While the budget would reduce Medicare spending by $845 billion over ten years, the reductions amount to $592 billion after accounting for the proposed general revenue payments for GME and uncompensated care. Medicare’s trustees

Full Answer

What Medicare cuts are being considered?

Sep 02, 2021 · In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

Will tax reform force Medicare cuts?

Mar 06, 2020 · President Trump’s proposed fiscal year 2021 budget will include substantial Medicaid and Medicare budget cuts. The HHS budget notes that taxpayers could save $756 billion in Medicare through 2030 by reducing fraud and waste and relying on lower payments to hospitals through “site-neutral” payment policies.

What are good things about budget cuts?

Aug 09, 2021 · 01:04 Senate releases $3.5 trillion budget resolution Health insurance for America’s older population would be expanded under a $3.5 trillion budget plan released Monday by Senate Democrats. As...

Should Medicare be cut?

Mar 19, 2021 · WASHINGTON — The House voted on Friday to avert an estimated $36 billion in cuts to Medicare next year and tens of billions more from farm subsidies and other social safety net programs, moving to...

How much will Medicare be cut in 2022?

The Congressional Budget Office, in a letter to Representative Kevin McCarthy of California, the minority leader, estimated that without the waiver enacted before the end of the calendar year, $36 billion would be cut from Medicare spending — 4 percentage points — in 2022 alone and billions more from dozens of other federal programs.

How much money will Biden spend in 2022?

Ambitious total spending: President Biden would like the federal government to spend $6 trillion in the 2022 fiscal year, and for total spending to rise to $8.2 trillion by 2031.

When will the 2022 fiscal year start?

The 2022 fiscal year for the federal government begins on October 1, and President Biden has revealed what he’d like to spend, starting then. But any spending requires approval from both chambers of Congress. Here’s what the plan includes: Ambitious total spending: President Biden would like the federal government to spend $6 trillion in ...

What is Biden's plan for the American family?

Families plan: The budget also addresses the other major spending proposal Biden has already rolled out, his American Families Plan, aimed at bolstering the United States’ social safety net by expanding access to education, reducing the cost of child care and supporting women in the work force.

What are mandatory programs?

Mandatory programs: As usual, mandatory spending on programs like Social Security, Medicaid and Medicare make up a significant portion of the proposed budget. They are growing as America’s population ages.

What is Joe Biden's agenda?

Joe Biden entered the White House with an expansive agenda that includes taming the coronavirus, reshaping the economic recovery, overhauling climate policy and rethinking the power of tech companies. Follow along as we track the administration's first 100 days. ».

Who is Matthew Dickerson?

Matthew Dickerson, a director at the conservative Heritage Foundation, said Republicans could offer their support for preventing the reductions in exchange for more measured steps to reducing the nation’s debt and deficit, like an agreement to curb spending on mandatory programs.

How much did Medicare pay in 2018?

In 2018, Medicare benefit payments totaled $731 billion, up from $462 billion in 2008 (Figure 2) (these amounts do not net out premiums and other offsetting receipts). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 50 percent to 41 percent, spending on Part B benefits (mainly physician services and hospital outpatient services) increased from 39 percent to 46 percent, and spending on Part D prescription drug benefits increased from 11 percent to 13 percent.

Is Medicare spending going up?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis. According to CBO’s most recent long-term projections, net Medicare spending will grow from 3.0 percent of GDP in 2019 to 6.0 percent in 2049.

How many people are covered by Medicare?

Published: Aug 20, 2019. Medicare, the federal health insurance program for more than 60 million people ages 65 and over and younger people with long-term disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical ...

