If you have already paid for the yearly part B deductible, Medicare covers around 80 percent of the Medicare-approved cost. You’ll need to pay for the rest 20 percent. Depending on the duration for which it has been advised, you may need to buy or rent a walker. Medicare also pays for the rent of the walker if that’s what you need to do.

Full Answer

What does Medicare cover and what can you claim?

Under Medicare you can be treated as a public patient in a public hospital, at no charge. Medicare will also cover some or all the costs of seeing a GP or specialist outside of hospital, and some pharmaceuticals.

What percentage does Medicare Part a cover?

There is no limit on benefit periods. Part A also covers 100% of hospice care and skilled intermittent home health care . When it pays: Part A coverage begins when you're admitted under a physician's orders to a hospital that accepts Medicare.

Does everyone pay the same for Medicare?

While Medicare Part A is free to everyone who qualifies for Medicare by having paid into Medicare taxes for 40 quarters, Medicare Part B has a premium. This premium is the same for most people, but not all people. Persons with higher incomes pay proportionately more for Medicare Part B, and as of 2011, higher income Medicare recipients also pay ...

What does Medicare really cover?

Medicare covers up to 100 days of part-time daily care or intermittent care if medically necessary. You must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care. If you don’t qualify for home health care coverage under Part A, you might have Medicare coverage under Part B.

What does Medicare Part B cover?

Does Medicare cover tests?

About this website

Does Medicare cover the entire cost?

For each lifetime reserve day, Medicare pays all covered costs except for a daily coinsurance. : All costs. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What percentage is covered by Medicare?

18 percentMedicare is an important public health insurance scheme for U.S. adults aged 65 years and over. As of 2020, approximately 18 percent of the U.S. population was covered by Medicare, a slight increase from the previous year.

How do I know what my Medicare covers?

For general information on what Medicare covers, visit Medicare.gov, or call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

What is usually not covered by Medicare?

Medicare doesn't provide coverage for routine dental visits, teeth cleanings, fillings, dentures or most tooth extractions. Some Medicare Advantage plans cover basic cleanings and X-rays, but they generally have an annual coverage cap of about $1,500.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What is the maximum out of pocket for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

Does Medicare cover blood work?

Medicare Part B covers outpatient blood tests ordered by a physician with a medically necessary diagnosis based on Medicare coverage guidelines. Examples would be screening blood tests to diagnose or manage a condition. Medicare Advantage, or Part C, plans also cover blood tests.

Is surgery covered by Medicare?

Yes. Medicare covers most medically necessary surgeries, and you can find a list of these on the Medicare Benefits Schedule (MBS). Since surgeries happen mainly in hospitals, Medicare will cover 100% of all costs related to the surgery if you have it done in a public hospital.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Does Medicare only covers 80 percent?

Original Medicare only covers 80% of Part B services, which can include everything from preventive care to clinical research, ambulance services, durable medical equipment, surgical second opinions, mental health services and limited outpatient prescription drugs.

Is there a Medicare supplement that covers everything?

Medicare Supplement insurance Plan F offers more coverage than any other Medicare Supplement insurance plan. It usually covers everything that Plan G covers as well as: The Medicare Part B deductible at 100% (the Part B deductible is $203 in 2021).

