Most beneficiaries pay $0 per month for Medicare Part A. Beneficiaries who buy Part A pay up to $407 per month in 2015.

Full Answer

What is the monthly premium for Medicare Part A?

If you paid federal taxes for 30 – 39 quarters, the monthly premium for Part A is $252.00. If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period.

What does Medicare cover for seniors?

The program was designed to provide insurance coverage of hospital expenses through Part A, and of medical costs through Part B. Medicare covers senior citizens aged 65 and older and younger individuals with specific disabilities. Medicare is available for legal permanent residents that have met the qualifying number of years worked.

How old do you have to be to get Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older. The U.S. government has set the age of eligibility for Original Medicare Parts A and B at 65.

Are Medicare premiums automatically deducted when you receive Social Security?

Retired individuals aged 65 and older who are receiving Social Security income will see their Medicare premiums automatically deducted from their monthly statements.

What were Medicare premiums in 2015?

2015 Part B (Medical) Monthly Premium & DeductibleIf Your Yearly Income is$85,000 or below$170,000 or below$104.90*$85,001 - $107,000$170,001 - $214,000$146.90*$107,001 - $160,000$214,001 - $320,000$209.80*$160,001 - $214,000$320,001 - $428,000$272.70*3 more rows

What was the Medicare Part B premium for 2016?

If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90.

What was the cost of Medicare in 2014?

Medicare spending, which represented 20 percent of national health spending in 2014, grew 5.5 percent to $618.7 billion, a faster increase than the 3.0 percent growth in 2013.

What was the Medicare Part B premium for 2017?

$134Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What was Medicare premium in 2013?

Today we announced that the actual rise will be lower—$5.00—bringing 2013 Part B premiums to $104.90 a month. By law, the premium must cover a percent of Medicare's expenses; premium increases are in line with projected cost increases.

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

How much did Medicare cost in 2013?

Most people will pay more for this government health care plan for seniors.2011 ADJUSTED GROSS INCOME$85,000 or less (single), $170,000 or less (joint)More than $214,000 (single), more than $428,000 (joint)2013 Medicare Part B monthly premium$104.90$335.702013 Medicare Part D monthly premiumpremium only$66.40 surcharge

What is the Medicare premium for 2022?

$170.10 forThe standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021.

What is the Medicare deductible for 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021. Once the Part B deductible has been paid, Medicare generally pays 80% of the approved cost of care for services under Part B.

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

How much did Medicare go up in 2018?

Medicare Part A Premiums/Deductibles The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017.

When did Medicare start charging a premium?

1966President Johnson signs the Medicare bill into law on July 30 as part of the Social Security Amendments of 1965. 1966: When Medicare services actually begin on July 1, more than 19 million Americans age 65 and older enroll in the program. 1972: President Richard M.

When did Medicare become law?

In a nutshell, Medicare, signed into law by President Johnson in 1965 , is a federal health insurance program for those aged 65 and up. (It also serves some younger people with disabilities and certain people with end-stage renal disease.)

How much is Part B tax deductible?

Part B sports a deductible of $147 per year , and costs most people (individuals earning $85,000 or less, or couples filing jointly and earning $170,000 or less) $104.90 per month. Those earning more will pay more, with the highest earners paying $335.70 per month.

Is Medicare free for adults?

Here's a quick review of what it is, how it works, and, importantly, what it costs. (It's worth noting, after all, that although it's a government-provided service , it's not free.)

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

What percentage of Medicare deductible is paid?

After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

How much is Part A deductible for 2020?

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

What is Medicare Part C?

Medicare Part C is Managed Medicare or Medicare Advantage. These policies are sold by private insurance companies. Part C covers everything that Original Medicare Parts A and B cover plus some additional coverage. Most plans include prescription drug coverage too.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How much does Medicare Part B cost?

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How much does a MA plan cost?

On average, MA plan premiums range between $0 to $400.00 per month. Your MA plan provider may charge either a copay or coinsurance.

How much did Medicare cost in 2015?

In FY 2015, gross current law spending on Medicare benefits will total $605.9 billion. Medicare will provide health insurance to 55 million individuals who are 65 or older, disabled, or have end-stage renal disease (ESRD).

How many people will be on Medicare in 2015?

For 2015, the number of beneficiaries enrolled in Medicare Part D is expected to increase by about 3 percent to 41 million , including about 12 million beneficiaries who receive the lowincome subsidy.

What is the Medicare Part B deductible?

Modify Part B Deductible for New Enrollees: Beneficiaries who are enrolled in Medicare Part B are required to pay an annual deductible ($147 in calendar year 2014). This deductible helps to share responsibility for payment of Medicare services between Medicare and beneficiaries. To strengthen program financing and encourage beneficiaries to seek high-value health care services, this proposal would apply a $25 increase to the Part B deductible in 2018, 2020, and 2022 respectively for new beneficiaries beginning in 2018. Current beneficiaries or near retirees would not be subject to the revised deductible.

