How much does Medicare Advantage cost a month?

Sep 15, 2018 · Specified Low-Income Medicare Beneficiary Program (SLMB) The SLMB program may help subsidize your Part B premiums only. The individual monthly income limit in 2017 is generally $1,226 and individual resources limit is $7,390 (the same as the QMB program). Qualifying Individual Program (QI)

What is a Medicare Advantage subsidy?

depend on: Whether the plan charges a monthly premium . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium (and the Part A premium if you don't have premium-free Part A). Whether the plan pays any of your monthly Medicare Part B (Medical Insurance)

Do Medicare Advantage plans have a premium?

May 28, 2021 · At a minimum Medicare Advantage (MA) plans cost the same amount as your monthly Medicare Part B premium: $170.10. If your annual income is over $91,000, you will pay a bit more. You may notice that some Medicare Advantage plans in your area have a zero-dollar ($0.00) premium.

What are the out-of-pocket costs in a Medicare Advantage plan?

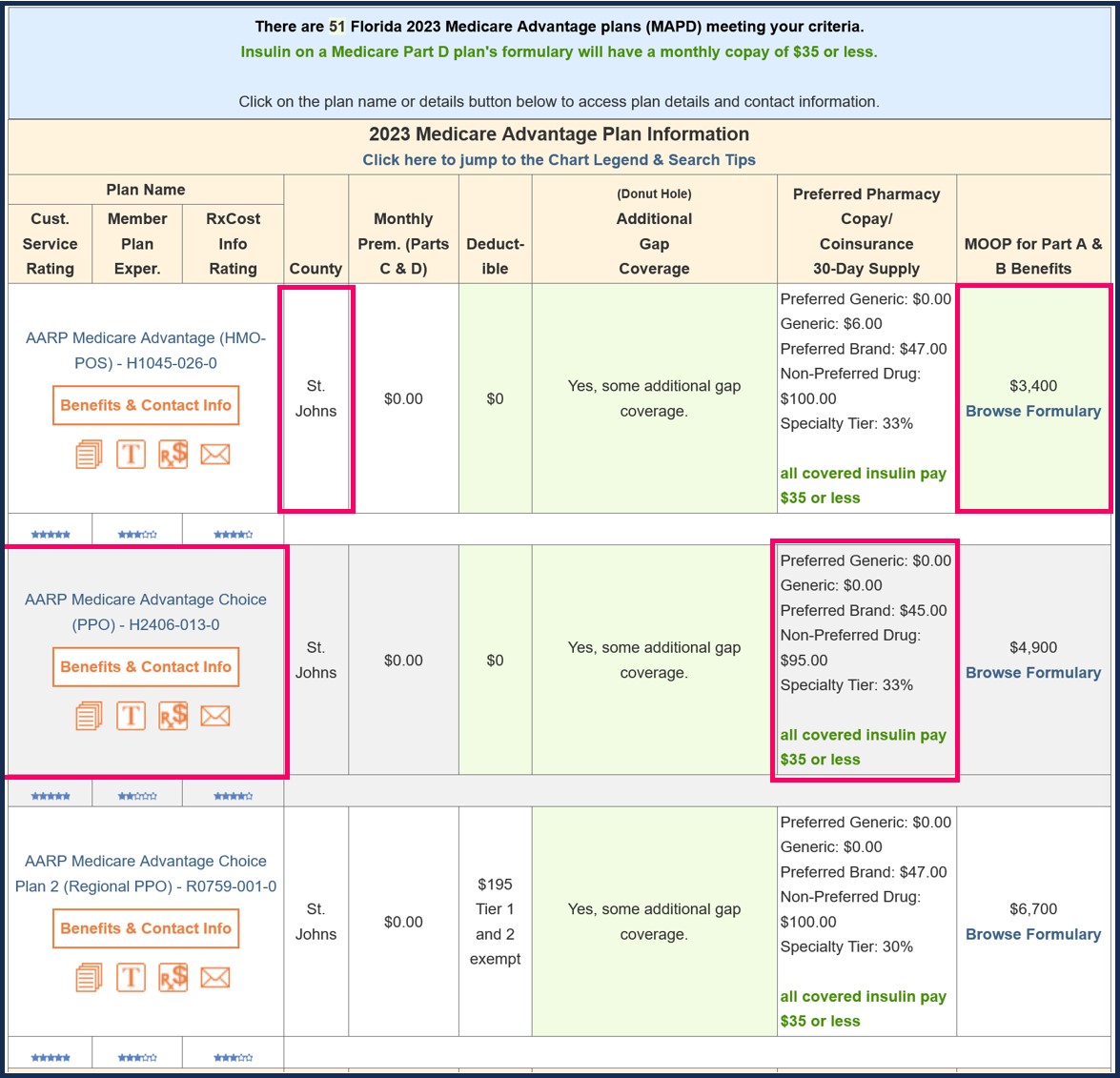

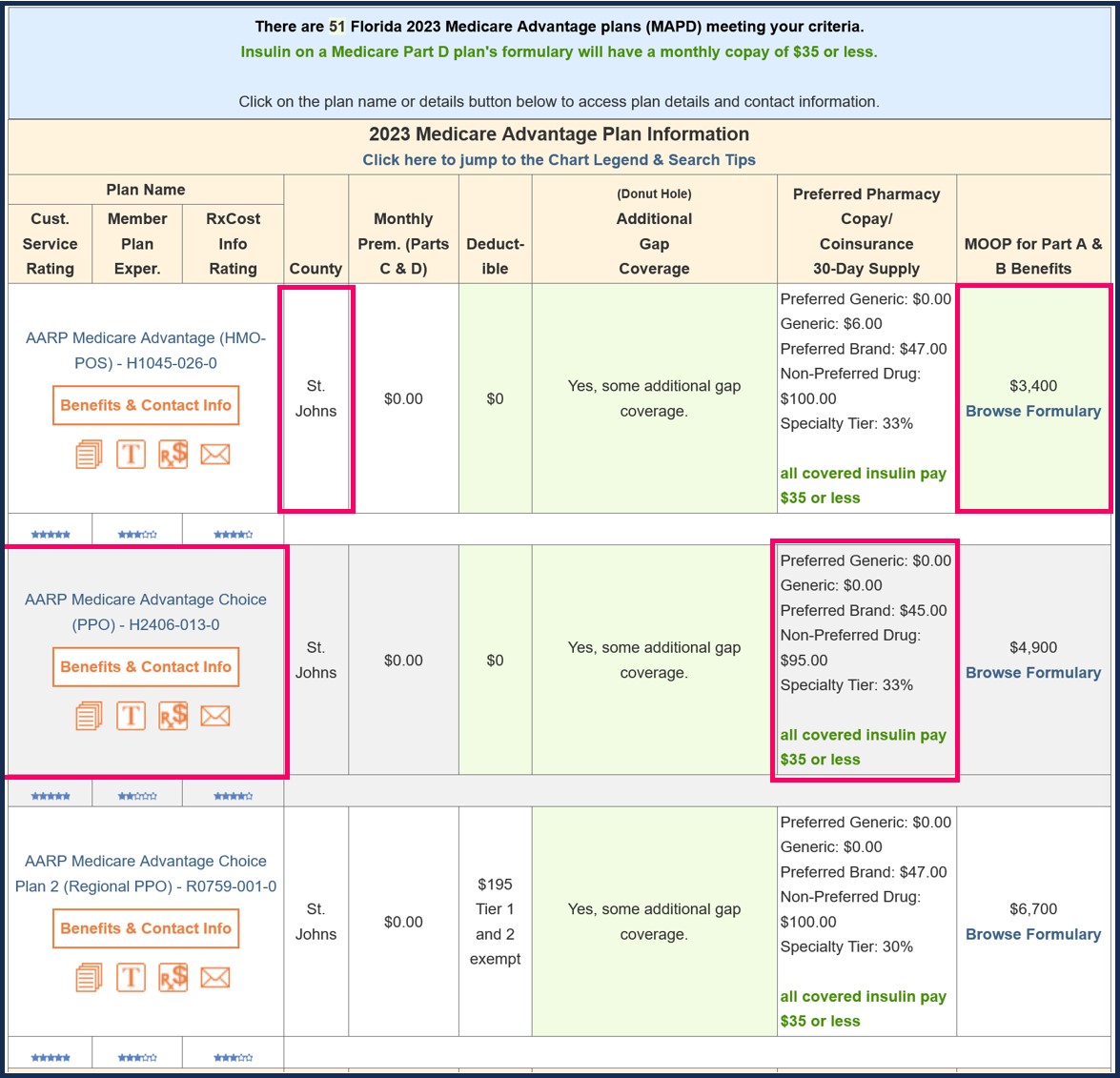

5 rows · Medicare Advantage Plans, sometimes called “Part C” are offered by Medicare-approved private ...

Is Medicare Advantage subsidized?

In Medicare Advantage, the government pays the plan sponsors a set amount per person per year, regardless of each individual's use of health-care services. Subsidies for Medicare Advantage long matched the average per-person costs of traditional Medicare, calculated county by county.

