Is Medicare dental worth it?

Part A can pay for hospital stays if you need to have emergency or complicated dental procedures, even though it doesn't cover dental care. Your costs in Original Medicare You pay 100% for non-covered services, including most dental care.

What dental services are covered by Medicare?

Nov 01, 2021 · In the 116th Congress, the House of Representatives passed the Elijah E. Cummings Lower Drug Costs Now Act, which among many provisions, provided for dental coverage under Part B of the Medicare program, starting in 2025 if enacted into law. Medicare would cover 80% of the cost of preventive services and basic treatments, and would phase up …

Is dental insurance covered by Medicare?

Jan 06, 2022 · Medicare Costs in 2022-How much Medicare coverage will be depends on a number of factors. This guide covers costs from 2022. ... Medicare does have rather limited dental health coverage, but other options exist that can potentially help offset these types of expenses. Medicare Advantage, PACE, and stand-alone dental policies are three to ...

Does Medicare pay on dental?

6 rows · Aug 25, 2020 · How Much Does a Medicare Advantage Plan With Dental Coverage Cost Out-of-Pocket Over the ...

Medicare and a Lack of Dental Coverage

Unfortunately, having Medicare doesn’t always help with this issue. According to Medicare.gov, this federal health insurance program typically does not cover dental care, procedures, or supplies.

Medicare Part B Dental Benefits

On the other hand, if the physician conducts the examination needed prior to kidney transplant or heart valve replacement, the CMS states that Part B benefits will apply.

Medicare Advantage Dental Policies

One exception to the dental exclusions under Original Medicare’s parts A and B is Medicare Advantage. Commonly referred to as Part C, these types of policies are offered by private insurance companies and are intended to cover all of the same basic expenses participants receive under the Original Medicare plan.

Dental Coverage Through PACE

PACE is another type of Medicare program that provides some level of dental coverage.

A Stand-Alone Dental Plan

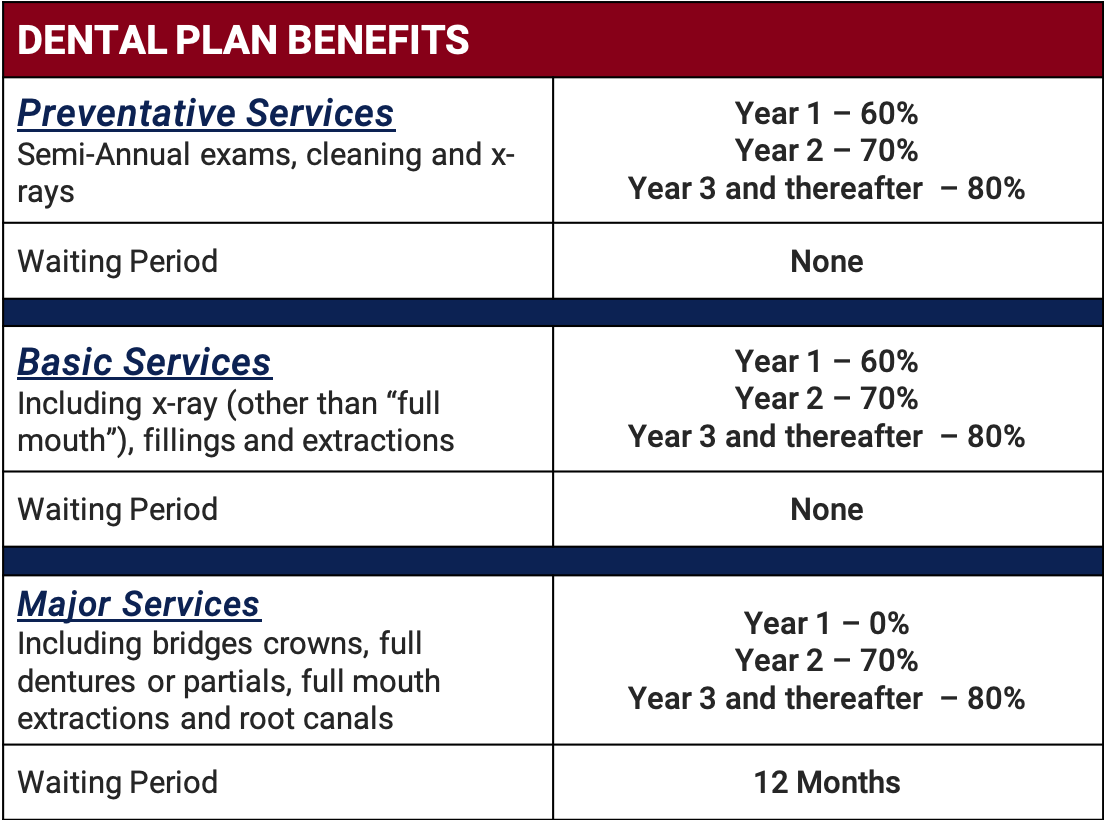

Whether you need dental services not covered under a Medicare plan or you don’t qualify for Medicare coverage options that would pay for some or all of your dental care needs, you always have the option of purchasing a stand-alone dental plan.

What percentage of medical insurance plans have dental benefits?

According to the Kaiser Family Foundation (KFF), a non-profit organization focusing on national health issues, 67% of Medical Advantage Plan enrollees have a dental benefit. 2. Medicare Advantage Plans are available through private companies approved by Medicare.

How much will Medicare cost in 2021?

According to the Centers for Medicare & Medicaid Services, the average Medicare Advantage monthly premium for 2021 is $21, although the monthly premiums for a Medicare Advantage Plan can range from $0 to over $100. 9 There are also out-of-pocket costs such as copayments and coinsurance.

Why do people choose Medicare Advantage?

Some people prefer a Medicare Advantage Plan because it bundles all coverage under one plan that often includes a prescription drug program and added benefits such as dental, vision, and hearing care . Also, many prefer a lower monthly premium (sometimes $0) based on how they feel they will access the coverage.

How many seniors are poor at the dentist?

If visiting the dentist is not your favorite task, you’re not alone. According to the National Institute of Dental and Craniofacial Research (NIDCR), 16% of seniors describe their oral health as “poor,” and 23% of those who are of Medicare age (65 and over) have gone five years or more since their last dental visit. 1.

Is Wellcare a part of Medicare?

Founded in 1985, WellCare is a relative newcomer. We picked them as one to watch for potential new offerings in their Medicare Advantage Plans for two reasons: In 2019, WellCare acquired Aetna’s Part D prescription drug plan (PDP) and in 2020, they were acquired by Centene, one of the largest providers of Medicaid.

Does Medicare Advantage cover dental?

When shopping for a Medicare Advantage plan with dental coverage, make sure that the plan covers the dental services that are most important to you. This could include routine dental exams, X-rays, gum disease treatment, fillings, or dentures.

Does United Healthcare have all plans?

Cons. Doesn’t have all plans (HMO, HMO-POS, PPO) in all the markets in which they offer plans. United Healthcare, founded in 1977, was chosen as best overall based on its popularity and its affiliation with the American Association of Retired People (AARP).

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

How much does vision insurance cost?

Vision insurance can typically cost around $20 per month or less. 3. Hearing plans. Unlike dental and vision insurance, hearing insurance plans are not a common insurance product. Some hearing aid companies may offer extended warranties, but the warranties apply only to the hearing aid product itself.

Does Medicare Advantage cover dental?

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What does Medicare Part B cover?

This is a very broad category that covers medical office visits, non-emergency ambulance transportation, durable and disposable medical supplies and certain outpatient treatments.

Is Medicare Part D a private insurance?

Since 2006, Medicare-eligible seniors have had the option to enroll in Part D, Medicare’s prescription drug benefit. Unlike Part A and Part B, Medicare Part D prescription drug benefits are provided through a private insurance company that has been approved for the program.

Does Medicare cover coinsurance?

Many Medicare beneficiaries find that the gaps in their coverage – such as Medicare deductibles, coinsurance, copays and more – can leave them having to pay significant out of pocket costs. Medicare supplemental policies can pick up some of the coinsurance and co-payment requirements for each part of Medicare.