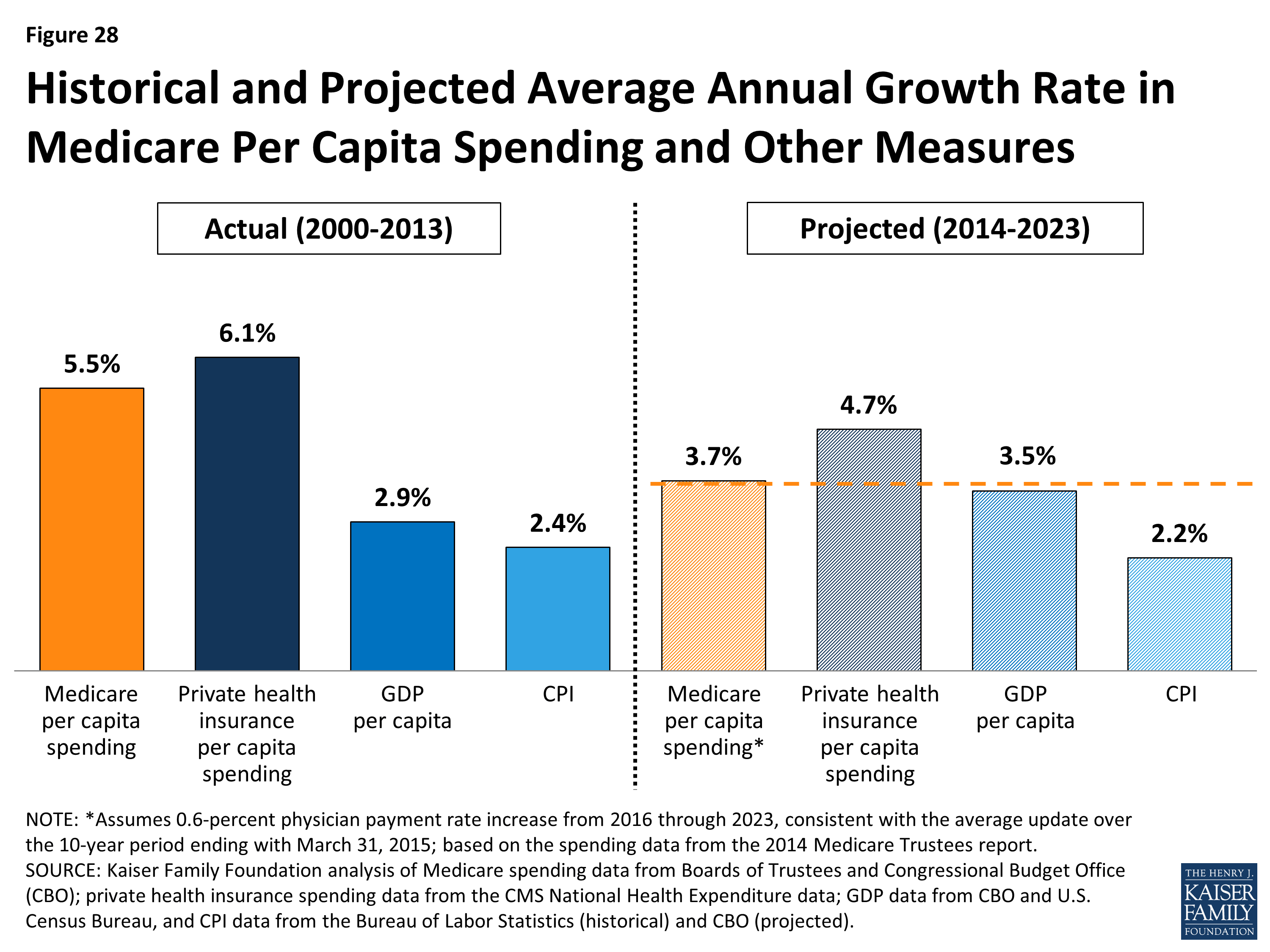

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Does Medicare Advantage cover Part A?

Medicare Advantage plans, such as HMOs and PPOs, cover Part A, Part B, and (typically) Part D benefits. Beneficiaries enrolled in Medicare Advantage plans pay the Part B premium, and may pay an additional premium if required by their plan; about half of Medicare Advantage enrollees pay no additional premium.