With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80. There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

Full Answer

What is the maximum premium for Medicare Part B?

Nov 15, 2021 · In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 ($148.50/month), in 2020 ($144.60/month), and in 2019 ($135.50/month). Some enrollees pay more than the standard premium, if they’re subject to a high-income surcharge (described below).

How is the premium calculated for Medicare Part B?

Mar 07, 2022 · With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80. There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

What is the deductible for Medicare Part B?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services. Who pays a higher premium because of income? How do I pay my Part B premium?

Does Medicaid pay for Medicare Part B?

Medicare Part B (Medical Insurance) Costs. Part B monthly premium. Most people pay the standard Part B monthly premium amount ($170.10 in 2022). Social Security will tell you the exact amount you’ll pay for Part B in 2022. You pay the standard premium amount if: You enroll in Part B for the first time in 2022.

How much does Medicare cover for Type B expenses?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

Does Medicare Part B pay 80% of covered expenses?

After the deductible has been paid, Medicare pays most (generally 80%) of the approved cost of care for services under Part B while people with Medicare pay the remaining cost (typically 20%) for services such as doctor visits, outpatient therapy, and durable medical equipment (e.g., wheelchairs, hospital beds, home ...

What does Medicare Part B reimburse for?

The Medicare Part B Reimbursement program reimburses the cost of eligible retirees' Medicare Part B premiums using funds from the retiree's Sick Leave Bank. The Medicare Part B reimbursement payments are not taxable to the retiree.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

What is the new Medicare Part B deductible for 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Is there a deductible for Medicare Part B?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

Who gets Medicare Part B reimbursement?

Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. 4.

How does Part B reimbursement work?

The giveback benefit, or Part B premium reduction, is when a Part C Medicare Advantage (MA) plan reduces the amount you pay toward your Part B monthly premium. Your reimbursement amount could range from less than $1 to the full premium amount, which is $170.10 in 2022.Dec 3, 2021

How do I get reimbursed for Part B premium?

If you or your dependents are paying an increased Part B premium (IRMAA) and would like to request additional reimbursement, submit a copy of your entire SSA notice showing the IRMAA determination, MAGI, and increased Part B premium to CalPERS. Processing time for IRMAA documents is up to 60 calendar days.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Why did I get an extra Social Security payment this month 2021?

Social Security benefits are getting their biggest increase in 40 years this month, thanks to soaring inflation in 2021. A new cost of living adjustment has increased payments by 5.9%, about $93 more per month on average for seniors and other beneficiaries, or $1,116 more per year.Jan 12, 2022

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

When do you pay income related premium surcharge?

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. [2019 tax returns were filed in 2020, so those are the most current returns available when income-related premium adjustments are determined for 2021.]

How much is the 2020 Social Security Cola?

But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020. And for 2021, the 1.3 percent COLA is adequate to cover the increase to ...

Does Medicare cover coinsurance?

But supplemental coverage (from an employer-sponsored plan, Medigap, or Medicaid) often covers these coinsurance charges. For people who became eligible for Medicare before the start of 2020, there are Medigap plans available (Plans C and F) that cover the Part B deductible, in addition to coinsurance charges.

How much is Medicare Part B 2021?

Medicare Part B Premium for 2021. In 2021, the standard Part B premium is $148.50 per month. Most people pay the standard premium amount. It’s either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

What is the Medicare Part B deductible for 2021?

Medicare Part B Deductible. The Part B deductible for 2021 is $203. This is the amount you are responsible for paying before Part B starts helping to pay your health care costs, but it doesn’t apply to most Medicare-covered preventive care services.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance. Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is IRMAA based on?

The IRMAA is based on your reported adjusted gross income from two years ago. Part B premiums for high-income beneficiaries who are married, lived with their spouse at any time during the taxable year, but who are filing separate are shown in the table below.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is Medicare Part B?

Medicare Part B pays for outpatient medical care, such as doctor visits, some home health services, some laboratory tests, some medications, and some medical equipment. (Hospital and skilled nursing facility stays are covered under Medicare Part A, as are some home health services.) If you qualify to get Medicare Part A, ...

How much is Medicare Part B 2021?

For Part B, you have to pay a monthly fee (called a premium ), which is usually taken out of your Social Security payment. For 2021, this fee is $148.50 per month. But if you have a higher than average personal income (over $85,000) or household income (over $176,000), you will have to pay a higher monthly premium for Medicare Part B.

