How much does Medicare Part D cost?

Your actual drug coverage costs will vary depending on:

- Your prescriptions and whether they’re on your plan’s list of covered drugs ( formulary A list of prescription drugs covered by a prescription drug plan or another insurance plan offering ...

- What “tier” the drug is in.

- Which drug benefit phase you’re in (like whether you’ve met your deductible, or if you’re in the catastrophic coverage phase).

Who is eligible for Medicare Part D?

Medicare Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don ...

How to compare Medicare Part D plans?

- Biggest Medicare changes for 2022

- Medicare proposes limited coverage of controversial new Alzheimer's drug

- AARP interview: new Medicare chief outlines her vision

How much does a part D cost?

You pay your portion of the monthly premium if you receive Part D coverage as part of Medicare. The cost varies, but the nationwide base is about $33 per month in 2022. Each plan will also have a copayment and coinsurance amount.

What was the Medicare Part D premium for 2017?

This issue brief provides an overview of the 2017 PDP marketplace,2 based on our analysis of data from the Centers for Medicare & Medicaid Services (CMS). Key findings include: The average monthly PDP premium in 2017 will increase by 9 percent from 2016, to $42.17 (weighted by 2016 plan enrollment).

What was the monthly cost of Medicare in 2017?

Days 101 and beyond: all costs. Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is the cost for Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What were Medicare premiums in 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What was the cost of Medicare Part B in 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What is the cost for Medicare Part D for 2021?

Average national premium is $33.37. People with high incomes have a higher Part D premium. Vary by plan and by drug within plan. In most plans, after spending usually $4,430 in total drug costs, you reach the coverage gap.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the 2021 Part D premium?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2021 is $33.06, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

What is the max out of pocket for Medicare Part D?

As expected, a $2,000 cap on out-of-pocket spending would generate larger savings than a $3,100 cap. Average out-of-pocket spending was $3,216 among the 1.2 million Part D enrollees with out-of-pocket spending above $2,000 in 2019.

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.

Medicare Advantage

Florida was the clear winner when comparing average Medicare Advantage premiums among states. The Sunshine State’s 2017 Medicare Advantage plans have an average premium of $19.24. North Dakota, in contrast, is over 6 times that amount with an average premium of $120.90.. South Dakota is similarly expensive with an average premium of $111.68.

Medicare Part D

When examining Medicare Part D trends on the state level, we found that lowest average premium was in Hawaii. At $43.95, the Aloha State had an average premium among 2017 Part D plans that is 17% lower than the national average of $53.22. In comparison, California had the highest average premium for their 2017 Part D plans.

Conclusion

Little inflation in 2017 average premium and deductible costs is welcome news for Part D and Medicare Advantage enrollees. However, a close inspection of the data reveals very different Medicare insurance markets across the United States. A combination of factors (e.g.

Author

This report was written by Kev Coleman, Head of Research & Data for HealthPocket. Correspondence regarding this study can be directed to [email protected].

Methodology

Premiums and deductibles for Medicare health and drug plans were obtained from the 2017 MA and PDP Landscape Source Files available at cms.gov on September 22, 2016 ( https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/index.html?redirect=/PrescriptionDrugCovGenIn/ last accessed on September 22, 2016).

Seniors are going to be paying a lot more for their prescription drug plans in 2017

A Fool since 2010, and a graduate from UC San Diego with a B.A. in Economics, Sean specializes in the healthcare sector and investment planning. You'll often find him writing about Obamacare, marijuana, drug and device development, Social Security, taxes, retirement issues and general macroeconomic topics of interest. Follow @AMCScam

Big prescription drug increases are headed seniors' way

Choosing a prescription drug plan is particularly important for seniors since they tend to be more prone to expensive illnesses compared to younger adults.

How to get the best Medicare drug plan

With rising prescription drug costs looking like a near-certainty moving forward, seniors need to be diligent in their efforts to pick out a PDP that suits their needs best. Here are a few tricks to ensuring you get the best possible value for your Part D plan.

How much does Medicare pay for prescription drugs in 2017?

Today, Medicare announced that the average basic premium for a Medicare Part D prescription drug plan in 2017 is projected to remain relatively stable at an estimated $34 per month.

How much will Medicare Part D increase in 2025?

Medicare Part D expenditures per enrollee are estimated to increase by an average of 5.8 percent annually through 2025, higher than the combined per-enrollee growth rate for Medicare Parts A and B (4.0 percent).

When does Medicare open enrollment end?

The upcoming annual Medicare open enrollment period begins on October 15, 2016, and ends on December 7, 2016.

Does Medicare Part D cost increase?

The stability in average basic Medicare Part D premiums for enrollees comes despite the fact that Part D costs continue to increase faster than other parts of Medicare, largely driven by high-cost specialty drugs and their effect on spending in the catastrophic benefit phase.

