Aetna’s Medicare options extend to most parts of the country, and premiums for Advantage plans begin at $0 a month. Part D coverage, which helps pay for prescription drugs, begins at about $7 a month in most states.

Full Answer

How much does Aetna Health Insurance Cost per month?

Oct 07, 2021 · In 2021, the standard Part A premium is $471 if you have fewer than 30 credits. If you have 30 to 39 credits, it’s $259. Part A hospital inpatient deductible and coinsurance. In 2021, you pay: $1,484 deductible for each benefit period (A …

What is the preferred pharmacy for Aetna?

Sep 08, 2021 · Speak with a Aetna Specialist: (855) 935-1973. One of the many perks, as we age, is that the U.S government provides supported health insurance for those over 65 (and others who have eligible disabilities) in the form of Medicare. But let's face it, with the rising costs of health care and medications, Medicare isn't always enough to make ...

How to find Aetna Medicare providers?

Dec 14, 2018 · How much is Aetna health insurance? Among eHealth shoppers, the average premium for an ACA-compliant health insurance in 2018 was $465.86 for an individual plan , although insurance costs can vary significantly depending on the kind of plan you choose, the benefits included and your location.

Is Aetna open choice PPO?

Plan N = $233 deductible, then $20 copay for outpatient visits. All three provide 100% coverage for Inpatient Hospital services. Guaranteed Acceptance …. With our Aetna Medicare Supplement plans, your acceptance is guaranteed if you apply for coverage before, or within six months of, enrolling in Medicare Part B.

Does Aetna offer original Medicare?

Aetna Medicare Advantage plans may include coverage for things that Original Medicare generally doesn't cover, such as routine vision, routine dental, routine hearing care, and prescription drugs you take at home.

Is Aetna Medicare the same as Medicare?

Aetna Medicare is a HMO, PPO plan with a Medicare contract. Our SNPs also have contracts with State Medicaid programs. Enrollment in our plans depends on contract renewal.

What insurance company has the best Medicare plans?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What type of insurance is Aetna Medicare?

Aetna is one of the largest private insurance companies that offers Medicare Advantage plans. Aetna offers HMO, HMO-POS, PPO, and D-SNP plans. Not all of Aetna's Medicare Advantage plans may be available in your area.

Is Medicare Part A free at age 65?

Most people age 65 or older are eligible for free Medical hospital insurance (Part A) if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance (Part B) by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Is Aetna Medicare an Advantage plan?

Aetna Medicare Advantage plans take a total approach to health. Our Part C plans often include prescription drug coverage and extra benefits. And many feature an affordable plan premium – sometimes as low as $0.Jan 6, 2022

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is Aetna plan G?

Aetna Medicare Supplement Plan G This plan is perfect for those looking for great coverage that won't break the bank with monthly premium costs. On Medigap Plan G, you pay the Medicare Part B deductible yourself, and then Medigap Plan G covers the rest.Feb 9, 2022

What is the eligibility for an Aetna Medigap Plan?

You are eligible to apply for a Medigap Plan if you are in a state that offers the policy, have Medicare Parts A and B, and are age 65 or older, or...

What happens to my policy if I move states?

You can keep your policy even if you move states as long as you still have Original Medicare. However, Medigap policies may vary from state to stat...

Do Medigap policies work with Medicare Advantage Plans?

No, Medigap plans do not work with Medicare Advantage Plans. Medigap policies do not pay deductibles, copayments, coinsurance, or premiums under Me...

Can I lose my Medigap coverage?

Generally no, because the Medigap policy is guaranteed to be renewable. Reasons your insurance company can drop you include: premium payments aren’...

What is ACA subsidy?

A subsidy is financial assistance from the federal government to help you pay for your health insurance.

Why is health insurance important?

Health insurance is critical to protecting both your physical and financial health. Every year, you have an opportunity to weigh your options to ensure you have the plan that meets your needs and budget best. Price is always a key factor to consider when deciding on a health insurance provider.

Why are Medicare Supplement plans so popular?

WHY are Medicare Supplement plans popular? 1 Freedom of choice. You can see any doctor or hospital in the U.S. who accepts Medicare. If a person wants access to different doctors, specialists and hospitals, a Medicare Supplement provides that flexibility. 2 Coverage. Most Medicare Supplement’s provide very comprehensive coverage. Plan F is 100%, Plan G is 100% after a small $203 deductible and Plan N has the $198 deductible and $20 copay. 3 Very little change from year to year. Medicare Supplement coverage and benefits rarely change from year to year. Where Medicare Advantage plans tend to change benefits, deductibles, Rx coverage and doctor and hospital networks every year.

Does Aetna offer Medicare Supplement?

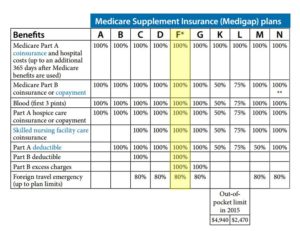

Aetna offers Medicare Supplement plans; A, B, F, G and N in most states. All have different coverage levels and pricing. The most popular being Plans F, G and N. Feel free to contact me anytime, and I’ll compare the different Medicare Supplement companies in your area to find the best monthly rate and the plan which best fits your unique needs.

What is Aetna insurance?

Aetna is the brand name used for products and services provided by one or more of the Aetna group of companies, including Aetna Life Insurance Company and its affiliates (Aetna). Health benefits and health insurance plans contain exclusions and limitations. See all legal notices.

What is provider cost estimator?

Our provider cost estimator tool helps your office estimate how much your patients will owe for an office visit or procedure. And it approximates how much Aetna will pay for services. Plus, you can use it prior to a patient's scheduled appointment or procedure.

Is Aetna responsible for the content of linked sites?

Aetna Inc. and its subsidiary companies are not responsible or liable for the content, accuracy, or privacy practices of linked sites, or for products or services described on these sites. Continue. You are now being directed to the US Department of Health and Human Services site.

Is Aetna a part of CVS?

and its subsidiary companies are not responsible or liable for the content, accuracy or privacy practices of linked sites, or for products or services described on these sites. Aetna is proud to be part of the CV S Health family . You are now being directed to the CVS Health site.

What is premium insurance?

Premiums are regular payments to keep your health care plan active. Higher premiums usually mean lower deductibles. An example of how it works: Trisha, 57, plans on devoting herself to her three grandchildren after she retires.

What is coinsurance in insurance?

Coinsurance is the percentage of the bill you pay after you meet your deductible. An example of how it works: Ben, 28, is a security expert living in suburban Philadelphia with his wife and two small boys. Their 3-year-old recently fell at the playground and broke his arm.

What is a deductible in insurance?

A deductible is the amount you pay for coverage services before your health plan kicks in. After you meet your deductible, you pay a percentage of health care expenses known as coinsurance. It's like when friends in a carpool cover a portion of the gas, and you, the driver, also pay a portion. A copay is like paying for repairs when something goes ...

Aetna Covers Hearing Aids for Those Diagnosed with Hearing Loss

Aetna offers hearing care services for some of its Medicare members. These services are delivered by Hearing Care Solutions. As a part of its hearing care cover, individuals may receive help with the cost of hearing exams, the purchase of hearing aids and any fitting costs.

Aetna Can Provide Reimbursement For Out-Of-Network Hearing Aid Providers

Medicare Advantage plans usually offer total coverage for routine hearing tests and hearing aid fitting. Some plans also cover the cost of purchasing a new hearing aid from an in-network provider.