How much does Medicare Part B costs?

4 rows · Nov 10, 2016 · For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare ...

What is the monthly premium for Medicare Part B?

Nov 17, 2016 · Last week, the Centers for Medicare & Medicaid Services (CMS) announced the Medicare Part B premiums for 2017. Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month.

How much does Part B insurance cost?

7 rows · Nov 13, 2016 · Medicare has recently announced that the standard monthly Part B premium for 2017 will be ...

Does Medicare Part B cost money?

6 rows · Jan 15, 2017 · What Medicare Part B costs in 2017. The short answer is that the standard Medicare Part ...

What was the Medicare Part B premium for 2018?

What was Medicare Part B premium in 2016?

What was Medicare Part B premium in 2015?

How much will Medicare Part B premiums go up in 2022?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

How much did Medicare go up in 2016?

| How Much You'll Pay for Medicare Part B in 2016 | ||

|---|---|---|

| Single Filer Income | Joint Filer Income | 2016 Monthly Premium |

| Up to $85,000 | Up to $170,000 | $121.80 or $104.90* |

| $85,001 - $107,000 | $170,001 - $214,000 | $170.50 |

| $107,001 - $160,000 | $214,001 - $320,000 | $243.60 |

What is the Irmaa for 2017?

| If Your Yearly Income Is | 2017 Medicare Part B IRMAA | |

|---|---|---|

| $85,000 or below | $170,000 or below | $0.00 |

| $85,001 - $107,000 | $170,000 - $214,000 | $53.50 |

| $107,001 - $160,000 | $214,000 - $320,000 | $133.90 |

| $160,001 - $214,000 | $320,000 - $428,000 | $214.30 |

What is Medicare Part B premium in 2020?

What was Medicare premium in 2013?

What is the Medicare Part B deductible for 2020?

Why is my Medicare Part B premium so high?

Are Medicare Part B premiums going up in 2021?

What is the Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What Medicare Part B Covers

In a nutshell, Medicare Part B, or "medical insurance," is the part of Medicare that covers most medical services and supplies other than hospital...

What Medicare Part B Costs in 2017

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There ar...

Is Medicare in Financial Trouble?

You may have seen headlines about Medicare's financial troubles, so let's set the record straight. First of all, those headlines are referring to t...

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

How much is Medicare Part B deductible?

In addition to the updated premium amounts, CMS announced an increase in the Medicare Part B annual deductible, from $166 in 2016 to $183 in 2017.

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

How much is the Part B premium for 2017?

The standard Part B premium amount in 2017 will be $134 (or higher depending on your income). However, most people who get Social Security benefits will pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits. If you pay your Part B premium through your monthly Social Security benefit, you’ll pay less ($109 on average). Social Security will tell you the exact amount you will pay for Part B in 2017. You’ll pay the standard premium amount if:

How much does Medicare pay for Part B?

Over 90% of eligible Medicare beneficiaries enroll in Part B and over 70% use Part B services during a year. Part B generally pays 80% of the approved amount for covered services in excess of the annual deductible ($166 in 2016 and $183 in 2017). The beneficiary is liable for the remaining 20%. Many beneficiaries purchase a Medicare Supplement (Medigap) policy to cover that exposed 20%.

What is Medicare for seniors?

Medicare is the federal health insurance program that covers people 65 and older and some younger adults with permanent disabilities and certain medical conditions. When Medicare was established in 1965 about half of American seniors had no health insurance. Today, virtually all Americans over age 65 have at least some health coverage through Medicare.

What is covered by Part B?

Part B covers physician services, outpatient hospital care, and some home health visits. It also covers laboratory and diagnostic tests, such as X-rays and blood work; durable medical equipment, such as wheelchairs and walkers; certain preventive services and screening tests, such as mammograms and prostate cancer screenings; outpatient physical, speech and occupational therapy; outpatient mental health care ; and ambulance services.

Does Medicare cover all medical services?

Medicare does not cover all health care services. For example, Medicare generally does not pay for long-term care services, regular eye exams and eyeglasses, hearing aids, or routine dental care.

How much does Medicare Part B cost?

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There are essentially three categories of beneficiaries, each with different premiums. About 70% of Medicare beneficiaries pay their premiums directly through their Social Security benefits.

What is Medicare Part B?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images.

What are the preventative services covered by Medicare Part B?

Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, and cancer; and services intended to prevent diseases (such as your annual flu shot).

When will Medicare be privatized?

This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

When will the hospital insurance fund run out?

After that, however, deficits are projected, and the Hospital Insurance trust fund is expected to run out in 2028. So it's fair to assume that something will need to change in the coming years.

Is Medicare funded by premiums?

First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums.

Does Medicare cover a wheelchair?

This is the part of Medicare you would use when you see your doctor or have surgery. It also covers supplies that are deemed medically necessary, such as a wheelchair or a walker. Medicare Part B also covers ambulance services, but only if other transportation could endanger your health. For instance, if you're having a heart attack, Medicare Part B would cover ambulance transportation.

How much more will COLA pay for Part B?

In 2017, because the COLA will raise benefits by a measly 0.3 percent, they will pay an average of $4.10 more for Part B, depending on the dollar increase in their Social Security checks.

How much did you pay in 2017 if you were not on Social Security?

If you're enrolled in Part B but are not receiving Social Security payments, or the premiums are not deducted from them, you'll pay $134 a month in 2017.

Can you pay more in Part B than you receive from Cola?

Under the law, people with Medicare who draw Social Security benefits cannot pay more in Part B premium increases than they receive from the COLA. So in 2016, these people — about 70 percent of beneficiaries — were "held harmless" from any premium increase and paid the same as they had in 2015. In 2017, because the COLA will raise benefits by ...

Will Part B premiums be paid in 2017?

If your Part B premiums are paid by your state because of low income, you will continue to pay no premiums in 2017, as long as you remain eligible for this assistance.

Will Medicare pay higher Part B premiums in 2017?

En español | Almost everyone in Medicare will pay higher Part B premiums in 2017, with most seeing modest increases while others are hit with much larger hikes.

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

What is SMI in Medicare?

They needed to make sure that there were adequate reserves in the Supplementary Medical Insurance (SMI) Trust Fund. The SMI, which applies to both Medicare Part B and Part D (prescription drug coverage), is funded by beneficiary premiums, Congressional funding and general revenues. Aside from Parts B and D, the SMI pays for Medicare’s administrative costs.

How many people are covered by Medicare?

According to the Department of Health and Human Services (HHS), the agency overseeing the CMS, Medicare currently provides 47.9 million Americans 65 years or older with access to high-quality, affordable and convenient health insurance. Another 9.1 million individuals with certain disabilities, including end-stage renal disease (ESRD) and Amyotrophic lateral sclerosis (ALS, or Lou Gehrig’s disease), receive this coverage today.

Will Medicare Part B premiums increase in 2016?

The news may be even better for Medicare Part B (medical insurance) premiums. As with 2013, 2014 and 2015, the majority of enrollees will not see their Medicare premiums for 2016 increase; they’ll again pay $104.90 per month. But those members who do pay a monthly premium can also take a breath of relief, as a previously announced — and huge — increase in premiums and deductibles never materialized. This increase was seen as necessary, due to multiple factors, including lack of a 2016 cost-of-living adjustment (COLA) for Social Security benefits.

Part A costs

Most Medicare participants get hospital insurance coverage under Part A without paying a premium. However, for those who didn't collect enough credits for paying Medicare taxes during their career and don't have a qualifying spouse, Medicare charges a monthly premium of up to $413 per month. That's $2 higher than the maximum amount for 2016.

Part B costs

Medical care coverage under Medicare Part B will also see cost increases in 2017. The deductible that you have to pay on doctors' visits and other outpatient services goes up to $183 per year in 2017, climbing $17 from 2016.

What is the 20% coinsurance for Medicare Part B?

Besides the premium and deductible, there are other Medicare Part B costs you should know about: for example, many Medicare services and supplies require a 20% coinsurance payment or a copayment after you’ve reached your annual deductible .

What is Medicare Part B 2021?

Medicare Part B costs in 2021. Medicare Part B (medical insurance) is also part of Original Medicare. Part B carries a monthly premium and an annual deductible. Costs shown below are for 2021. Medicare Part B premium. The amount you pay for your Part B premium may vary based on your situation.

What is Medicare Supplement?

Medigap is private insurance, and premiums may vary depending on the area you live in and which plan you choose.

What is Medicare Advantage?

Medicare Part A continues to pay for hospice benefits when you have a Medicare Advantage plan. Some Medicare Advantage plans include prescription drug coverage and may include other benefits as well. Premiums and deductibles for Medicare Advantage plans may vary, depending on which plan you choose and the extent of your health coverage.

How to calculate late enrollment penalty for Medicare?

You can calculate the late-enrollment penalty by multiplying the number of full months you went without Part D or creditable coverage by 1% of the national base beneficiary premium , which is $33.06 in 2021. Then, round the total to the nearest $0.10, and add it to your Medicare prescription drug plan’s monthly premium.

How much does Medicare pay after deductible?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services. If your income is over a certain amount, your Medicare Part B monthly premium may be higher. The government looks to your reported income from two years ago to see if you have to pay a higher amount.

How much will Medicare pay for prescription drugs in 2021?

For the year 2021, once you and your plan have spent a combined $4,130 on covered prescription drugs, you’ll reach the coverage gap (sometimes also referred to as the “donut hole”).

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

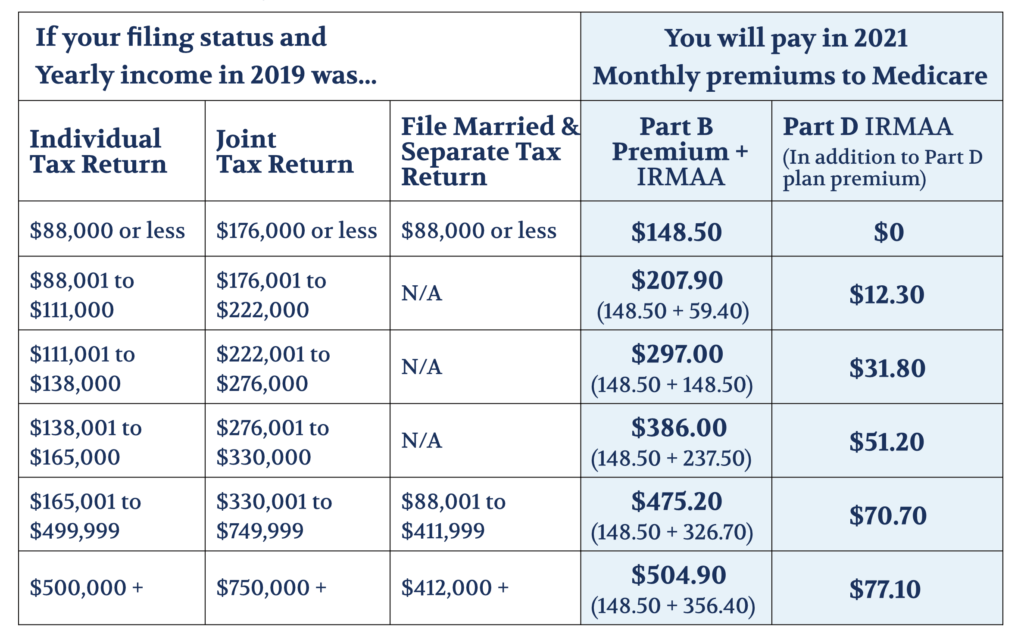

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is the Medicare premium for 2017?

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4 The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration's cost-of-living adjustments (COLA).

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

When do you get Medicare if you don't have Social Security?

If you're not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare .

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Does Medicare have a hold harmless?

Medicare has a "hold harmless" provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. 4 While this keeps seniors from paying more than they should, you'll have to pay the increased premiums if your COLA is higher than the increase.