How much does PPO insurance cost?

What is PPO insurance? Type of plan Average monthly premium for single cover ... Average monthly premium for family cover ... Average annual deductible Referral to see specialists PPO $111 $501 $1,204 No HMO $101 $440 $1,201 Yes HDHP $88 $404 $2,303 Varies

How common are Medicare PPO plans?

How common are Medicare PPO plans? There were 618 Medicare PPO plans available in 2018, which represented about 28 percent of all available Medicare Advantage plans. 1 As of 2018, every state except Alaska, Delaware, Minnesota, New Hampshire, North Dakota and Wyoming offered at least one local or regional Medicare PPO plan.

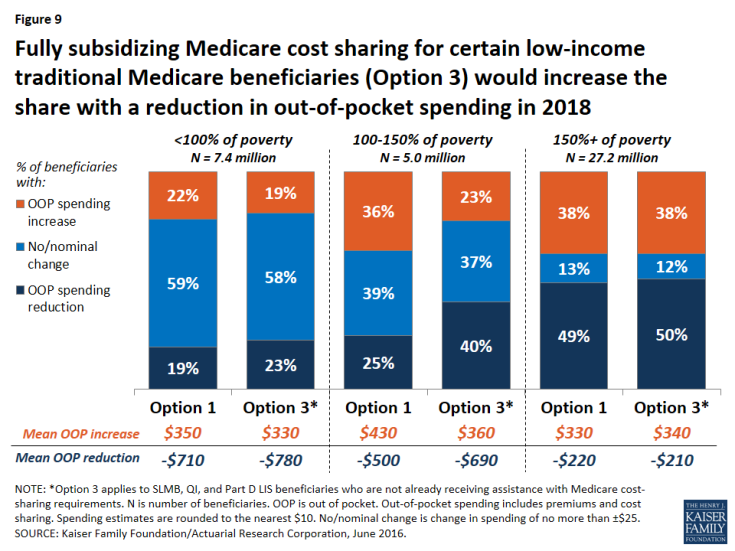

Do Medicare PPO plans pay out of pocket?

Medicare PPO plan beneficiaries will typically pay less money out of pocket if they receive care out of their network of providers, however, when compared to beneficiaries of other types of health plans. Where can I sign up for Medicare PPO plans?

What are the benefits of a Medicare PPO plan?

Medicare PPOs typically offer the freedom and flexibility to seek health care services from providers outside of their plan network, though it will typically be at a higher out-of-pocket cost. This can be especially beneficial to people who frequently travel.

What is the cost of Medicare Advantage plans in 2022?

How much does Medicare Advantage cost per month? In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is PPO premium?

PPO, which stands for Preferred Provider Organization, is defined as a type of managed care health insurance plan that provides maximum benefits if you visit an in-network physician or provider, but still provides some coverage for out-of-network providers.

How much is Medicare insurance every month?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Can I switch from a Medicare Advantage plan back to Original Medicare?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why is PPO more expensive?

The additional coverage and flexibility you get from a PPO means that PPO plans will generally cost more than HMO plans. When we think about health plan costs, we usually think about monthly premiums – HMO premiums will typically be lower than PPO premiums.

What are the advantages and disadvantages of PPO?

PPO plans offer a lot of flexibility, but the downside is that there is a higher cost relative to plans like HMOs. The upsides of PPO plans include not needing to select a primary care physician, and not being required to get a referral to see a specialist.

Do doctors prefer HMO or PPO?

A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. More flexibility to use providers both in-network and out-of-network. You can usually visit specialists without a referral, including out-of-network specialists.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How much does Medicare cost the average person?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

Is Medicare premium based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do PPOs have the same benefits as Medicare?

Register. Medicare Preferred Provider Organizations (PPOs) must provide you with the same benefits as Original Medicare but may do so with different rules, restrictions, and costs. PPOs can also offer additional benefits. Below is a list of general cost and coverage rules for Medicare PPOs.

Do PPOs charge higher premiums?

Plans may charge a higher premium if you also have Part D coverage. Plans may set their own deductibles, copayments, and other cost-sharing for services. PPOs typically set fixed copays for in-network services and may charge more if you see an out-of-network provider.

How much is a PPO deductible?

Medicare PPO plans can charge a deductible amount for both the plan, as well as the prescription drug portion of the plan. Sometimes this amount is $0, but it depends entirely on the plan you choose.

What is a PPO plan?

Medicare PPO plans have a list of in-network providers that you can visit and pay less. If you choose a Medicare PPO and seek services from out-of-network providers, you’ll pay more.

What is the difference between a PPO and an HMO?

