What is the monthly premium for Medicare Part B?

Medicare Part B (Medical Insurance) Costs. Part B monthly premium. Most people pay the standard Part B monthly premium amount ($170.10 in 2022). Social Security will tell you the exact amount you’ll pay for Part B in 2022. You pay the standard premium amount if: You enroll in Part B for the first time in 2022.

How much does Medicare Part B costs?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the …

How much does Part B insurance cost?

Nov 15, 2021 · In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 ($148.50/month), in 2020 ($144.60/month), and in 2019 ($135.50/month). Some enrollees pay more than the standard premium, if they’re subject to a high-income surcharge(described below).

Does Medicaid pay for Part B premium?

What is the cost of Medicare going to be for 2022?

Those who have paid Medicare taxes for 30 to 39 quarters will see their Part A premium increase to $274 per month in 2022 (up from $259 per month in 2021).Jan 4, 2022

What is the premium for Medicare Part B 2022?

$170.10The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

Will there be an increase in Part B Medicare for 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the increase in Social Security for 2022?

5.9 percentCost-of-Living Adjustment (COLA) Information for 2022 Social Security and Supplemental Security Income (SSI) benefits for approximately 70 million Americans will increase 5.9 percent in 2022. Read more about the Social Security Cost-of-Living adjustment for 2022.

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

Will Social Security get a $200 raise in 2022?

The 2022 COLA increases have been applied to new Social Security payments for January, and the first checks have already started to hit bank accounts. This year, the highest COLA ever will be applied to benefits, with a 5.9% increase to account for rampant and sudden inflation during the pandemic.Jan 22, 2022

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

How much is the 2020 Medicare premium?

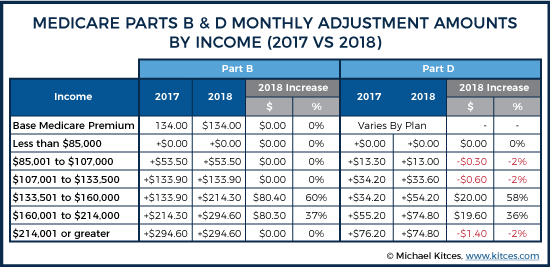

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

When do you pay income related premium surcharge?

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. [2019 tax returns were filed in 2020, so those are the most current returns available when income-related premium adjustments are determined for 2021.]

How much is the 2020 Social Security Cola?

But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020. And for 2021, the 1.3 percent COLA is adequate to cover the increase to ...

Does Medicare cover coinsurance?

But supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid) often covers these coinsurance charges. For people who became eligible for Medicare before the start of 2020, there are Medigap plans available (Plans C and F) that cover the Part B deductible, in addition to coinsurance charges.