How do Medicare Advantage plans with no premium make money?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.Oct 6, 2021

What are the disadvantages to a Medicare Advantage Plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

What is the average cost of a Medicare Advantage plan?

According to CMS, the average Medicare Advantage premium is around $20 per month in 2021. Some plans have no premium at all, but your annual deductible and copayments/coinsurance may be higher.Sep 22, 2021

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Do you still pay Medicare Part B with an Advantage plan?

You continue to pay premiums for your Medicare Part B (medical insurance) benefits when you enroll in a Medicare Advantage plan (Medicare Part C). Medicare decides the Part B premium rate. The standard 2022 Part B premium is estimated to be $158.50, but it can be higher depending on your income.Nov 8, 2021

What is the average Medicare Part B premium?

$170.10The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

Does Medicare Advantage take the place of Medicare?

Medicare Advantage does not replace original Medicare. Instead, Medicare Advantage is an alternative to original Medicare. These two choices have differences which may make one a better choice for you.

What is Medicare Advantage?

The amount you are required to pay for each health care visit or service. Medicare Advantage plans typically include cost-sharing measures such as copayments and coinsurance, and the amounts of these costs can correlate with that of the premium. The type of plan.

How to save money on medicaid?

Saving money with Medicare Advantage 1 If you qualify for Medicaid, your Medicaid benefits can be used to help pay your Medicare Advantage premiums. 2 A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible. 3 If your Medicare Advantage plan includes a doctor and/or pharmacy network, you can save a considerable amount of money by staying within that network when receiving services. 4 Some Medicare Advantage plans may include extra health perks such as gym memberships. There is even the possibility of Medicare Advantage plans soon covering expenses like the cost of air conditioners, home-delivered meals and transportation.

What is a Medicare Savings Account?

A Medicare Savings Account (MSA) is a type of Medicare Advantage plan that deposits money into a savings account that can be used to pay for out-of-pocket expenses prior to meeting your deductible.

What to look for when shopping for Medicare Advantage?

When you are shopping for a Medicare Advantage plan, you may consider features such as a plan’s range of benefits and possible network rules. But above all else, perhaps the biggest thing you might consider is the cost of a plan. When it comes to Original Medicare (Medicare Part A and Part B), the cost of premiums is standardized across the board.

How much does vision insurance cost?

Vision insurance can typically cost around $20 per month or less. 3. Hearing plans. Unlike dental and vision insurance, hearing insurance plans are not a common insurance product. Some hearing aid companies may offer extended warranties, but the warranties apply only to the hearing aid product itself.

Which state has the lowest Medicare premium?