What is the difference between PPO and HMO plans? Medicare PPOs are different from Medicare HMOs because they allow beneficiaries the opportunity to seek services from out-of-network providers. When you visit out-of-network providers with a PPO plan, you are covered but will pay more for the services.

How much is Medicare Part B coinsurance?

Medicare Part B charges a 20 percent coinsurance that you will out pay out-of-pocket after your deductible has been met. This amount can add up quickly with a Medicare PPO plan if you are using out-of-network providers.

What is Medicare Part A?

Medicare Part A, which includes hospital services, limited skilled nursing facility care, limited home healthcare, and hospice care. Medicare Part B, which includes medical insurance for the diagnosis, prevention, and treatment of health conditions. prescription drug coverage (offered by most Medicare Advantage PPO plans) ...

Does Medicare Advantage have an out-of-network max?

All Medicare Advantage plans have an out-of-pocket maximum amount that you will pay before they cover 100 percent of your services. With a Medicare PPO plan, you will have both an in-network max and out-of-network max. Below is a comparison chart for what your costs may look like if you enroll in a Medicare Advantage PPO plan in a major U.S. city.

Do Medicare Advantage plans charge a premium?

In addition, Medicare PPO plans can charge their own monthly premium, although some “ free ” plans don’ t charge a plan premium at all.

How much does a PPO cost in 2021?

In 2021, the regular cost of a Medicare Part B is $148.50 per month. It may be higher depending on a person’s income.

What is a PPO plan?

They are provided by Medicare-approved, private health companies. A PPO plan is comprised of a group , called a network, of healthcare providers and hospitals from which a person can choose. These providers will be cheaper than using providers outside of the network. Most PPO plans are flexible, and a person can receive services from any healthcare ...

What is the difference between a PPO and an HMO?

PPO vs. HMO. While PPO plans and Health Maintenance Organization (HMO) plans share many characteristics, PPO plans offer more flexibility. A Medicare Advantage HMO plan member usually must receive their healthcare from a list of providers in the plan’s network. In contrast, people with a PPO plan can choose someone from outside of their network, ...

What is not covered by Medicare Advantage?

What is not covered? A Medicare Advantage PPO plan is a type of Medicare Advantage plan offered by a private health insurance company. Preferred Provider Organization (PPO) plans usually have an in-network or group of healthcare providers and hospitals from which to choose. Choosing a health care provider that is in-network may cost less ...

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

When do PPO plans change?

It may be higher depending on a person’s income. Keep in mind that PPO plans often make changes on the 1st day of each year. They may make changes to any or all of the following: benefits. pharmacy network. provider network. premium. copayments and coinsurance.

Does a PPO plan have a copay?

However, it is important to note that every PPO plan is different and may offer different coverage. Many prescription drugs have a copay . The copay amount will usually be less for a generic drug than for a particular brand.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

Who accepts Medicare?

who accepts. assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. if: You're in a PPO, PFFS, or MSA plan.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

What are the advantages of Medicare PPO?

The most significant advantage that a Medicare PPO plan offers is the flexibility to choose providers based upon your own preferences rather than being restricted to the plan’s in-network selections.

What is a PPO plan?

Medicare PPO plans are one of several types of Medicare Advantage plans available to those who are eligible for original Medicare. Every Medicare PPO plan provides both Medicare Part A and Medicare Part B benefits and caps the out-of-pocket spending that is required, but in doing so it also provides enrollees the freedom to choose ...

What is Medicare Advantage?

Among the Medicare Advantage plans there are several different types and options, all of which are offered by private insurance companies. Medicare Preferred Provider Organizations, or PPO plans, are among the most popular of these options. PPO plans allow beneficiaries the flexibility of using their in-network physicians ...

How long is the Medicare enrollment period?

The Initial Enrollment Period (IEP) and Initial Coverage Election Period (ICEP). When you become eligible for Medicare (by turning 65), there is a 7-month enrollment period that begins three months before you become eligible, includes the month that you become eligible, and ends three months after the month that you become eligible.

What is Medicare expert?

As a Medicare expert, he regularly consults beneficiaries on Medicare rules, regulations, and strategies. Once you are eligible for Medicare and enroll in both Parts A and Parts B, you have the option of remaining with that basic coverage or arranging for additional benefits via either a Medicare Advantage plan that is available in your state ...

How old do you have to be to get medicare?

Eligibility for Medicare is linked to being either a U.S. citizen or a legal resident of the United States for a minimum of five years and who have turned 65 years old. Disabled individuals who are under the age of 65 are also eligible for Medicare and can enroll in the program once they have been receiving either Social Security disability ...

Does Medicare PPO have copays?