What happens if you don't sign up for Medicare Part B?

If you don't sign up for Medicare Part B when you first become eligible (and you don’t have comparable coverage from an employer), your monthly fee may be higher than $148.50. You’ll pay a lifetime 10% penalty for every 12 months you delay your enrollment. Medical and other services.

What is the Medicare approved amount?

Medicare decides what it will pay for any particular medical service. This is called the Medicare-approved amount. If your doctor is willing to accept what Medicare pays and won't charge you any more, they are said to "accept assignment.".

Does Medicare pay for mental health?

Medicare also pays for mental health care costs. Laboratory and radiology services. This includes blood tests, X-rays, and other tests. Outpatient hospital services. Medicare Part B covers some of these fees. You must pay a co-payment for outpatient hospital services The exact amount varies depending on the service.

What does Part B cover?

Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies.

What does Medicare cover?

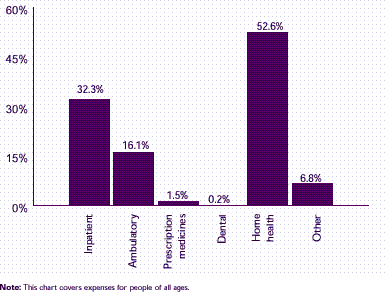

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

Does Medicare Supplement cover Part A and Part B?

If you’re concerned about how much Original Medicare (Part A and Part B) doesn’ t typically cover, you might want to learn about Medicare Supplement (Medigap) insurance. This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket ...

Does Medicare Advantage work?

To answer that question, here’s a quick rundown on how the Medicare Advantage (Medicare Part C) program works. When you have a Medicare Advantage plan, you still have Medicare – but you get your Medicare Part A and Part B benefits through the plan, instead of directly from the government.

Does Medicare cover out of pocket expenses?

Unlike Original Medicare, Medicare Advantage plans have annual out-of-pocket spending limits. So, if your Medicare-approved health -care costs reach a certain amount within a calendar year, your Medicare Advantage plan may cover your approved health-care costs for the rest of the year. The table below compares health-care costs ...

How long do you have to pay coinsurance?

You pay this coinsurance until you’ve used up your “lifetime reserve days” (you get 60 altogether). After that, you typically pay all health-care costs. *A benefit period begins when you’re admitted as an inpatient. It ends when you haven’t received inpatient care for 60 days in a row.

Does Medicare cover prescription drugs?

Medicare Part A and Part B don’ t cover health-care costs associated with prescription drugs except in specific situations. Part A may cover prescription drugs used to treat you when you’re an inpatient in a hospital. Part B may cover medications administered to you in an outpatient setting, such as a clinic.

What is Medicare Part B?

cost for enrollees who have worked for at least ten years. Medicare Part B. Medicare Part B is the portion of Medicare that covers your medical expenses. Sometimes called "medical insurance," Part B helps pay for the Medicare-approved services you receive.

How much is Medicare Part B 2021?

Medicare Part B premium 2021: $148.50. Your income plays a part in your Part B premium. For 2021, individuals making $88,000 per year or less, and couples making $176,000 or less, pay the standard monthly amount of $148.50 each.

What is Medicare Part A coinsurance?

You’re responsible for a daily coinsurance. Coinsurance is the percentage of your medical costs that you pay after you meet your deductible.

What is disability insurance?

A disability is an illness or injury that limits daily activities. Disability insurance may be part of your health plan, or you may buy it to supplement your health plan. Disability coverage usually pays for some or all of your salary if you can't work. .

What is Medicare Part B premium?

This higher Part B premium amount is called the Medicare income-related monthly adjustment amount, or IRMAA. The higher your combined annual income, the more your Medicare Part B premiums will ...

How much will Medicare pay for 2021?

In 2021, you’ll also pay $203 for your Part B deductible before your some of your Part B benefits kick in. After paying this amount, you’ll typically pay 20% of the Medicare-approved amount for medical expenses covered by Part B, including: Most doctor services. Outpatient therapy.

Who is Zia Sherrell?

About the author. Zia Sherrell is a digital health journalist with over a decade of healthcare experience, a bachelor’s degree in science from the University of Leeds and a master’s degree in public health from the University of Manchester.