Medicare Supplement plan cost comparison

| Washington, D.C. | Des Moines, IA | Aurora, CO | San Francisco, CA | |

| Plan A | $72–$1,024 | $78–$273 | $90–$379 | $83–$215 |

| Plan B | $98–$282 | $112–$331 | $122–$288 | $123–$262 |

| Plan C | $124–$335 | $134–$386 | $159–$406 | $146–$311 |

| Plan D | $118–$209 | $103–$322 | $137–$259 | $126–$219 |

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

How much does a Medicare supplement insurance plan cost?

Medicare Supplement Insurance Cost Factors

- Plan Coverage. One big factor in the cost of a Medicare Supplement Insurance plan is the level of coverage provided.

- Carrier. Medicare Supplement Insurance is sold by private insurance companies that set their own plan prices.

- Location. ...

- Enrollment Time. ...

- Pricing Structure. ...

- Discounts. ...

- Gender. ...

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Why are Medicare Supplement plans so expensive?

Younger buyers may find Medicare Supplement insurance plans that are rated this way very affordable. Over time, however, these plans may become very expensive because your premium increases as you grow older. Premiums may also increase because of inflation and other factors.

What is the most basic Medicare Supplement plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Do Medicare Supplement plans have premiums?

Community rating: Generally the premium is priced so that everyone who purchases a Medicare Supplement insurance plan of a particular type pays the same premium each month. Over time, premiums may increase because of inflation and other factors, but they won't change because of your age.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

Do Medicare Supplement plans increase with age?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age.

Do you have to renew Medicare Supplement every year?

Medicare Supplement (Medigap) Plans: You do not have to do anything annually to renew them, and there is no annual open enrollment period for Medicare Supplement plans. They have the benefit of being “guaranteed renewable”. It will continue indefinitely unless you don't pay the premium.

What is the difference between Medicare Advantage and Medicare Supplement?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How to collect Medicare Supplement Insurance?

The easiest way to collect Medicare Supplement Insurance plan costs is to contact a licensed insurance agent who can gather up price quotes for multiple carriers selling Medigap plans in your location . You can also compare plans for free online.

What happens if you apply for Medicare Supplement?

If you apply for a Medicare Supplement Insurance plan during your Medigap Open Enrollment Period, you will have guaranteed issue rights. That means an insurance company is not allowed to use medical underwriting to charge you a higher rate for your coverage.

Does Medicare Supplement Insurance offer discounts?

It’s not uncommon for insurance companies to offer discounts on Medicare Supplement Insurance plans. Discounts are often available for non-smokers, married couples and other criteria. Be sure to ask your insurance agent or insurance carrier about any potential discounts that may be available.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is a Medigap monthly premium?

The Medigap monthly premium is paid in addition to other monthly premiums associated with Medicare. These can include premiums for: Medicare Part A (hospital insurance), if applicable. Medicare Part B (medical insurance)

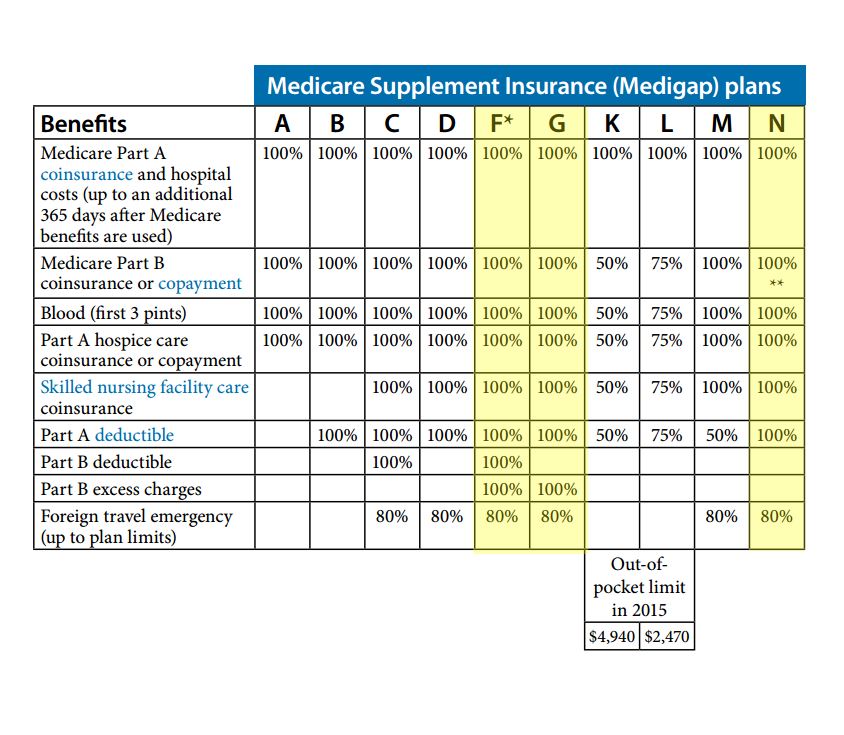

What is Medicare supplement insurance?

Medicare supplement insurance (Medigap) policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that aren’t covered by original Medicare. Some examples of the costs that may be covered by Medigap include: deductibles for parts A and B. coinsurance or copays for parts A and B.

How do insurance companies set monthly premiums?

Insurance companies can set monthly premiums for their policies in three different ways: Community rated. Everyone that buys the policy pays the same monthly premium regardless of age. Issue-age rated. Monthly premiums are tied to the age at which you first purchase a policy, with younger buyers having lower premiums.

What is a Medigap plan?

Medigap is a type of supplemental insurance that you can purchase to help pay for health-related costs that aren’t covered by original Medicare. There are 10 different types of standardized Medigap plan. The cost of a Medigap plan depends on the plan you choose, where you live, and the company from which you purchase your policy.

Does Medigap premium increase as you get older?

Premiums don’t increase as you get older. Attained-age rated. Monthly premiums are tied to your current age. That means your premium will go up as you get older. If you’d like to enroll in a Medigap plan, it’s important to compare multiple policies that are offered in your area.

What is the maximum amount you can pay out of pocket for 2021?

This is a maximum amount that you’ll have to pay out of pocket. In 2021, the Plan K and Plan L out-of-pocket limits are $6,220 and $3,110, respectively. After you meet the limit, the plan pays for 100 percent of covered services for the rest of the year.

Does Medigap cover coinsurance?

Like deductibles, Medigap itself isn’t associated with coinsurance or copays. You may still have to pay certain coinsurance or copays associated with original Medicare if your Medigap policy doesn’t cover them.

When it comes to Medicare Supplement Insurance, your monthly premium varies considerably depending on where you live

The average cost of supplemental insurance for Medicare is around $150 per month, with monthly premiums typically ranging between $50 and $450. Please note that premiums vary considerably from plan to plan. There are numerous variables that play a role in setting rates for Medicare Supplement Insurance (more commonly known as Medigap ).

How Much Does Medicare Supplement Insurance Cost?

When comparing your Medicare plan options, one of your first considerations is likely cost. That makes sense. How can you decide between Medicare Supplement Insurance and a Medicare Advantage plan if you don't have a good idea what each option costs?

What Happens If You Have a Guaranteed Issue Right?

If you have guaranteed issue rights, your Medigap application does not go through medical underwriting. You cannot be denied a Medigap policy or charged a higher premium – even if you have preexisting conditions and a history of tobacco use.

What Pricing Method Do Medigap Insurers Use?

Like most types of insurance, your Medigap premium will likely fluctuate over time. You can better estimate the long-term cost of your Supplement plan if you know what pricing method the insurance company used.

Where Do You Live?

Where you live plays an enormous role in Medigap pricing. That's nothing new – most of us are used to costs being higher in certain parts of the country. But with Medigap premiums, there's a second reason location makes a difference: state laws.

Additional Pricing Factors

There are two more items that influence pricing: age and gender. You'll usually pay less for a Medigap plan if you're a woman and under age 75.

How Much Does Medigap Plan F vs. Medigap Plan G Cost?

Thanks to its coverage of the Medicare Part B deductible, Medigap Plan F offers the most comprehensive benefits of all the Supplement plans. However, as of January 1, 2020, any Medigap plan that pays the Part B deductible is prohibited. If you already had Plan F, you may keep it.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

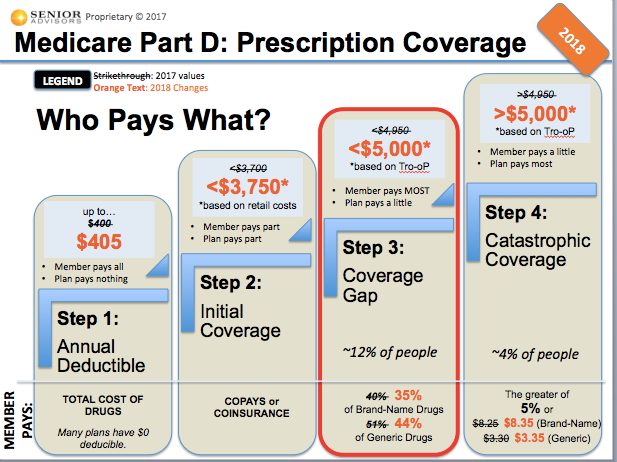

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.