How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How does disability affect Medicare?

If you get Social Security Disability Income (SSDI) and have Medicare. You're considered covered under the health care law and don't have to pay the penalty that people without coverage must pay. You can't enroll in a Marketplace plan to replace or supplement your Medicare coverage.

Does Medicare automatically come with disability?

You will typically be automatically enrolled in Original Medicare, Part A and B, after you've received Social Security disability benefits (or certain Railroad Retirement Board disability benefits) for two straight years. Your Medicare coverage will start 24 months from the month you qualified for disability benefits.

How do I get health insurance if I am on disability?

Apply for Medicaid or a private health plan through the MarketplaceWhen you fill out your Marketplace application, answer “yes” when asked if you have a disability. ... If you don't qualify for Medicaid, you may qualify for premium tax credits and other savings on a Marketplace health plan .More items...

How can I increase my Social Security disability payments?

Cost of Living Adjustment. One way an SSDI beneficiary can receive an increase is through a cost of living adjustment (COLA). Periodically, Social Security beneficiaries will receive cost of living adjustments.Mar 24, 2021

What other benefits can I get with Social Security disability?

If you get SSI, you also may be able to get other benefits, such as Medicaid and the Supplemental Nutrition Assistance Program (SNAP). For more information about SSI, read Supplemental Security Income (SSI) (Publication No. 05-11000). After you receive disability benefits for 24 months, you'll be eligible for Medicare.

Does Social Security pay for Medicare?

Will a beneficiary get Medicare coverage? Everyone eligible for Social Security Disability Insurance (SSDI) benefits is also eligible for Medicare after a 24-month qualifying period. The first 24 months of disability benefit entitlement is the waiting period for Medicare coverage.

What insurance do you get with Social Security disability?

Two Social Security Administration programs pay benefits to people with disabilities. Learn about Social Security Disability Insurance (SSDI) and Supplemental Security Insurance (SSI).

How many people are covered by Medicare?

Medicare provides coverage for about 10 million disabled Americans under the age of 65 . Medicare isn't available to most people until age 65, but if you have a long-term disability or have been diagnosed with certain diseases, Medicare is available at any age.

When do you get Medicare cards?

You'll get Medicare cards in the mail three months before your 25th month of disability.

How to apply for SSDI?

Your application for SSDI is likely to move more quickly if you select one doctor as the lead contact for your case. It's best to go with one who: 1 Has experience with disability cases 2 Responds promptly to requests for information 3 Is familiar with your overall health situation

How long does it take to get approved for SSDI?

However, getting approved for SSDI can be a long process, and even after you're approved, you'll have to wait 24 months before your Medicare benefits begin (with exceptions for end-stage renal disease and amyotrophic lateral sclerosis).

How long does Medicare cover ESRD?

If you have employer-sponsored or union-sponsored insurance and you become eligible for Medicare due to ESRD, Medicare will coordinate with your existing coverage for 30 months. During that time, your private insurance will be your primary coverage, and Medicare will pick up a portion of the remaining costs.

What happens if you don't want Medicare Part B?

If you don't want Medicare Part B, you can send back the card. If you keep the card, you'll keep Part B and will pay Part B premiums. In 2021, the Part B premium is $148.50 per month for most enrollees. 6 . You'll also be eligible to join a Medicare Part D prescription drug plan.

How long does it take for SSDI to start?

According to the law, your SSDI payments cannot start until you have been disabled for at least five full months. 4 Your payment will usually start with your sixth month of disability.

How much is hospitalization for Medicare Part A 2021?

In 2021, hospitalization costs with Medicare Part A include: Deductible: $1,484 for each benefit period. Days 1–60: after the deductible has been met, inpatient stays will be completely covered until the 60th day the benefit period. Days 61–90: $371 per day coinsurance.

How long does a disability last?

Generally, this means you are unable to work and that your condition is expected to last for at least a year. Medicare doesn’t determine who is eligible for disability coverage.

How much is Medicare Part B 2021?

The standard Part B premium for 2021 is $148.50 per month. The deductible for Medicare Part B in 2021 is $203. After you meet the deductible, some services are covered in full. You’ll pay 20 percent of the Medicare-approved amount for other services.

How long do you have to wait to get Medicare?

In most cases, you’ll need to wait 24 months before your Medicare coverage begins. There is a 2-year waiting period that begins the first month you receive a Social Security benefit check.

How much is coinsurance for 61 days?

Days 61–90: $371 per day coinsurance. Day 91 and above: $742 per day coinsurance until you exhaust your lifetime reserve days (60 days for a lifetime) After 60 lifetime reserve days: you pay all costs.

