Is CPT code 87086 covered by Medicare?

CPT CODE and description. 87086 – Culture, bacterial; quantitative colony count, urine – average fee amount – $10 – $20. 87088 – Culture, bacterial; with isolation and presumptive identification of each isolate, urine. 87186 – Susceptibility studies, antimicrobial agent; microdilution or agar dilution (minimum inhibitory concentration [MIC] or breakpoint), each multi-antimicrobial ...

What is the Medicare-approved amount?

A part of a hospital where you get outpatient services, like an observation unit, surgery center, or pain clinic. You’ll see how much the patient pays with Original Medicare and no supplement (Medigap) policy. Search by procedure name or. code. Enter a CPT code or HCPCS code. These are used for billing insurance.

How long does Medicare pay for hospital costs?

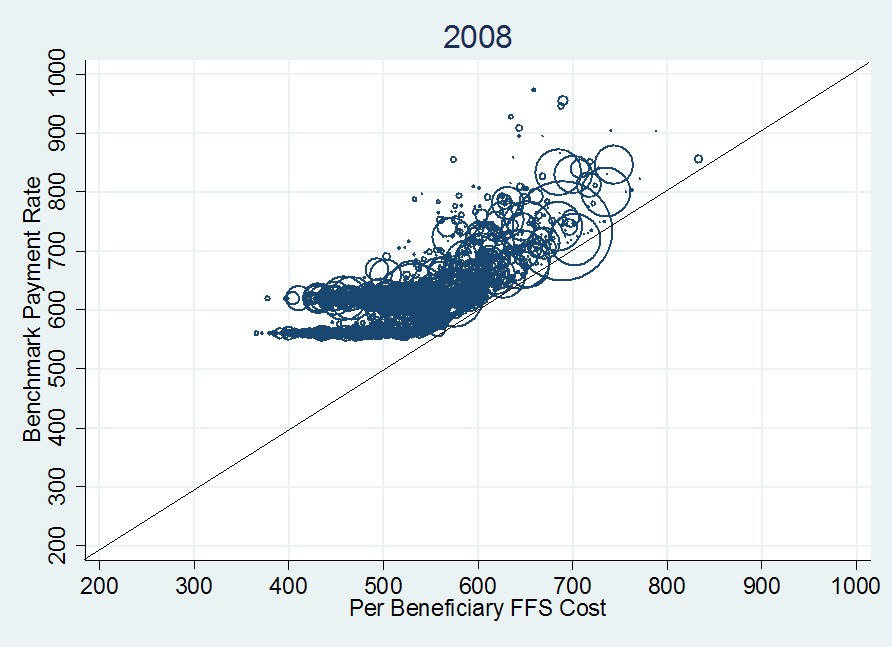

· Fee Schedules - General Information. A fee schedule is a complete listing of fees used by Medicare to pay doctors or other providers/suppliers. This comprehensive listing of fee maximums is used to reimburse a physician and/or other providers on a fee-for-service basis. CMS develops fee schedules for physicians, ambulance services, clinical ...

How do providers get reimbursed in Medicare?

Medicare Clinical Laboratory Fee Schedule Comparison of 2017 CLFS Prepared by the College of American Pathologists 87070 Culture othr specimn aerobic $11.82 $7.67 $10.64 -10% 87077 Culture aerobic identify $11.08 $7.19 $9.97 -10% 87086 Urine culture/colony count $11.07 $7.19 $9.96 -10% 87088 Urine bacteria culture $11.10 $7.21 $9.99 -10%

Does Medicare pay for CPT 87086?

CMS (Medicare) has determined that Bacterial Culture, Urine (CPT Codes 87086, 87088) is only medically necessary and, therefore, reimbursable by Medicare when ordered for patients with any of the diagnostic conditions listed below in the “ICD-9-CM Codes Covered by Medicare Program.” If you are ordering this test for a ...

What does CPT code 87086 mean?

87086, 87088. Urine Culture, Bacterial. Coverage Indications, Limitations, and/or Medical Necessity. A bacterial urine culture is a laboratory test service performed on a urine specimen to establish the probable etiology of a presumed. urinary tract infection.