3.4 billion in savings over 10 years]

What percentage of Medicare beneficiaries are covered by Part B?

Part B coverage is voluntary, and about 92 percent of all Medicare beneficiaries are enrolled in Part B. Approximately 25 percent of Part B costs are financed by beneficiary premiums, with the remaining 75 percent covered by general revenues.

What is Medicare Shared Savings Program?

Medicare Shared Savings Program (MSSP): This initiative is a feeforservice program established by the Affordable Care Act designed to improve beneficiary outcomes and increase value of care. ACOs that meet certain quality objectives and reduce overall expenditures get to share in the savings with Medicare and may also be subject to losses. Since the first cohort of ACOs entered the program in 2012, 343 MSSP ACOs have been established. In the first year of the program, Medicare ACOs generated interim shared savings totaling $128 million for the Medicare trust fund. Fiftyfour ACOs had lower expenditures than projected, and 29 will share interim savings.

What is the Medicare sequestration for 2023?

Modifications to Medicare sequestration for fiscal year 2023 : The Bipartisan Budget Act of 2013 extended the sequestration of Medicare provider payments along with the sequestration of other non-exempt mandatory programs through FY 2023. An additional provision in the Pathway for SGR Reform Act of 2013 accelerates FY 2023 savings from sequestration by applying a higher percentage Medicare reduction to the first six months. (Savings: $2.1 billion from acceleration of Medicare spending reductions in FY 2023)

What is Medicare 1/?

1/ Represents all spending on Medicare benefits by either the Federal government or other beneficiary premiums. Includes Medicare Health Information Technology Incentives.

Options for Covering Medicare Costs

If you’re concerned about out of pocket costs, you may choose a Medicare Advantage plan (MA) that maxes out your out of pocket cost. MA plans usually covers prescription drugs and extras like dental and vision.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!

What percentage of Medicare expenses are covered by seniors?

If seniors' benefits are increasing, it also means their potential liability might be as well. Keep in mind that about 80% of medical expenses are covered by Medicare, possibly putting seniors on the hook for 20% of a growing number by 2030.

How much does Social Security outweigh Medicare?

So, for those who turned 65 in 2010, average Social Security benefits outweigh average Medicare benefits by $97,000 for men and by $95,000 for women. However, by 2030, per the Urban Institute's calculations, this gap is expected to shrink to $28,000 for men and just $9,000 for women. In other words, Medicare's importance is growing by leaps ...

How much more will male retirees get in 2030?

The Urban Institute estimates that by 2030, male retirees will receive $221,000 more in lifetime benefits than they paid into Medicare, while female retirees will take home $263,000 on top of what they contributed. This fundamental flaw behind Medicare makes fixing the program for the long term a daunting task.

How much does a single woman make in a lifetime?

Single female earning an average wage: $207,000 in lifetime benefits. Two-earner couple earning an average wage: $387,000 in lifetime benefits. You may have noticed the difference in lifetime benefits between men and women. That difference arises because women live an average of five years longer than men, and thus have higher medical costs.

When will Medicare shrink?

First, the current gap (as of 2010) between the estimated lifetime benefits received from Social Security and Medicare is expected to shrink dramatically by 2030.

What is the most important social program for seniors?

Social Security, which provides income to retired workers in order to help them meet their monthly expenses, is typically seen as the most important social program for seniors. It's easy to see why, given that Social Security pays out a cash benefit each and every month for the rest of your life. But let's not forget about Medicare.

Is original Medicare only for seniors?

