Typically, employers and employees each pay 6.2% in Social Security tax and 1.45% in Medicare tax, but you won't owe this on your unemployment income. As for state taxes on unemployment benefits, the rules vary depending on where you live.

How much unemployment tax do employers pay?

· The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural …

How much Medicare tax do I have to pay for employees?

· Medicare taxes for the self-employed Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2 The self-employed tax consists of two parts: 12.4% for Social Security

What is the current Medicare rate for employers?

· The 1099 tax rate consists of two parts: 12.4% for social security tax and 2.9% for Medicare. The self-employment tax applies evenly to everyone, regardless of your income bracket. For W-2 employees, most of this is covered by your employer, but not for the self-employed!

What is the Medicare surtax on wages and self-employment income?

· Under SUTAs, tax rates in each state range from a low of 1% to 3.4%. The taxable wage base, or amount of wages that are taxable under state unemployment laws, also varies by state. Currently the lowest is at the $7,000 FUTA rate but the taxable wage base goes to a high of $47,300 in Washington State. Employers must pay both federal and state ...

What is the employer Medicare tax rate for 2020?

1.45 percentThe FICA tax rate, which is the combined Social Security rate of 6.2 percent and the Medicare rate of 1.45 percent, remains 7.65 percent for 2020 (or 8.55 percent for taxable wages paid in excess of the applicable threshold).

Do employees and employers pay Medicare tax?

Generally, if you are employed in the United States, you must pay the Medicare tax regardless of your or your employer's citizenship or residency status. These taxes are deducted from each paycheck, and your employer is required to deduct Medicare taxes even if you do not expect to qualify for Medicare benefits.

How much did the employee contribute to Medicare?

The Medicare tax rate is 1.45% of an employee's wages. Again, Medicare is an employer and employee tax. You must withhold 1.45% from an employee's pay and contribute a matching 1.45%. Altogether, Medicare makes up 2.9% of the FICA tax rate of 15.3%.

What is the total percentage paid by you and your employer for Social Security and Medicare?

If you work for an employer, you and your employer each pay a 6.2% Social Security tax on up to $147,000 of your earnings. Each must also pay a 1.45% Medicare tax on all earnings. If you're self-employed, you pay the combined employee and employer amount.

How is Medicare tax calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.

What is Medicare tax in paycheck?

Medicare tax: 1.45%. Sometimes referred to as the “hospital insurance tax,” this pays for health insurance for people who are 65 or older, younger people with disabilities and people with certain conditions. Employers typically have to withhold an extra 0.9% on money you earn over $200,000. Federal income tax.

Does everyone pay Medicare tax?

Who pays the Medicare tax? Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

How do you calculate Medicare tax 2021?

The FICA withholding for the Medicare deduction is 1.45%, while the Social Security withholding is 6.2%. The employer and the employee each pay 7.65%. This means, together, the employee and employer pay 15.3%. Now that you know the percentages, you can calculate your FICA by multiplying your pay by 7.65%.

What percentage of wages are taxed?

There are seven tax brackets for most ordinary income for the 2021 tax year: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

How do I calculate Medicare wages from my paystub?

The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction. Dental – subtract the YTD employee dental insurance deduction.

Why is Medicare taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

Does employer or employee pay additional Medicare tax?

employerAn employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee.

