Who is exempt from paying Medicare tax?

Jan 04, 2022 · Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2022 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%. Your Medicare tax is deducted automatically from your paychecks.

How do you calculate Medicare taxes?

Mar 15, 2022 · Different rates apply for these taxes. Social Security and Medicare Withholding Rates The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How much does employer pay in taxes for employee?

Mar 16, 2022 · The current Medicare tax rate is 1.45 percent of your wages and is withheld from your paycheck. Your employer matches your contribution by paying another 1.45 percent. If you are self-employed, you have to pay the full 2.9 percent of your net income as the Medicare portion of your FICA taxes.

What is the current Medicare tax rate?

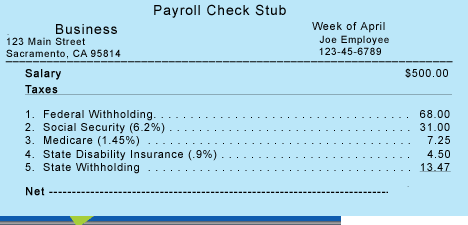

Jul 06, 2021 · The Medicare tax rate is determined by the IRS and is subject to change. To calculate the Medicare tax, multiply your earnings by 0.0145. So if your biweekly pay is $2,000, your Medicare tax will be $29 (2,000 x 0.0145 = 29). In this example, both the employee and employer will owe $29 to Medicare for the pay period.

How is Medicare tax calculated on paycheck?

The Medicare withholding rate is gross pay times 1.45 %, with a possible additional 0.9% for highly-paid employees. Your portion as an employer is also 1.45% with no limit, but you (the employer) don't have to pay the additional 0.9% For a total of 7.65% withheld, based on the employee's gross pay.Nov 7, 2019

Who pays the 3.8 Medicare tax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

How much Medicare tax do I pay in 2020?

7.65 percentThe FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

What is employee Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee's paycheck or paid as a self-employment tax.

What is the Medicare tax rate for 2021?

1.45%2021-2022 FICA tax rates and limitsEmployee paysEmployer paysMedicare tax1.45%.1.45%.Total7.65%7.65%Additional Medicare tax0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers)1 more row•Jan 13, 2022

What is the 2021 tax bracket?

How We Make MoneyTax rateSingleMarried filing jointly or qualifying widow10%$0 to $9,950$0 to $19,90012%$9,951 to $40,525$19,901 to $81,05022%$40,526 to $86,375$81,051 to $172,75024%$86,376 to $164,925$172,751 to $329,8504 more rows•Apr 7, 2022

What is the tax rate for employees?

Payroll Tax Rates That means that combined FICA tax rates for 2021 and 2022 are 7.65% for employers and 7.65% for employees, bringing the total to 15.3%.Jan 13, 2022

Is there a Medicare tax limit?

Income tax caps limit do not apply to Medicare taxes, but Social Security taxes have a wage-based limit—meaning, they don't apply to earnings above a certain amount. That amount gets adjusted annually, reflecting inflation.

How do I calculate my self-employment tax?

As noted, the self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings. Self-employment tax is not the same as income tax. For the 2021 tax year, the first $142,800 of earnings is subject to the Social Security portion.

Do I have Medicare if I pay Medicare tax?

According to the Internal Revenue Service (IRS), taxes withheld from your pay help pay for Medicare and Social Security benefits. If you're self-employed, you generally still need to pay Medicare and Social Security taxes. Payroll taxes cover most of the Medicare program's costs, according to Social Security.

How do you calculate FICA and Medicare tax 2021?

In other words, for both 2022 & 2021, the FICA tax rate is 15.30% which is split equally between the employer and employee. So Employer deducts the FICA tax of 7.65%. (6.2% for Social Security and 1.45% for Medicare) from wages of an employee and deposits, the combined contribution (its own 7.65%) totalling 15.3%.Feb 12, 2021

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.Feb 18, 2022

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you are required to pay the Medicare tax regardless of your or your employer’s citizenship. Th...

Are tips subject to Additional Medicare Tax?

Tips are subject to Additional Medicare Tax in certain situations. If the amount of tips, when combined with other wages, exceeds the minimum thres...

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA tax?

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

Does Everyone Pay Medicare Tax?

If your income is reported for tax filing purposes, then you will typically pay the Medicare tax.

Is There a Limit on Medicare Tax?

Unlike Social Security taxes, there is no limit on how much of your income is subject to Medicare taxes. The Medicare tax rate applies to all earned income and taxable wages, and there is no minimum income required to be subject to Medicare taxes.

How Is Medicare Tax Calculated?

The Medicare tax rate is determined by the IRS and is subject to change. To calculate the Medicare tax, multiply your earnings by 0.0145. So if your biweekly pay is $2,000, your Medicare tax will be $29 (2,000 x 0.0145 = 29).

What if I Have Additional Medicare Tax Questions?

You may call 1-800-MEDICARE (1-800-633-4227) with any additional questions about Medicare.

What is Medicare tax?

Medicare tax is a payroll tax that funds the Medicare Hospital Insurance program. Employers and employees each pay Medicare tax at a rate of 1.45% with... Menu burger. Close thin.

What is the Medicare surtax rate?

It is not split between the employer and the employee. If your income means you’re subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000.

When did Medicare HI start?

Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks. Since 1966 the Medicare HI tax rate has risen, though it’s still below the Social Security tax rate.

What is the Social Security tax for 2017?

As of 2017, the employee share of Social Security and Medicare taxes is 7.65%. If you make over $200,000, remember to account for the Additional Medicare Tax. It may seem like a lot of trouble now, but all this tax withholding is designed to give you a safety net when you reach retirement.

Is there a limit on Medicare taxes?

Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes. Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

What is the tax rate for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your paycheck. There are two ways that you may see the Medicare payroll deduction applied to your paycheck.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

What is the Medicare tax rate?

The standard Medicare tax is 1.45 percent, or 2.9 percent if you’re self-employed. Taxpayers who earn above $200,000, or $250,000 for married couples, will pay an additional 0.9 percent toward Medicare.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

Social Security

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

Medicare

Unlike Social Security, Medicare taxes do not have a wage base. Instead, Medicare has an additional withholding tax for employees who earn more than a set amount. In 2021, this base amount is $200,000 (single). Therefore, employees who earn more than $200,000 in 2021 pay 1.45% and an additional 0.9% to Medicare.

Self-employed tax

If you are self-employed, pay the entire cost of payroll taxes (aka self-employment taxes ). And, pay the additional 0.9% Medicare tax, too, if you earn more than the threshold per year.