A closer look at 2021 data also reveals: Nevada has the lowest average monthly premium for Medicare Advantage Prescription Drug (MAPD) plans at $11.58 per month. The highest average MAPD monthly premium is in North Dakota, at $76.33 per month.

Does Medicare Advantage cover dental?

While a Medicare Advantage plan by law must cover the same benefits as Medicare Part A and Medicare Part B , benefits like prescription drugs, dental, vision and hearing can be covered at varying degrees (or not at all).

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

How much does Medicare Advantage cost in 2021?

At a minimum Medicare Advantage (MA) plans cost the same amount as your monthly Medicare Part B premium. For the 2021 plan year that’s $148.50. If your annual income is over $85,000, you will pay a bit more.

What are the advantages of Medicare Advantage?

The primary benefit of Medicare Advantage is extra benefits. And, if you are a healthy senior, the additional benefits and cost savings really add up. But, there are some serious disadvantages as well, including network provider limitations, costly inpatient copays, and no coverage traveling away from home.

What is the most important thing to understand about Medicare Advantage plans?

One of the most important things to understand about Medicare Advantage plans is how much it costs to use health care services. Like all private health insurance, covered services (i.e., doctor visits) have copayment or coinsurance out-of-pocket costs.

How many types of Medicare premiums are there?

In the federal Medicare program, there are four different types of premiums. ... adjust annually. In addition to the monthly premiums, you will pay the deductibles. A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share.... , copayments.

What is Medicare Part B?

If you enroll in a Medicare Advantage plan you must continue to pay your Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care.... premium.

Which is better, Medicare or Medicare Part A?

If you are not healthy, Original Medicare is the better option in terms of cost. Hospital insurance, covered by Medicare Part A. Medicare Part A is hospital inpatient coverage for people with Original Medicare , whereas Part B is medical coverage for doctor visits, tests, etc.... , is very expensive.

What is a copayment?

A copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service.... , and coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... outlined in your plan’s summary of benefits.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

What insurance company pays for Medicare Advantage?

When a Medicare beneficiary enrolls in a Medicare Advantage plan, usually sponsored by private insurance companies like Blue Cross, Blue Shield, Health Net, Kaiser, UnitedHealthcare, et al, Medicare pays the private insurer a monthly capitation amount to accept the responsibility of all the claims that might be generated by the beneficiary.

What is the foundation of Medicare monthly rate?

The foundation of the monthly rate is the health care claims Medicare pays for beneficiaries in Original Medicare Fee for Service coverage. In an effort to reduce the growth in spending on Medicare Advantage plans, the Congressional Budget Office (CBO) undertook a review of how the plans are paid and specifically the quality bonuses.

How much does Medicare pay per month?

Many people are shocked to learn that the federal government, through Medicare, can pay the Medicare Advantage plans over $1,000 per month for each enrollment per individual.

When did Medicare reduce quality bonus payments?

Reduce Quality Bonus Payments to Medicare Advantage Plans, December 13, 2018. Roughly one-third of all Medicare beneficiaries are enrolled in the Medicare Advantage program under which private health insurers assume the responsibility for, and the financial risk of, providing Medicare benefits.

Which CMS pays higher rated plans?

The Centers for Medicare & Medicaid Services (CMS) pays higher-rated plans more in two ways. First, plans that have composite quality scores with at least 4 out of 5 stars are paid on the basis of a benchmark that is 5 percent higher than the standard benchmark.

Why are health care payments adjusted?

Payments are further adjusted to reflect differences in expected health care spending that are associated with beneficiaries’ health conditions and other characteristics. Plans also receive additional payments—referred to as quality bonuses—that are tied to their average quality score.

Is Medicare Advantage free in California?

Medicare Advantage Plans Are Not Free, Federal Government Subsidies In California. As the Medicare Annual Enrollment Period opens in the fall of each year, many Medicare beneficiaries will see numerous plans with a very low or $0 monthly premiums. This has led to confusion that the Part B premium Medicare beneficiaries pay each month covers ...