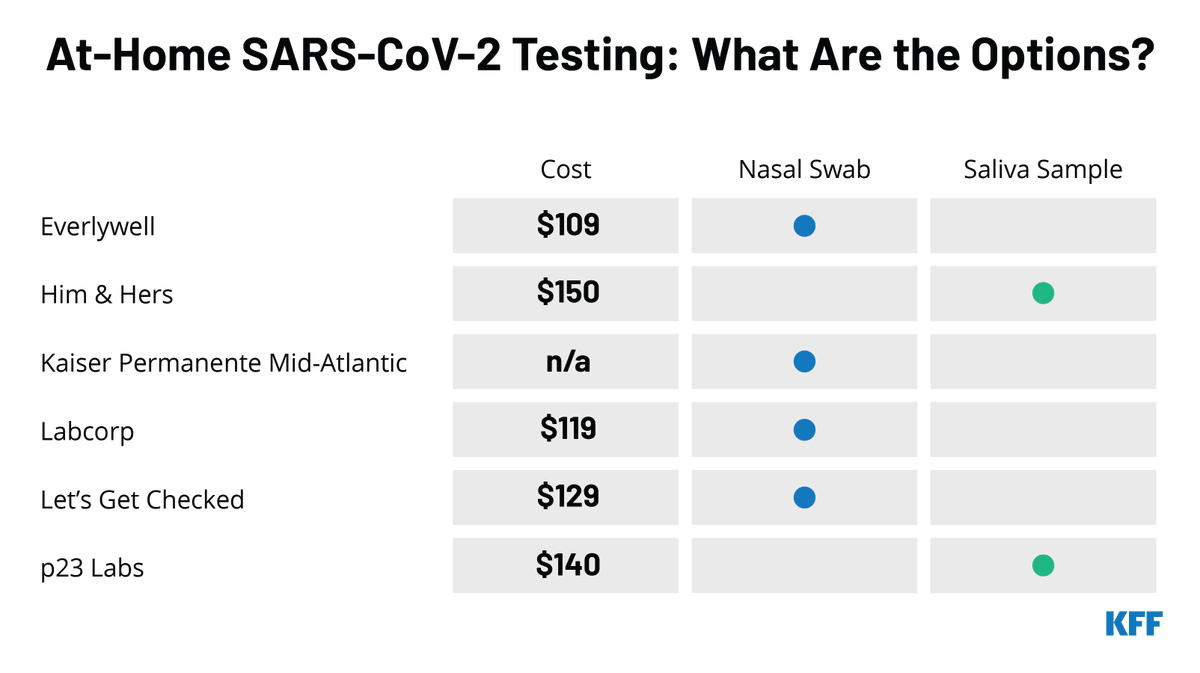

What is the reimbursement for 87635?

On May 19, the federal agency updated guidance to include Medicare payment details for CPT codes 87635, 86769, and 86328, which can be used by healthcare providers and laboratories to bill payers for testing patients for SARS-CoV2. Medicare will pay $51.31, $42.13, and $45.23, respectively, for the codes.

How Much Does Medicare pay for 85025?

1 — The CBC with automated differential is reported under CPT 85025 and CMS reimburses a maximum of $10.69.

Does Medicare pay for urinalysis?

Urinalysis is one of the laboratory services covered under Part B. Medicare benefits also include blood tests, screening tests and some tissue specimen testing. To be covered, the test must be medically necessary, ordered by a qualified health care practitioner and performed by a Medicare-approved laboratory.

Does Medicare pay for venipuncture?

Physician-Performed Venipuncture If a venipuncture performed in the office setting requires the skill of a physician for diagnostic or therapeutic purposes, the performing physician can bill Medicare both for the collection – using CPT code 36410 – and for the lab work performed in-office.

Is CPT 87635 covered by Medicare?

Laboratories can also use this CPT code to bill Medicare if your laboratory uses the method specified by CPT 87635. Medicare Part B pays for certain preventive vaccines (influenza, pneumococcal, and Hepatitis B) and coinsurance and deductible do not apply to preventive vaccines.

What is the difference between 87635 and U0003?

