How much do tax payers pay for Medicare?

MEDICARE premiums are set to jump by far more than what experts had estimated next year. The new rates were announced by the Centers for Medicare & Medicaid Services (CMS) on November 12, 2021 - we explain what you need to know. Medicare's Part B standard ...

What percentage of your paycheck is Medicare?

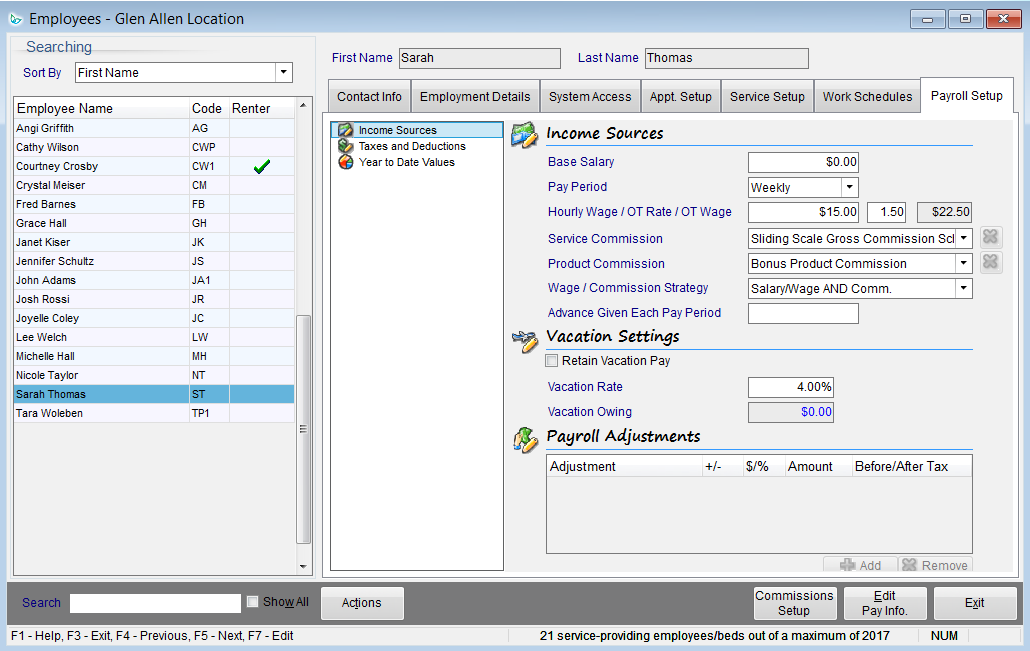

What Percentage of Federal Taxes and Medicare Are Deducted out of Gross Pay?

- Social Security and Medicare Tax 2019. Following adjustments to the federal tax code made in recent years, individuals can expect 6.2 percent of their pay up to a maximum income ...

- W-4s and Federal Tax Withholdings. ...

- Social Security Withholdings. ...

- Evaluating Medicare Withholdings and the Deduction Amount of Net Pay. ...

- Gaining More Information. ...

How is Medicare calculated for payroll?

- Subtract $4,300 for each Allowance.

- Find the Marital Status claimed, go to the Standard Withholding Rate Schedules (orange) IRS Percentage Method Table below, and use the appropriate status section of the table. ...

- Find the row that your calculated amount falls into. ...

- If you have a Monthly pay period frequency, divide by 12; if Semi-Monthly, divide by 24.

What is the current tax rate for Medicare?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers.

What is the Medicare tax rate for 2021?

1.45%What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

What is the Medicare tax rate for 2020?

1.45%NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

What is the Medicare tax rate for payroll?

2.9%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How does the 3.8 Medicare tax work?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

What are the FICA and Medicare rates for 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

What is the cap on Medicare?

Employers must withhold the additional Medicare tax from wages of employees earning more than $200,000 in a calendar year....2022 Wage Cap Jumps to $147,000 for Social Security Payroll Taxes.Payroll Taxes: Cap on Maximum EarningsType of Payroll Tax2022 Maximum Earnings2021 Maximum EarningsSocial Security$147,000$142,800MedicareNo limitNo limit1 more row•Oct 13, 2021

How is Medicare calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

How are Medicare wages calculated?

Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

At what income does the 3.8 surtax kick in?

There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.

What is the 3.8 percent Obamacare tax?

Effective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

At what income level does Medicare tax increase?

$200,000An employer must withhold Additional Medicare Tax from wages it pays to an individual in excess of $200,000 in a calendar year, without regard to the individual's filing status or wages paid by another employer.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What type of tax is Medicare?

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and peopl...

What is the tax rate for Social Security and Medicare?

The FICA tax includes the Social Security tax rate at 6.2% and the Medicare tax at 1.45% for a total of 7.65% deducted from your paycheck.

What does it mean if you see a Medicare deduction on your paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital In...

What happens if your employer did not withhold Social Security and Medicare taxes?

Employers that do not adhere to tax laws by withholding FICA taxes for Social Security and Medicare could be subject to criminal and civil sanction...

How do self-employed people pay Medicare tax?

