2017 Medicare Part D Plans By State

| STATE | AVG PREMIUM | AVG DEDUCTIBLE |

| ALABAMA | $52.10 | $227.05 |

| ALASKA | $52.11 | $271.88 |

| ARIZONA | $47.92 | $237.50 |

| ARKANSAS | $48.39 | $237.25 |

How much does Medicare Part D cost?

Your actual drug coverage costs will vary depending on:

- Your prescriptions and whether they’re on your plan’s list of covered drugs ( formulary A list of prescription drugs covered by a prescription drug plan or another insurance plan offering ...

- What “tier” the drug is in.

- Which drug benefit phase you’re in (like whether you’ve met your deductible, or if you’re in the catastrophic coverage phase).

Who is eligible for Medicare Part D?

Medicare Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don ...

How to compare Medicare Part D plans?

- Biggest Medicare changes for 2022

- Medicare proposes limited coverage of controversial new Alzheimer's drug

- AARP interview: new Medicare chief outlines her vision

How much does a part D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost for Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the cost of Medicare Part D for 2018?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred.

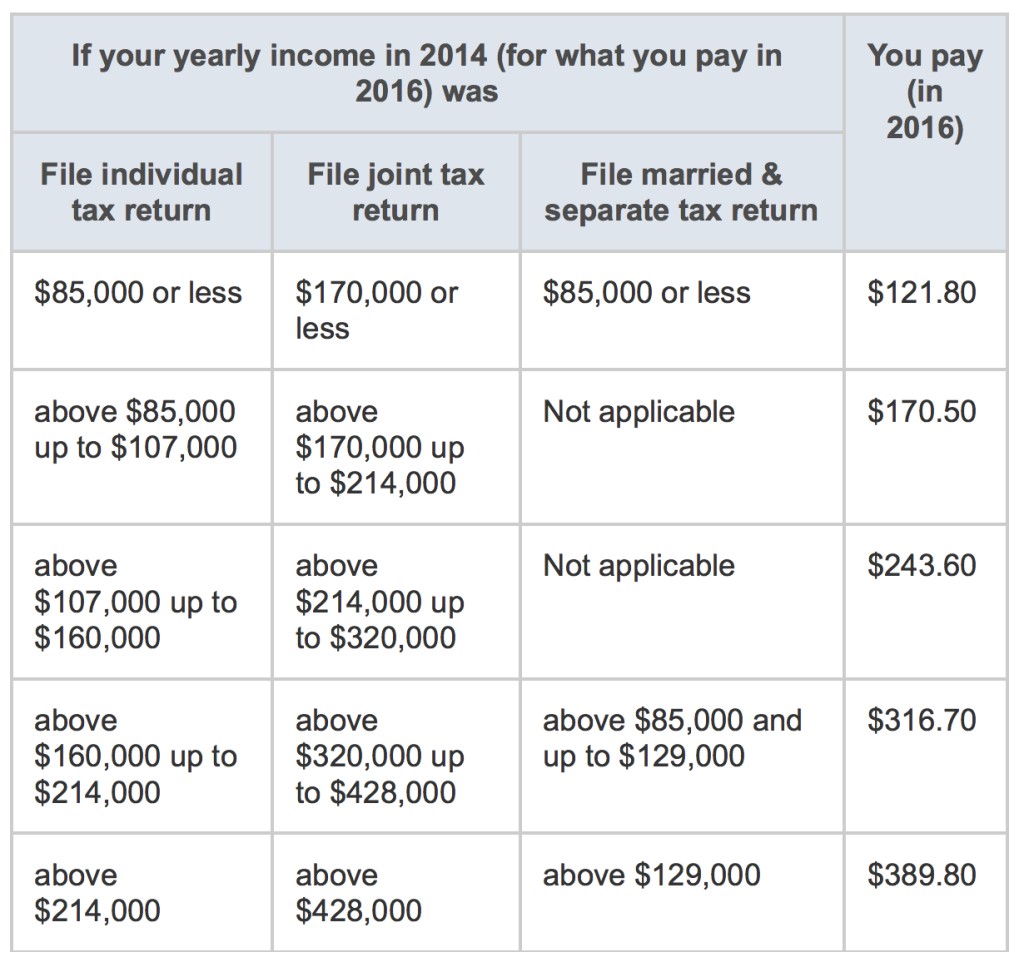

What was the cost of Medicare in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What were Medicare premiums in 2017?

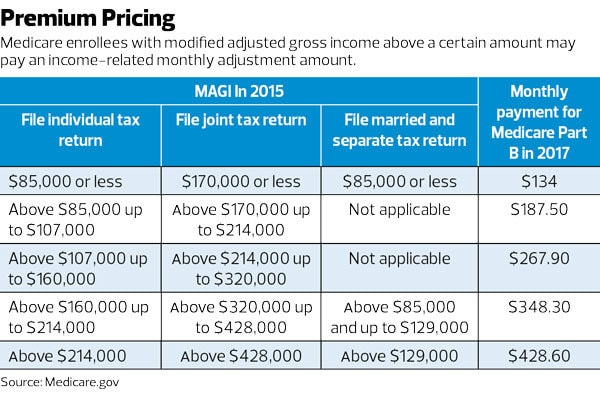

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

How much is the Medicare Part D premium for 2019?

around $41.21 per month2019 Medicare Part D premiums The average Part D plan premium in 2019 is around $41.21 per month, which is a 2 percent increase from the 2018 average premium. Part D plan premiums can also be subject to a Medicare IRMAA for higher income earners.

What is the 2021 Part D premium?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What is the Irmaa for 2017?

And since 2011, a similar IRMAA surcharge has applied to Part D premiums, applying a flat dollar surcharge of as much as $914/year in 2017.

Medicare Part D coverage

Understanding what drugs Part D covers is tricky, because accessing this benefit requires all patients to go through a private insurer. As such, each Part D plan provider has its own unique list of covered drugs, which Medicare refers to as a plan’s formulary.

Medicare Part D costs

Unlike other Medicare programs, the cost of accessing Part D benefits can vary wildly from person to person. A recipient’s actual expenses will change based on the drugs that he or she uses, the plan chosen, the pharmacy used, and whether the person qualifies for Medicare’s Extra Help feature.

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

How much is the 2017 Part D deductible?

The Part D deductible for 2017 is $400 up from $360 in 2016. It’s important to note that not all Part D plans require you to pay the deductible. Some plans begin with first dollar coverage. But as $34 is the average Part D premium those plans in that range and below are likely to require the $400 deductible before any benefit is realized.

How to get Part D for 2017?

Unless you are entitled to extra help due to a low income you have the option to obtain your 2017 Part D coverage either by enrolling in a stand-alone plan or by enrolling in a Medicare Advantage Plan that includes drug coverage. Some Medicare Advantage Plans offer $0 premiums even when drug coverage is included.

What is the 60% discount on drugs in the donut hole?

Due to legislation that closes the donut hole you will receive a 60% discount on brand name drugs while in thew donut hole. After you have spent $4950 you will enter the catastrophic portion of the Part D program.

How many Medicare beneficiaries are there?

There are approximately 55 million Medicare beneficiaries and all are eligible for Part D prescription drug coverage. The Medicare Modernization Act of 2003 established this voluntary prescription drug program for people on Medicare.

What is Medicare formulary?

The formulary is the list of covered drugs. Most Medicare Advantage Plans with drug benefits included (MAPD) have a basic formulary. A basic formulary includes the most common drugs prescribed to people on Medicare.

Does Medicare Advantage have a $0 premium?

Some Medicare Advantage Plans offer $0 premiums even when drug coverage is included. But you will not be immune to other costs associated with Part D. Part D costs include: If you are enrolling in a stand-alone Part D plan you’ll have the option of choosing a plan with either a basic or enhanced Part D formulary.

Is Part D a good plan?

The first thing you need to understand related to getting the best 2017 Part D plan is that if your drugs are not included in the Part D formulary it’s not a good plan for you. The same plan may be ideal for someone else but you need to enroll in a plan that covers your drugs. If you are considering a Medicare Advantage Plan be certain ...

Seniors are going to be paying a lot more for their prescription drug plans in 2017

A Fool since 2010, and a graduate from UC San Diego with a B.A. in Economics, Sean specializes in the healthcare sector and investment planning. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Follow @AMCScam

Big prescription drug increases are headed seniors' way

Choosing a prescription drug plan is particularly important for seniors since they tend to be more prone to expensive illnesses compared to younger adults.

How to get the best Medicare drug plan

With rising prescription drug costs looking like a near-certainty moving forward, seniors need to be diligent in their efforts to pick out a PDP that suits their needs best. Here are a few tricks to ensuring you get the best possible value for your Part D plan.

Medicare Advantage

Florida was the clear winner when comparing average Medicare Advantage premiums among states. The Sunshine State’s 2017 Medicare Advantage plans have an average premium of $19.24. North Dakota, in contrast, is over 6 times that amount with an average premium of $120.90.. South Dakota is similarly expensive with an average premium of $111.68.

Medicare Part D

When examining Medicare Part D trends on the state level, we found that lowest average premium was in Hawaii. At $43.95, the Aloha State had an average premium among 2017 Part D plans that is 17% lower than the national average of $53.22. In comparison, California had the highest average premium for their 2017 Part D plans.

Conclusion

Little inflation in 2017 average premium and deductible costs is welcome news for Part D and Medicare Advantage enrollees. However, a close inspection of the data reveals very different Medicare insurance markets across the United States. A combination of factors (e.g.

Author

This report was written by Kev Coleman, Head of Research & Data for HealthPocket. Correspondence regarding this study can be directed to [email protected].

Methodology

Premiums and deductibles for Medicare health and drug plans were obtained from the 2017 MA and PDP Landscape Source Files available at cms.gov on September 22, 2016 ( https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/index.html?redirect=/PrescriptionDrugCovGenIn/ last accessed on September 22, 2016).

How Many Medicare Part D Enrollees Had High Out-of-Pocket Drug Costs in 2017?

The Medicare Part D prescription drug benefit has helped improve the affordability of medications for people with Medicare. Yet Part D enrollees can face relatively high out-of-pocket costs because the Part D benefit does not have a hard cap on out-of-pocket spending.

Key Findings

In 2017, 1 million Medicare Part D enrollees had out-of-pocket spending above the catastrophic threshold, with average annual out-of-pocket costs exceeding $3,200—over six times the average for all non-LIS enrollees.

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

Is Medicare Part B deductible finalized?

Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.