How much is the Part A premium for 2021?

If you’re still younger than age 65 once that 8.5-year time period as passed, you’ll begin paying the Part A premium. In 2021, the standard Part A premium is $259.

When does Medicare start covering ALS?

If you have amyotrophic lateral sclerosis (ALS), also known as Lou Gehrig’s Disease, you’ll be enrolled in coverage in the first month you receive SSDI. If you have end stage renal disease (ESRD), your Medicare coverage normally begins after you’ve received 3 months of dialysis treatment.

How long do you have to wait to get Medicare if you have Social Security Disability?

Social Security Disability Insurance (SSDI) & Medicare coverage. If you get Social Security Disability Income (SSDI), you probably have Medicare or are in a 24-month waiting period before it starts. You have options in either case.

What is SSI disability?

Supplemental Security Income (SSI) Disability & Medicaid coverage. Waiting for a disability status decision and don’t have health insurance. No disability benefits, no health coverage. The Marketplace application and disabilities. More information about health care for people with disabilities.

Can I enroll in a Medicare Marketplace plan if I have Social Security Disability?

You’re considered covered under the health care law and don’t have to pay the penalty that people without coverage must pay. You can’t enroll in a Marketplace plan to replace or supplement your Medicare coverage.

Can I keep my Medicare Marketplace plan?

One exception: If you enrolled in a Marketplace plan before getting Medicare, you can keep your Marketplace plan as supplemental insurance when you enroll in Medicare. But if you do this, you’ll lose any premium tax credits and other savings for your Marketplace plan. Learn about other Medicare supplement options.

Can I get medicaid if I have SSDI?

You may be able to get Medicaid coverage while you wait. You can apply 2 ways: Create an account or log in to complete an application. Answer “ yes” when asked if you have a disability.

Can I get medicaid if I'm turned down?

If you’re turned down for Medicaid, you may be able to enroll in a private health plan through the Marketplace while waiting for your Medicare coverage to start.

How long after Social Security disability is Medicare free?

You are eligible for Medicare two years after your entitlement date for Social Security disability insurance (SSDI). (This is the date that your backpay was paid from; see our article on when medicare kicks in for SSDI recipients ). Medicare isn't free for most disability recipients though.

How much does Medicare cost if you have a low Social Security check?

But some people who have been on Medicare for several years will pay slightly less (about $145) if their Social Security checks are low (due to a hold harmless provision). And some people will pay more. If your adjusted gross income is over $88,000 (or $176,000 for a couple), the monthly premium can be over $400.

How to save money on Medicare?

You can often save money on Medicare costs by joining a Medicare Advantage plan that offers coverage through an HMO or PPO. Many Medicare Advantage plans don't charge a monthly premium over the Part B premium, and some don't charge copays for doctor visits and other services.

How much is the Part D premium for 2021?

Part D Costs. Part D premiums vary depending on the plan you choose. The maximum Part D deductible for 2021 is $445 per year, but some plans waive the deductible. There are subsidies available to pay for Part D for those with low income (called Extra Help).

How many quarters do you have to work to be fully insured?

Generally, being fully insured means having worked 40 quarters (the equivalent of 10 years) in a job paying FICA taxes. Many disability recipients aren't fully insured because they became physically or mentally unable to work before getting enough work credits.

Does Medicare go up every year?

There are premiums, deductibles, and copays for most parts of Medicare, and the costs go up every year. Here are the new figures for 2021, and how you can get help paying the costs.

Is Medicare expensive for disabled people?

Medicare can be quite expensive for those on disability who aren't fully insured, but if you are eligible to be a Qualified Medicare Beneficiary (QMB) because of low-income, a Medicare Savings Program will pay your Part A premium, and possibly other costs as well.

What is Medicare Advantage?

Medicare Advantage Plans for Disabled Under 65. Most Social Security Disability Advantage plans combine Medicare coverage with other benefits like prescription drugs, vision, and dental coverage. Medicare Advantage can be either HMOs or PPOs. You may have to pay a monthly premium, an annual deductible, and copays or coinsurance for each healthcare ...

How long do you have to be on Medicare if you are 65?

When you’re under 65, you become eligible for Medicare if: You’ve received Social Security Disability Insurance (SSDI) checks for at least 24 months. At the end of the 24 months, you’ll automatically enroll in Parts A and B. You have End-Stage Renal Disease (ESRD) and need dialysis or a kidney transplant. You can get benefits with no waiting period ...

