How much does Medicare cost the United States?

That's $11,582 per person. This figure accounted for 17.7% of gross domestic product (GDP) that year. If we look at each program individually, Medicare spending grew 6.7% to $799.4 billion in 2019...

How much does the average American worker contribute to Medicare?

By dividing the total Medicare tax that came from wage income by the number of workers, we find that the average American worker's contribution to the Medicare Hospital Insurance (HI) program was about $1,537.

How much do you pay in Medicare taxes?

For the time being, Medicare taxes are a relatively small piece of the average American's tax bill. In another recent article, my colleague Brian Feroldi determined that the average American pays a wage-based tax rate of nearly 32% between income (federal and state), Social Security, and Medicare taxes.

How much can you pay out-of-pocket for Medicare?

There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare).

How much money goes to Medicare each year?

Historical NHE, 2020: Medicare spending grew 3.5% to $829.5 billion in 2020, or 20 percent of total NHE. Medicaid spending grew 9.2% to $671.2 billion in 2020, or 16 percent of total NHE. Private health insurance spending declined 1.2% to $1,151.4 billion in 2020, or 28 percent of total NHE.

How much did the US spend on Medicare in 2020?

$829.5 billionMedicare spending totaled $829.5 billion in 2020, representing 20% of total health care spending. Medicare spending increased in 2020 by 3.5%, compared to 6.9% growth in 2019. Fee-for-service expenditures declined 5.3% in 2020 down from growth of 2.1% in 2019.

Does the government make money from Medicare?

The plans do not receive money from the federal government. Because Medicare Parts A and B cover only about 80% of medical costs, a supplemental plan is used to fill in the coverage gaps and reduce the amount that enrollees pay for medical care.

How much did the government spend on Medicare in 2019?

roughly $644 billionThe federal government spent nearly $1.2 trillion on health care in fiscal year 2019 (table 1). Of that, Medicare claimed roughly $644 billion, Medicaid and the Children's Health Insurance Pro-gram (CHIP) about $427 billion, and veterans' medical care about $80 billion.

Who paid for Medicare?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare.

What percentage of healthcare is paid by the government?

Government Now Pays For Nearly 50 Percent Of Health Care Spending, An Increase Driven By Baby Boomers Shifting Into Medicare. A new CMS report projects that U.S. health care spending will surpass $5.9 trillion in 2027, growing to represent more than 19 percent of the economy.

How much is Medicare in debt?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

Why is Medicare running out money?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

Is Medicare paid for by taxes?

Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

How much does the US pay for healthcare?

How Much Does the United States Spend on Healthcare? The United States has one of the highest costs of healthcare in the world. In 2020, U.S. healthcare spending reached $4.1 trillion, which averages to over $12,500 per person.

HOW MUCH OF US taxes go to healthcare?

Tax-funded health expenditures totaled $1.877 trillion in 2013 and are projected to increase to $3.642 trillion in 2024. Government's share of overall health spending was 64.3% of national health expenditures in 2013 and will rise to 67.1% in 2024.

How much has Covid cost the US government?

How is total COVID-19 spending categorized?AgencyTotal Budgetary ResourcesTotal OutlaysDepartment of Labor$726,058,979,281$673,702,382,650Department of Health and Human Services$484,524,400,000$279,893,610,481Department of Education$308,328,604,971$127,408,234,7359 more rows

How much did the US spend on Medicare in 2021?

$696 billionIn FY 2021 the federal government spent $696 billion on Medicare.

How much did the United States spend on healthcare in 2019?

$3.8 trillionUS health care spending increased 4.6 percent to reach $3.8 trillion in 2019, similar to the rate of growth of 4.7 percent in 2018. The share of the economy devoted to health care spending was 17.7 percent in 2019 compared with 17.6 percent in 2018.

How much of US GDP is spent on healthcare?

19.7%In 2020, U.S. national health expenditure as a share of its gross domestic product (GDP) reached an all time high of 19.7%. The United States has the highest health spending based on GDP share among developed countries. Both public and private health spending in the U.S. is much higher than other developed countries.

How much does the US spend on healthcare per year?

