Will the Republican tax plan cut Social Security and Medicare?

· In 2018 alone, that means a cut of around $25 billion to Medicare and the elimination of all non-exempt programs, including the Student Loan Administration and agricultural subsidies and supports. Over ten years, the Republican tax plan would cut Medicare by up to $410 billion, with hospitals and providers shouldering much of the burden.

How much of a tax cut will you get under Obamacare?

With a number that large, Congress’s “pay as you go” rules that prevent unchecked spending would fall into place, a move that could cut Medicare’s budget by as much as $25 billion for 2018.

How big is the federal budget for Social Security and Medicare?

Republicans continue to press for changes to our nation’s health care system that will upend markets, breed uncertainty, and leave millions wondering whether they will have health coverage. Now, the Republican tax plan threatens significant cuts to the Medicare program. A little-known law could mean that the passage of the GOP tax reform bill will invoke massive cuts to the …

Why are GOP lawmakers working to cut funding for the IRS?

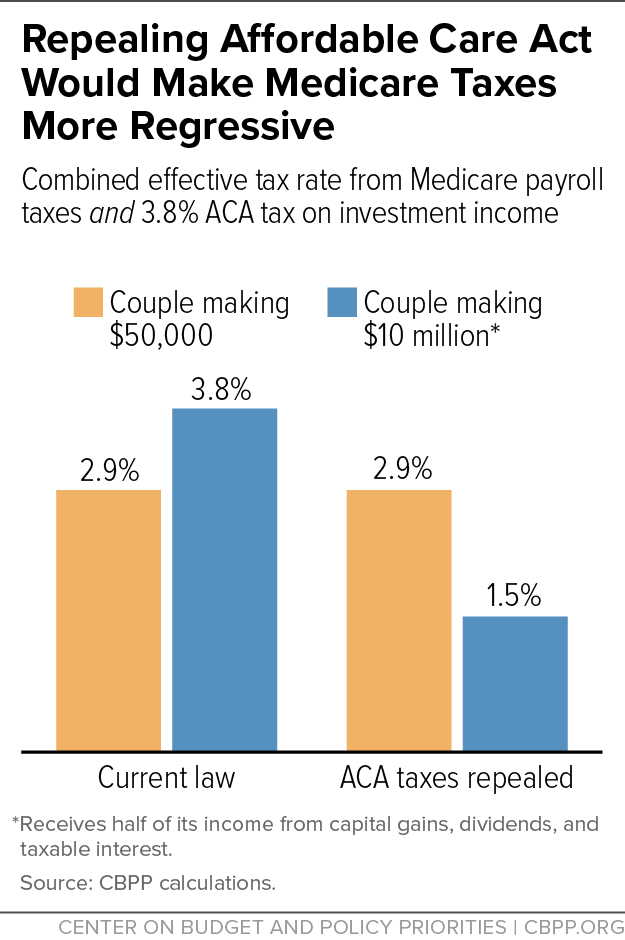

· Gives a massive tax cut to millionaires ― Millionaires get an average tax cut of $230,000 each year, once the plan is fully phased in 2027. This is more than 75 percent of all the tax cuts in the plan. Households earning less than $100,000 are not even getting 10 …

What programs are exempt from cuts?

Just to make this a little more complex, it's worth emphasizing that a whole bunch federal programs are exempt from these cuts, including Social Security and Veterans Affairs, but the cuts would affect priorities such as Medicare and student loans. (Vox explained that cuts to Medicare "are capped at 4 percent," which is where the $25 billion figure comes from.)

Will the federal deficit get bigger if the GOP tax plan passes?

The federal budget deficit, which Republicans used to pretend to care about, is poised to get vastly larger if the GOP tax plan passes. There's reason to believe, however, that Republicans will renew their interest in balancing the budget -- just as soon as they're done slashing tax rates on the wealthy and corporations.

Can Congress circumvent PayGo?

The catch is, Congress can simply vote to circumvent PAYGO and prevent unpopular cuts from taking effect, and Republicans are now saying this is what would happen to prevent Medicare cuts. But that would require approval from both chambers, including 60 votes in the Senate, where Democrats may not be in the mood to help Republicans clean up their own mess.

What is the Republican tax plan?

Republican Tax Plan: Tax Cuts for the Rich, Paid for by Everyone Else. This budget’s primary purpose is to provide reconciliation instructions for tax reform, but the Republican plan is not tax reform – it is a $2.4 trillion tax cut for the wealthy at the expense of everyone else. The inequities are startling.

What is the step 3 of the tax cut?

Step 3: Cut important benefits for American families, like Medicare, Social Security, and education assistance, while doing nothing to make millionaires pay their fair share. Gives a massive tax cut to millionaires ― Millionaires get an average tax cut of $230,000 each year, once the plan is fully phased in 2027.

What are the steps of the GOP?

This is step one of the GOP’s three steps to giving to the rich and making American families pay for it Republicans are trying to take away critical investments and benefits in a deceitful three-step process: Step 1: Cut taxes for the rich, and claim that economic growth will pay for it.

Which class pays for the tax cuts?

Middle class pays for the tax cuts for big corporations, wealthy partnerships, and rich estates ― Individual income taxes actually go up by $471 billion, while big corporations, wealthy passthroughs, and rich estates get their taxes cut by $2.9 trillion.

Will the middle class get taxed in 2027?

For every provision in the Republican plan which might help the middle class, Republicans take away other middle-class tax benefits, and many see their taxes go up. By 2027, nearly 30 percent of households earning $50k to $150k would see a tax increase, and 45 percent of all households with children face a tax increase.

What is the Republican tax cut plan?

Senate Tax plan Republicans Medicare. Update | Florida Senator Marco Rubio admits that the Republican tax cut plan, which benefits corporations and the wealthy, will require cuts to Social Security and Medicare to pay for it. To address the federal deficit, which will grow by at least $1 trillion ...

What percentage of the federal budget is Medicare?

The simple answer is Social Security and Medicare, which together make up 38 percent of the total federal budget, second only to military spending. The bottom line: the American people do not want us to pass tax breaks for billionaires today and they certainly don’t want us to cut Social Security, Medicare and Medicaid.

When will Social Security be exhausted?

Both Social Security and Medicare programs are on a fiscally unsustainable path— Medicare's hospital insurance trust fund will be exhausted by 2029, and Social Security's trust fund will be exhausted by 2034.

Will the deficit grow if the tax plan passes?

To address the federal deficit, which will grow by at least $1 trillion if the tax plan passes, Congress will need to cut entitlement programs such as Social Security, Rubio told reporters this week. Advocates for the elderly and the poor have warned that entitlement programs would be on the chopping block, but this is the first time a prominent Republican has backed their claims.