How much does Medicare coverage cost?

Most people get Medicare Part A for free because they’ve been in the workforce for at least 10 years and paid Medicare taxes as a payroll deduction. If you don't qualify for free Medicare Part A, monthly costs can range from $259 to $471 based on how much you or a spouse has already paid in Medicare taxes.

How much is the standard Medicare premium?

The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

What is the best health insurance for Medicare?

To determine the metros with the best health insurance coverage in the ... The share of the population covered by each type of insurance — Medicare, Medicaid, VA, employer, direct-purchase ...

Is there a monthly premium for Medicare?

What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance (

What was the monthly cost of Medicare in 2019?

$135.50The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium. This higher Part B premium is called the Income-Related Monthly Adjusted Amount (IRMAA).

What is the average monthly cost for Medicare?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

What was the cost of Medicare Part B in 2019?

$135.50The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

How much was the Medicare deduction from Social Security in 2019?

NOTE: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings.

Is Medicare premium based on income?

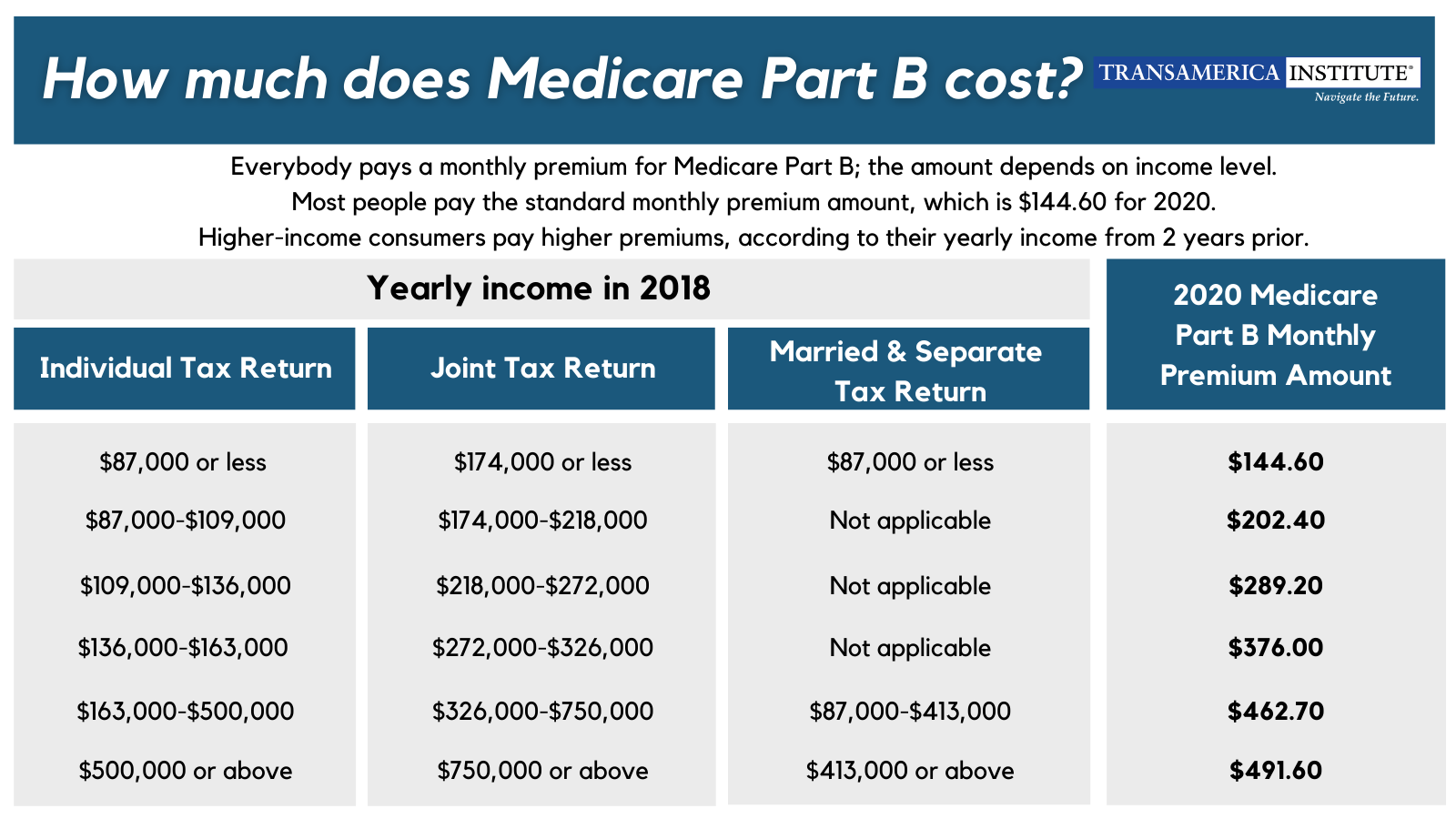

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

How much does Medicare cost out of your Social Security check?

How much is taken out of your Social Security check for Medicare? Most Medicare beneficiaries qualify for premium-free Part A. However, the Medicare Part B premium is deducted from your Social Security check if you are receiving Social Security benefits. In 2022, the Part B premium is $170.10.

How much money is taken out of Social Security for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

How much is deducted for Medicare?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What amount of Social Security is taxable in 2019?

Maximum Taxable Earnings Each YearYearAmount2016$118,5002017$127,2002018$128,4002019$132,9004 more rows

How are Medicare premiums calculated for 2019?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from $134 in 2018.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

Will Medicare IRMAA increase in 2020?

It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020. This means that fewer people may have to pay the IRMAA, and the adjustment will delay when other beneficiaries are required to pay more for their 2020 Part B premiums.

How much is Medicare premium in 2019?

The standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018. A small number of participants will pay less than this if the increases in their Social Security benefits in recent years have been insufficient to keep up with the rising cost of Medicare premiums.

How much is Medicare Part A deductible?

You can see all the options in the table below: Medicare Charge. 2019 Cost (Change From 2018) Hospital deductible. $1,364 ( up $24) Coinsurance for days 61-90 of hospital stay.

How much does Medicare pay if you don't qualify?

Those who don't qualify have to make premium payments. Those who have 30 to 39 quarters of qualifying work will pay $240 per month, up $8 from last year. If you have less than 30 quarters, then the monthly charge jumps to $437, up $15 from 2018. If you end up using your Medicare Part A coverage, then you'll also have to pay deductibles ...

Can Medicare retirees afford to pay more?

Many Medicare participants are retired and can't afford to pay any more than they have to for their healthcare coverage. Although 2019's increases to Medicare costs are relatively modest, they'll still put some strain on the finances of millions of older Americans in the coming year.

Can Medicare Advantage be used as a replacement for Medicare?

Others use Medicare Advantage as a substitute for traditional Medicare. Private insurers offer both Medicare Advantage and Part D plans, and so costs can vary greatly depending on the level of coverage and the insurance company. Although costs generally go up over time, you can sometimes find cheaper plan alternatives.

Is Medicare free for older people?

However, Medicare isn't free , and the costs involved are often surprising to those who aren't familiar with the program.

Does Medicare have a monthly premium?

One of the most important parts of Medicare often comes with no monthly premium for participants. Hospital insurance coverage, also known as Medicare Part A, is free to those who had 40 quarters of qualifying employment for which they paid Medicare payroll taxes during their careers or are married to a spouse who did so.

What you'll pay for Part A hospital coverage

One of the most important parts of Medicare often comes with no monthly premium for participants. Hospital insurance coverage, also known as Medicare Part A, is free to those who had 40 quarters of qualifying employment for which they paid Medicare payroll taxes during their careers or are married to a spouse who did so.

What you'll pay for Part B medical coverage

In contrast to Part A, everyone pays a monthly premium for medical coverage under Medicare Part B, which covers doctor visits and most outpatient procedures and services. The standard premium is set to rise to $135.50 per month in 2019, up $1.50 per month from 2018.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much did health insurance cost in 2019?

The net cost of health insurance declined 3.8% in 2019 largely because of a suspension of the health insurance providers’ tax. Private health insurance spending (31% of total health care spending) increased 3.7% to $1.2 trillion in 2019, which was slower than the 5.6% rate of growth in 2018.

How much is healthcare spending in 2019?

The share of the economy devoted to health spending was relatively stable in 2019, at 17.7% compared with a 17.6% share in 2018. The 4.6% growth in healthcare expenditures was faster than the 4.0% overall economic growth as measured by Gross Domestic Product (GDP) in 2019. The growth in total national healthcare expenditures in 2019 reached $3.8 ...

What was the health care spending rate in 2019?

Health care spending growth was faster in 2019 for the three largest goods and service categories – hospital care, physician and clinical services, and retail prescription drugs. Hospital spending (31% of total health care spending) growth accelerated in 2019, increasing 6.2% to $1.2 trillion compared to 4.2% growth in 2018.

What is the national healthcare spending rate?

CMS Office of the Actuary Releases 2019 National Health Expenditures. Total national healthcare spending in 2019 grew 4.6%, which was similar to the 4.7% growth in 2018 and the average annual growth since 2016 of 4.5%, according to a study conducted by the Office of the Actuary at the Centers for Medicare & Medicaid Services (CMS) ...

What was the decline in the cost of health insurance in 2019?

The net cost of health insurance declined 3.8% in 2019 largely because of a suspension of the health insurance providers’ tax.

How much did the federal government spend on healthcare in 2019?

Expenditures in these areas follow: Federal government’s spending on health care increased 5.8% in 2019, up slightly from a rate of 5.4% in 2018. The faster growth in 2019 was driven mainly by federal general revenue and Medicare net trust fund expenditures that increased 9.4% in 2019 after growth of 6.1% in 2018.

How much is prescription drug spending?

Retail prescription drug spending (10% of total health care spending) increased 5.7% in 2019 to $369.7 billion, accelerating from growth of 3.8% in 2018. Faster growth in use, or the number of prescriptions dispensed, contributed to the acceleration in total retail prescription drug spending, as prices for prescription drugs declined for ...

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board. You're eligible to get Social Security or Railroad benefits but haven't filed for them yet. You or your spouse had Medicare-covered government employment.

What is premium free Part A?

Most people get premium-free Part A. You can get premium-free Part A at 65 if: The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

How much does Medicare cover?

Since Medicare only covers about 80% of your medical bills, many people add on a Medicare Supplement to pick up the remaining costs. The monthly premium for a Medicare Supplement will depend on which plan you choose, your age, your gender, your zip code, and your tobacco usage.

What will Medicare pay for in 2021?

2021 Medicare Part A Costs. Medicare Part A helps cover bills from the hospital. So, if you are admitted and receive inpatient care, Medicare Part A is going to help with those costs. If you’ve worked at least 10 years or can draw off a spouse who has, Medicare Part A is free to have.

What is Medicare MSA?

A Medicare MSA, a type of Medicare Advantage plan, is another option for seniors. The most widely available plan is from Lasso Healthcare, and it is $0 premium. An MSA combines high-deductible health coverage with an annually funded medical savings account.

How much is Medicare Part A deductible for 2021?

The Medicare Part A deductible, as well as the coinsurance for care, fluctuates slightly every year, but here are the current costs for 2021: $1,484 deductible. Days 1-60: $0 coinsurance. Days 61-90: $371 coinsurance. Days 91+: $742 coinsurance per “lifetime reserve day,” which caps at 60 days. Beyond lifetime reserve days: You pay all costs.

How much does Medicare Part B cost in MA?

Often times, MA plans also include a drug benefit, so you also replace Part D. However, you still must pay the $148.50 monthly premium for Medicare Part B. MA premiums vary, depending on which type of plan you choose, which area you’re in, and other similar factors.

How much is coinsurance for days 21 through 100?

For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in a benefit period will be $185.50 in 2021.

Is MA insurance low?

In general, MA premiums are quite low, and sometimes, they’re even $0. . While the monthly premium is very low or even $0, there are some things to consider before opting an MA plan. You can read about the pros and cons of Medicare Advantage here.