What is the CPT code 99233?

The AMA CPT® manual defines code 99233 as follows: Subsequent hospital care, per day, for the evaluation and management of a patient, which requires at least two of these three key components:

What if a provider reports a subsequent hospital care code (99231)?

Contractors will not find fault with providers who report subsequent hospital care codes (99231 and 99232) in cases where the medical record appropriately demonstrates that the work and medical necessity requirements are met for reporting a subsequent hospital care code (under the level selected) .

Is there a bundling edit for CPT code 99239?

There was a bundling edit when using CPT code 99232 and 99233 with 99239 back in January of 2020. However, if you enter today's date and enter these codes there is no longer any bundling edits.

What is Byby medical billing 99231?

by Medical Billing 99231 : Inpatient hospital visits: Initial and subsequent subsequent hospital care, per day, for the evaluation and management of a patient, which requires at least 2 of the 3 key components: A problem focused interval history; A problem focused examination; Medical decision making that is straightforward or of low complexity.

How much does Medicare reimburse for 99233?

approximately $106The 99233 represents the highest level of care for hospital progress notes. This is the second most popular code selected by internists who used the 99233 level of care for about 35% of these encounters in 2018. The Medicare allowable reimbursement for this level of care is approximately $106 and it is worth 2.0 RVUs.

Does Medicare pay for 99223?

For Medicare patients, inpatient consultations are now reported with the initial hospital visit CPT codes 99221–99223 (and not an emergency department [ED] visit code).

How many RVU is 99233?

2.0 work RVU'sA 99233 CPT code is associated with 2.0 work RVU's also known as wRVU.

Is CPT code 99233 inpatient or outpatient?

inpatientRemember: 99231-99233 are inpatient codes. If the patient is in observation status and not admitted to inpatient status, use outpatient consult codes (check your payer) or typical office visits such as 99201-99205 and 99211-99215.

What is the difference between 99223 and 99233?

If a doctor is asked to come in and "consult" and it fits the rules for billing a true consult, then yes you would bill a 99221-99223. However, if the doctor is "consulting" on a problem they will be managing or currently manage then you should bill a 99231-99233.

How often can 99223 be billed?

Both Initial Hospital Care (CPT codes 99221 – 99223) and Subsequent Hospital Care codes are “per diem” services and may be reported only once per day by the same physician or physicians of the same specialty from the same group practice.

What is the RVU for 99223?

A 99223 (level 3 initial visit) is currently worth 5.73 RVUs, which breaks down into 3.86 (wRVUs) + 1.58 (PEs) + 0.29 (MP). Median productivity per this benchmark is 7,489 RVU/FTE/year.

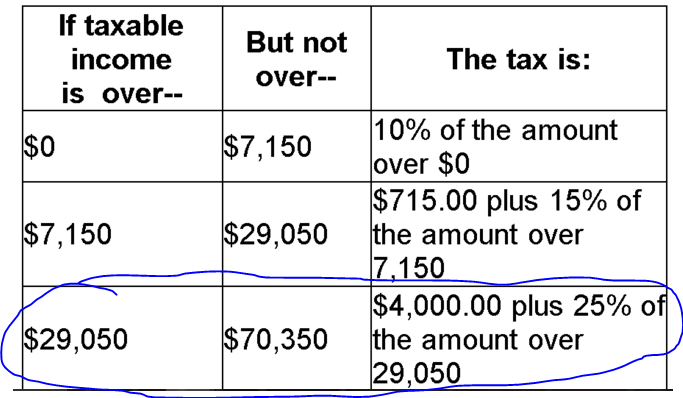

How much does Medicare reimburse per RVU?

On the downside, CMS set the 2022 conversion factor (i.e., the amount it pays per RVU) at $33.59, which is $1.30 less than the 2021 conversion factor. There was also mixed news on telehealth.

How do I bill CPT 99233?

Both documentations guidelines 1995 and 19997 are acceptable for CPT 99233. It includes all the reviewing of diagnostic studies results, medical records, and changes in the treatment since the last examination was done. CPT 92333 will be reported for subsequent or follow-up services only.

What is the difference between 99232 and 99233?

Code 99232 identifies patients with minor complications requiring active, continuous management, or patients who aren't responding to treatment adequately. Code 99233 identifies unstable patients, or patients with significant new complications or problems.

What is the place of service for CPT 99233?

hospital inpatientsDescription Of The 99233 CPT Code: CPT code 99233 is used to report Evaluation and Management services to established hospital inpatients after the initial inpatient encounter during subsequent visits.

Can you Bill 99233 twice a day?

Payment is usually allowed for one E/M service per day. Hope this helps!

Is CPT code 99223 inpatient or outpatient?

CPT 99223 represents the highest level of initial inpatient hospital care. CPT 99223 is defined as: Initial hospital care, per day, for the evaluation and management of a patient, which requires these three key components: A comprehensive history.

How Much Does Medicare pay for 99232?

Not surprisingly, this is the most popular level of care selected by internists who selected the 99232 level of care for 59.97% of these encounters in 2018. The Medicare allowable reimbursement for this level of care is approximately $74 and it is worth 1.39 RVUs.

Can 99223 be billed as outpatient?

New. 99221-99223 are inpatient initial visit codes to be used if the consulting doctor is called to see an inpatient and their insurance does not accept consult codes.

Does CPT 99223 need a modifier?

The requirement to conduct reviews of claims for services for CPT codes 99221 through 99223, 99251 through 99255 and 99238 that are furnished on the same date as inpatient dialysis is deleted. These codes are separately payable using modifier “ -25".

What is CPT Code 99233?

CPT code 99233 is assign ed to a level 3 hospital subsequent care (follow up) note . 99233 is the highest level of non-critical care daily progress note. When it comes to 99233 documentation is critical, however understanding of the documentation required is even more critical. WorK RVU (wRVU) for cpt code 99233 is of course higher than that for 99232.

How long is 99233?

The 99233 represent what would typically be 35 minutes of care at the patient bedside or on the patient’s floor or unit.

How many data points are needed for a 99233?

Personally reviewing the radiology test CXR is 2 point. Independent review of the EKG is 2 points (If we had decided to review old records and summarized that would have been 2 points). Later we order an echo, that’s a further point. We had already reviewed the lab above, that’s a further point. In total here we have 6 data points that exceeds the 4 data points required for the 99233. That’s already one of the 2 requirements of the complex medical decision making out the way. Remember it has to be 2 out of the 3 of 4 problem points, 4 data points and high risk. We already have evidence for the new significant diagnosis / problem point above so in theory this note already qualifies for a 99233.

How many key components are needed to bill 99233?

To bill a 99233 you need at least 2 of the 3 key components.

Is 99233 a higher level of billing?

Since 99233 is higher levels of billing when it comes to inpatient follow up , it is likely to come under more scrutiny and therefore documentation and understanding of requirements is critical. In general, many inpatients are truly sick and if there is genuinely high complexity in terms of the patient and the situation the documentation will take care of it by itself. When we take a deeper dive in to the guidelines for documentation it becomes ridiculously convoluted and takes an investment of time to truly develop an understanding to where it can be applied. Once that understanding is developed the whole thing becomes much easier. Unfortunately a note becomes like a point system where a certain number of points are required for a certain number of categories. That can be advantageous however when it comes to efficiency in documentation for those that understand how it works.

What is CPT code 99231?

CPT codes 99231-99233 are used to describe subsequent hospital care. These codes require documentation of the interval history at either problem focused, expanded problem focused, or detailed levels. The examination requires the same levels of documentation. The Medical decision making documentation must support straightforward, low, moderate, or high complexity. The nature of the presenting problem usually determines the levels of history and physical exam required.

What is 99499 in Medicare?

