How much does Medicare pay for a doctor visit? Everyone with Medicare is entitled to a yearly wellness visit that has no charge and is not subject to a deductible. Beyond that, Medicare Part B covers 80% of the Medicare-approved cost of medically necessary doctor visits. The individual must pay 20% to the doctor or service provider as coinsurance.

Will Medicare cover the costs of my doctor visits?

Medicare may cover doctor visits if certain conditions are met, but in some cases, you’ll have out-of-pocket costs, like deductibles and coinsurance amounts. No matter what kind of Medicare coverage you may have, it’s important to understand that your doctor must accept Medicare assignment.

How much is a doctor visit with Medicare?

Let’s say the Medicare-approved costs were $100 for the doctor visit and $900 for the MRI. Assuming that you’ve paid your Part B deductible, and that Part B covered 80% of these services, you’d still be left with some costs. In this scenario, you’d typically pay $20 for the doctor visit and $180 for the x-rays.

Are doctor visits covered by Medicare?

Medicare Part B (Medical Insurance) covers E-visits with your doctors and certain other practitioners. Your costs in Original Medicare You pay 20% of the Medicare-approved amount for your doctors’ services, and the Part B deductible applies.

Which part of Medicare covers doctor visits?

- Medicare won’t cover appointments with a podiatrist for routine services such as corn or callous removal or toenail trimming.

- Medicare sometimes covers services provided by an optometrist. ...

- Original Medicare (parts A and B) doesn’t cover dental services, though some Medicare Advantage plans do. ...

What is Medicare approved amount for doctor visit?

Medicare's approved amount for the service is $100. A doctor who accepts assignment agrees to the $100 as full payment for that service. The doctor bills Medicare who pays him or her 80% or $80, and you are responsible for the 20% coinsurance (after you have paid the Part B annual deductible).

What percentage of the allowable fee does Medicare pay a doctor?

Under current law, when a patient sees a physician who is a “participating provider” and accepts assignment, as most do, Medicare pays 80 percent of the fee schedule amount and the patient is responsible for the remaining 20 percent.

Does Medicare pay for medical consultations?

Medicare Part B covers a wide range of doctor's visits, including medically necessary appointments and preventive care.

What part of Medicare pays for doctors?

Part BPart B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Does Medicare only pay 80%?

You will pay the Medicare Part B premium and share part of costs with Medicare for covered Part B health care services. Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

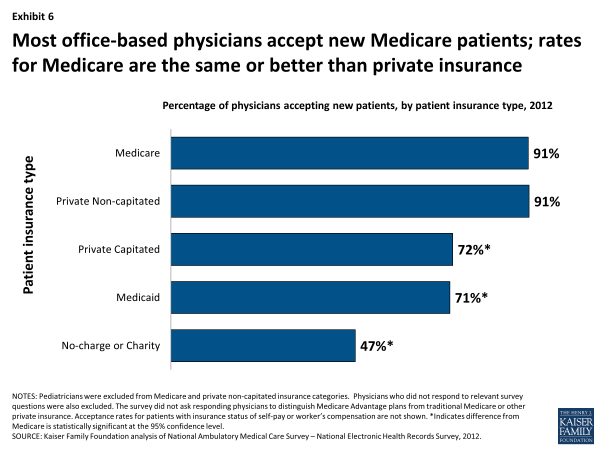

Do doctors lose money on Medicare patients?

Summarizing, we do find corroborative evidence (admittedly based on physician self-reports) that both Medicare and Medicaid pay significantly less (e.g., 30-50 percent) than the physician's usual fee for office and inpatient visits as well as for surgical and diagnostic procedures.

Does Medicare Part B cover 100 percent?

Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare Part B cover doctor visits?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment.

How often will Medicare pay for routine blood work?

For people watching their cholesterol, routine screening blood tests are important. Medicare Part B generally covers a screening blood test for cholesterol once every five years. You pay nothing for the test if your doctor accepts Medicare assignment and takes Medicare's payment as payment in full.

How often can you have a Medicare Annual Wellness visit?

once every 12 monthsHow often will Medicare pay for an Annual Wellness Visit? Medicare will pay for an Annual Wellness Visit once every 12 months.

How much is a doctor visit without insurance 2021?

The cost of a primary care visit without insurance generally ranges from $150-$300 for a basic visit and averages $171 across major cities in the United States....Cost of Primary Care Visit By City.ServicesCost without insuranceAverage$1715 more rows•Oct 27, 2021

How does Medicare reimburse physician services?

Traditional Medicare reimbursements Instead, the law states that providers must send the claim directly to Medicare. Medicare then reimburses the medical costs directly to the service provider. Usually, the insured person will not have to pay the bill for medical services upfront and then file for reimbursement.

Which Medicare Part covers doctor visits?

Which parts of Medicare cover doctor’s visits? Medicare Part B covers doctor’s visits. So do Medicare Advantage plans, also known as Medicare Part C. Medigap supplemental insurance covers some, but not all, doctor’s visits that aren’t covered by Part B or Part C.

How to contact Medicare for a medical emergency?

For questions about your Medicare coverage, contact Medicare’s customer service line at 800-633-4227, or visit the State health insurance assistance program (SHIP) website or call them at 800-677-1116. If your doctor lets Medicare know that a treatment is medically necessary, it may be covered partially or fully.

What percentage of Medicare Part B is covered by Medicare?

The takeaway. Medicare Part B covers 80 percent of the cost of doctor’s visits for preventive care and medically necessary services. Not all types of doctors are covered. In order to ensure coverage, your doctor must be a Medicare-approved provider.

How long do you have to enroll in Medicare?

Initial enrollment: 3 months before and after your 65th birthday. You should enroll for Medicare during this 7-month period. If you’re employed, you can sign up for Medicare within an 8-month period after retiring or leaving your company’s group health insurance plan and still avoid penalties.

When is Medicare open enrollment?

Annual open enrollment: October 15 – December 7. You may make changes to your existing plan each year during this time. Enrollment for Medicare additions: April 1 – June 30. You can add Medicare Part D or a Medicare Advantage plan to your current Medicare coverage.

Does Medicare cover eyeglasses?

If you have diabetes, glaucoma, or another medical condition that requires annual eye exams, Medicare will typically cover those appointments. Medicare doesn’t cover an optometrist visit for a diagnostic eyeglass prescription change. Original Medicare (parts A and B) doesn’t cover dental services, though some Medicare Advantage plans do.

Does Medicare cover a doctor's visit?

Medicare will cover doctor’s visits if your doctor is a medical doctor (MD) or a doctor of osteopathic medicine (DO). In most cases, they’ll also cover medically necessary or preventive care provided by: clinical psychologists. clinical social workers. occupational therapists.

What are the costs associated with Medicare Advantage Plans?

The costs associated with Medicare Advantage Plans vary depending on several factors, including: whether the plan has a premium. whether the plan pays the Medicare Part B premium. the yearly deductible, copayment, or coinsurance. the annual limit on out-of-pocket expenses.

How many parts does Medicare have?

Medicare is a federally funded insurance plan consisting of four parts: Part A, Part B, Part C, and Part D. Each part covers different medical expenses. In 2020, Medicare provided healthcare benefits for more than 61 million older adults and other qualifying individuals. Today, it primarily covers people who are over the age of 65 years, ...

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare Part C?

Medicare Part C plans, also known as Medicare Advantage plans, are an all-in-one alternative to original Medicare that private insurance companies administer. These plans must provide the same coverage level as original Medicare, including coverage for visits to the doctor.

How much is Medicare Part B deductible?

Beyond that, Medicare Part B covers 80% of the Medicare-approved cost of medically necessary doctor visits. The individual must pay 20% to the doctor or service provider as coinsurance. The Part B deductible also applies, which is $203 in 2021. The deductible is the amount of money that a person pays out of pocket before ...

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is the Medicare premium for 2021?

The standard monthly premium in 2021 is $148.50. If a person did not sign up when they were eligible at the age of 65 years, they might also need to pay a late enrollment penalty. This penalty can increase the premiums by 10% for each year that someone qualified for Medicare but did not enroll.

How much does Medicare pay after paying $203?

