How Much Does Skilled Nursing Cost Through Medicare? Your out-of-pocket costs will depend on the number of days skilled nursing care is required.2 Days 1-20: $0 for each benefit period Days 21-100: $185.50 coinsurance per day of each benefit period

Full Answer

How much does coinsurance cost for a skilled nursing facility?

If you’re admitted to a skilled nursing facility, this is the breakdown of 2021 coinsurance costs: 1 Days 1 to 20: $0 daily coinsurance 2 Days 21 to 100: $185.50 daily coinsurance 3 Day 101 and beyond: all costs

What is Medicare coinsurance and how much does it cost?

Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Keep reading to learn more about Medicare coinsurance and how much you might pay based on the plans you’re enrolled in.

When does Medicare not cover skilled nursing facility costs?

If your stay in a skilled nursing facility longer than 100 days in a benefit period, Medicare generally doesn’t cover these costs. How can I get help paying skilled nursing facility costs?

What is the Medicare-approved amount?

The Medicare-approved amount is a predetermined amount of money that Medicare has agreed to pay for a covered service or item. Private Medicare plans, such as Medicare Advantage and Medicare Part D Prescription Drug Plans (PDP), may feature coinsurance of their own.

What is Medicare typical coinsurance?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items.

Do Medicare patients pay coinsurance?

Coinsurance is when you and your health care plan share the cost of a service you receive based on a percentage. For most services covered by Part B, for example, you pay 20% and Medicare pays 80%.

How many days will Medicare pay 100% of the covered costs of care in a skilled nursing care facility?

20 daysSkilled Nursing Facility (SNF) Care Medicare pays 100% of the first 20 days of a covered SNF stay. A copayment of $194.50 per day (in 2022) is required for days 21-100 if Medicare approves your stay.

What is the Medicare coinsurance amount for 2022?

Daily Coinsurance Costs for Medicare Part A in 2022 You pay $0 coinsurance for first 20 days and $194.50 for days 21 to 100.

What is the Medicare coinsurance rate for 2021?

$371Part A Deductible and Coinsurance Amounts for Calendar Years 2021 and 2022 by Type of Cost Sharing20212022Daily coinsurance for 61st-90th Day$371$389Daily coinsurance for lifetime reserve days$742$778Skilled Nursing Facility coinsurance$185.50$194.501 more row•Nov 12, 2021

What is the percentage of co insurance that Medicare applies for patient responsibility?

10% of the treatment cost.

How Long Will Medicare pay for home health care?

To be covered, the services must be ordered by a doctor, and one of the more than 11,000 home health agencies nationwide that Medicare has certified must provide the care. Under these circumstances, Medicare can pay the full cost of home health care for up to 60 days at a time.

What happens when Medicare hospital days run out?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

Does Medicare pay for the first 30 days in a nursing home?

If you're enrolled in original Medicare, it can pay a portion of the cost for up to 100 days in a skilled nursing facility. You must be admitted to the skilled nursing facility within 30 days of leaving the hospital and for the same illness or injury or a condition related to it.

What is the Medicare Plan G deductible for 2022?

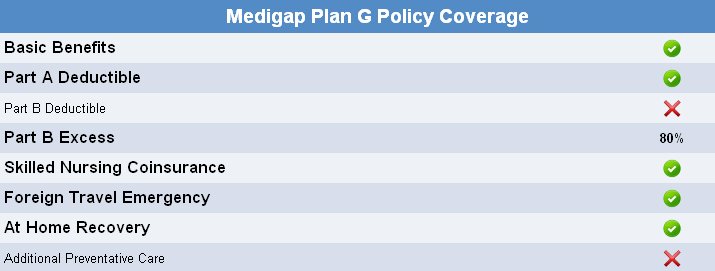

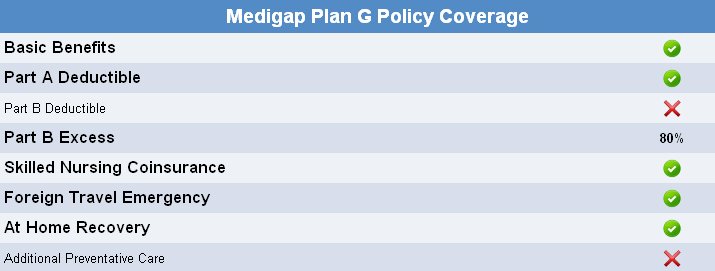

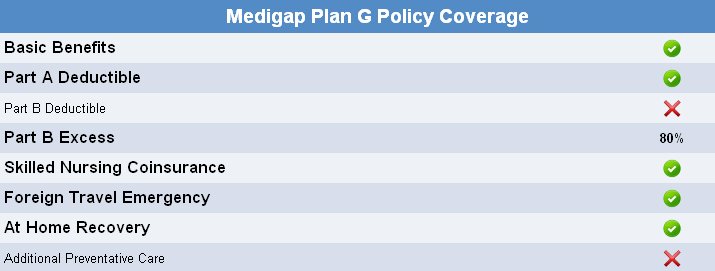

$2,490What is the Plan G deductible in 2022? $233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

How much does Social Security take out for Medicare each month?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

What is the Medicare Part B deductible for the year 2022?

$233The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.

When Could I Need Skilled Nursing Care?

You may need skilled nursing care if you have an illness or injury that requires treatment or monitoring. Skilled nursing facilities provide 24-hou...

When Would I Be Eligible For Medicare Coverage of Skilled Nursing Facility Care?

Generally Medicare will help pay for skilled nursing facility (SNF) care if all of these are true: 1. You were a hospital inpatient for at least th...

What Skilled Nursing Facility Services Does Medicare Cover?

Typically Medicare will pay for the following items and services delivered by trained health professionals: 1. Semi-private room 2. Meals 3. Care b...

How Can I Get Help Paying Skilled Nursing Facility Costs?

You might want to consider a Medicare Supplement plan for help paying some of your skilled nursing facility out-of-pocket costs. Medicare Supplemen...

How Can I Find A Medicare-Certified Skilled Nursing Facility?

You can call Medicare to find out about Medicare-certified skilled nursing facilities in your area. Call Medicare at 1-800-MEDICARE (1-800-633-4227...

What is Medicare supplement?

Medicare supplement or Medigap plans cover various types of Medicare coinsurance costs. Here’s a breakdown of what Medigap plans cover in terms of Part A and Part B coinsurance. Plan A and Plan B cover: Part A coinsurance and hospital costs up to 365 days after you’ve used up your Medicare benefits. Part A hospice coinsurance.

What is Medicare Part B?

Medicare Part B. Medigap. Takeaway. Medicare coinsurance is the share of the medical costs that you pay after you’ve reached your deductibles. Although original Medicare (part A and part B) covers most of your medical costs, it doesn’t cover everything. Medicare pays a portion of your medical costs, and you’re responsible for the remaining amount.

How much is Medicare Part B coinsurance?

With Medicare Part B, after you meet your deductible ( $203 in 2021), you typically pay 20 percent coinsurance of the Medicare-approved amount for most outpatient services and durable medical equipment.

How much will Medicare pay in 2021?

If you have Medicare Part A and are admitted to a hospital as an inpatient, this is how much you’ll pay for coinsurance in 2021: Days 1 to 60: $0 daily coinsurance. Days 61 to 90: $371 daily coinsurance. Day 91 and beyond: $742 daily coinsurance per each lifetime reserve day (up to 60 days over your lifetime)

Can you pay coinsurance out of pocket?

You can either pay the coinsurance out of your pocket or purchase a Medicare supplement (Medigap) plan to cover all or part of it.

Does Medicare Advantage have coinsurance?

The type pf Medicare Advantage (Part C) plan you choose can also have an impact on whether you’ll pay coinsurance of copays for different services. If you’re on an HMO or PPO plan but choose to visit an out-of-network provider, this can increase your costs.

What skilled nursing facility services does Medicare cover?

Typically Medicare will pay for the following items and services delivered by trained health professionals:

How can I find a Medicare-certified skilled nursing facility?

Or you can visit Medicare’s web site at Medicare.gov to search and compare skilled nursing facilities . At this web site you may also want to read the guide to choosing a nursing home and/or the checklist of questions to ask when you are visiting skilled nursing facilities.

When could I need skilled nursing care?

You may need skilled nursing care if you have an illness or injury that requires treatment or monitoring. Skilled nursing facilities provide 24-hour care for people who need rehabilitation services or who suffer from serious health issues that are too complicated to be tended at home. Some skilled nursing facilities might have laboratory, radiology and pharmacy services, social and educational programs, and limited transportation to needed health services that are not available at the facility.

How can I get help paying skilled nursing facility costs?

You might want to consider a Medicare Supplement plan for help paying some of your skilled nursing facility out-of-pocket costs. Medicare Supplement (Medigap) plans help pay for some of your out-of-pocket costs under Medicare Part A and Part B, including certain cost-sharing expenses. In most states, plan benefits are standardized across 10 plan types (labeled letters A through N), and each plan includes different benefits and level of coverage. Several of these standardized plans may cover at least a portion of skilled nursing facility copayments.

How long does Medicare benefit last?

You haven’t used up all the days in your Medicare benefit period. A benefit period starts the day you’re admitted to a hospital as an inpatient. It ends when you haven’t been an inpatient in a hospital or skilled nursing facility for 60 days in a row. If you meet these requirements, Medicare may cover skilled nursing facility care ...

What does Medicare pay for?

Typically Medicare will pay for the following items and services delivered by trained health professionals: 1 Semi-private room 2 Meals 3 Care by registered nurses 4 Therapy care (including physical, speech and occupational therapy) 5 Medical social services 6 Nutrition counseling 7 Prescription medications 8 Certain medical equipment and supplies 9 Ambulance transportation (when other transportation would be dangerous to your health) if you need care that’s not available at the skilled nursing facility

How long do you have to be in a hospital to be a skilled nursing facility?

You were a hospital inpatient for at least three days in a row (not counting the day you leave), and you entered a Medicare-certified skilled nursing facility within 30 days of leaving the hospital.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How long do you have to pay late enrollment penalty?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

Does Medicare Cover Skilled Nursing?

Skilled nursing falls under Original Medicare Part A. Medicare Part A covers up to 100 days of skilled nursing facility care per benefit period. A benefit period begins the day you’re admitted as an inpatient in a hospital or skilled nursing facility and ends when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 days in a row. There are no limitations on the number of benefit periods. Before you receive Medicare-covered skilled nursing care, you have to have a new three-day qualifying hospital stay each benefit period. Medicare-covered skilled nursing services include the following:

Where Can I Find Medicare and Medicaid Skilled Nursing Care Near Me?

If you or your loved one are in the hospital and need the services of an SNF, the hospital care team is your first point of contact. They’ll discuss skilled nursing care options and verify the necessary treatment is administered in a nearby Medicare-certified or Medicaid-certified skilled nursing facility .

Who Is Eligible for Skilled Nursing?

You are enrolled in Medicare Part A and have days remaining to use in your benefit period.

What are the requirements to be a skilled nursing provider?

Eligibility requirements include that you have Medicare Part A with days left in your benefit period and have a qualifying hospital stay.

What is skilled nursing in Medicare?

Skilled nursing and skilled nursing facilities (SNFs) provide short-term care from skilled staff with specific expertise to treat patients. The goal of a skilled nursing facility is to help you recover to your best possible level of wellbeing. Why would you need skilled nursing? If you have been hospitalized and are ready to be discharged, your doctor will assess whether you can return home or need additional care or therapy in a skilled nursing facility. You will need to meet Medicare’s skilled nursing care eligibility requirements (we’ll cover this later in the article). While skilled nursing sounds similar to nursing care (and the terms are sometimes used interchangeably), the two are quite different when it comes to Medicare coverage. This is essential to know, as Medicare coverage for skilled nursing facility services varies from coverage for a nursing home stay (even if the facility provides both).

Is skilled nursing covered by medicaid?

Medicaid provides health coverage to over 74 million Americans, including eligible low-income adults, seniors, and people with disabilities.3 Although Medicaid is a federal government program, individual states are responsible for decisions on coverage and benefits for Medicaid recipients. Skilled nursing falls under Medicaid’s Nursing Facility Services. Eligible Medicaid recipients have to meet criteria for SNF care in their own state, yet the individual states must also abide by federal law and regulations when setting their skilled nursing care requirements and guidelines. According to federal requirements, Medicaid-covered skilled nursing service must provide the following:4

Can you lose skilled nursing coverage if you refuse?

First, if you refuse your daily skilled care or your therapy, you could potentially lose your Medicare-eligible skilled nursing coverage. Another factor to take note of is that sometimes doctors or other healthcare ...

What is Medicare coinsurance?

Coinsurance is the percentage of a medical bill that you (the Medicare beneficiary) may be responsible for paying after reaching your deductible. Coinsurance is a form of cost-sharing; it's a way for the cost of care to be split between you and your provider.