U0003 should be used to identify tests that would otherwise be reported by CPT code 87635 but were performed with the high throughput technologies. U0004 would be used to identify tests that would otherwise by reported by HCPCS code U0002 but were performed with the high throughput technologies.

Does 87635 need a QW modifier?

HCPCS code U0002 and 87635 must have the modifier QW to be recognized as a test that can be performed in a facility having a CLIA certificate of waiver.

What is the difference between 85025 and 85027?

If a treating physician orders an automated complete blood count with automated differential WBC count (CPT code 85025) or without automated differential WBC count (CPT code 85027), the laboratory sometimes examines a blood smear in order to complete the ordered test based on laboratory selected criteria flagging the ...

What does CPT 85025 include?

Description: Blood count; complete (CBC), automated (Hgb, Hct, RBC, WBC and platelet count) and automated differential WBC count.

How Much Does Medicare pay for 81479?

81479 Charge/Payment Ratios Most had less than $10,000 in Medicare payments. The average payment was $177.

What does routine urine culture test for?

A urine culture test can identify bacteria or yeast causing a urinary tract infection (UTI). If bacteria multiply, an antibiotic sensitivity test can identify the antibiotic most likely to kill those particular bacteria. Your healthcare provider may order a urine culture if you get chronic or hard-to-treat UTIs.

What is the CPT code for urine dipstick?

* One of these policies bundles CPT code 81002 and CPT code 81003 (Urinalysis, by dip stick or tablet reagent) when reported with an Evaluation and Management service (e.g., CPT codes 99201-99205, 99211-99215 and 99381-99397).

What is the CPT code for urine culture and sensitivity?

Test Details If culture is positive, CPT code(s): 87088 (each isolate) will be added with an additional charge. Identification will be performed at an additional charge (CPT code(s): 87077 or 87140 or 87143 or 87147 or 87149).

How do you bill a urinalysis?

CPT Code For Urinalysis Complete CPT Code 81003 is to bill for complete urine analysis. It would be done to detect a wide range of abnormalities like UTI, Kidney diseases, or other disorders of the urinary bladder.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Is there a late fee for Part B?

It’s not a one-time late fee — you’ll pay the penalty for as long as you have Part B.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

What is Medicare approved amount?

The Medicare-approved amount is the total payment that Medicare has agreed to pay a health care provider for a service or item. Learn more your potential Medicare costs. The Medicare-approved amount is the amount of money that Medicare will pay a health care provider for a medical service or item.

How much does Medicare pay for a doctor appointment?

Typically, you will pay 20 percent of the Medicare-approved amount, and Medicare will pay the remaining 80 percent .

What is Medicare Supplement Insurance?

Some Medicare Supplement Insurance plans (also called Medigap) provide coverage for the Medicare Part B excess charges that may result when a health care provider does not accept Medicare assignment.

What is Medicare Part B excess charge?

What are Medicare Part B excess charges? You are responsible for paying any remaining difference between the Medicare-approved amount and the amount that your provider charges. This difference in cost is called a Medicare Part B excess charge. By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over ...

What is 20 percent coinsurance?

Your 20 percent amount is called Medicare Part B coinsurance. Let’s say your doctor decides to refer you to a specialist to have your shoulder further examined. The specialist you visit agrees to treat Medicare patients but does not agree to accept the Medicare-approved amount as full payment. You still only pay 20 percent ...

How much can a provider charge for not accepting Medicare?

By law, a provider who does not accept Medicare assignment can only charge you up to 15 percent over the Medicare-approved amount. Let’s consider an example: You’ve been feeling some pain in your shoulder, so you make an appointment with your primary care doctor.

Does Medicare cover a primary care appointment?

This appointment will be covered by Medicare Part B, and you have already satisfied your annual Part B deductible. Your primary care doctor accepts Medicare assignment, which means they have agreed to accept Medicare as full payment for their services. Because you have met your deductible for the year, you will split the Medicare-approved amount ...

What is Medicare Part A?

Medicare Part A, the first part of original Medicare, is hospital insurance. It typically covers inpatient surgeries, bloodwork and diagnostics, and hospital stays. If admitted into a hospital, Medicare Part A will help pay for:

How much does Medicare Part A cost in 2020?

In 2020, the Medicare Part A deductible is $1,408 per benefit period.

