What is the premium for Medicare Part B in 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is the monthly cost for Medicare Part B in 2022?

$170.10 forThe standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much will Part B go up in 2022?

$170.10Part B costs The standard monthly premium for Part B will be $170.10 in 2022, up from $148.50 this year and marking the program's largest annual jump dollar-wise ($21.60).Dec 31, 2021

Will Part B premiums increase 2022?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

How much is the Medicare deductible for 2022?

$233The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

What changes are coming to Medicare in 2022?

Also in 2022, Medicare will pay for mental health visits outside of the rules governing the pandemic. This means that mental health telehealth visits provided by rural health clinics and federally qualified health centers will be covered. Dena Bunis covers Medicare, health care, health policy and Congress.Jan 3, 2022

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is Medicare Part B premium going down 2022?

If you're on Medicare, chances are you had a bit of a shock when seeing the 2022 Medicare Part B premium amount. It went up by $21.60, from $148.50 in 2021 to $170.10 in 2022. That's a 14.5% increase, and is one of the steepest increases in Medicare's history.Jan 26, 2022

Why did Medicare Part B go up so much in 2022?

Medicare officials cited the high price of the drug as a key reason for a 14.5 percent increase in the Part B premium, from $148.50 in 2021 to $170.10 in 2022.Jan 14, 2022

Why is Medicare Part B going up so much in 2022?

Medicare Part B prices are set to rise in 2022, in part because the Biden administration is looking to establish a reserve for unexpected increases in healthcare spending. Part B premiums are set to increase from $148.50 to $170.10 in 2022. Annual deductibles will also increase in tandem from $203 to $233.

What is Medicare Part B?

Medicare Part B helps cover medically-necessary services like doctors’ services and tests, outpatient care, home health services, durable medical e...

Is it mandatory to buy Medicare Part B?

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during...

How much is Part B insurance in 2021?

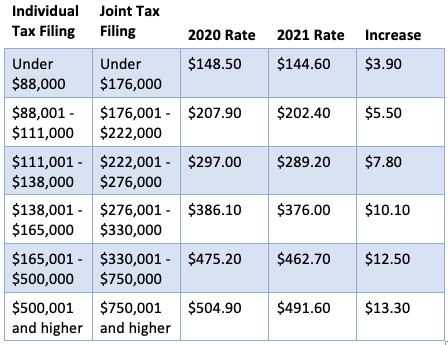

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

When do you pay income related premium surcharge?

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. [2019 tax returns were filed in 2020, so those are the most current returns available when income-related premium adjustments are determined for 2021.]

How much is the 2020 Social Security Cola?

But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020. And for 2021, the 1.3 percent COLA is adequate to cover the increase to ...

Does Medicare cover coinsurance?

But supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid) often covers these coinsurance charges. For people who became eligible for Medicare before the start of 2020, there are Medigap plans available (Plans C and F) that cover the Part B deductible, in addition to coinsurance charges.

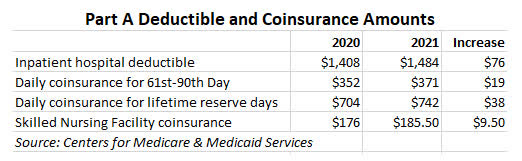

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

How much is coinsurance for skilled nursing in 2021?

Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay. Skilled nursing care is based on benefit periods like inpatient hospital stays.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

How much is Medicare Part B 2021?

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

What is Medicare Part B?

cost for enrollees who have worked for at least ten years. Medicare Part B. Medicare Part B is the portion of Medicare that covers your medical expenses. Sometimes called "medical insurance," Part B helps pay for the Medicare-approved services you receive.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

What is disability insurance?

A disability is an illness or injury that limits daily activities. Disability insurance may be part of your health plan, or you may buy it to supplement your health plan. Disability coverage usually pays for some or all of your salary if you can't work. .

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What does Medicare Part B cover?

This is a very broad category that covers medical office visits, non-emergency ambulance transportation, durable and disposable medical supplies and certain outpatient treatments.

Does Medicare cover coinsurance?

Many Medicare beneficiaries find that the gaps in their coverage – such as Medicare deductibles, coinsurance, copays and more – can leave them having to pay significant out of pocket costs. Medicare supplemental policies can pick up some of the coinsurance and co-payment requirements for each part of Medicare.

Is Medicare Part D a private insurance?

Since 2006, Medicare-eligible seniors have had the option to enroll in Part D, Medicare’s prescription drug benefit. Unlike Part A and Part B, Medicare Part D prescription drug benefits are provided through a private insurance company that has been approved for the program.