Are you expecting Medicare to pay for long-term care?

Mar 09, 2021 · Although Medicare covers long-term hospital care, you could face significant charges if you receive long-term care beyond three months. In 2021 under Medicare Part A, you generally pay $0 coinsurance for the first 60 days of each benefit period, once you have paid your Part A deductible. For days 61-90, you pay $371 per day of each benefit period.

What role does Medicare play in long term care?

See how Medicare is responding to COVID-19. Days 1-60: $1,556 deductible.*. D ays 61-90: $389 coinsurance each day. Days 91 and beyond: $778 coinsurance per each “lifetime reserve day” after day 90 for each benefit period (up to a maximum of 60 reserve days over your lifetime). Each day after the lifetime reserve days: All costs. *You don’t have to pay a deductible for care you …

Does Medicare or Medicaid cover long-term care cost?

Nov 17, 2021 · In these qualified situations, Medicare will cover the total cost of a skilled nursing facility for the first 20 days. On days 21 through 100, you’ll be responsible for covering a daily co-pay ($185.50 in 2021), and Medicare will cover the rest. After 100 days, Medicare coverage ends, and you’ll have to pay the full bill.

Does Medicare cover long term care?

Your costs in Original Medicare You pay 100% for non-covered services, including most long-term care. What it is Long-term care is a range of services and support for your personal care needs. Most long-term care isn't medical care.

How long does it take to get discharged from a long term care hospital?

You’re transferred to a long-term care hospital directly from an acute care hospital. You’re admitted to a long-term care hospital within 60 days of being discharged from a hospital.

What is Medicare Part A?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. covers the cost of long-term care in a. long-term care hospital. Acute care hospitals that provide treatment for patients who stay, on average, more than 25 days.

When does the benefit period end?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. ...

How long does an acute care hospital stay?

Acute care hospitals that provide treatment for patients who stay, on average, more than 25 days. Most patients are transferred from an intensive or critical care unit. Services provided include comprehensive rehabilitation, respiratory therapy, head trauma treatment, and pain management. .

Do you have to pay a deductible for long term care?

Each day after the lifetime reserve days: All costs. *You don’t have to pay a deductible for care you get in the long-term care hospital if you were already charged a deductible for care you got in a prior hospitalization within the same benefit period.

Medicare Coverage for Skilled Nursing Care

What are the specific instances where Medicare will cover long-term care? If you or your loved one sustains an injury or suffers some other unfavorable health incident and you are admitted to the hospital for at least three days, Medicare may cover your stay at a skilled nursing facility for up to 100 days.

How to Pay for Long-Term Care?

If Medicare doesn’t provide coverage, how can you pay for long-term care? Fortunately, you have a few different options to cover these costs, depending on your situation.

Long-Term Care Insurance

If you are relatively young and healthy and don’t immediately require care, you can p urchase a Long-Term Care Insurance (LTCI) policy to cover a future long-term care stay.

Out of Pocket

You may be able to pay out of pocket for long-term care, but unless you have a high net worth, you risk losing your life savings in just a few years. Although you might believe you have to exhaust your savings paying out of pocket before you can qualify for assistance, this simply isn’t true. That’s where Medicaid comes in.

Medicaid

Medicaid is the primary payer of long-term care costs in the U.S. As long as you meet the requirements, you can use Medicaid benefits to cover a nursing home stay. If you have too many assets to qualify, our professional network can provide a solution to help you protect your savings while accelerating your eligibility for benefits.

What is long term care?

What it is. Long-term care is a range of services and support for your personal care needs. Most long-term care isn't medical care. Instead, most long-term care is help with basic personal tasks of everyday life like bathing, dressing, and using the bathroom, sometimes called "activities of daily living.".

What is custodial care?

custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom. It may also include the kind of health-related care that most people do themselves, like using eye drops.

How much does Medicare pay for nursing care?

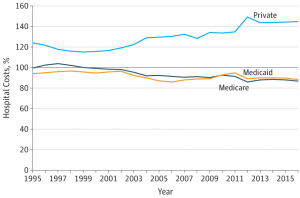

Between 21 and 100 days, if you are deemed to still be in need of such services, Medicare will pay $167.50 per day in 2018. (Whether or not you are still deemed to be in need of such services may be a point of debate in some cases.) This reimbursable amount is less than the national average daily cost of skilled nursing care for a semi-private room, which hovers around $235 according to Genworth Financial. Therefore, many people will still end up paying for some amount of care out of their own pocket during those 80 days. Also, if a private room is preferred over a semi-private room, this could increase the out-of-pocket cost further.