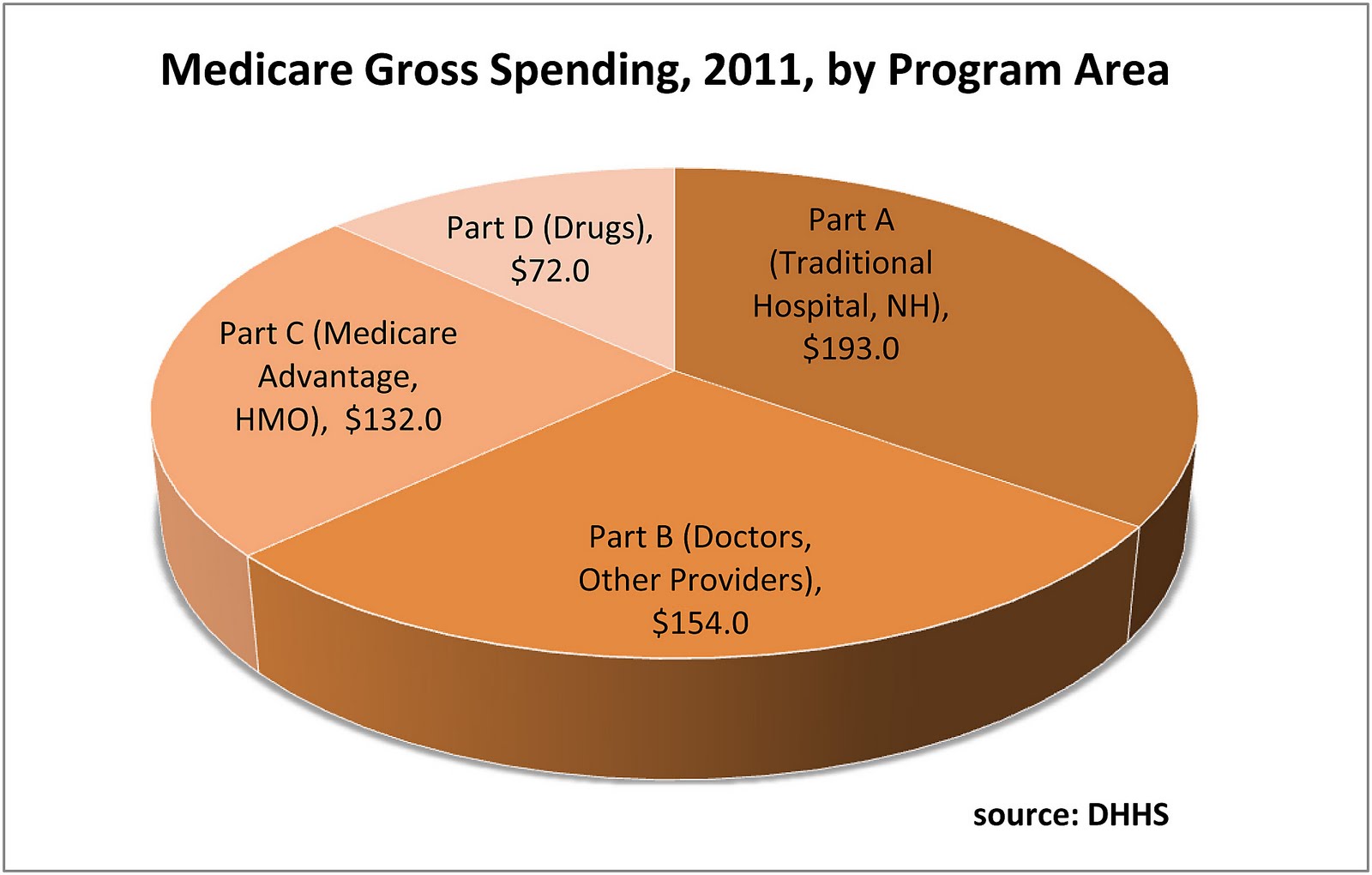

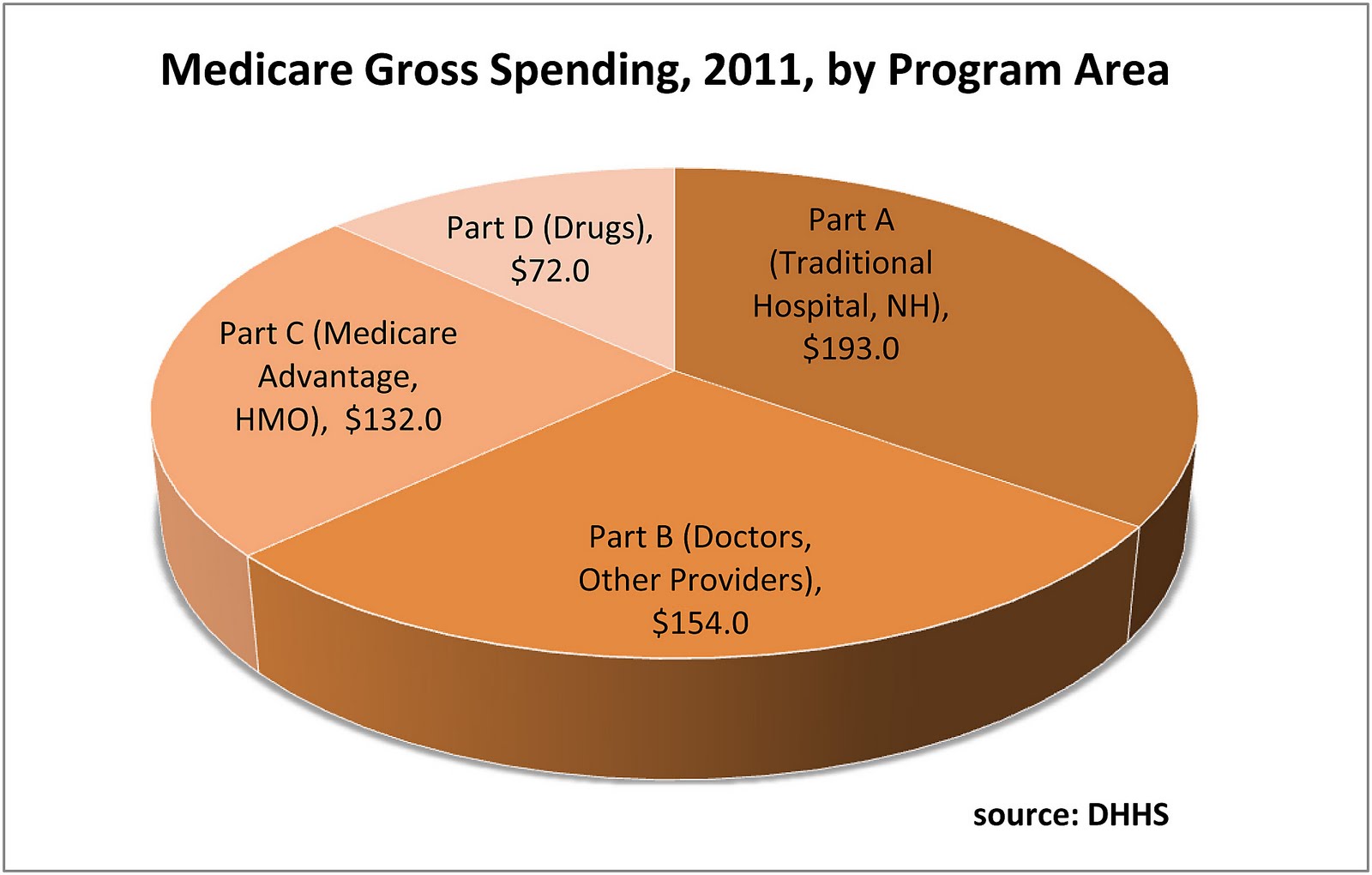

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Items and Services Not Covered Under Medicare Booklet

Items & Services Not Covered Under Medicare MLN Booklet Page 5 of 19 ICN MLN906765 December 2020. INTRODUCTION. This booklet outlines the 4 categories of items and services Medicare doesn’t cover and exceptions

2021 Medicare Parts A & B Premiums and Deductibles | CMS

On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs. Medicare Part B Premiums/Deductibles Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services ...

Your Medicare Coverage | Medicare

Didn’t find what you’re looking for? Use this list if you’re a person with Medicare, family member or caregiver. Medicare coverage for many tests, items and services depends on where you live.

What Part A covers | Medicare

Medicare Part A hospital insurance covers inpatient hospital care, skilled nursing facility, hospice, lab tests, surgery, home health care.

Medicare Program | Benefits.gov

Medicare is health insurance for people 65 or older, people under 65 with certain disabilities, and people of any age with End-Stage Renal Disease (ESRD) (permanent kidney failure requiring dialysis or a kidney Determine your eligibility for this benefit

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

Who is covered by Part A and Part B?

All people with Part A and/or Part B who meet all of these conditions are covered: You must be under the care of a doctor , and you must be getting services under a plan of care created and reviewed regularly by a doctor.

What is a medical social service?