How long does Medicare Part A deductible last?

Unlike some deductibles, the Medicare Part A deductible applies to each benefit period. This means it applies to the length of time you’ve been admitted into the hospital through 60 consecutive days after you’ve been out of the hospital.

How many days can you use Medicare in one hospital visit?

Medicare provides an additional 60 days of coverage beyond the 90 days of covered inpatient care within a benefit period. These 60 days are known as lifetime reserve days. Lifetime reserve days can be used only once, but they don’t have to be used all in one hospital visit.

What is the Medicare deductible for 2020?

Even with insurance, you’ll still have to pay a portion of the hospital bill, along with premiums, deductibles, and other costs that are adjusted every year. In 2020, the Medicare Part A deductible is $1,408 per benefit period.

What to do if you anticipate an extended hospital stay?

If you or a family member anticipate an extended hospital stay for an underlying health condition, treatment, or surgery, take a look at your insurance coverage to understand your premiums and to analyze your costs.

How long do you have to work to qualify for Medicare Part A?

To be eligible, you’ll need to have worked for 40 quarters, or 10 years, and paid Medicare taxes during that time.

Who signed the Medicare Amendment?

Lyndon B. Johnson signing the Medicare amendment. Former President Harry S. Truman (seated) and his wife, Bess, are on the far right.

Who is responsible for Medicare eligibility?

The Social Security Administration (SSA) is responsible for determining Medicare eligibility, eligibility for and payment of Extra Help/Low Income Subsidy payments related to Parts C and D of Medicare, and collecting most premium payments for the Medicare program.

What is the CMS?

The Centers for Medicare and Medicaid Services (CMS), a component of the U.S. Department of Health and Human Services (HHS), administers Medicare, Medicaid, the Children's Health Insurance Program (CHIP), the Clinical Laboratory Improvement Amendments (CLIA), and parts of the Affordable Care Act (ACA) ("Obamacare"). Along with the Departments of Labor and Treasury, the CMS also implements the insurance reform provisions of the Health Insurance Portability and Accountability Act of 1996 (HIPAA) and most aspects of the Patient Protection and Affordable Care Act of 2010 as amended. The Social Security Administration (SSA) is responsible for determining Medicare eligibility, eligibility for and payment of Extra Help/Low Income Subsidy payments related to Parts C and D of Medicare, and collecting most premium payments for the Medicare program.

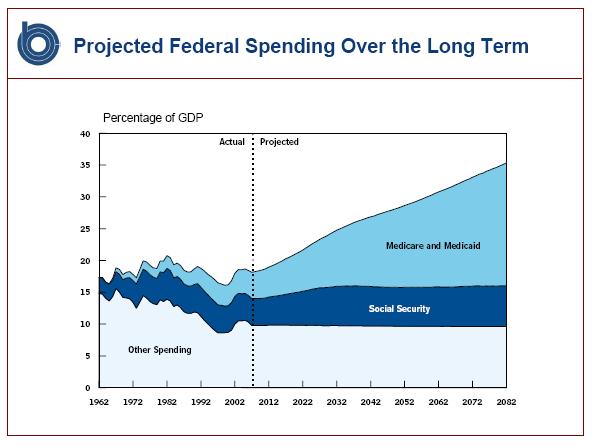

How much does Medicare cost in 2020?

In 2020, US federal government spending on Medicare was $776.2 billion.

What is Medicare and Medicaid?

Medicare is a national health insurance program in the United States, begun in 1965 under the Social Security Administration (SSA) and now administered by the Centers for Medicare and Medicaid Services (CMS). It primarily provides health insurance for Americans aged 65 and older, ...

How is Medicare funded?

Medicare is funded by a combination of a specific payroll tax, beneficiary premiums, and surtaxes from beneficiaries, co-pays and deductibles, and general U.S. Treasury revenue. Medicare is divided into four Parts: A, B, C and D.

What is a RUC in medical?

The Specialty Society Relative Value Scale Update Committee (or Relative Value Update Committee; RUC), composed of physicians associated with the American Medical Association, advises the government about pay standards for Medicare patient procedures performed by doctors and other professionals under Medicare Part B.