Annual health expenditures stood at over four trillion U.S. dollars in 2020, and personal health care expenditure equaled 10,202 U.S. dollars per resident. Federal and state government budgets are being further stretched by the coronavirus outbreak, which is pushing health expenditures even higher.

How much do you pay for Medicare after you pay your deductible?

You’ll usually pay 20% of the cost for each Medicare-covered service or item after you’ve paid your deductible.

How much will Medicare premiums be in 2021?

If you don’t qualify for a premium-free Part A, you might be able to buy it. In 2021, the premium is either $259 or $471 each month, depending on how long you or your spouse worked and paid Medicare taxes.

How often do you pay premiums on a health insurance plan?

Monthly premiums vary based on which plan you join. The amount can change each year. You may also have to pay an extra amount each month based on your income.

How often do premiums change on a 401(k)?

Monthly premiums vary based on which plan you join. The amount can change each year.

Do you have to pay Part B premiums?

You must keep paying your Part B premium to keep your supplement insurance.

How much did Medicare spend?

Medicare spending increased 6.4% to $750.2 billion, which is 21% of the total national health expenditure. The rise in Medicaid spending was 3% to $597.4 billion, which equates to 16% of total national health expenditure.

What percentage of Medicare is paid to MA?

Based on a federal annual report, KFF performed an analysis to reveal the proportion of expenditure for Original Medicare, Medicare Advantage (MA) and Part D (drug coverage) from 2008 to 2018. A graphic depiction on the KFF website illustrates the change in spending of Medicare options. Part D benefit payments, which include stand-alone and MA drug plans, grew from 11% to 13% of total expenditure. Payments to MA plans for parts A and B went from 21% to 32%. During the same time period, the percentage of traditional Medicare payments decreased from 68% to 55%.

What is the agency that administers Medicare?

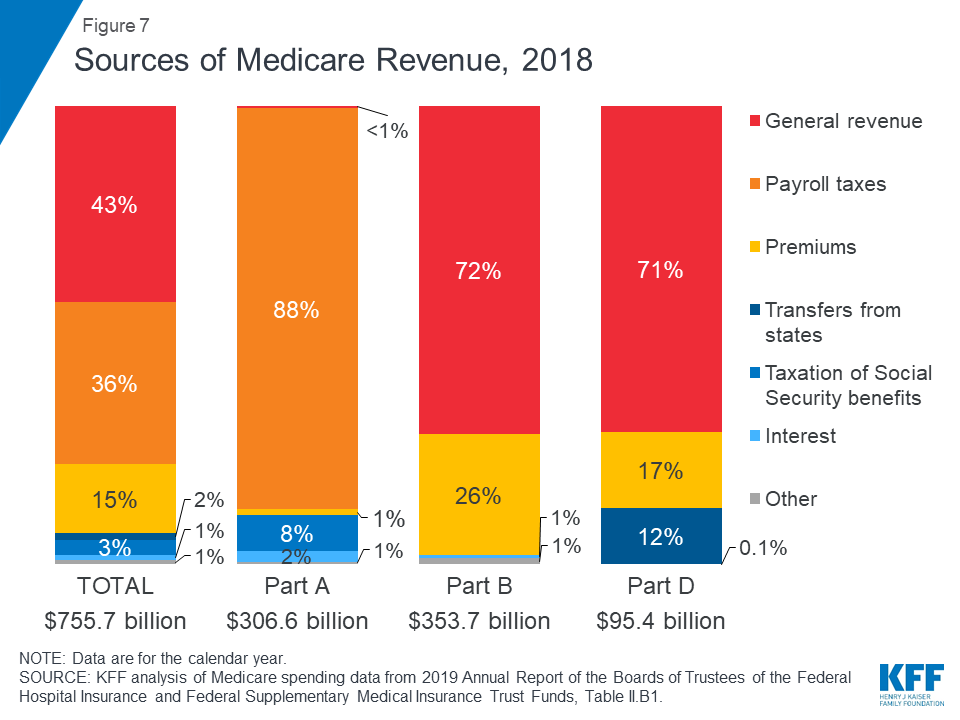

To grasp the magnitude of the government expenditure for Medicare benefits, following are 2018 statistics from the Centers for Medicare & Medicaid Services (CMS), which is the agency that administers Medicare:

What is the largest share of health spending?

The biggest share of total health spending was sponsored by the federal government (28.3%) and households (28.4%) while state and local governments accounted for 16.5%. For 2018 to 2027, the average yearly spending growth in Medicare (7.4%) is projected to exceed that of Medicaid and private health insurance.

Is Medicare a concern?

With the aging population, there is concern about Medicare costs. Then again, the cost of healthcare for the uninsured is a prime topic for discussion as well.

Does Medicare pay payroll taxes?

Additionally, Medicare recipients have seen their share of payroll taxes for Medicare deducted from their paychecks throughout their working years.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

How much Medicare tax does the average American worker pay?

So, let's see how much the average American pays in Medicare taxes. According to the Bureau of Labor Statistics, there were about 137.9 million American workers in mid-2015, if you include part-time employees. Also in 2015, the most recent year for which complete taxation data is available, $241.1 billion was paid in Medicare payroll taxes.

How much was Medicare paid in 2015?

Also in 2015, the most recent year for which complete taxation data is available, $241.1 billion was paid in Medicare payroll taxes. Of this amount, $211.9 billion came from wage income. The remaining $30 billion or so came from other sources that don't impact the average American, such as the 0.9% additional Medicare tax I mentioned earlier.

What is the Medicare tax rate?

Image source: Getty Images. On the other hand, the Medicare tax rate of 1.45% is assessed on all wage income. Employers pay an equal amount, for a total rate of 2.9%. And although it doesn't affect the average American worker, in the interest of being complete, there's an additional Medicare tax that high earners are required to pay.

How much is Medicare deficit?

According to the Medicare Trustees Report, the 75-year deficit is projected to be equivalent to 0.73% of taxable payroll. This means that by raising the current 2.9% Medicare tax rate to 3.63% (1.815% for employees), the program would maintain its solvency for at least another 75 years.

Is Medicare taxing in 2028?

However, there's a strong possibility that the Medicare tax rate will be increased in the not-too-distant future. It's no secret that Medicare isn' t in the best financial shape, and at the current rate, the program will be out of money in 2028.

Is Medicare based on income?

Of the three wage-based types of tax American workers pay, Medicare is perhaps the most straightforward and easy to calculate. Federal and state income taxes are based on a set of marginal tax brackets, and Social Security tax is only assessed on income below a certain threshold that changes annually.

What percentage of births were covered by Medicaid in 2018?

Other key facts. Medicaid Covered Births: Medicaid was the source of payment for 42.3% of all 2018 births.[12] Long term support services: Medicaid is the primary payer for long-term services and supports.

What is the federal Medicaid share?

The Federal share of all Medicaid expenditures is estimated to have been 63 percent in 2018. State Medicaid expenditures are estimated to have decreased 0.1 percent to $229.6 billion. From 2018 to 2027, expenditures are projected to increase at an average annual rate of 5.3 percent and to reach $1,007.9 billion by 2027.

What percentage of Medicaid beneficiaries are obese?

38% of Medicaid and CHIP beneficiaries were obese (BMI 30 or higher), compared with 48% on Medicare, 29% on private insurance and 32% who were uninsured. 28% of Medicaid and CHIP beneficiaries were current smokers compared with 30% on Medicare, 11% on private insurance and 25% who were uninsured.

What is the Perm rate?

PERM results:[8] Through the Payment Error Rate Measurement (PERM) program, HHS estimates Medicaid and CHIP improper payments on an annual basis, utilizing federal contractors to measure three components: FFS, managed care, and eligibility. The PERM program uses a 17-state rotational approach to measure the 50 states and the District of Columbia over a three-year period. Under this approach, each state is measured once every three years and national improper payment rates include findings from the most recent three-year cycle measurements. Each time a cycle of states is measured, the new findings are utilized and the respective cycle’s previous findings are removed. The FY 2019 national Medicaid improper payment rate estimate is 14.9 percent. The FY 2019 national improper payment rate estimate for CHIP is 15.83 percent. The FY 2019 improper payment rate for each Medicaid component is: