When you are self-employed, then: Medicare tax = $8,000 × 2.9%= $232.00 So total FICA tax (social security and Medicare tax) a person (employer and employee) or self-employed s has to pay on monthly gross pay of $8,000 is $612.00, $1,224.00 respectively.

How much Fica do I pay if I am self employed?

So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%. Self-employed workers get stuck paying the entire FICA tax on their own.

What is the Medicare tax rate for self employed?

The Additional Medicare Tax rate is 0.90% and it applies to employees’ (and self-employed workers’) wages, salaries and tips. So any part of your income that exceeds a certain amount gets taxed for Medicare at a total rate of 2.35% (1.45% + 0.90%).

How much is FICA tax on social security?

So each party pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%. Self-employed workers get stuck paying the entire FICA tax on their own. For these individuals, there’s a 12.4% Social Security tax, plus a 2.9% Medicare tax.

What is the 2019 FICA tax rate for self-employed?

2019 FICA Tax Rate for Self-Employed. The self-employed person's FICA tax rate for 2019 (January 1 through December 31, 2019) is 15.3% on the first $132,900 of net income plus 2.9% on the net income in excess of $132,900.

How is FICA calculated for self-employed?

FICA tax for the self-employed. The self-employed don't have an employer to collect and pay FICA taxes. Instead, you must pay both the employer and worker amounts (15.3% total), and deduct one-half of the self-employment taxes on your personal tax return.

What is self-employed FICA rate?

2021 FICA Tax Rate for Self-Employed The self-employed person's FICA tax rate for 2021 (January 1 through December 31, 2021) is 15.3% on the first $142,800 of net income plus 2.9% on the net income in excess of $142,800.

Do self-employed pay Social Security and Medicare?

Do I still have to pay Social Security and Medicare taxes? Yes. You pay in the form of Self-Employment Contributions Act (SECA) taxes, reported on your federal tax return.

How do you calculate FICA Medicare?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

Do sole proprietors pay FICA?

What is the self-employment tax? If you're a sole proprietor or a partner or an LLC member, you're not considered to be an employee. You get no W-2 and nothing is withheld from your pay for FICA or medicare taxes.

What is Medicare tax rate?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

How do independent contractors pay Social Security and Medicare?

Independent contractors contribute to Social Security and Medicare through the self-employment tax (SET). Since ICs have no employer, they pay both the employer and the employee shares of the Social Security and Medicare contributions.

Do self-employed pay Social Security quarterly?

Because you're self-employed, you'll be expected to pay estimated taxes each quarter, as well as filing your annual return. Your quarterly estimated tax payments should include amounts to cover both your Social Security and Medicare tax obligations, as well as your estimated income tax bill.

How does a 1099 employee pay Social Security?

Income you earn on a 1099 is not subject to tax withholding, including the Social Security Insurance tax. However, this doesn't mean you don't have to pay it. Instead, you calculate your SSI tax on a Schedule SE with your federal tax return.

How do you calculate FICA and Medicare tax 2020?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

What is the FICA rate for 2021?

7.65%For 2021, the FICA tax rate for employers is 7.65%—6.2% for OASDI and 1.45% for HI (the same as in 2020).

Is FICA based on gross or net income?

FICA Taxes Calculate FICA withholding using gross wages with no reductions for withholding allowances or pre-tax deductions. The Social Security rate as of 2014 was 6.2 percent. Another 1.45 percent is taken out for Medicare, giving a combined rate of 7.65 percent.

What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is Self-Employment Tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.

How much is Medicare tax for 2021?

The amount increased to $142,800 for 2021. (For SE tax rates for a prior year, refer to the Schedule SE for that year). All your combined wages, tips, and net earnings in the current year are subject to any combination of the 2.9% Medicare part of Self-Employment tax, Social Security tax, or railroad retirement (tier 1) tax.

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

Does the 1040 affect self employment?

This deduction only affects your income tax. It does not affect either your net earnings from self-employment or your self-employment tax. If you file a Form 1040 or 1040-SR Schedule C, you may be eligible to claim the Earned Income Tax Credit (EITC).

Is self employment tax included in Medicare?

Self-Employment Tax (Social Security and Medicare Taxes) It should be noted that anytime self-employment tax is mentioned, it only refers to Social Security and Medicare taxes and does not include any other taxes that self-employed individuals may be required to file. The list of items below should not be construed as all-inclusive.

What is FICA tax?

FICA tax is Social Security/Medicare tax on employment ; Self-employment tax (sometimes called SECA) is Social Security/Medicare tax on self-employment. Also note that your employer pays half of the FICA tax due, while you as a self-employed individual must pay the entire amount of Social Security/Medicare on your self-employment income.

How much tax do you pay if you are self employed?

If you are self-employed, you pay self-employment tax (SECA) based on your net income (profit) from your business. You pay this tax the rate of 12.6% of that income. You don't have to pay this tax as you go since you don't have to withhold it from your business income. You don't get a paycheck from your business since you are not an employee.

What line is the $3720 on my 1040?

The $3720 you owe as self-employment tax is included on Line 27 of your personal Form 1040, and is included with any income tax you owe to determine your total tax bill for the year. If your income from employment and self-employment is greater than the Social Security maximum, you still must continue to pay Medicare tax.

What is a self employed individual?

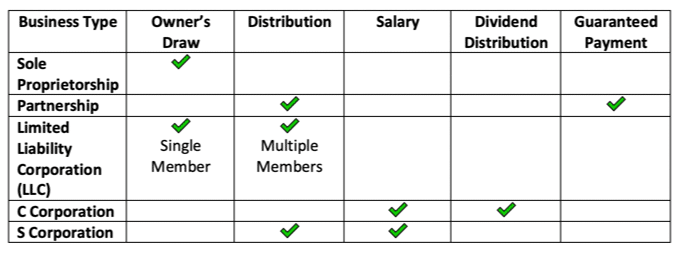

A self-employed individual can be someone who runs a business as a sole proprietor, LLC owner, or partner in a partnership. You may not have a formal business structure, but you report your business taxes on Schedule C with your personal tax return.

Do you have to pay taxes on self employment?

You must pay self-employment tax on the net profit of your employment if you still owe these taxes after considering your total income for the year. You must pay these taxes on your total income. But you can't over-pay unless your employer has made a calculation error. Here's a more detailed explanation of how the process ...

Is Medicare taxed if you are self employed?

If you are self-employed and you also earn wages or salary from employment, your Social Security and Medicare eligibility and total self-employment tax is affected. You are self-employed if you are making money in your own business, as an independent contractor, freelancer, sole proprietor, partner in a partnership, ...

Is Social Security tax deducted from my taxes?

Finally, the amount already paid from your employment is deducted from the total Social Security/Medicare tax owed. If there is anything left, it is due to self-employment tax, on your personal tax return.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

How many parts are there in self employed tax?

The self-employed tax consists of two parts:

How Much Is the Medicare Tax Rate in 2021?

The 2021 Medicare tax rate is 2.9%. You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Learn more.

How is Medicare financed?