Do I have to pay Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

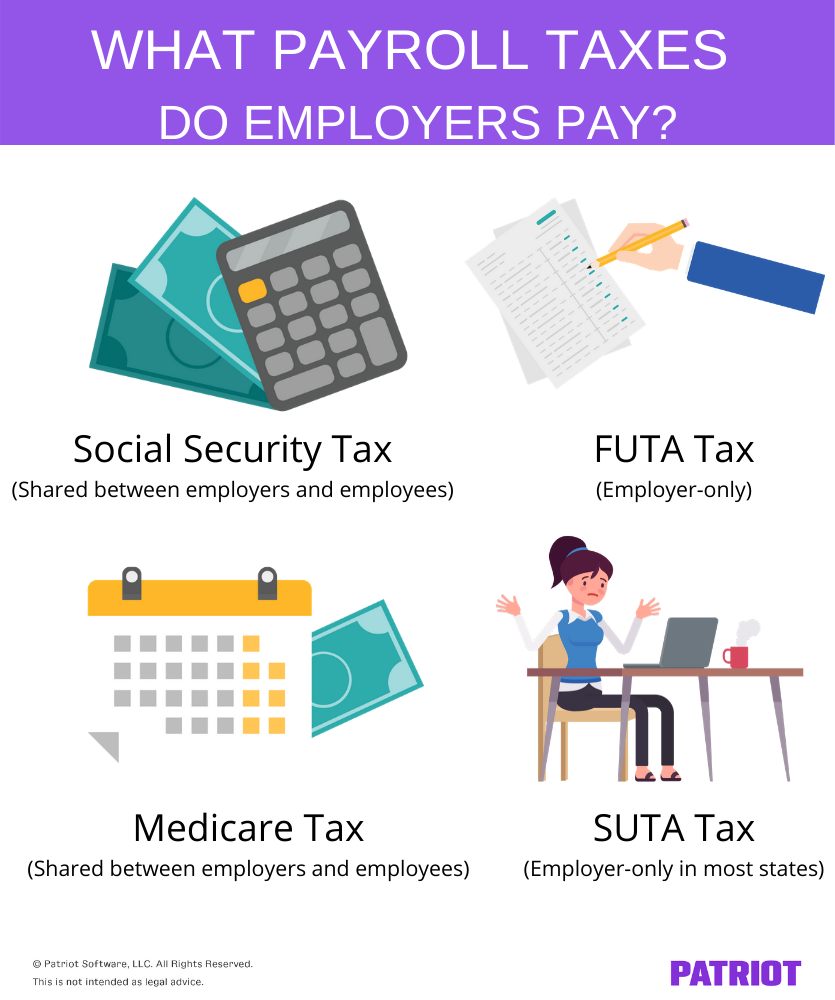

What taxes are employers responsible for?

An employer's federal payroll tax responsibilities include withholding from an employee's compensation and paying an employer's contribution for Social Security and Medicare taxes under the Federal Insurance Contributions Act (FICA). Employers have numerous payroll tax withholding and payment obligations.

Does Medicare come out of my paycheck?

What percentage of a person's income is withheld from their paycheck for Medicare and Social Security taxes? Employers withhold a total of 7.65% of an employee's pre-tax wages for Medicare and Social Security. Of that amount, 6.2% goes to Social Security and the remaining 1.45% goes to Medicare.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

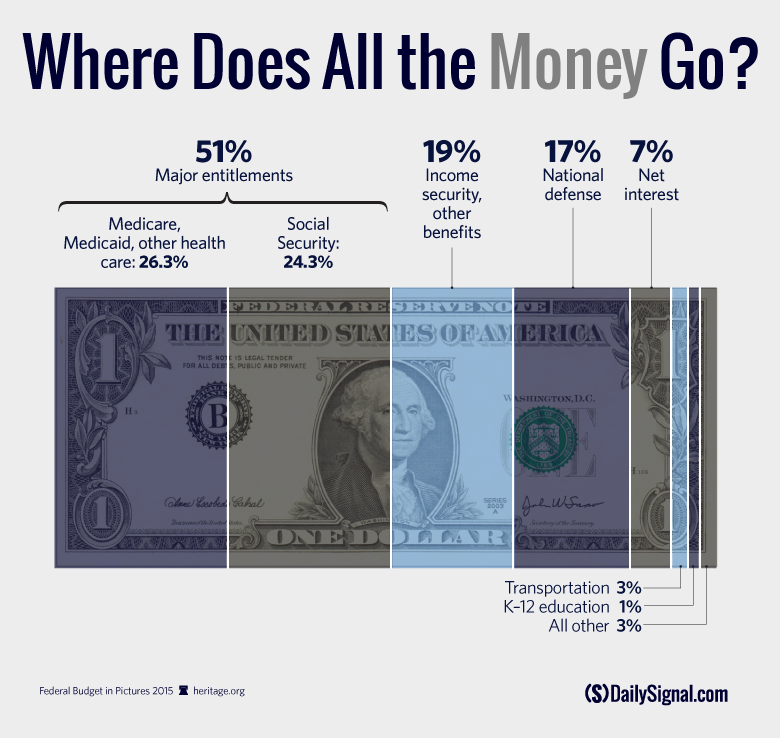

What is the federal unemployment tax?

There are two main types of unemployment taxes — federal and state. The Federal Unemployment Tax Act (FUTA) is administered by the Department of Labor. All businesses must pay FUTA taxes unless they are government or educational organizations or are exempt as a qualified 501 (c)3 charitable or religious organization under IRS guidelines.

Do employers pay unemployment taxes?

Employers are fully responsible for unemployment taxes. Unlike other salary deductions, employees do not contribute to unemployment tax payments. Businesses make payments for FUTA through their federal payroll tax contributions. For SUTA, through state payroll tax contributions.

What is unemployment insurance?

When employees are out of work through no fault of their own, unemployment insurance provides monies to tide an individual over until they can find another position. We’re all familiar with unemployment compensation and how it helps workers bridge the gap between jobs. From a business owner’s point of view there are some basics ...

How long is a probationary period for unemployment?

When you hire a new employee, it may be advantageous to make sure your new hire probationary period is well within the base period. If your probationary period is 6 months, for example, but the base period to be eligible for unemployment compensation is 3 months in your state, you’ll be responsible for that person’s claim.

What is experience rating?

These are called ‘experience ratings’ since as a company experiences claims, the state is better able to assess their risk and set a payment rate that’s appropriate. How and how often experience ratings are determined and reevaluated varies by state.

What to do if an employee quits?

If an employee quits, ask for their resignation in writing, so you have a copy should they file for unemployment compensation. If the employee was fired for cause, make sure you have ample evidence of the rule violation that led to their dismissal.

Who is Riia O'Donnell?

Riia O’Donnell is a Human Resource professional with over 15 years of hands-on experience in every discipline of the field. A subject matter expert, she has written for the online HR market for over 8 years. Her first job, at age 15, was working the early morning shift at a local bakery on weekends.

What is the federal tax on unemployment?

The Federal Unemployment Tax Act (FUTA) is a federal law that imposes an unemployment tax on employers. FUTA tax is an employer-only tax. Employees do not have to pay into federal unemployment.

What is the maximum unemployment tax credit?

Most employers are eligible for a federal unemployment tax credit that reduces their FUTA tax rate. The largest credit you can receive is 5.4%. Employers with the maximum credit only have a rate of 0.6% (6% – 5.4%) on the first $7,000 of each employee’s wages.

What is a FUTA tax?

FUTA tax. The Federal Unemployment Tax Act (FUTA) is a federal law that imposes an unemployment tax on employers. FUTA tax is an employer-only tax. Employees do not have to pay into federal unemployment. Most employers have to pay FUTA tax. However, some employers are not required to. You must pay FUTA tax if you have:

How to calculate Medicare tax?

Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

Is Medicare tax indexed for inflation?

Medicare wages are reported on Form W-2 in box 5. As of tax year 2020, the threshold amounts aren't indexed for inflation. 2 They are: Filing Status.

How much does Barney earn?

Barney earned $75,000 in wages, which is below the $125,000 threshold for a married person filing separately, so he doesn't have wages in excess of the threshold amount. He doesn't have to pay any Additional Medicare Tax. But Betty's wages are $200,000.

What is net self employment income?

Net self-employment income is the total of all self-employment income after deductions for business expenses are taken on Schedule C, Schedule F, or Schedule E, which reports self-employment income from partnerships. The total self-employment income is then reduced by multiplying it by 92.35%.

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

Who is William Perez?

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification.

Social Security

Social Security taxes have a wage base. In 2021, this wage base is $142,800. The wage base means that you stop withholding and contributing Social Security taxes when an employee earns more than $142,800.

Medicare

Unlike Social Security, Medicare taxes do not have a wage base. Instead, Medicare has an additional withholding tax for employees who earn more than a set amount. In 2021, this base amount is $200,000 (single). Therefore, employees who earn more than $200,000 in 2021 pay 1.45% and an additional 0.9% to Medicare.

Self-employed tax

If you are self-employed, pay the entire cost of payroll taxes (aka self-employment taxes ). And, pay the additional 0.9% Medicare tax, too, if you earn more than the threshold per year.

How does unemployment tax work?

In brief, the unemployment tax system works as follows: Employers pay into the system, based on a percentage of total employee wages. You don't deduct unemployment taxes from employee wages. Most employers pay both federal and state unemployment taxes. Employers must pay federal unemployment taxes and file an annual report.

Do businesses pay unemployment taxes?

Businesses also may have to pay state unemployment taxes, which are coordinated with the federal unemployment tax. 1 . As an employer, your business is responsible for paying unemployment taxes to the IRS and making reports to the IRS on Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return.

What is an EIN number?

If your state collects this tax, you will need to register with your state. All businesses with employees must get a Federal Employer ID Number (EIN), to be used for all employment taxes. This ID number qualifies as the registration for your business and federal unemployment insurance payments.

When is the 940 due?

IRS Form 940 is due on January 31 of the year after the year of the report information. For example, the 940 for 2020 is due January 31, 2021. The best way to file by IRS E-file . The calculations for FUTA tax are complicated. A payroll processing service can help you figure out how much to pay and when.

What are fringe benefits?

Most fringe benefits, including wages and salaries, commissions, fees, bonuses, vacation allowances, sick pay, and the value of goods, lodging, food, and other non-cash benefits, and. Employer contributions to employee retirement plans, and. Other specific payments, as noted above. From this amount, deduct: