Medicare Premiums Increase for Many Beneficiaries in 2018

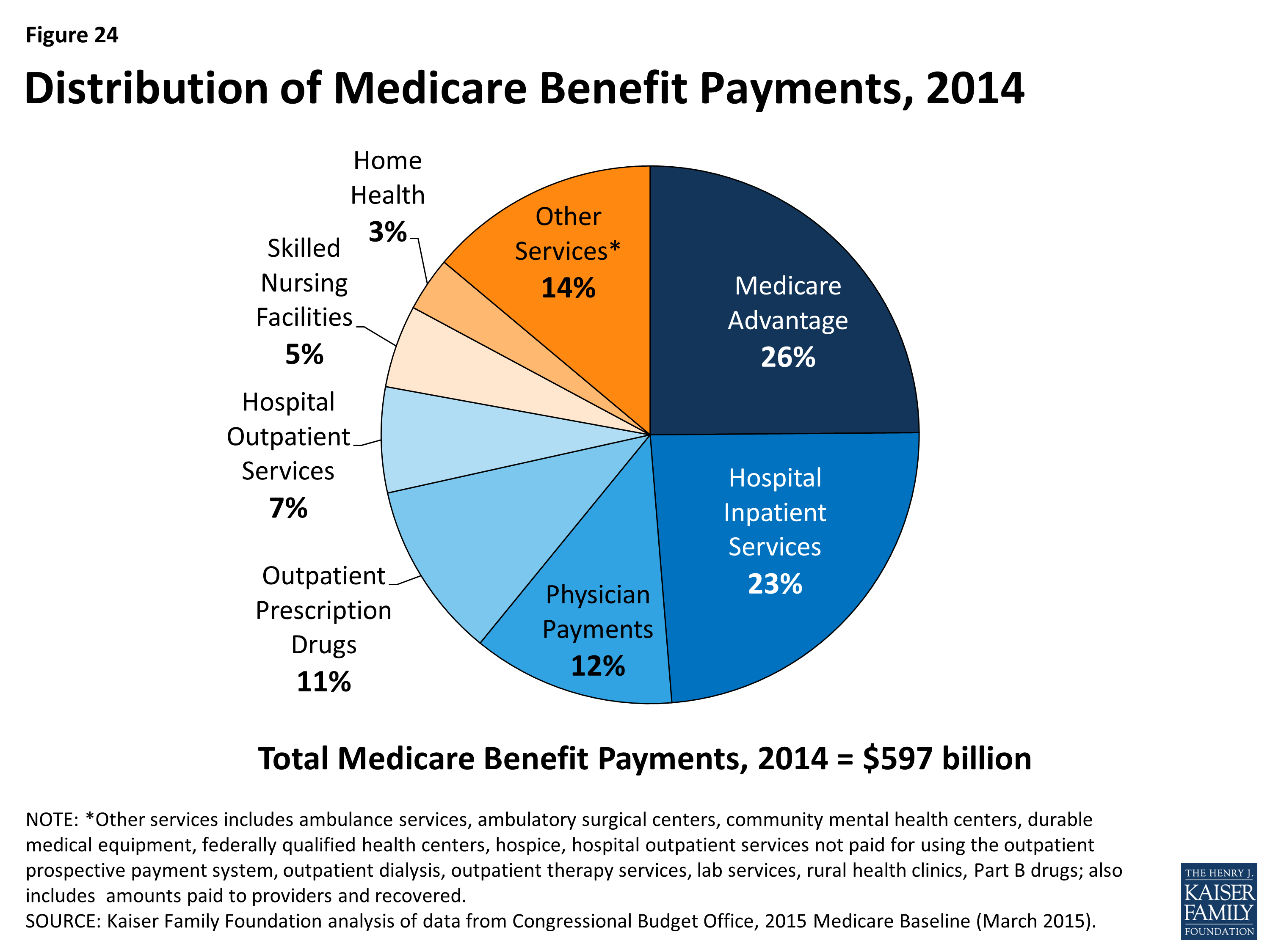

| Income | Part B monthly premium amount |

| Individuals with income between $85,000 ... | Standard premium + $53.50 = $187.50 |

| Individuals with income between $107,000 ... | Standard premium + $133.90 = $267.90 |

| Individuals with income between $133,500 ... | Standard premium + $214.30 = $348.30 |

| Individuals with income above $160,000 o ... | Standard premium + $294.60 = $428.60 |

How much will you pay for Medicare Part B?

The standard Part B premium in 2021 is $148.50 per month, though you could potentially pay more, depending on your income. Your Medicare Part B premium largely depends on the income reported on your tax return from two years prior.

Is Medicare Part B Worth It?

Part B is an elective program that requires a monthly premium, so it’s important to understand if Medicare Part B is right for you. While Part B is not a 100% cover plan, it does tend to cover most people’s needs. Therefore, Part B is one of the more commonly elected aspects of the Medicare service.

What is the maximum premium for Medicare Part B?

The standard monthly premium for Part B, which covers outpatient care and durable equipment ... or offers a different copay and an out-of-pocket maximum (a Medicare Advantage Plan). The Aduhelm situation highlights the ripple effect that expensive drugs ...

Do I really need Medicare Part B?

You don't have to take Part B coverage if you don't want it, and your FEHB plan can't require you to take it. There are some advantages to enrolling in Part B: You must be enrolled in Parts A and B to join a Medicare Advantage plan. You have the advantage of coordination of benefits (described later) between Medicare and your FEHB plan, reducing your out-of-pocket costs.

How much does Medicare Part B increase each year?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

How much will Medicare B go up in 2021?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Why is my Medicare Part B bill so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the Medicare Part B increase for 2022?

$170.10In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

What is the premium for Medicare Part B 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

At what income level do my Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Does Social Security count as income for Medicare premiums?

(Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How can I reduce my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

What is the cost of Medicare Part B for 2019?

$135.50Part B. On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

When was the last time Medicare Part B increased?

Medicare Part B premiums went up in 2013 from the previous year, but then they stayed the same until the projected 2016 increase.

What was the cost of Medicare Part B in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

How much is Medicare premium in 2018?

The average basic premium for a Medicare prescription drug plan in 2018 is projected to decline to an estimated $33.50 per month.

What is Medicare Part B premium?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. Some beneficiaries who were held harmless ...

What is the Medicare deductible for 2018?

CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. ...

Will Part B premiums increase in 2018?

Some beneficiaries who were held harmless against Part B premium increases in prior years will have a Part B premium increase in 2018, but the premium increase will be offset by the increase in their Social Security benefits next year. “Medicare’s top priority is to ensure that beneficiaries have choices for affordable, ...

Is there more coverage for Medicare?

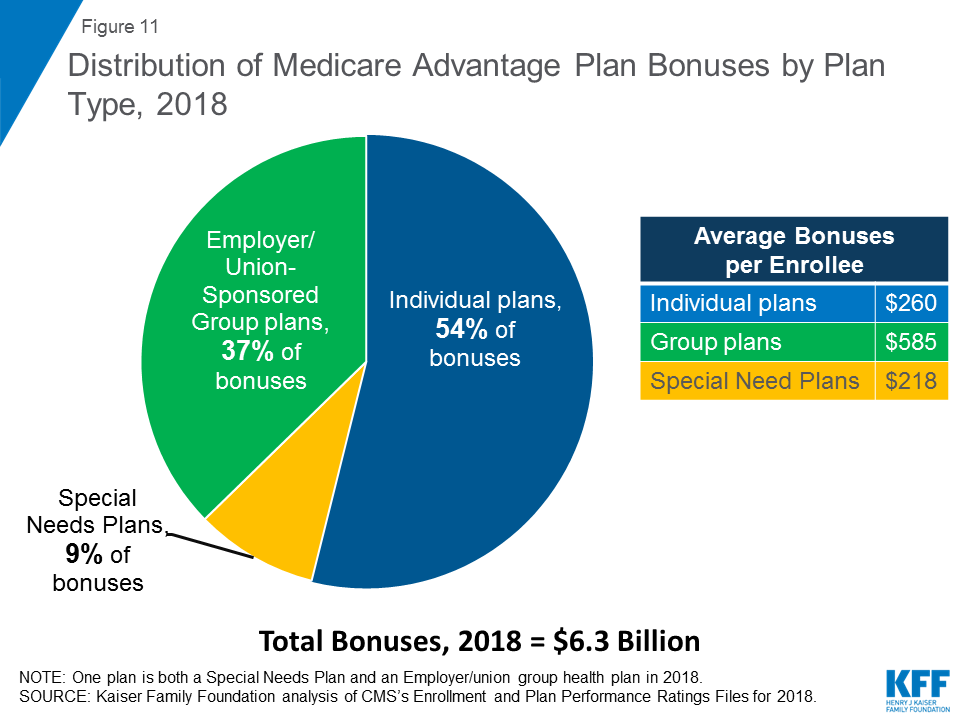

CMS recently released the benefit, premium, and Star Ratings information for Medicare health and drug plans which shows that there will be more health coverage choices, improved access to high-quality health choices, and decreased premiums in 2018.

How much will Medicare increase in 2018?

The average benefit for a retired worker will rise by $27 a month to $1,404 in 2018. Many recipients will find most or all of their increase eaten up by the jump in the Medicare Part B premiums deducted from their monthly Social Security checks.

How much is Medicare Part B?

The Centers for Medicare & Medicaid Services has announced Medicare Part B premiums for 2018, and the base premium stays the same as this year at $134 a month, but a lot actually changes. For 70% of Social Security recipients who have been paying an artificially low $109 a month, they’ll see a big jump to the $134 a month level.

Why are the Part B premiums going up?

They’re facing hikes for 2018 because of a 2015 Congressional budget deal, which compressed tax brackets, which forces more people to pay higher surcharges.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

How much does it cost to get a quarter credit in 2017?

If you earn fewer than 30 quarter credits, the cost is $413 a month in 2017. Few people might pay the premium for Part A, but everyone with this coverage still must meet certain deductibles, and cost-sharing is still required. In 2017, you can expect the following costs:

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

When will Medicare Part B premiums be 20 percent higher?

For example, if your initial enrollment period ended on September 30, 2015, but you don't sign up for Medicare Part B until March 2018, your premiums will be 20 percent higher as long as you are enrolled in Medicare due to two full years of delayed enrollment.

How much is Medicare Part B?

The standard Medicare Part B monthly premium will be $134 in 2018 (or higher, depending on your income), the same amount as in 2017. But many beneficiaries who have been paying less than the standard rate for the past several years will see a jump in their premiums.

What is the maximum amount of Medicare Part B premium?

High-income Medicare beneficiaries. Beneficiaries with high incomes are required to pay more for Medicare Part B. Those with an income that exceeds $85,000 as an individual or $170,000 for married couples have $53.50 added to their monthly rate for a total premium of $187.50. Seniors with retirement income between $107,000 ...

How much Medicare Part B do seniors pay?

Seniors with retirement income between $107,000 and $133,500 ($214,000 to $267,000 for couples) must pay $267.90 per month for Medicare Part B in 2018, and monthly premiums further increase to $348.30 per month for beneficiaries bringing in between $133,500 and $160,000 ($267,000 to $320,000 for couples). Wealthy beneficiaries with incomes ...

What percentage of Social Security benefits were paid in 2017?

Social Security recipients only received a 0.3 percent cost-of-living adjustment in 2017, so they continued to pay premiums that were less than the standard rate charged to new enrollees and other people not protected by Social Security's "hold harmless" rule.

Will Medicare premiums increase in 2018?

Medicare Premiums Increase for Many Beneficiaries in 2018. Most of the Social Security cost-of-living adjustment will be used to pay for higher Medicare Part B premiums. Here's a look at how much retirees can expect to pay for Medicare Part B premiums in 2018. (Getty Images)

Who pays the premiums for Medicare?

Low-income beneficiaries who are eligible for both Medicare and Medicaid generally have their premiums paid by state Medicaid agencies. Medicaid pays the standard premium on behalf of the qualifying beneficiary. High-income Medicare beneficiaries.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When did Medicare Part B start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Who's Not Held Harmless

Of note, Medicare Part B enrollees not subject to the hold-harmless provision include beneficiaries who do not receive Social Security benefits, those who enroll in Part B for the first time in 2018, those who are directly billed for their Part B premium, those who are dually eligible for Medicaid and have their premium paid by state Medicaid agencies, and those who pay an income-related premium.

Going Forward, We're Looking Back

As for 2019, Neuman isn't sure whether Medicare Part B premiums will decline or rise. "Look for a signal when we see what the (Social Security) COLA will be in 2019, along with projections for the standard Part B premium," she said.

How much does Medicare cover?

You're responsible for paying that amount out of your own pocket before Medicare starts providing coverage, and after that, Medicare typically covers 80% of most services that Part B covers, leaving you with the remaining 20%. There are exceptions to this rule for certain preventive services for which Part B pays the entire amount.

Why is Medicare paying a lower amount?

About a quarter of Medicare beneficiaries will qualify to pay a lower amount due to unusually low cost-of-living increases in their Social Security payments over the past several years.

What is a Medicare visit?

Referred to as a "Welcome to Medicare" visit, you'll get a doctor to review your medical history and assess key health characteristics such as height, weight, blood pressure, and a calculation of your body mass index.

What is part B of medical?

Medical diagnostic tests as part of one's ordinary treatment are also typical charges. Part B covers a wider range of items, ranging from ambulance services, clinical research, and durable medical equipment to mental-health services and second opinions for surgical operations. Image source: Getty Images.

Does Medicare cover wellness visits?

After that, Medicare also provides yearly wellness visits to keep your vital information up to date.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.