If you are a self-employed person, Medicare tax is not withheld from your paycheck. You would typically file estimated taxes quarterly and use the...

What is a Medicare benefit tax statement?

This evidence of coverage statement confirms that you have enrolled in Medicare Part A and have health insurance that meets the Affordable Care Act...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What does Medicare tax mean?

Medicare tax is a federal payroll tax that pays for a portion of Medicare. Because of the $284 billion paid in Medicare taxes each year, about 63 million seniors and people with disabilities have access to hospital care, skilled nursing and hospice.

How does it work?

Medicare tax is a two-part tax where you pay a portion as a deduction from your paycheck, and part is paid by your employer. The deduction happens automatically as a part of the payroll process.

What is the Medicare tax used for?

The Medicare tax pays for Medicare Part A, providing health insurance for those age 65 and older as well as people with disabilities or those who have certain medical issues. Medicare Part A, also known as hospital insurance, covers health care costs such as inpatient hospital stays, skilled nursing care, hospice and some home health services.

What's the current Medicare tax rate?

In 2021, the Medicare tax rate is 1.45%. This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

Frequently asked questions

Medicare tax is a required employment tax that's automatically deducted from your paycheck. The taxes fund hospital insurance for seniors and people with disabilities.

What are payroll taxes?

Payroll taxes are broken into two parts: taxes that employers pay and taxes that employees pay. As the employer, you’re responsible for withholding your employee’s taxes due from their paychecks and remitting it to the applicable tax agencies along with any amounts you owe. Employees are responsible for paying federal income taxes ...

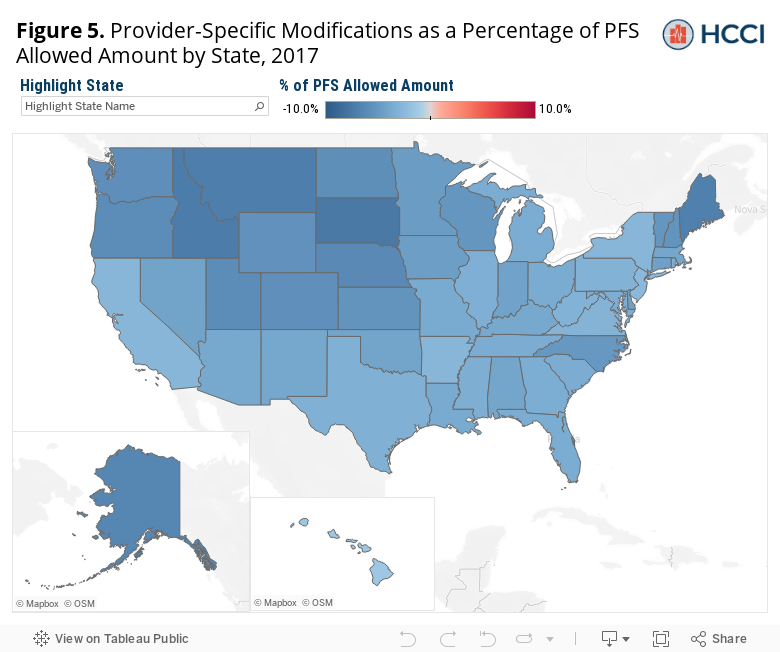

How much is Social Security tax?

Federal tax rates, like income tax, Social Security (6.2% each for both employer and employee), and Medicare (1.45% each), are set by the IRS. However, each state specifies its own tax rates. Below is a state-by-state map showing rates for taxes, including supplemental taxes and workers’ compensation.

What happens if you don't pay payroll taxes?

If employers fail to remit payroll tax payments or send them in late, it could have the following impact: 1 Employers may face criminal and civil sanctions 2 Employees may lose access to future Social Security or Medicare benefits 3 Employees may lose access to future unemployment benefits

Why is it important to pay payroll taxes?

Paying your payroll taxes correctly and on time is an important part to becoming a successful employer, but it can become challenging as you grow . Tax rates change from year to year, especially state payroll tax rates, and you must keep track of them to accurately calculate your business and your employees’ tax obligations.

What is the FICA tax rate?

For employees earning more than $200,000, the Medicare tax rate goes up by an additional 0.9%; therefore, FICA can range between 15.3% and 16.2%.

How much does SUTA pay?

New employers pay 3.13% in SUTA for employees making more than $11,100 per year. They refer to it as the Unemployment Insurance Contribution Rate (UI). Existing employers pay between 0.06% and 7.9%. Employers with few unemployment claims may pay nearly 10 times less than those with high unemployment claims. In New York, as in most states, it pays to reduce your turnover.

How much is supplemental pay taxed?

Some states tax supplemental wages like bonuses, commissions, overtime, and severance pay as examples. Less than half of US states have no supplemental tax while the rest range from 1.84% to 11%—except Vermont that charges 30%. For instance, in California, employees are taxed 6.6% for most supplemental pay but are taxed at 10.23% if the supplemental pay is received from a bonus or stock option.

What is the Medicare tax rate?

Medicare tax. The second component of the payroll tax is Medicare, which is taxed at a rate of 1.45% each for the employee and employer. Unlike the Social Security tax, there is no upper income limit to the Medicare tax. Even if your earned income is in the millions, you'll pay Medicare tax on all of it.

How much Medicare tax is paid on income over $250,000?

In fact, there's an additional 0.9% Medicare tax paid by individuals with earned income in excess of $200,000 and joint filers with earned income greater than $250,000 that only applies to income over the threshold.

How much is the Social Security tax rate for self employed?

This means they pay a Social Security tax rate of 12.4% on earned income up to $142,800 in 2021, Medicare tax of 2.9% on all income, and the 0.9% additional Medicare tax on income in excess ...

What is payroll tax?

Payroll taxes are types of tax that are applied to earned income, meaning wages, salaries, bonuses, and income from a business you actively participate in. There are two components to the payroll tax in the United States -- Social Security and Medicare.

What is the first component of payroll tax?

The first component of the U.S. payroll tax is known as OASDI (Old Age, Survivors, and Disability Insurance) tax, but it is more commonly referred to as Social Security tax.

How much tax will be on self employment in 2021?

In all, here's how the self-employment tax breaks down for a single individual who gets all of their income from self-employment in 2021: 3% tax on the first $142,800 in self-employment income. 9% tax on income from $142,800 to $200,000. 8% tax on income in excess of $200,000.

What is the maximum amount of Social Security income in 2021?

In 2021, the upper limit -- commonly known as the Social Security wage base -- is $142,800. (Note: This is the only income threshold in this article that is adjusted for inflation each year.) It's important to note that Social Security tax only applies ...

What is the HI payroll tax?

The primary source of financing for Hospital Insurance (HI) benefits provided under Medicare Part A is the HI payroll tax. The basic HI tax is 2.9 percent of earnings. For employees, 1.45 percent is deducted from their paychecks and 1.45 percent is paid by their employers. Self-employed individuals generally pay 2.9 percent of their net self-employment income in HI taxes. Unlike the payroll tax for Social Security, which applies to earnings up to an annual maximum ($128,400 in 2018), the 2.9 percent HI tax is levied on total earnings.

Why would the HI tax increase?

That is because a larger share of the income of lower-income families is, on average, from earnings, which are subject to the HI tax. As a result, an increase in the HI tax would represent a greater proportion of the income of lower-income taxpayers than would be the case for higher-income taxpayers.

Social Security

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

Medicare

Unlike Social Security, Medicare taxes do not have a wage base. Instead, Medicare has an additional withholding tax for employees who earn more than a set amount. In 2021, this base amount is $200,000 (single). Therefore, employees who earn more than $200,000 in 2021 pay 1.45% and an additional 0.9% to Medicare.

Self-employed tax

If you are self-employed, pay the entire cost of payroll taxes (aka self-employment taxes ). And, pay the additional 0.9% Medicare tax, too, if you earn more than the threshold per year.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

What is the Medicare tax rate?

The Additional Medicare Tax rate is 0.90% and it applies to employees’ (and self-employed workers’) wages, salaries and tips. So any part of your income that exceeds a certain amount gets taxed for Medicare at a total rate of 2.35% (1.45% + 0.90%).

What are the different types of payroll taxes?

There are several different types of payroll taxes, including unemployment taxes, income taxes and FICA taxes. Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes. Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act of 1935.

How to calculate FICA tax burden?

To calculate your FICA tax burden, you can multiply your gross pay by 7.65%. Self-employed workers get stuck paying the entire FICA tax on their own. For these individuals, there’s a 12.4% Social Security tax, plus a 2.9% Medicare tax. You can pay this tax when you pay estimated taxes on a quarterly basis.

How much does each party pay for FICA?

Employers and employees split the tax. For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

How much is FICA tax?

If you earn a wage or a salary, you’re likely subject to FICA taxes. (FICA stands for Federal Insurance Contributions Act.) Not to be confused with the federal income tax, FICA taxes fund the Social Security and Medicare programs and add up to 7.65% of your pay (in 2020). The breakdown for the two taxes is 6.2% for Social Security (on wages up to $137,700) and 1.45% for Medicare (plus an additional 0.90% for wages in excess of $200,000). Also known as payroll taxes, FICA taxes are automatically deducted from your paycheck. Your company sends the money, along with its match (an additional 7.65% of your pay), to the government. In this article we’ll discuss what FICA taxes are, how they’re applied and who’s responsible for paying them.

What happens if you overpay Social Security?

If you overpaid Social Security and you only have one job, you’ll need to ask your employer for a refund. Excess Medicare tax repayments are nonrefundable since there’s no wage base limit. If you have more than one job, you may underpay the amount of FICA taxes you owe.

What was the Social Security tax rate in the 1960s?

Social Security tax rates remained under 3% for employees and employers until the end of 1959. Medicare tax rates rose from 0.35% in 1966 (when they were first implemented) to 1.35% in 1985. For the past couple of decades, however, FICA tax rates have remained consistent. Employers and employees split the tax.