What percentage of Medicare coinsurance is covered by Part B?

Medicare coinsurance is typically 20 percent of the Medicare-approved amount for goods or services covered by Medicare Part B. So once you have met your Part B deductible for the year, you will then typically be responsible for 20 percent of the remaining cost for covered services and items. The Medicare-approved amount is a predetermined amount ...

What is a copayment in Medicare?

Copayment, or copay, is another term you’ll see used in relation to Medicare cost-sharing . A copay is like coinsurance, except for one difference: While coinsurance typically involves a percentage of the total medical bill, a copayment is generally a flat fee. For example, Part B of Medicare uses coinsurance, which is 20 percent in most cases.

How much is Medicare Part B 2021?

Part B carries an annual deductible of $203 (in 2021), so John is responsible for the first $203 worth of Part B-covered services for the year. After reaching his Part B deductible, the remaining $97 of his bill is covered in part by Medicare, though John will be required to pay a coinsurance cost. Medicare Part B requires beneficiaries ...

What is the average coinsurance amount for Medicare Advantage?

While 20 percent is the typical coinsurance amount for Medicare Advantage plans, some plans may feature a 70-30 or 90-10 split.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are optional plans sold by private insurers that offer some coverage for certain out-of-pocket Medicare costs , such as coinsurance, copayments and deductibles.

What is deductible for Medicare?

The deductible is the amount you are required to pay in a given year or benefit period before Medicare begins paying its share.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

How many hours a day is part time nursing?

Part-time or intermittent nursing care is skilled nursing care you need or get less than 7 days each week or less than 8 hours each day over a period of 21 days (or less) with some exceptions in special circumstances.

What is personal care?

Custodial or personal care (like bathing, dressing, or using the bathroom), when this is the only care you need

What is the eligibility for a maintenance therapist?

To be eligible, either: 1) your condition must be expected to improve in a reasonable and generally predictable period of time, or 2) you need a skilled therapist to safely and effectively make a maintenance program for your condition , or 3) you need a skilled therapist to safely and effectively do maintenance therapy for your condition. ...

Does Medicare pay for home health aide services?

Usually, a home health care agency coordinates the services your doctor orders for you. Medicare doesn't pay for: 24-hour-a-day care at home. Meals delivered to your home.

Does Medicare change home health benefits?

Your Medicare home health services benefits aren't changing and your access to home health services shouldn’t be delayed by the pre-claim review process. For more information, call us at 1-800-MEDICARE.

Can you get home health care if you attend daycare?

You can still get home health care if you attend adult day care. Home health services may also include medical supplies for use at home, durable medical equipment, or injectable osteoporosis drugs.

How long can you live in hospice?

Things to know. Only your hospice doctor and your regular doctor (if you have one) can certify that you’re terminally ill and have a life expectancy of 6 months or less. After 6 months, you can continue to get hospice care as long as the hospice medical director or hospice doctor recertifies ...

What happens when you choose hospice care?

When you choose hospice care, you decide you no longer want care to cure your terminal illness and/ or your doctor determines that efforts to cure your illness aren't working . Once you choose hospice care, your hospice benefit will usually cover everything you need.

How long can you be in hospice care?

After 6 months , you can continue to get hospice care as long as the hospice medical director or hospice doctor recertifies (at a face-to-face meeting) that you’re still terminally ill. Hospice care is usually given in your home but may also be covered in a hospice inpatient facility. Original Medicare will still pay for covered benefits for any health problems that aren’t part of your terminal illness and related conditions, but this is unusual. When you choose hospice care, you decide you no longer want care to cure your terminal illness and/or your doctor determines that efforts to cure your illness aren't working. Once you choose hospice care, your hospice benefit will usually cover everything you need.

What is hospice care?

hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient. Hospice also provides support to the patient's family or caregiver. care.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for inpatient respite care.

Does Medicare cover hospice care?

Any other services Medicare covers to manage your pain and other symptoms related to your terminal illness and related conditions, as your hospice team recommends. Medicare doesn’t cover room and board when you get hospice care in your home or another facility where you live (like a nursing home).

Can you stop hospice care?

As a hospice patient, you always have the right to stop hospice care at any time. Prescription drugs to cure your illness (rather than for symptom control or pain relief). Care from any hospice provider that wasn't set up by the hospice medical team. You must get hospice care from the hospice provider you chose.