Who is Brad Breeding?

Brad Breeding is president and co-founder of myLifeSite, a North Carolina company that develops web-based resources designed to help families make better-informed decisions when considering a continuing care retirement community (CCRC) or lifecare community.

Do skilled nursing facilities accept Medicare?

Not all skilled nursing facilities are Medicare-certified. Often referred to as “private pay” providers, these facilities do not accept Medicare and, therefore, residents must pay out-of-pocket for services beginning on day one.

How long does it take to get Medicare long term care?

Medicare long term care eligibility is attainable under the following conditions when hospitalized: You must be an inpatient at an approved hospital for at least three days. After being admitted to a Medicare-certified nursing facility within 30 days of your inpatient hospital visit. You must require additional therapy such as physical ...

How long does Medicare pay for physical therapy?

Medicare long term eligibility starts after meeting these requirements and pays for a maximum of 100 days during each benefit period.

How long does it take to qualify for Medicare?

Medicare long term care eligibility is attainable under the following conditions when hospitalized: 1 You must be an inpatient at an approved hospital for at least three days 2 After being admitted to a Medicare-certified nursing facility within 30 days of your inpatient hospital visit 3 You must require additional therapy such as physical or occupational 4 Your condition medically demands skilled nursing services

What are some examples of programs that help with costs?

Other programs can help with costs. For example, Medicaid aids low-income individuals or families to help with healthcare costs. The Medicaid program is the largest payer in the country for long-term and nursing home care. Other alternatives include buying long-term care insurance.

How much does a nursing home cost?

A private nursing home room costs over $250 per day or $8,000 a month. You can imagine how financially exhausting this may become – and fast if you’re unprepared. However, proper long-term care insurance must meet your healthcare needs.

What are the benefits of Medicare Advantage?

Advantage plans are extending coverage even further; benefits may include personal care, meal delivery, transportation, and adult day care services. One rule of thumb Medicare and long-term care remains consistent, even with the new benefit options. Medicare nor Medicare Advantage plans include the cost of room and board or assistance ...

What states have long term care partnerships?

Four original states pioneered the Long Term Care Partnership Program; terms are different in California, Connecticut, New York, and Indiana. The program is protection for your lifestyle, income, and assets. Although conventional long-term care insurance is the only type to qualify for Partnership asset protection, without long-term care insurance, ...

How much does Medicare pay for skilled nursing?

If you qualify for short-term coverage in a skilled nursing facility, Medicare pays 100 percent of the cost — meals, nursing care, room, etc. — for the first 20 days. For days 21 through 100, you bear the cost of a daily copay, which was $170.50 in 2019.

How long does Medicare pay for a stroke?

If you’re enrolled in original Medicare, it can pay a portion of the cost for up to 100 days in a skilled nursing facility.

What is the 3 day rule for Medicare?

Two more things to note about the three-day rule: Medicare Advantage plans, which match the coverage of original Medicare and often provide additional benefits, often don’t have those same restrictions for enrollees. Check with your plan provider on terms for skilled nursing care.

Does Medicare cover nursing homes?

Under specific, limited circumstances, Medicare Part A, which is the component of original Medicare that includes hospital insurance, does provide coverage for short-term stays in skilled nursing facilities, most often in nursing homes.

Does Medicare cover long term care?

Of course, Medicare covers medical services in these settings. But it does not pay for a stay in any long-term care facilities or the cost of any custodial care (that is, help with activities of daily life, such as bathing, dressing, eating and going to the bathroom), except for very limited circumstances when a person receives home health services ...

Does observation count as time spent in a skilled nursing facility?

In both cases you are lying in a hospital bed, eating hospital food and being attended to by hospital doctors and nurses. But time spent under observation does not count toward the three-day requirement for Medicare coverage in a skilled nursing facility.

Does long term care insurance pay for veterans?

Long-term care insurance: Some people have long-term care insurance that might pay, depending on the terms of their policies. The VA: Military veterans may have access to long-term care benefits from the U.S. Department of Veterans Affairs.

What is assignment in Medicare?

Assignment —An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance.

Does Medicare pay for DME repairs?

Medicare will pay 80% of the Medicare-approved amount (up to the cost of replacing the item) for repairs. You pay the other 20%. Your costs may be higher if the supplier doesn’t accept assignment.