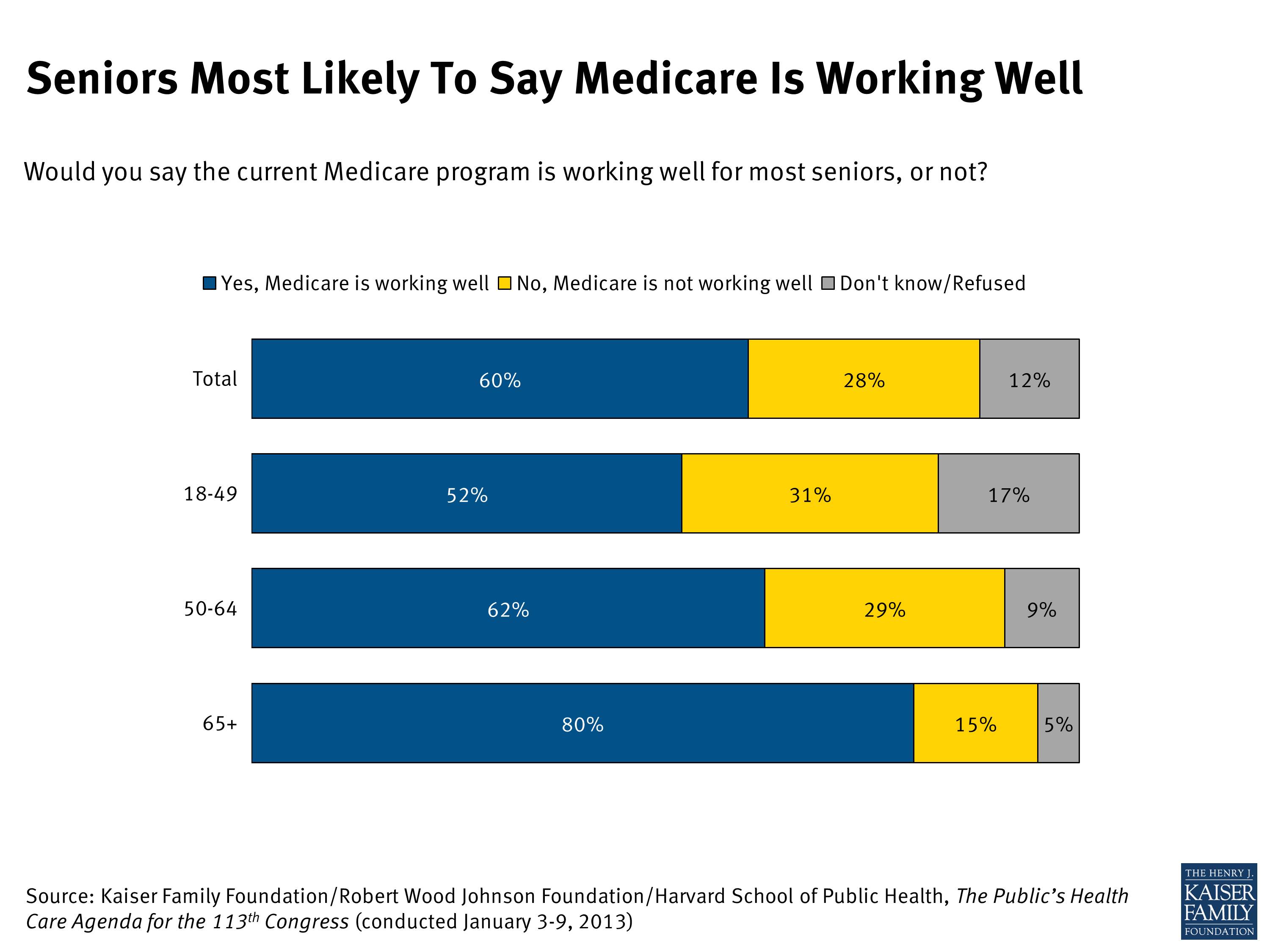

First, understand that original Medicare isn't your only option. For around 70% of today's seniors, original Medicare has been working wonderfully.

How much does Medicare cost a month?

Depending on the number of quarters worked, the monthly premiums can range from $252 a month for an individual who have worked 30 to 39 quarters, and up to $458 a month for an individual who worked less than 30 quarters. Medicare Part B.

How long does it take to get Medicare if you are 65?

Individuals under the age of 65 that are receiving Social Security Disability Income or Railroad Retirement Board Disability income have a two year , sliding scale, waiting period to qualify for Medicare insurance beginning at age 62.

What age do you have to retire without health insurance?

If someone retires without a continuing employer-provided health insurance plan, they will need to purchase an individual or family health plan that will meet their medical expectations until reaching the qualifying age of 65 . Medicare Coverage Due to Disease or Disability. Disease Eligibility.

When was Medicare signed into law?

Medicare was signed into law by President Lyndon B. Johnson in 1965 . The program was designed to provide insurance coverage of hospital expenses through Part A, and of medical costs through Part B. Medicare covers senior citizens aged 65 and older and younger individuals with specific disabilities. Medicare is available for legal permanent residents that have met the qualifying number of years worked. Those eligibilities remain in effect today.

Is Medicare Part A premium free?

Cost of Medicare. Medicare Part A. Individuals are provided premium-free Medicare Part A Hospital Insurance if the individual or a spouse paid the payroll Medicare tax for a defined period of time while working. If someone does not qualify for the premium-free Part A, they may be able to purchase Part A for a monthly premium, ...

Does Medicare Part B change?

The monthly premiums for Medicare Part B are subject to change from one year to another. There is a standard monthly premium. If an individual’s modified adjusted gross income exceeds the standard income bracket, that person will pay an extra charge for Part B that is calculated on the amount of the additional income.