What is Part D insurance?

Part D covers prescription drug costs, and it was introduced in 2003 to help seniors afford medication. It’s a popular provision. How much you pay for Part D varies based on the type of coverage you choose, but there are standards in place to limit your out-of-pocket spending. Once again, higher-income enrollees will pay an income-based surcharge on top of their monthly premiums:

How much does Medicare Part B cost?

Most recipients pay an average of $109 a month for coverage, but certain beneficiaries pay the standard premium of $134 a month. If you meet one of the following conditions, then you’ll pay the standard amount ($134) or more:

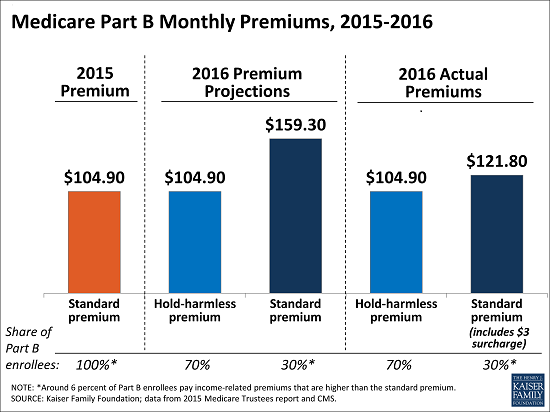

Why did Medicare premiums go up in 2016?

The Centers for Medicare & Medicaid Services (CMS) cited several reasons for the price hike, including paying off mounting debt from past years and ensuring funding for future coverage. But another important factor was that 2016 saw no cost-of-living adjustment (COLA) for Social Security benefits. For 70 percent of Medicare beneficiaries, this meant that premium rates would stay the same in 2016. The remaining 30 percent — about 15.6 million enrollees — faced higher monthly premiums. And everyone who signs up for Medicare in 2016, regardless of enrollment status or income, will pay a higher annual deductible.

What is Medicare Advantage?

Medicare Advantage offers a bevy of benefits to seniors who are looking for more comprehensive coverage. These plans must include at least the same benefits offered through Parts A and B, and many (but not all) plans cover prescription drugs. Because these plans are sold through private insurers instead of directly through the federal government, Medicare Advantage has different costs that vary by plan. As with any insurance plan, costs rise each year. If you want to learn more about this type of coverage, then check out our guide to Medicare Advantage.

Is Medigap the same as Medicare?

In all but three states, Medigap plans are the same. They are organized into plans A through N. These plans are offered by private insurance companies and are not part of Medicare. They offer the same things Medicare does and then some.

How much does Medicare pay for Part D?

Patients who qualify will pay no more than $3.30 for each generic drug or $8.25 for each brand-name covered drug. l.

What is Part D covered by Medicare?

Understanding what drugs are covered under Part D covers is tricky, because accessing this benefit requires all patients to go through a private insurer. As such, each Part D plan provider has its own unique list of covered drugs, which Medicare refers to as a plan's formulary. It is common for Part D providers to break out the groups ...

How long do you have to change your Medicare plan?

While a plan's formulary generally remains consistent throughout the year, it is possible for a plan to change its coverage midyear so long as it follows Medicare's rules. Those rules require all affected patients to be given at least 60 days' notice before any change becomes effective. In addition, the plan must honor a refill request ...

How much is out of pocket for a patient in 2017?

Once a patient's annual out-of-pocket costs have reached $4,950 out of pocket in 2017, he or she will pay only a small coinsurance amount or copayment for all covered drugs for the remainder of the year.

When did Medicare Part D start?

Since its launch in 2006, Medicare Part D has helped tens of millions of patients lower their prescription-drug costs. That makes it vital to stay informed so you can pick a plan that best fits your needs. The Motley Fool has a disclosure policy. Prev.

Does Medicare Extra Help change based on drug use?

A recipient's actual expenses will change based on the drugs that he or she uses, the plan chosen, the pharmacy used, and whether the person qualifies for Medicare's Extra Help feature. That's because Part D plans get to dictate the terms of the policies they offer. However, there are some common attributes that apply to all Part D plans.

Does Medicare cover prescription drugs?

Millions of Medicare participants currently rely on Part D to help them pay for prescription drugs. However, it can be difficult to understand all the ins and outs of this program, since it operates a little bit differently from most other parts of Medicare. Still, it's important for all current and future recipients to know what Part D will cover ...

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most ...

How much is Medicare Part A deductible?

The Medicare Part A inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,316 per benefit period in 2017, an increase of $28 from $1,288 in 2016. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

Is Medicare Part B deductible finalized?

Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B monthly premiums. These income-related monthly premium rates affect roughly five percent of people with Medicare.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.