If you’re eligible for Medicare, but not other federal benefits, you’ll pay a Part A premium of $274 or $499 each month, depending on how long you’ve paid Medicare taxes. The deductible for Medicare Part A is $1,556 per benefit period.

Full Answer

How much would 'Medicare for all' cost taxpayers?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

What is the average monthly cost of Medicare?

Dec 01, 2021 · If you’re eligible for Medicare, but not other federal benefits, you’ll pay a Part A premium of $274 or $499 each month, depending on how long you’ve paid Medicare taxes. The deductible for Medicare Part A is $1,556 per benefit period.

Does Medicare have monthly premiums?

Medicare Part A (Hospital Insurance) Costs Part A monthly premium Most people don’t pay a Part A premium because they paid Medicare taxes while . working. If you don’t get premium-free Part A, you pay up to $499 each month. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

Is there a monthly premium for Medicare?

Mar 24, 2022 · If you have to purchase Medicare Part A, it can cost up to $499 per month. 4 What it is: Medicare Part A provides coverage for hospital services and care. This includes expenses for care received during stays in hospitals, skilled nursing facilities, hospice or home health care facilities. Premium-Free Part A Eligibility

How much does Medicare cost the average person?

2022If your yearly income in 2020 (for what you pay in 2022) wasYou pay each month (in 2022)File individual tax returnFile joint tax return$91,000 or less$182,000 or less$170.10above $91,000 up to $114,000above $182,000 up to $228,000$238.10above $114,000 up to $142,000above $228,000 up to $284,000$340.203 more rows

How much does Medicare usually cost per month?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How much does Medicare take out of your check?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium.Nov 22, 2021

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

How much does Medicare cost at age 83?

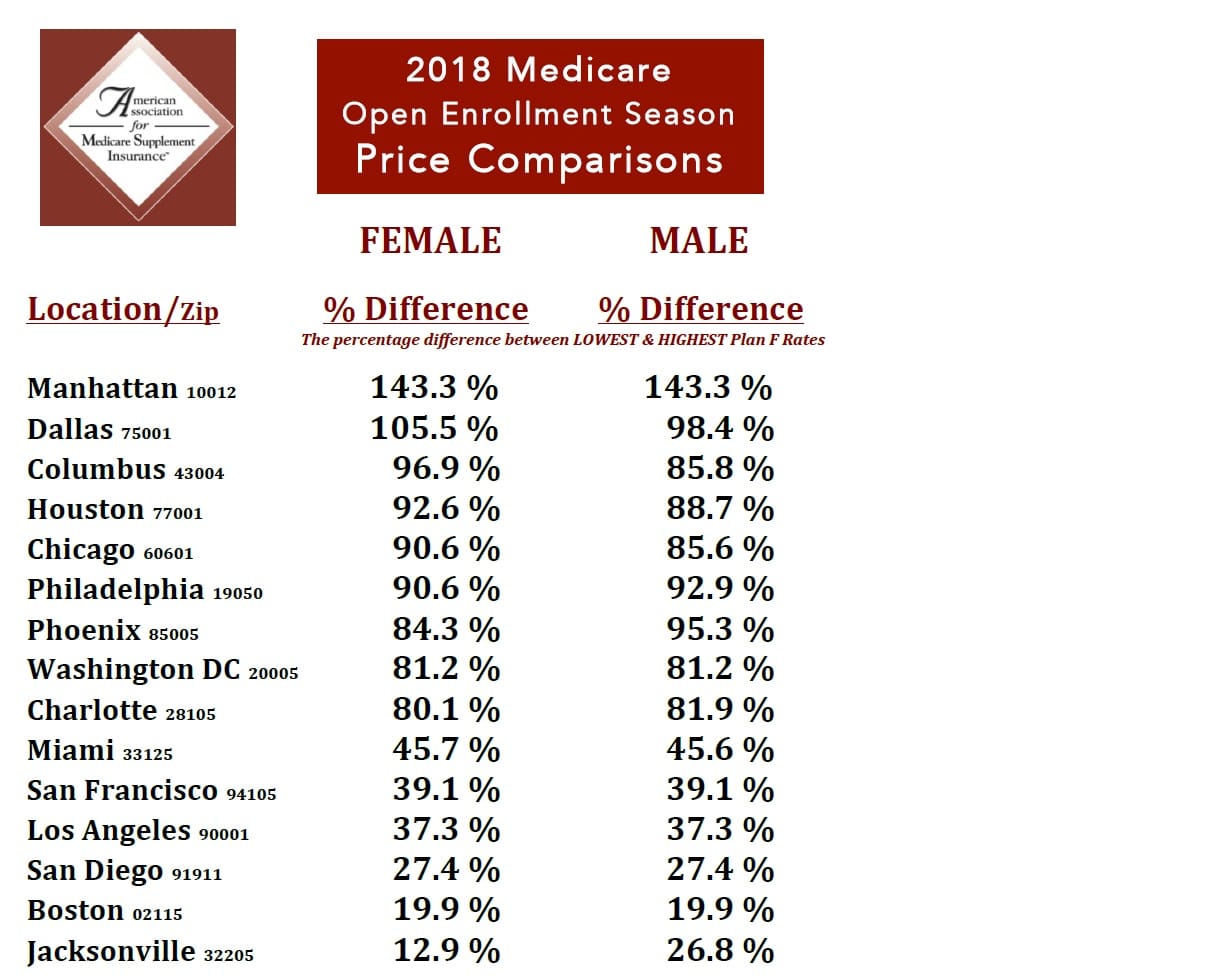

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

Is Medicare Part B going up 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

How much does Medicare cost at age 62?

Reaching age 62 can affect your spouse's Medicare premiums He can still receive Medicare Part A, but he will have to pay a monthly premium for it. In 2020, the Medicare Part A premium can be as high as $458 per month.Feb 15, 2022

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare have to come out of your Social Security check?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Does Social Security pay for Medicare?

Will a beneficiary get Medicare coverage? Everyone eligible for Social Security Disability Insurance (SSDI) benefits is also eligible for Medicare after a 24-month qualifying period. The first 24 months of disability benefit entitlement is the waiting period for Medicare coverage.

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

What is copay in Medicare?

Copay : A flat fee you pay for covered services. Coinsurance : The percentage of costs you pay after reaching your deductible. Knowing how these expenses work is essential to understanding the costs of Medicare. Learn more about about health insurance premiums, deductibles, copayments, and coinsurance.

Do you have to pay penalties for Medicare if you don't sign up?

You will have to pay penalties for some parts of Medicare if you don’t sign up when you’re first eligible and don’t have a particular set of circumstances — like leaving your workplace coverage.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

How long does Medicare Part A last?

Medicare Part A is the inpatient benefit and is available to eligible recipients without a monthly premium as long as you paid 40 quarters of Medicare taxes while working.

How much is Medicare Part B 2020?

This deductible typically changes each year, and for 2020, the deductible is $1,048. Medicare Part B is the inpatient benefit, and it does require a monthly premium payment in order for benefits to apply.

Does Medicare Advantage have the same benefits as Original Medicare?

Medicare Advantage plans provide the same Part A and Part B benefits found in Original Medicare, but they are offered through private insurers and may come with additional benefits and savings. Costs and coverage between plans can vary, so compare your options before enrolling.

How much is the deductible for Part D?

The deductible for Part D coverage in 2020 is $435, and the standard base premium is $32.74 per month.

Does Medicare cover out-of-pocket costs?

Medicare is a program designed to help seniors and other eligible Americans access quality healthcare at an affordable price; however, taking part in Medicare will include some out-of-pocket costs. While there are some state-sponsored healthcare and wellness programs available at no cost, including Medicaid and the Supplemental Nutrition Assistance ...

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is Medicare Part B?

Medicare Part B#N#Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care....#N#is medical insurance for your doctor visits, lab tests, specialists, and other services. It covers your out-patient care.

Is Medicare Advantage the only way to get more coverage?

Medicare Advantage is a great way to get more coverage, but it’s not the only way. You also have the option to keep your Original Medicare and add a Medigap#N#Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage....#N#plan.

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How much is Part A deductible for 2020?

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

What does Part C cover?

These policies are sold by private insurance companies. Part C covers everything that Original Medicare Parts A and B cover plus some additional coverage. Most plans include prescription drug coverage too. The amount you pay for your monthly premium depends on the coverage it has and the state where you live.