Medical social services. Part-time or intermittent home health aide services (personal hands-on care) Injectible osteoporosis drugs for women. Usually, a home health care agency coordinates the services your doctor orders for you. Medicare doesn't pay for: 24-hour-a-day care at home. Meals delivered to your home.

Do you have to be homebound to get home health insurance?

You must be homebound, and a doctor must certify that you're homebound. You're not eligible for the home health benefit if you need more than part-time or "intermittent" skilled nursing care. You may leave home for medical treatment or short, infrequent absences for non-medical reasons, like attending religious services.

Does Medicare cover home health services?

Your Medicare home health services benefits aren't changing and your access to home health services shouldn’t be delayed by the pre-claim review process.

Not everyone pays for Medicare with their Social Security check

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

Who Is Eligible for Medicare?

Medicare is a social insurance program available to U.S. citizens and permanent residents 65 years of age or older. It’s also available to some younger Americans who are disabled or diagnosed with End-Stage Renal Disease (ESRD).

When Do You Have To Pay for Medicare?

If you don’t qualify for premium-free Part A coverage, you’ll need to pay a monthly premium. You’ll also have to pay a premium if you sign up for Part B, which is optional.

Medicare Costs You Can Deduct From Social Security

Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here’s a closer look at what costs you can expect to see taken out of your checks.

Can You Change How You Pay for Medicare?

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you don’t qualify for Social Security benefits, you’ll get a bill from Medicare that you’ll need to pay via:

What does Medicare pay for?