Contractors shall not find fault in cases where the medical record appropriately demonstrates that the work and medical necessity requirements are met for reporting a subsequent hospital care code (under the level selected), even though the reported code is for the provider’s first E/M service to the inpatient during the hospital stay. Unlisted evaluation and management service (code 99499) shall only be reported for consultation services when an E/M service that could be described by codes 99251 or 99252 is furnished, and there is no other specific E/M code payable by Medicare that describes that service. Reporting code 99499 requires submission of medical records and contractor manual medical review of the service prior to payment. CMS expects reporting under these circumstances to be unusual. T he principal physician of record is identified in Medicare as the physician who oversees the patient’s care from other physicians who may be furnishing specialty care. The principal physician of record shall append modifier “- AI” (Principal Physician of Record), in addition to the E/M code. Follow-up visits in the facility setting shall be billed as subsequent hospital care visits and subsequent nursing facility care visits.

What is the CPT code for a patient who is unstable?

Physicians typically spend 35 minutes at the bedside and on the patient’s hospital floor or unit. CPT codes 99231-99233 are used to describe subsequent hospital care.

What is the Medicare code for a physician of record?

or D.O. to be the principal physician of record (sometimes referred to as the admitting physician.) The principal physician of record is identified in Medicare as the physician who oversees the patient’s care from other physicians who may be

When any level of subsequent hospital care is under review, should the medical record include results of diagnostic studies and changes to the?

When any level of subsequent hospital care is under review, the medical record should include results of diagnostic studies and changes to the patient’s status since the last assessment. Changes include history, physical condition and response to management.

Can a contractor find fault for a hospital code?

Contractors will not find fault with providers who report subsequent hospital care codes (99231 and 99232) in cases where the medical record appropriately demonstrates that the work and medical necessity requirements are met for reporting a subsequent hospital care code (under the level selected) .

Is 99221 a CPT code?

CMS is aware of concerns pertaining to reporting initial hospital care codes for services that previously could have been reported with CPT consultation codes, for which the minimum key component work and/or medical necessity requirements for CPT codes 99221 through 99223 are not documented.

What is MAC 99233?

Prior to the introduction of Targeted Probe and Educate reviews, the Parts A/B Medicare Administrative Contractor (MAC) for jurisdictions E and F, Noridian Healthcare Solutions, undertook a service-specific probe review for internal medicine providers reporting 99233.#N#Most of the published findings reflected simple process issues, such as lack of signature, failure to submit documentation, incorrect date of service, incorrect provider, and illegible documentation. But one finding was more significant: insufficient documentation/medical necessity.#N#Insufficient documentation reflects a failure to meet the documentation requirements based on the CPT® code description. Documentation requirements for supporting 99233 are two of the following three key components:

What does 99232 mean?

99232 – “Usually, the patient is responding inadequately to therapy or has developed a minor complication.”. Based on these statements, it is the documented stability of the patient that determines the medical necessity of these subsequent care levels (when not billing based on time).

Is it medically necessary to bill a higher level of evaluation and management service?

Medical necessity of a service is the overarching criterion for payment in addition to the individual requirements of a CPT code. It would not be medically necessary or appropriate to bill a higher level of evaluation and management service when a lower level of service is warranted. The volume of documentation should not be ...

Can you bill 99233?

In other words, just because the physician documents a detailed history and detailed exam doesn’t necessarily mean you can bill 99233. All billed services must be reasonable, necessary, and warranted.

Do you need to count history to get 99233?

Although you still need to count the history and exam elements to meet the 99233 documentation requirements, you should keep in mind the stability of the patient’s conditions by asking:

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

How much would E/M reduce payment?

E/M Payment Reduction: Would reduce payment by 50% for the least expensive procedure or visit that the same physician (or a physician in the same group practice) furnishes on the same day as a separately identifiable E/M visit

What is the CPT/RUC workgroup?

The CPT/RUC Workgroup on E/M is committed to changing the current coding and documentation requirements for office E/M visits to simplify the work of the health care provider and improve the health of the patient.