How much does Medicare cost the government?

Nov 08, 2019 · Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What is the monthly premium for Medicare Part B?

Jan 03, 2022 · Medicare Part B Premium 2021. Although Part A, which pays for hospital care, is free for most beneficiaries, youll pay a monthly premium for Part B, which covers doctor visits and outpatient services. In 2021, the standard monthly premium will …

Is Medicare Part B premium?

Dec 21, 2019 · Medicare Charge. 2020 Cost (Change From 2019) Hospital deductible. $1,408 (up $44) Co-insurance for days 61-90 of hospital stay. $352 (up $11) Co-insurance for days 91 and beyond of hospital stay ...

Is Medicare Part a deductible?

Oct 06, 2021 · However, this report also exposed that the basic Medicare Part B premium, which assists seniors in paying for doctors’ fees and outpatient services, is expected to increase by $8.80 to a whopping $144.30 a month in 2020. It’s also likely for more Medicare benefit users to pay high-income surcharges, more commonly known as IRMAA, next year. In 2018, 3.7 million …

What are 2021 Medicare premiums?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

How much is Medicare monthly?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How much does Medicare deduct in 2020 for Social Security?

Medicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019.Nov 8, 2019

What does the average person pay for Medicare?

How much does Medicare cost?Medicare planTypical monthly costPart B (medical)$170.10Part C (bundle)$33Part D (prescriptions)$42Medicare Supplement$1631 more row•Mar 18, 2022

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

Is Medicare Part B based on income?

Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What month is Medicare deducted from Social Security?

Hi RCK. The Medicare premium that will be withheld from your Social Security check that's paid in August (for July) covers your Part B premium for August. So, if you already have Part B coverage you'll need to pay your Medicare premiums out of pocket through July.Mar 5, 2021

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

Does Medicare pay 100 percent of hospital bills?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

What is the monthly premium for Medicare Part B?

Part B participants pay premiums, with the monthly premium for most people in 2020 set to go up to $144.60. That's up by $9.10 per month from 2019 levels, which is a fairly high boost compared ...

Who is Dan Caplinger?

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

Does Medicare cover co-pays?

In particular, the various parts of Medicare coverage impose a wide variety of different costs for participants to pay. Whether you face deductibles, co-payments, premiums, or other expenses, being on Medicare requires some financial planning in order to make sure you can cover your costs. The following sections take a look at Medicare ...

Can I get Medicare Advantage?

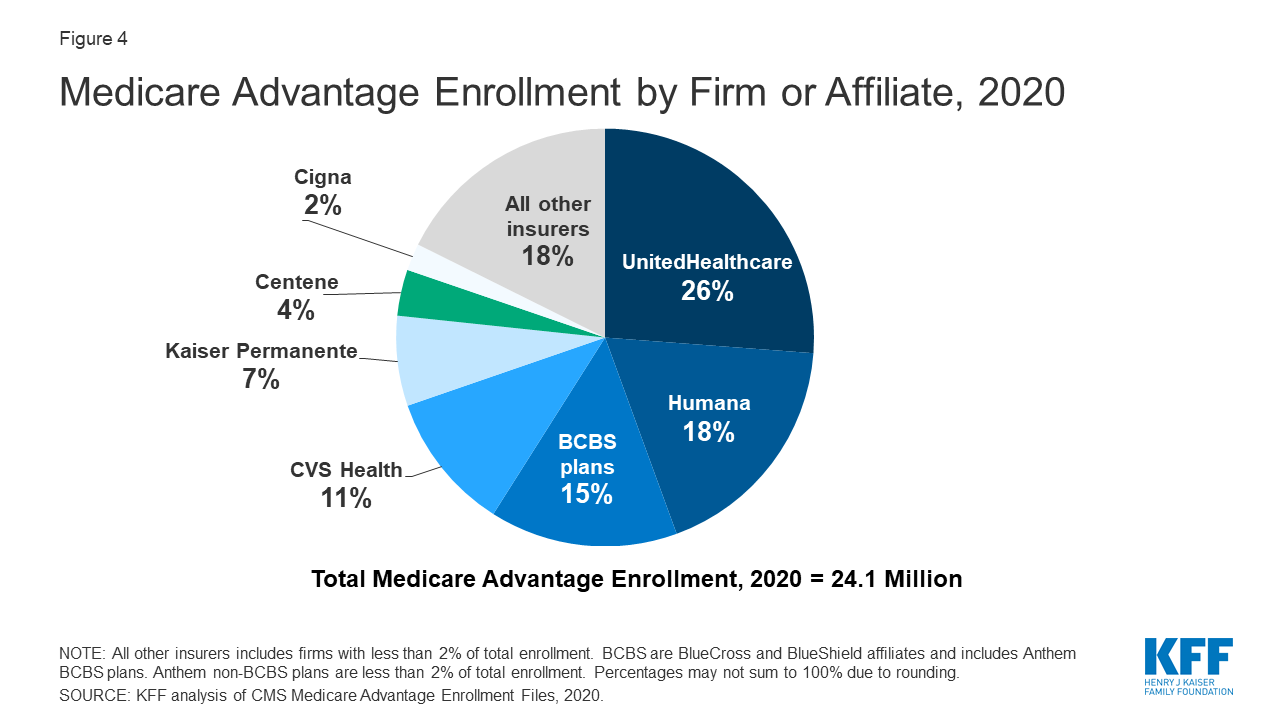

Medicare participants have the option to get a Medicare Advantage plan rather than using Parts A and B. Private insurers offer Advantage plans to eligible participants, and they typically provide comprehensive coverage than includes not only hospital and medical services but also prescription drug coverage . The costs of these plans vary widely, with more-comprehensive plans typically charging higher premiums. The trade-off is that you might have to use certain networks of medical providers under a Medicare Advantage plan, limiting your choices for healthcare professionals beyond what traditional Medicare does.

