?

If you end up choosing an Advantage Plan, there’ s a good chance limited coverage for dental and vision will be included. For long-term care coverage — which involves help with daily living activities like dressing and bathing — some people consider purchasing insurance specifically designed to cover those expenses.

Can you pair a medicaid plan with an Advantage plan?

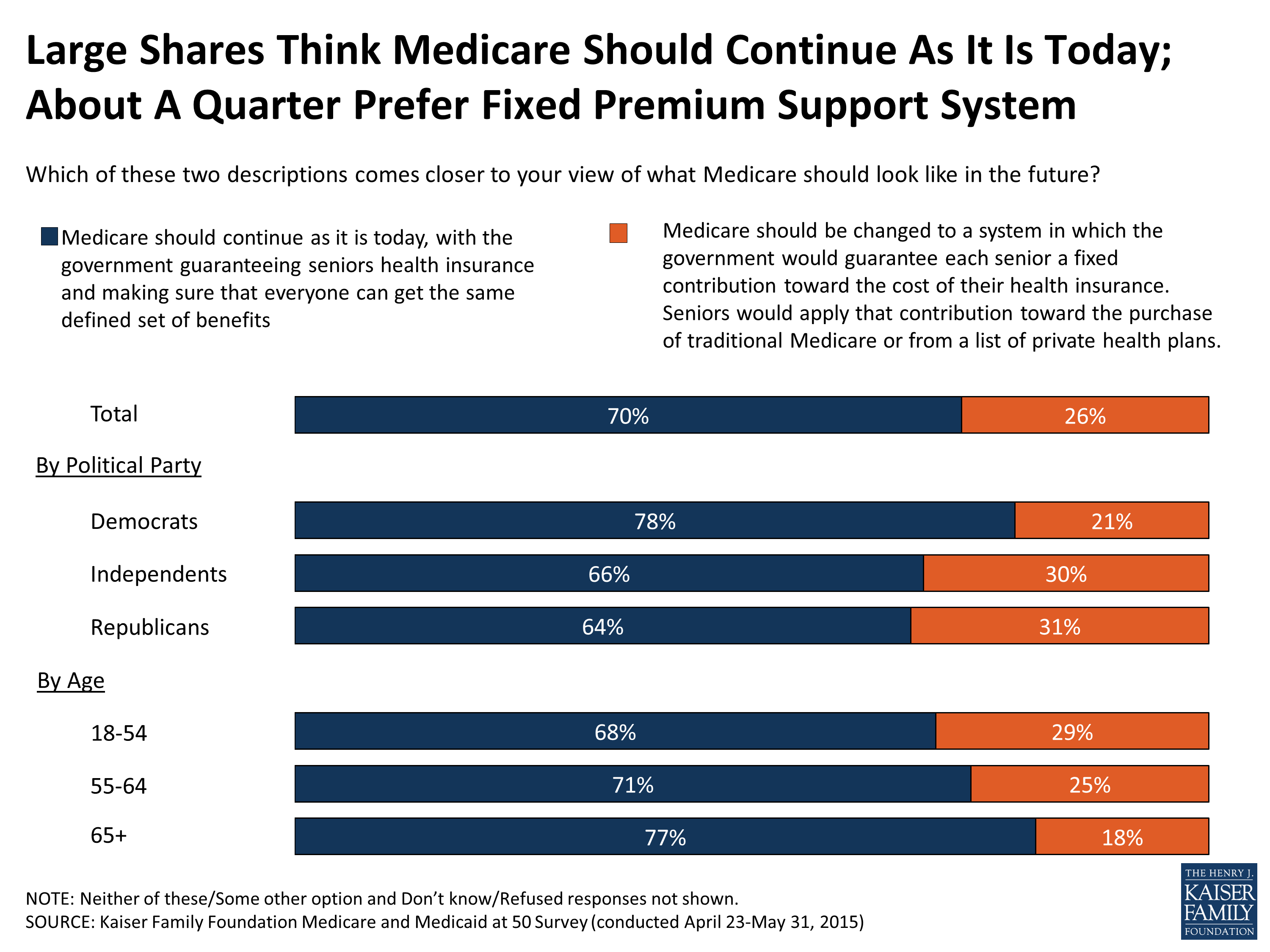

You cannot, however, pair a Medigap policy with an Advantage Plan. Of people without any type of extra coverage beyond basic Medicare — such as employer coverage or Medicaid — 28% have either struggled to pay their medical bills or to get care due to the cost, according to the Kaiser Family Foundation.

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.