What is a special needs plan?

A Special Needs Plan fits the healthcare needs of the people in the policy.

Can a disabled child get medicare?

Medicare for Disabled Youth. Children under the age of 20 with ESRD can qualify for Medicare if they need regular dialysis treatment and at least one of their parents is eligible for or receives Social Security retirement benefits. If your child is over the age of 20, they qualify for Medicare after receiving SSDI benefits for at least 24 months.

Does Medicare cover Medigap?

Medicare pays a large portion of the cost, but not all of it. Medigap can help cover what Medicare doesn’t cover. But if you’re under 65, it can be hard to find an affordable Medigap plan. While some states require companies to offer at least one Medigap plan to people under age 65, others do not.

Is Medigap premium higher at 65?

Additionally, premiums for this plan are lower since it includes fewer benefits. As Medigap premiums are much higher when you’re under 65, it can be beneficial to enroll in a Plan such as A to control costs and switch to a plan with more benefits after you turn 65.

Can you sign up for Medicare and Medicaid?

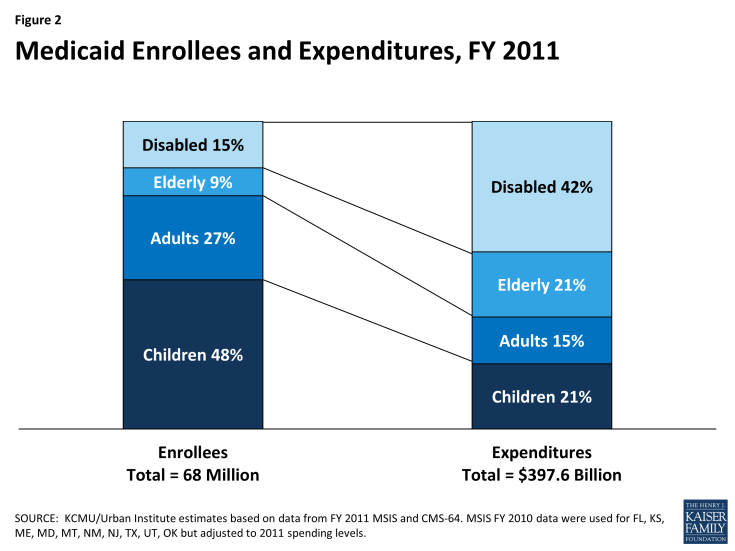

Many people on Social Security Disability also qualify for their state’s Medicaid program. If you’re on Medicare and Medicaid, you can still sign up for an Advantage plan. The two programs together will usually cover almost all your healthcare costs.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

How much does Medigap cost?

The average Medigap premiums can be anywhere from $20 to over $500. Essentially, you are paying an extra monthly cost to have more coverage later on if Original Medicare falls short. Deductibles range from $203 (the deductible you pay for Medicare Part B) to $6,220, if you opt for a high-deductible Medigap plan.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.

How much is the late enrollment penalty for Medicare?

The penalties are added to your monthly premium. Part A late enrollment penalty : 10% higher premium for twice the number of years you didn’t sign up. Part B late enrollment penalty : 10% higher premium for every 12 months you don’t sign up after becoming eligible, for as long as you have the plan.

How much will Social Security pay in 2021?

To give you an idea of what you might receive, for 2021, the average SSDI benefit amount is $1,277 per month, ...

What is an offset for disability?

Offsets for Other Disability Income. Some disability payments, such as workers' compensation settlements, can reduce your benefit amount. These are called "offsets.". Most other disability benefits, however, such as veterans benefits or payments made by private insurance, do not affect your benefit amounts.

How does the SSA determine your AIME?

To do this, the SSA will adjust, or index, your lifetime earnings to account for the increase in general wages that happened during the years you worked. This is done to make sure that the payments you get in the future mirror this rise.

How many years does the SSA use?

The SSA will use up to 35 of your working years in the calculation. The SSA takes the years with the highest indexed earnings, adds them together, and divides them by the total number of months for those years. The average is then rounded down to reach your AIME. You can see an example of how the SSA calculates an AIME on its website.

Is Social Security disability based on past earnings?

To be eligible, you must be insured under the program and meet the Social Security Administration's (SSA's) definition of disabled. SSI payments, on the other hand, aren't based on past earnings.)

Is SSDI based on past earnings?

SSI payments, on the other hand, aren't based on past earnings.) Your SSDI benefit payment may be reduced if you get disability payments from other sources, such as workers' comp, but regular income doesn't affect your payment amount.