Medicare pays for many different types of medical expenses. Part A covers inpatient hospital care, surgery, and home health care, among other items. Part B covers things such as preventive care, doctors’ visits, and durable medical equipment. Part D covers prescription drugs.

How much will I pay for Medicare?

The amount you’ll pay for Medicare depends on several factors, including your sign-up date, income, work history, prescription drug coverage, and whether you sign up for extra coverage with an Advantage or Medigap plan. The Medicare Plan Finder can help you compare costs between different plans.

What does Medicare Part A cover?

Part A provides coverage for inpatient hospital services. Part B covers outpatient care and durable medical equipment (DME). Original Medicare coverage typically requires the care to be “medically necessary” in order for it to be covered by ...

What is the number to call for Medicare?

1-800-557-6059 | TTY 711, 24/7. The services and items below are not necessarily a complete list of procedures that are covered by Original Medicare. Click on each item in the list to learn more about how it’s covered by Medicare and how much they may cost. Acupuncture. Air Ambulance transportation.

Does Medicare Advantage cover prescriptions?

Many Medicare Advantage plans also offer prescription drug coverage, and some plans offer benefits like dental, vision, hearing, gym and wellness program memberships and more, all of which aren't typically covered by Original Medicare.

Does Medicare cover assisted living?

Procedures Medicare typically doesn't cover may be covered by some Medicare Advantage plans. Some procedures that aren't typically covered by Original Medicare may sometimes be covered by certain Medicare Advantage (Medicare Part C) plans. These procedures may include but are not limited to the following: Assisted living.

Does Medicare cover coinsurance?

Certain other restrictions may apply, depending on the procedure you need. Depending on the type of service you get and how Medicare covers it, you may face certain deductible, coinsurance and/or copayment costs.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for inpatient respite care.

How long can you be in hospice care?

After 6 months , you can continue to get hospice care as long as the hospice medical director or hospice doctor recertifies (at a face-to-face meeting) that you’re still terminally ill. Hospice care is usually given in your home but may also be covered in a hospice inpatient facility. Original Medicare will still pay for covered benefits for any health problems that aren’t part of your terminal illness and related conditions, but this is unusual. When you choose hospice care, you decide you no longer want care to cure your terminal illness and/or your doctor determines that efforts to cure your illness aren't working. Once you choose hospice care, your hospice benefit will usually cover everything you need.

How long can you live in hospice?

Things to know. Only your hospice doctor and your regular doctor (if you have one) can certify that you’re terminally ill and have a life expectancy of 6 months or less. After 6 months, you can continue to get hospice care as long as the hospice medical director or hospice doctor recertifies ...

What happens when you choose hospice care?

When you choose hospice care, you decide you no longer want care to cure your terminal illness and/ or your doctor determines that efforts to cure your illness aren't working . Once you choose hospice care, your hospice benefit will usually cover everything you need.

What is hospice care?

hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient. Hospice also provides support to the patient's family or caregiver. care.

Can you get hospice care from a different hospice?

You can't get the same type of hospice care from a different hospice, unless you change your hospice provider. However, you can still see your regular doctor or nurse practitioner if you've chosen him or her to be the attending medical professional who helps supervise your hospice care. Room and board.

Do you have to pay for respite care?

You may have to pay a small copayment for the respite stay . Care you get as a hospital outpatient (like in an emergency room), care you get as a hospital inpatient, or ambulance transportation, unless it's either arranged by your hospice team or is unrelated to your terminal illness and related conditions.

Why is Physical Therapy Valuable?

According to the American Physical Therapy Association (APTA), physical therapy can help you regain or maintain your ability to move and function after injury or illness. Physical therapy can also help you manage your pain or overcome a disability.

Does Medicare Cover Physical Therapy?

Medicare covers physical therapy as a skilled service. Whether you receive physical therapy (PT) at home, in a facility or hospital, or a therapist’s office, the following conditions must be met:

What Parts of Medicare Cover Physical Therapy?

Part A (hospital insurance) covers physical therapy as an inpatient service in a hospital or skilled nursing facility (SNF) if it’s a Medicare-covered stay, or as part of your home health care benefit.

Does Medicare Cover In-home Physical Therapy?

Medicare Part A covers in-home physical therapy as a home health benefit under the following conditions:

What Are the Medicare Caps for Physical Therapy Coverage?

Medicare no longer caps medically necessary physical therapy coverage. For outpatient therapy in 2021, if you exceed $2,150 with physical therapy and speech-language pathology services combined, your therapy provider must add a modifier to their billing to show Medicare that you continue to need and benefit from therapy.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.