How much does Medicare Part B costs?

Oct 12, 2018 · The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018. An estimated 2 million Medicare beneficiaries (about 3.5%) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B …

What is the maximum premium for Medicare Part B?

Jan 21, 2022 · There are a few other out-of-pocket Part B costs that you may be required to pay in 2019. 2022 Part B deductible. The Medicare Part B deductible for 2022 is $233 for the year. Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in.

How much does Part B insurance cost?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Does Medicaid pay for Part B premium?

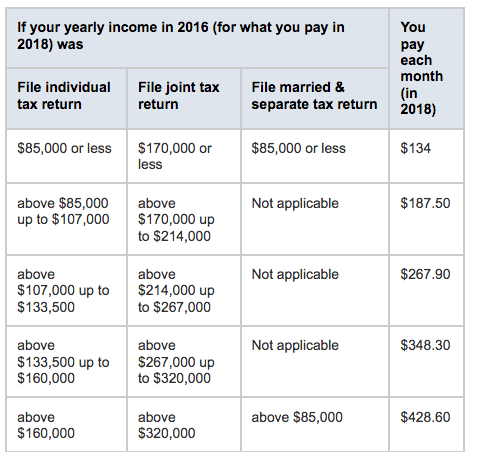

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium . This higher Part B premium is called the Income-Related Monthly Adjusted Amount (IRMAA).

What was the Medicare Part B premium in 2019?

What is the monthly cost of Medicare Part B in 2019?

How much does Medicare Part B normally cost?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much were Medicare premiums in 2019?

What is the Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Are Medicare Part B premiums going up in 2021?

Do I have to pay for Medicare Part B?

You pay a premium each month for Part B. Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board.

Can I get Medicare Part B for free?

How much is deducted from Social Security for Medicare?

How much is Medicare Part B 2019?

There are a few other out-of-pocket Part B costs that you may be required to pay in 2019. 2019 Part B deductible. The Medicare Part B deductible for 2019 is $185 for the year. Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in.

What are the costs of Medicare Part B?

What Are the Other 2019 Medicare Part B Costs? 1 2019 Part B deductible#N#The Medicare Part B deductible for 2019 is $185 for the year.#N#Part B beneficiaries must pay the first $185-worth of Part B covered services out of their own pocket before their Part B coverage kicks in. The deductible resets with each new year. 2 2019 Part B coinsurance or copayment#N#After you meet your Part B deductible, you are typically required to pay the Part B coinsurance or copayment for additional Part B services you receive in 2019.#N#Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 3 2019 Part B excess charges#N#If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.#N#These providers are allowed to charge you up to 15 percent more than the Medicare-approved amount for your care. This extra amount is called an “ excess charge ” and you will be responsible for paying it in full.

What is QMB in Medicare?

Qualified Beneficiary Medicare (QMB) Program. This program helps pay for the Medicare Part A and Part B premium, along with deductibles, copayments and coinsurance. Individuals can qualify with monthly incomes lower than $1,061 in 2019, and married couples may qualify with combined incomes of less than $1,430 in 2019.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, or Medigap, is a type of private insurance that is used along with Original Medicare (Part A and Part B) to provide coverage for some of Original Medicare's out-of-pocket costs.

What is Part B coinsurance?

Your Part B coinsurance for most services and items is typically 20 percent of the Medicare-approved amount. 2019 Part B excess charges. If you visit a provider who does not accept Medicare assignment, that means they still treat Medicare patients but they do not accept Medicare reimbursement as full payment.

What happens if you don't sign up for Medicare Part B?

However, if you do not sign up for Medicare Part B during your Initial Enrollment Period (IEP) and decide you want to enroll in Part B later on, you will be charged a late enrollment penalty for the rest of the time that you have Part B.

How much does the penalty increase for Part B?

The penalty raises your Part B premium by up to 10 percent for each year that you were eligible for Part B but did not sign up. The penalty remains in force for as long as you continue to be enrolled in Part B.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

What are the factors that affect Medicare Supplement?

It's important to note that several factors can affect the Medicare Supplement plan premiums in 2019, such as gender, smoking status and where you live.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

What happens if you don't receive your Part B?

If you don’t receive any of these benefit payments, you will simply get a bill in the mail for your Part B premium. How it changed from 2018. The 2019 Part B premiums rose by close to 1.1 percent from 2018 across all income levels.

Where are Medicare Part C plans sold?

Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and location.

How much is the standard Part B premium in 2020?

The standard Part B premium increased by about $9/month in 2020. But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the Social Security Cola for 2021?

The high-income threshold (where premiums increase based on income) grew to $88,000 for a single person for 2021. The Part B deductible increased to $203 for 2021. Q: How much does Medicare Part B cost the insured? ...

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

How much is the Part B tax deductible for 2021?

The Part B deductible increased to $203 for 2021, and is projected to increase to $217 in 2022.

What is Medicare Part B?

Medicare Part B covers doctor visits, lab tests, preventive screenings and other outpatient health care services. Part B costs include a monthly premium, an annual deductible and coinsurance for most services.

How much is Medicare Part B 2021?

Medicare Part B Premium for 2021. In 2021, the standard Part B premium is $148.50 per month. Most people pay the standard premium amount. It’s either deducted from your Social Security check or you may pay Medicare directly, depending on your situation.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is the Medicare Part B deductible for 2021?

Medicare Part B Deductible. The Part B deductible for 2021 is $203. This is the amount you are responsible for paying before Part B starts helping to pay your health care costs, but it doesn’t apply to most Medicare-covered preventive care services.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance. Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

What to do if Medicare costs are a concern?

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

Does Medicare Advantage cover doctor visits?

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services . However, your out-of-pocket costs are limited to the annual plan maximum. Once you’ve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

How to know if Medicare will cover you?

Talk to your doctor or other health care provider about why you need certain services or supplies. Ask if Medicare will cover them. You may need something that's usually covered but your provider thinks that Medicare won't cover it in your situation. If so, you'll have to read and sign a notice. The notice says that you may have to pay for the item, service, or supply.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.