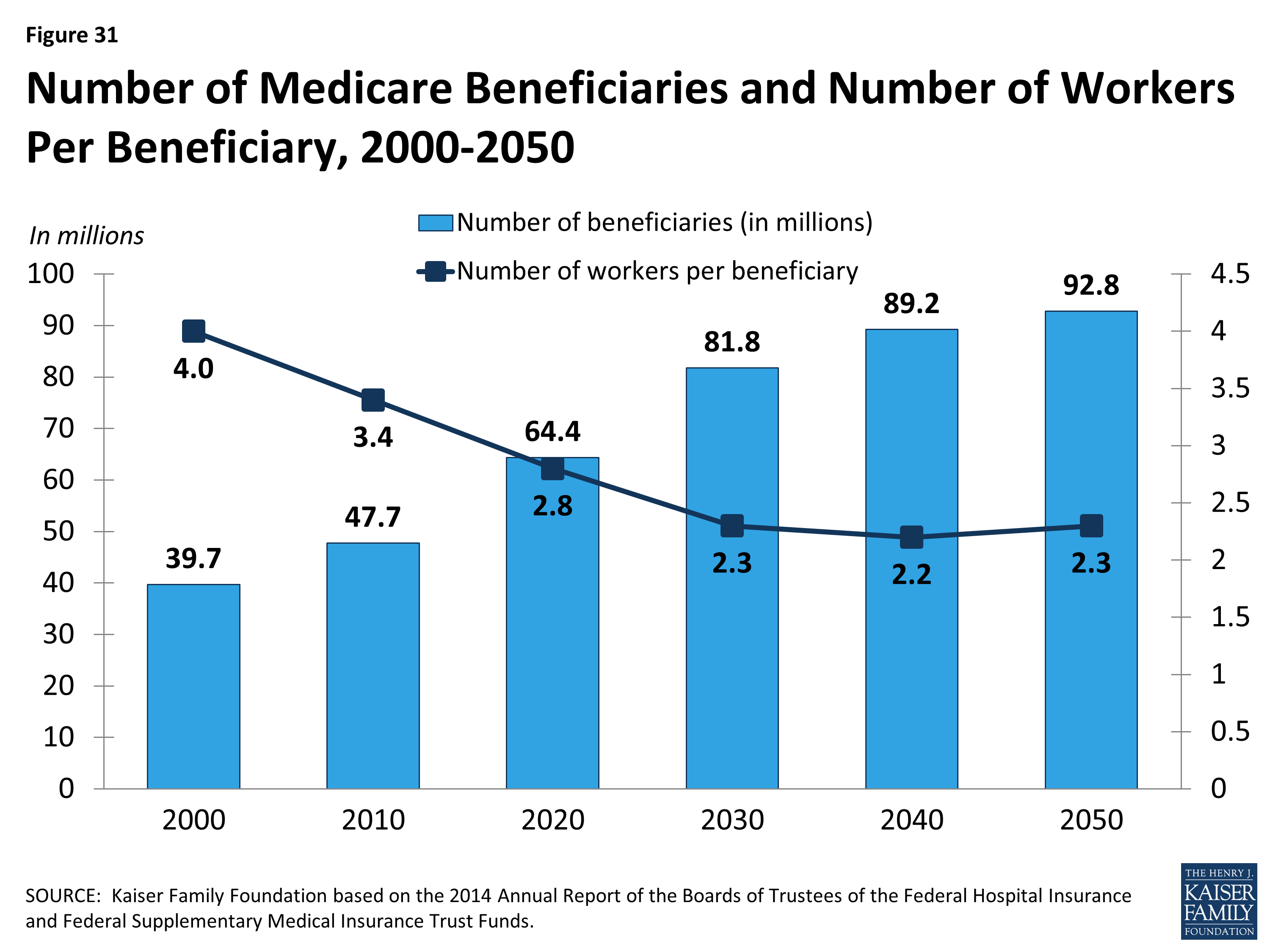

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What are the taxes that are withheld from paychecks?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

What is the tax for self employed?

must pay taxes to fund Social Security and Medicare. For self-employed individuals, this is called Self-Employment Tax, sometimes called SECA Tax. It's similar to FICA taxes (Social Security and Medicare taxes paid by employees and employers). 1 .

What is My Income for Self-Employment Tax?

Business owners pay income taxes on their business income in different ways. The business income for self-employment tax purposes depends on the type of business:

How Is SECA Tax Calculated for Income Tax Purposes?

The amount of SECA tax is calculated and included in the owner's personal tax return in several steps:

How Does SECA Tax Work If I Also Have Employment Earnings?

You may get a paycheck from an employer as well as having a side business that is profitable and gets you Social Security benefits. In general, your FICA earnings are considered first for Social Security benefits, but it's a little more complicated than that.

How is SECA tax calculated?

The amount of SECA tax is calculated and included in the owner's personal tax return in several steps: Step 1: The business owner's taxable income is calculated, depending on the type of business owned, as described above. Step 2: This income is used to calculate self-employment tax by using Schedule SE.

What is Schedule SE?

Schedule SE is used to calculate your self-employment tax liability for your tax return. This calculation includes a deduction of half the amount of tax from your adjusted gross income. This deduction reduces your self-employment tax liability, but it doesn't change the amount for benefit calculations. Social Security Tax.

Where is half of self employment tax deducted?

Step 3: Half of the calculated amount of the self-employment tax is deducted from the individual's taxable income on page 1 of the 1040 form.