Is Medicare plan N a cost-effective choice?

Oct 26, 2021 · The average cost of Medicare Supplement Plan N in 2022 is around $120-$180 per month. However, there are many factors that determine premium cost. Premiums vary from one ZIP Code to another. Thus, in some areas, Medicare Supplement Plan N can be as much as $250 and in others, it can be as low as $80.

What does plan N cover in Medicare?

5 rows · premium. The periodic payment to Medicare, an insurance company, or a health care plan for ...

How much does Medicare plan cost?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a …

What is the best Medicare plan?

The LOWEST cost for Medicare Plan N is $ 78.06 per-month (female, age 65, non-smoker). The HIGHEST price in Washington is S242.12-per-month (Plan N, female, age 65, non-smoker). That is a significant monthly difference ($164-per-month). The difference is over $1,969 each year.

What is the average cost of Plan N?

between $120 and $180Monthly premiums for Plan N can average between $120 and $180, climbing over $200 in some states and dropping as low as $80 in other states. Rates are determined by location, age, gender and in some instances, current health status. This monthly cost is on top of the cost of Original Medicare (Parts A and B).Jan 24, 2022

How much are plan n copays?

$20Plan N covers the Medicare Part B coinsurance in full in most cases. As mentioned above, a copayment of up to $20 may be required for some doctor's office visits, and Plan N members may face a copayment of up to $50 for emergency room visits that do not result in an inpatient admission.Jan 4, 2022

How much does AARP plan n cost?

Kaiser Medicare Advantage ReviewPlan APlan NAARP Premium Estimate$92.11$99.73Part A deductible-100%Part A coinsurance and hospital costs100% after deductible100%Part A hospice coinsurance or copay100%100%7 more rows•Oct 21, 2020

Does Medicare Plan N cover prescriptions?

Like all Medigap plans, Medicare Supplement Plan N coverage does not include prescription drugs. If you want prescription coverage you can purchase Medicare Part D. Medicare Plan N also does not cover dental, vision, or hearing. If you want coverage for these services, consider a Medicare Advantage plan.May 12, 2020

Is Plan N guaranteed issue?

While Plan N does have a potential of fees that the patient is responsible for, its rate increase history has and will remain low as it is not a guaranteed issue plan. This secures your client in a stable plan for a longer amount of time.

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

Is Plan G better than Plan N?

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

Does Plan N cover Part A deductible?

Plan N also completely covers your Medicare Part A deductible, which is one of the more expensive deductibles in Medicare and repeats for each benefit period throughout the calendar year.

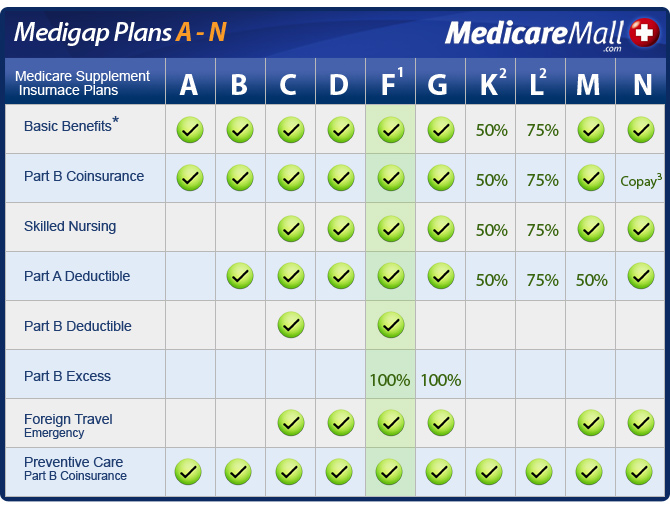

Does Plan N cover excess charges?

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount.Nov 23, 2021

What is Medicare Supplement N?

Medicare Supplement Plan N is a standardized Medicare Supplement insurance plan available in most states nationwide. As a Medicare Supplement, this plan helps cover certain cost-sharing expenses that would otherwise be the beneficiary's responsibility with Original Medicare.Mar 2, 2022

What is Medigap N?

Medicare Supplemental Plan N is one of 10 standardized Medigap plans available in most states. Like other Medigap basic benefits, this plan helps with certain costs that Original Medicare doesn't cover, including cost-sharing expenses you may have for hospital services or doctor visits.

What is Medicare Supplement Plan N?

Medicare Supplement Plan N. Medicare Supplement Plan N is one of the more popular plans among beneficiaries in 2021. It’s the plan for those who prefer lower monthly premiums without forfeiting benefits. Yet, when you enroll in this plan, you’re responsible for deductibles and a few copays.

What is the difference between Plan G and Plan N?

Plan G covers Part B excess charges , which are not a concern in most cases but especially not if they aren’t allowed in your state to begin with. Plan N also involves cost-sharing via copayments and coinsurance, which Plan G covers. However, premiums for Plan G are usually higher than those for Plan N.

Why is Plan N so popular?

This popularity is not surprising, because the policy offers a decent amount of coverage at a reasonable price. Plan N offers extra coverage to supplement your Medicare benefits without breaking the bank. The small copays this plan involves keeping the monthly premium lower.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What are the factors that affect your monthly premium rates?

Among the factors that affect your monthly premium rates is the pricing method that your carrier uses. In the last five years, premium rates for Plan N have increased between 2% and 4%. These increases are lower when compared to Plan F and comparable when compared to Plan G.

How much does Medigap cost in 2021?

How Much Does Medigap Plan N Cost in 2021. The average cost of Plan N is around $120-$180 per month. However, in some states, it can be as much as $200 and in others, it can be as low as $80. Your premium rates depend on your personal information as well as the plan letter you choose. Factors such as your state of residence, gender, age, ...

What is a plan F?

Plan F is a Medigap plan offering comprehensive coverage. It covers 100% of your out-of-pocket costs. Outside of the monthly premium, you never need to pay out-of-pocket. Plan N is two steps down from Plan F in terms of coverage. Yet, the premiums for Plan F are higher because the more benefits a plan offers, the higher the premiums will be.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

FREE DIRECTORY: USE IT TO FIND MEDICARE AGENTS NEAR ME

The Association offers the leading national directory for consumers asking “how do I find a Medicare insurance agent near me ”

LOWEST AND HIGHEST COSTS FOR MEDICARE PLAN N 2020

The Associations 2020 Medicare Insurance Price Index shows rates for 10 top metro markets. Medicare Insurance Plan N 2020 rates.

MONEY SAVINGS TIPS FOR CONSUMERS

Savings Tip #1: The best way to save money on Medigap insurance is to make sure you compare costs. Ask the agent (s) you speak with this question. “How many insurance companies are you appointed with?” Appointed is an insurance industry term. It reflects how many insurance companies the agent can actually sell and earn a commission from.