There are also copays for hospital stays and services. Every Medicare PPO publishes a Summary of Benefits that provides details regarding the copay amounts for each of these services. Medicare PPO enrollees will pay higher costs for services from out-of-network providers and less for services from those who are in the plan’s network.

How does preferred provider organization (PPO) insurance work?

PPO plans have provider networks, but you're not required to stay within the networks. You'll pay less for in-network providers, but you can use out-of-network doctors and facilities, too.

What does PPO insurance cover?

PPOs cover doctor's services, hospitalization, medical tests and radiology, outpatient services, and other health care expenses.

How much does PPO insurance cost?

The average total cost (for both the employer's and the employee's share) for a PPO in 2020 was $22,426 for family coverage and $7,880 for single coverage. That’s compared to $20,809 for family coverage and $7,284 for single coverage for HMOs, according to the Kaiser Family Foundation's 2020 Employer Health Benefits Survey.

Frequently Asked Questions

PPOs tend to have higher premiums than HMOs because you have the flexibility to use both in-network and out-of-network doctors and other providers.

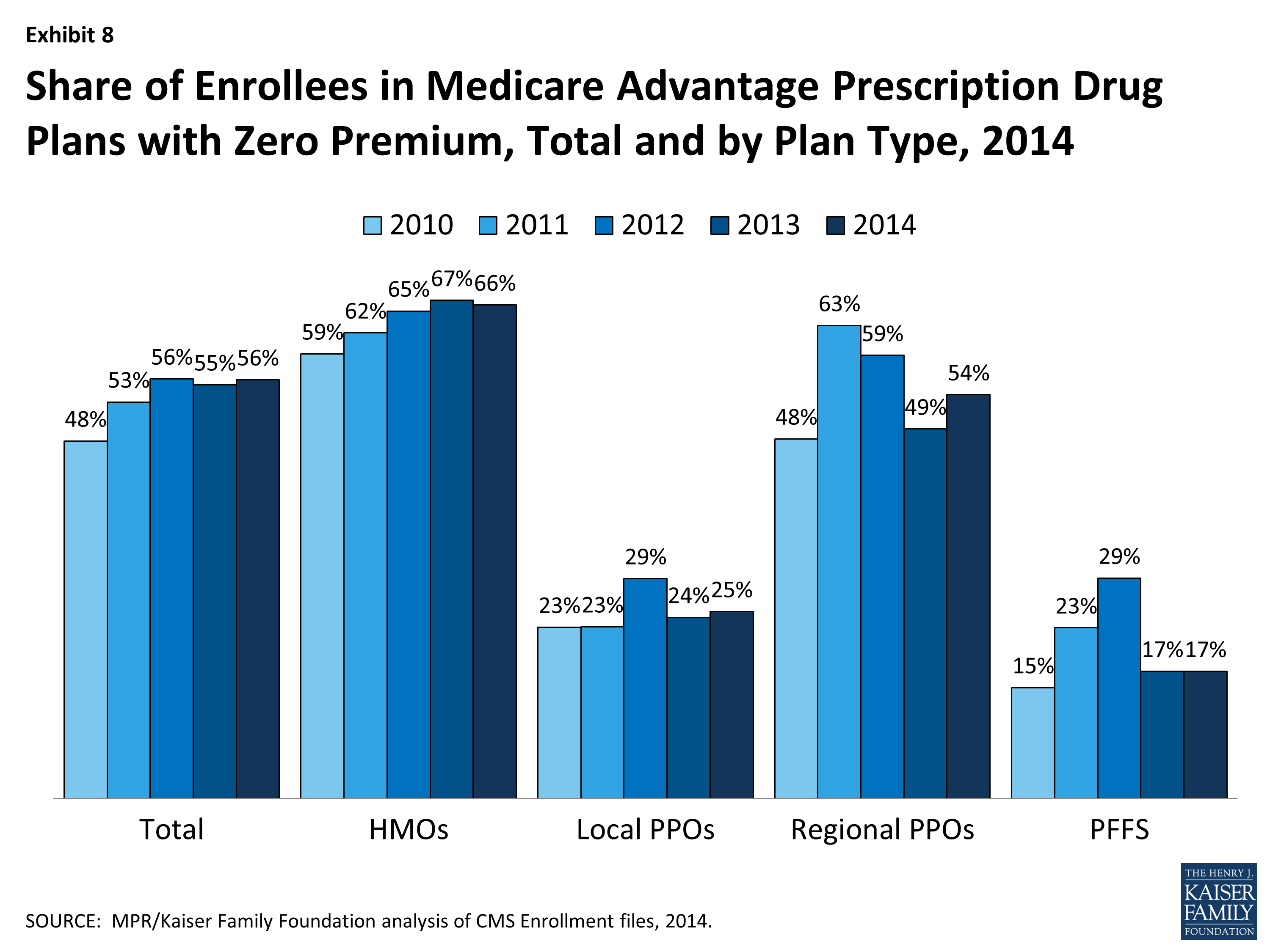

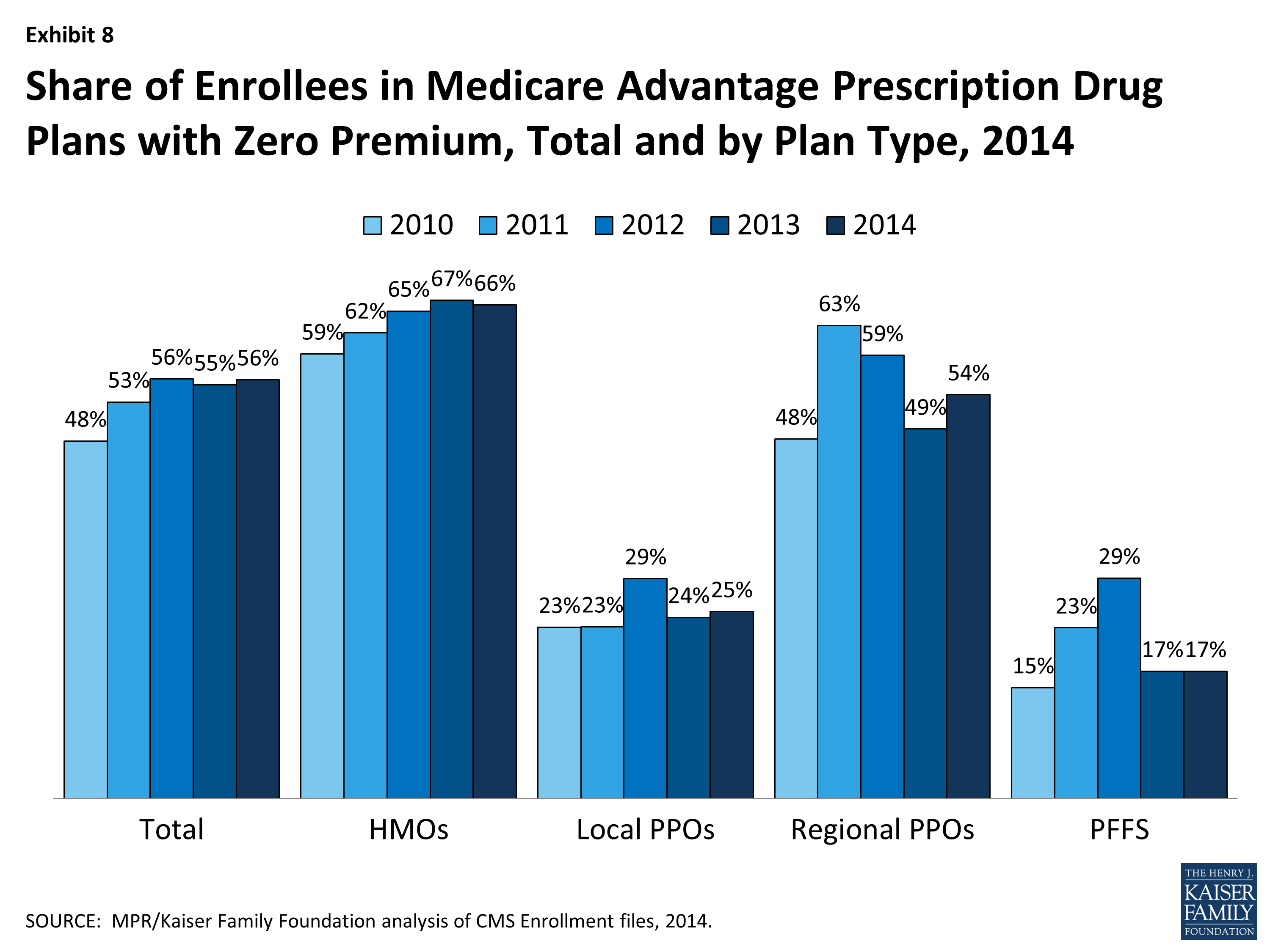

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

How much does vision insurance cost?

Vision insurance can typically cost around $20 per month or less. 3. Hearing plans. Unlike dental and vision insurance, hearing insurance plans are not a common insurance product. Some hearing aid companies may offer extended warranties, but the warranties apply only to the hearing aid product itself.

Does Medicare Advantage cover dental?

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).