If you’re eligible for Medicare, but not other federal benefits, you’ll pay a Part A premium of $274 or $499 each month, depending on how long you’ve paid Medicare taxes. The deductible for Medicare Part A is $1,556 per benefit period.

Full Answer

How much does therapy cost with Medicare Part B?

For therapy at a freestanding facility, you pay 20% of the Medicare-approved amount for the therapy, and the Part B deductible applies. To find out how much your test, item, or service will cost, talk to your doctor or health care provider. The specific amount you’ll owe may depend on several things, like:

What is the price of a dollar bill of 77333?

$66.49 $66.50 77333 $195.39 $97.69 $97.70 77334 $313.46 $172.40 $141.06 77336 $180.48 77338 $877.59 $457.09 $420.50 77370 $211.68

How much does Medicare Part B cost in 2022?

The standard Part B premium amount is $148.50 ($170.10 in 2022) (or higher depending on your income). $203 ($233 in 2022). After your deductible is met, you typically pay 20% of the In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

How much does a BR 76510 cost?

$293.53 $105.23 $188.30 76496 BR BR BR 76497 BR BR BR 76498 BR BR BR 76499 BR BR BR 76506 $146.55 $80.60 $65.95 76510 $316.38 $153.11 $163.28 76511 $154.02 $84.71 $69.31 76512 $155.37 $85.45 $69.92 76513 $155.37 $85.45 $69.92 76514

How Much Does Medicare pay for CPT codes?

Medicare payment rates for CPT codes 87635, 86769, and 86328 range from $42.13 to $51.31, CMS recently announced. May 20, 2020 - CMS recently revealed how much it will pay for new Current Procedural Terminology (CPT) codes developed by the American Medical Association (AMA) for COVID-19 diagnostic tests.

What is the G code for 77412?

Radiation treatment delivery: G codes G6003-G6014 will be used in the MPFS and CPT codes 77402, 77407, and 77412 will be used in OPPS. IMRT: G codes G6015 and G6016 are used for payment under the MPFS and CPT codes 77385 and 77386 will be used in OPPS.

What is the description of CPT code 77412?

CPT® 77412, Under Radiation Treatment Delivery The Current Procedural Terminology (CPT®) code 77412 as maintained by American Medical Association, is a medical procedural code under the range - Radiation Treatment Delivery.

How do you calculate CPT reimbursement rate?

You can search the MPFS on the federal Medicare website to find out the Medicare reimbursement rate for specific services, treatments or devices. Simply enter the HCPCS code and click “Search fees” to view Medicare's reimbursement rate for the given service or item.

Can 77412 and 77387 be billed together?

77387-TC should always be reported when image guidance is performed with CPT codes 77402, 77407 and 77412.

Is radiation therapy the same as radiation oncology?

Radiation therapy is a cancer treatment that uses high-energy x-ray or other particles to destroy cancer cells. A doctor who specializes in giving radiation therapy to treat cancer is called a radiation oncologist.

Does Humana pay for consultation codes?

Many non-Medicare payers still recognize consult codes for appropriately documented services....Table 1: Payer Reimbursement—Summary.PayerStatusEffectiveHumana Medicare (MCHMO and MCPPO)Does NOT Accept Consultation Codes01/01/1012 more rows•Oct 1, 2010

How many times can you bill 77338?

Standards for CPT® 77338 CPT® 77338 may only be billed one (1) time per IMRT plan created. other type of isodose planning. In the event of an IMRT boost, the treatment device is allowed even though the additional plan may not be allowed.

How many times can you bill 77280?

Only 1 verification simulation is allowed per phase of treatment. For HDR brachytherapy treatments, one (1) verification simulation (CPT® 77280) may be approved per treatment. Additional services may be requested and will be reviewed for medical necessity based on individual patient circumstances.

How do I find my Medicare fee schedule?

To start your search, go to the Medicare Physician Fee Schedule Look-up Tool. To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) .

What is CPT pricing?

Carriage Paid To (CPT) is an international commercial term (Incoterm) denoting that the seller incurs the risks and costs associated with delivering goods to a carrier to an agreed-upon destination.

How Much Does Medicare pay for a 99213?

A 99213 pays $83.08 in this region ($66.46 from Medicare and $16.62 from the patient). A 99214 pays $121.45 ($97.16 from Medicare and $24.29 from the patient). For new patient visits most doctors will bill 99203 (low complexity) or 99204 (moderate complexity) These codes pay $122.69 and $184.52 respectively.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference.

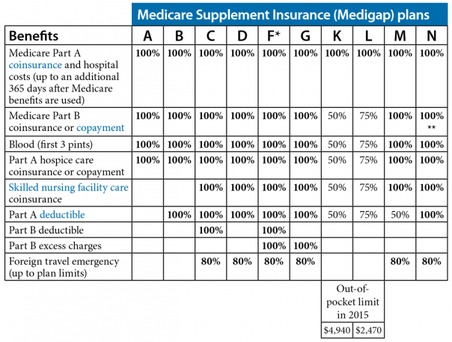

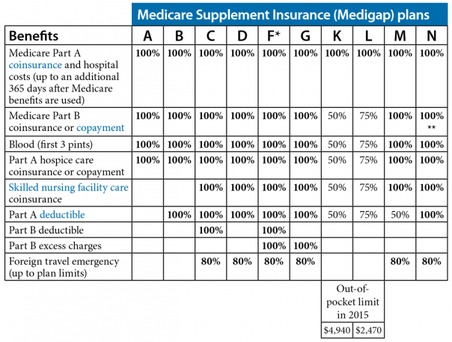

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. and. coinsurance. An amount you may be required to pay as your share of the cost for services after you pay any deductibles.

What is a copayment for a doctor?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. , and the Part B deductible applies. For therapy at a freestanding facility, you pay 20% of the. Medicare-Approved Amount.

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

What is Medicare drug coverage?

You'll make these payments throughout the year in a Medicare drug plan: A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ).

Why are my out-of-pocket drug costs less at a preferred pharmacy?

Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying your drug coverage costs.

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

Does Medicare cover hospital stays?

Medicare Part A can help provide coverage for hospital stays. You’ll still be responsible for deductibles and coinsurance. A stay at the hospital can make for one hefty bill. Without insurance, a single night there could cost thousands of dollars. Having insurance can help reduce that cost.

Does Medicare Part A cover inpatient care?

If you’re eligible for Medicare, Medicare Part A can provide some coverage for inpatient care and significantly reduce costs for extended hospital stays. But in order to receive the full scope of benefits, you may need to pay a portion of the bill. Keep reading to learn more about Medicare Part A, hospital costs, and more.