After you pay $203 yourself, your benefits kick in. After that, Medicare will pay 80% of the cost of most Part B services, and you (or your Medigap policy) pay the other 20%. Finally, it’s important to know that there's a penalty for signing up late for Part B.

What is the Medicare approved amount?

Medicare decides what it will pay for any particular medical service. This is called the Medicare-approved amount. If your doctor is willing to accept what Medicare pays and won't charge you any more, they are said to "accept assignment.".

What is Medicare Part B?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.) If you qualify to get Medicare Part A, ...

Why do people opt out of Medicare Part B?

Some people opt out of Medicare Part B because they still have coverage through union or employer health insurance. As long as your coverage is considered “creditable” you will not pay a penalty for signing up late.

What happens if you don't sign up for Medicare Part B?

If you don't sign up for Medicare Part B when you first become eligible (and you don’t have comparable coverage from an employer), your monthly fee may be higher than $148.50. You’ll pay a lifetime 10% penalty for every 12 months you delay your enrollment. Medical and other services.

How much is Medicare Part B 2021?

For Part B, you have to pay a monthly fee (called a premium ), which is usually taken out of your Social Security payment. For 2021, this fee is $148.50 per month. But if you have a higher than average personal income (over $85,000) or household income (over $176,000), you will have to pay a higher monthly premium for Medicare Part B.

Do you have to pay a co-payment for outpatient hospital services?

You must pay a co-payment for outpatient hospital services The exact amount varies depending on the service. Home health care. Medicare Part B pays for nurses and some therapists to provide occasional or part-time services in your home.

Co-pay vs. Co-insurance

Copays and coinsurance fees are often discussed when you hear about your medical insurance plan. Most of the time, a copay or copayment refers to a single fee that you will have to pay when you receive health care.

Does Medicare Use Co-pays?

Yes and no. Importantly, Part B of Medicare never uses copays. Part B has a deductible of $233 per benefit period, and after this, you will pay 20 percent of your costs, which is your coinsurance.

Mental Health Services -- The Exception

Mental health services are the one regular exception to this rule. There may be some instances in which you don't have to pay a copay for these services, but most of the time that is the arrangement that Medicare will use. Make sure to check the details with the office you are dealing with and with Medicare.

What About Part A?

Medicare Part A does not technically use a copayment, but the fees are very similar to what most people associate with copays. Part A hospital insurance uses a so-called coinsurance fee, but this fee is not percentage-based and is pre-set with a few tiers depending on the length of your skilled nursing facility or hospital stay.

Copays with Medicare Advantage

When it comes to copays, Medicare Advantage is a whole other story. Medicare Advantage, or Part C, refers to a way of receiving your Medicare coverage through a private health insurance company. If you have a Medicare Advantage plan, many of the associated fees will be set by that insurance company, rather than Medicare.

How do Part D Prescription Drug Plans Fit In?

Although Part D plans usually won't apply to your actual doctor visit, they are still very relevant to the process. If your doctor prescribes you medication during your visit, it will usually be covered by a Part D plan.

Can Medigap Plans Help?

Medigap plans, or Medicare Supplement Plans, are plans that cover some of your Medicare out-of-pocket costs. With these plans, you will only pay a monthly premium, with no other out-of-pocket costs. As an example, these plans can cover your Part B coinsurance, and cover many other out-of-pocket fee categories.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

Does Medicare cover hospital stays?

Medicare Part A can help provide coverage for hospital stays. You’ll still be responsible for deductibles and coinsurance. A stay at the hospital can make for one hefty bill. Without insurance, a single night there could cost thousands of dollars. Having insurance can help reduce that cost.

How often do you get a wellness visit?

for longer than 12 months, you can get a yearly “Wellness” visit once every 12 months to develop or update a personalized prevention plan to help prevent disease and disability, based on your current health and risk factors.

Do you have to pay coinsurance for a Part B visit?

You pay nothing for this visit if your doctor or other qualified health care provider accepts Assignment. The Part B deductible doesn’t apply. However, you may have to pay coinsurance, and the Part B deductible may apply if: Your doctor or other health care provider performs additional tests or services during the same visit.