How do I pay my monthly Medicare Part B premium?

Nov 24, 2021 · The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits.

Does Medicaid pay for Part B premium?

Nov 06, 2020 · The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Will Medicare supplement pay my Part B premium?

Nov 12, 2021 · Each year the Medicare Part B premium, deductible, and coinsurance rates are determined according to the Social Security Act. The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

Do I have to pay Medicare Part B premium?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services. Who pays a higher premium because of income? How do I pay my Part B premium?

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the usual premium for Medicare Part B coverage?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid.

Is Medicare Part B free for anyone?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How much does Medicare take out of Social Security?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.Nov 22, 2021

Is Medicare premium based on income?

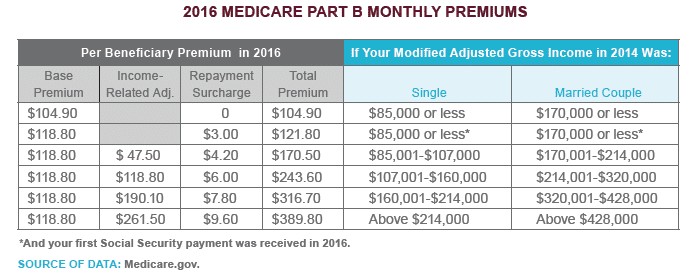

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Is Medicare Part B going up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

How much will Part B go up in 2022?

$170.10Part B costs The standard monthly premium for Part B will be $170.10 in 2022, up from $148.50 this year and marking the program's largest annual jump dollar-wise ($21.60).Dec 31, 2021

Are Medicare Part B premiums tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

What is the Medicare premium for 2021?

In 2021, the standard Medicare Part B premium is $148.50.

When do you have to be 65 to get Medicare?

Most people who are eligible for Medicare are automatically enrolled in Original Medicare (Part A and Part B) at age 65, if they’re receiving Social Security or Railroad Retirement Board benefits.

What happens if you don't sign up for Medicare?

If you don’t sign up for Part B as soon as you’re eligible for Medicare, you might have to pay a late-enrollment penalty each month when you do enroll into Part B, for as long as you get Medicare Part B benefits. The penalty adds 10% to your Part B premium for each year (12-month period) that you could have signed up for Part B, but didn’t enroll.

Do you pay more for Medicare if you have high income?

You might pay more if you have a high income. See details below. The standard premium also may apply to you if get both Medicare and Medicaid benefits, but your state may pay the standard Medicare Part B premium if you qualify. If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see ...

Is Medicare Part B automatically deducted from Social Security?

In most cases, your Medicare Part B premium is automatically deducted from your benefits payment, which makes managing your premium payment easy. If you’re billed for your Part B premium each month (that is, if it’s not automatically deducted from your Social Security benefits), your premium payment might be somewhat higher than if it were ...

Do you have to pay late enrollment penalty for Part B?

If you qualify for a Special Enrollment Period to enroll in Part B, you may not have to pay a late-enrollment penalty. For example, if you delayed Part B enrollment because you were still covered by an employer’s plan (either your employer or your spouse’s), you might qualify for an SEP when you can enroll in Part B without a penalty.

Does Medicare Part B have a premium?

Medicare Part B typically comes with a premium. If you’re new to Medicare or becoming eligible soon, you might be wondering how much your Part B premium will be. The amount can vary depending on your situation.

How much is the standard Part B premium in 2020?

The standard Part B premium increased by about $9/month in 2020. But the 1.6 percent Social Security COLA for 2020 increased the average beneficiary’s Social Security benefit by $24/month. Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees have been paying the standard premium in 2020.

How much income is required to pay Part B?

Since 2007, people who earn more than $85,000 ($170,000 for a couple) have paid higher Part B premiums (and higher Part D premiums) based on their income. For the first time, the threshold for what counts as “high income” was adjusted for inflation as of 2020, increasing it to $87,000 for a single individual and $174,000 for a couple.

What is the Medicare deductible for 2021?

Part B deductible also increased for 2021. Medicare B also has a deductible, which has increased to $203 in 2021, up from $198 in 2020. After the deductible is met, the enrollee is generally responsible for 20 percent of the Medicare-approved cost for Part B services.

How much is the Social Security Cola for 2021?

The high-income threshold (where premiums increase based on income) grew to $88,000 for a single person for 2021. The Part B deductible increased to $203 for 2021. Q: How much does Medicare Part B cost the insured? ...

How much is the 2020 Medicare premium?

Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month). But that’s in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium.

What is the income threshold for Part B?

For people with income above $87,000 ($174,000 for a couple) in 2020, Part B premiums for 2020 ranged from $202.40/month to $491.60/month. As explained by the math above, the high-income threshold has increased to $88,000 for a single individual and $176,000 for a couple in 2021.

How much is Part B insurance in 2021?

In 2021, most enrollees will be paying $148.50/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2020 ($144.60/month) and in 2019 ($135.50/month).