Can I sign up for a prescription drug plan with Medicare?

Even if you're part of traditional Medicare, you can also sign up for a prescription drug plan under Medicare Part D. Private insurers are also behind Part D plans, and again, they have considerable flexibility to charge monthly premiums based on the services they provide.

Do you have to have Medicare if you are 65?

Americans 65 and older rely on Medicare for the healthcare coverage they need. But even though most people are entitled to Medicare benefits, they don't come without cost. In fact, if you don't plan for healthcare expenses under Medicare, you'll get a nasty shock when you approach retirement.

How much will Medicare increase in 2028?

But Medicare expects to increase spending by an average of 5.1% per year from 2018-2028. This increase is because of growing Medicare enrollment, higher use of services and intensity of care, and rising health-care costs.

How much is coinsurance for 2021?

The first 60 days you’re an inpatient, you generally don’t pay coinsurance (but the deductible may apply). Days 61 through 90, you’ll typically pay $371 per day in 2021. From Day 91 on, your coinsurance is $742 per day for each “lifetime reserve day.”. You get a total of 60 lifetime reserve days in your lifetime.

What is Medicare Part A?

Medicare Part A is hospital insurance. Here’s how much Medicare Part A costs in 2021. Monthly premium: You might be able to save on this Medicare cost if you don’t have to pay the Part A premium. Most people don’t.

How much is Part B deductible in 2021?

Annual deductible: $203 per year in 2021. Coinsurance or copayment: Many Part B services and items cost you 20% of the Medicare-approved charges.

Does Medicare Advantage charge coinsurance?

Coinsurance or copayment: Medicare Advantage plans typically charge coinsurance or copayments as your share of covered services. Again, this cost may vary. To figure out your Medicare Advantage costs, compare plans and look at how much each one charges for premiums, deductibles, and other cost sharing.

Is Medicare going down?

Another eHealth study reported that Medicare Advantage premiums went down between 2019 and 2020, and held steady in 2021.*. The Kaiser Family Foundation reported that the government increased Medicare spending by 1.7% per year on average from 2010 to 2018.

What will happen to Medicare in 2020?

Although 2020 brings changes to premiums and deductible amounts for some Medicare recipients, it also brings changes to the coinsurance rate that determines how much a recipient will need to pay out of pocket.

How much is coinsurance for Medicare?

Afterward, for an additional 30 days, the recipient will be charged a coinsurance amount of $352 per day.

How to save money on Medicare?

You may also be able to save money by enrolling in a Medicare Advantage plan in order to reduce monthly costs or receive additional healthcare benefits that are not included in Original Medicare. Remember that Medicare Advantage plans are provided by private insurance companies, so it would be a good idea to shop around to find the provider and plan that meets your needs.

What is coinsurance in insurance?

Coinsurance is the fee that is passed on to the recipient after a deductible has been met and premiums are current. This differs from a co-payment in that co-pays are generally flat fees that stay the same regardless of deductible or premium amounts.

Will Medicare change in 2020?

Medicare recipients in 2020 will see some changes to the way that Medicare structures its financial requirements, and this includes the recipient’s co-insurance liability.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much is Medicare Part B 2021?

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if you’re receiving Social Security benefits. You also may pay more — up to $504.90 — depending on your income. The higher your income, the higher your premium. The deductible for Medicare Part B is $203 per year.

How much does Medicare pay for inpatient care?

Here’s how much you’ll pay for inpatient hospital care with Medicare Part A: Days 1-60 : $0 per day each benefit period, after paying your deductible. Days 61-90 : $371 per day each benefit period. Day 91 and beyond : $742 for each "lifetime reserve day" after benefit period. You get a total of 60 lifetime reserve days until you die.

What are the out-of-pocket expenses of Medicare?

Medicare costs. Beneficiaries face the same three major out-of-pocket expenses associated with any health insurance plan, which include: Premiums : The monthly payment just to have the plan. Deductible : The amount you must pay on your own before insurance starts to cover the costs.

How much is the deductible for Medicare Part A?

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day you’re admitted to a hospital and ends once you haven’t received in-hospital care for 60 days. The Medicare Part A coinsurance amount varies, depending on how long you’re in the hospital.

What is copay in Medicare?

Copay : A flat fee you pay for covered services. Coinsurance : The percentage of costs you pay after reaching your deductible. Knowing how these expenses work is essential to understanding the costs of Medicare. Learn more about about health insurance premiums, deductibles, copayments, and coinsurance.

Do you have to pay penalties for Medicare if you don't sign up?

You will have to pay penalties for some parts of Medicare if you don’t sign up when you’re first eligible and don’t have a particular set of circumstances — like leaving your workplace coverage.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers. Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius.