Press release 2016 Medicare Parts A & B Premiums and Deductibles Announced

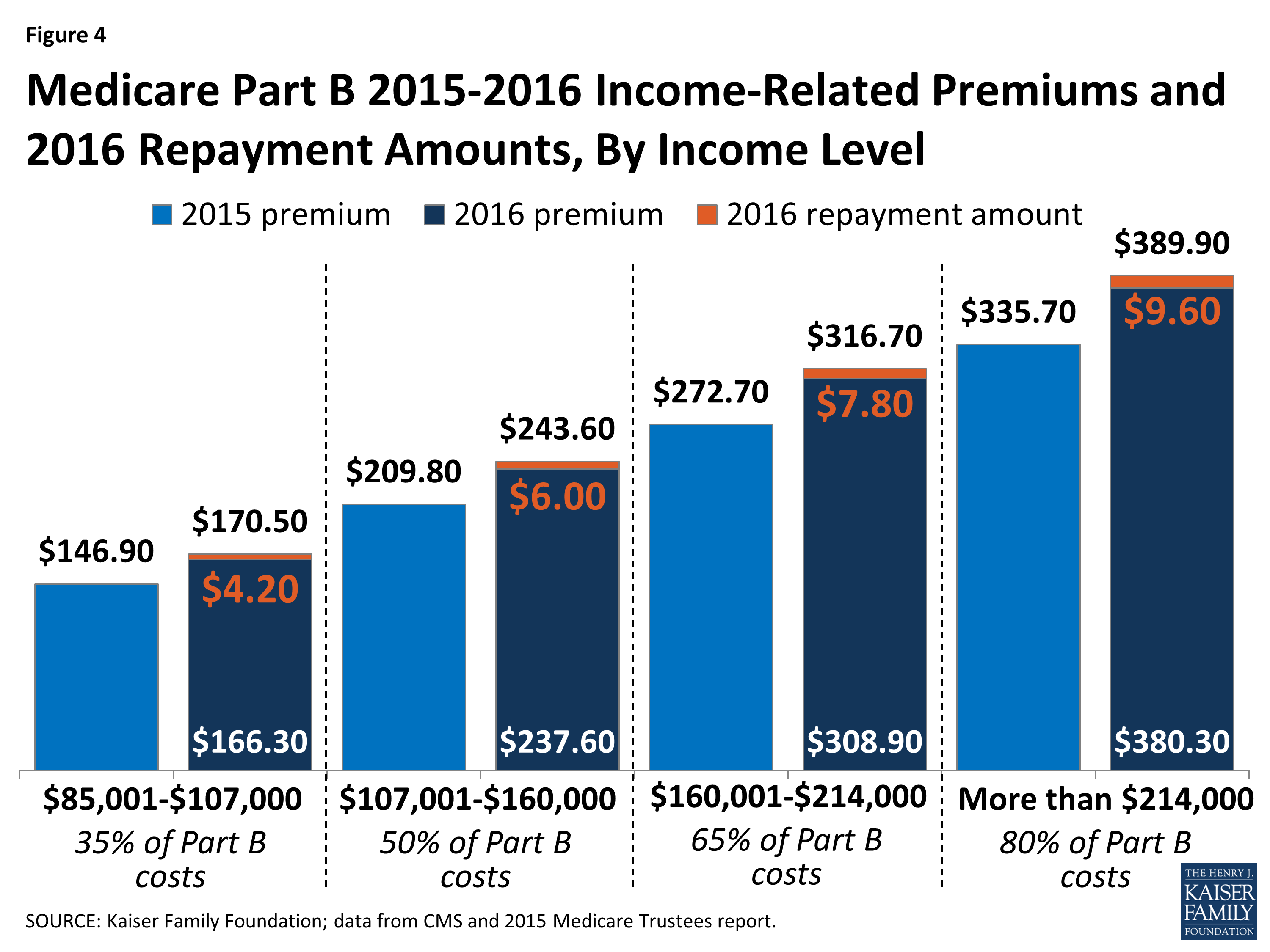

| Beneficiaries who file an individual tax ... | Beneficiaries who file a joint tax retur ... | Income-related monthly adjustment amount | Total monthly premium amount |

| Less than or equal to $85,000 | Less than or equal to $170,000 | $0.00 | $121.80 |

| Greater than $85,000 and less than or eq ... | Greater than $170,000 and less than or e ... | 48.70 | 170.50 |

| Greater than $107,000 and less than or e ... | Greater than $214,000 and less than or e ... | 121.80 | 243.60 |

| Greater than $160,000 and less than or e ... | Greater than $320,000 and less than or e ... | 194.90 | 316.70 |

Full Answer

What is the maximum premium for Medicare Part B?

6 rows · Nov 10, 2015 · As a result, by law, most people with Medicare Part B will be “held harmless” from any ...

How much are Medicare Part B premiums?

Dec 16, 2020 · Most Medicare Part A costs will increase in 2016. The Part A costs that will increase include: monthly premiums; inpatient hospital stay deductible; inpatient hospital stay co-insurance; skilled nursing facility co-insurance; Please reference the chart above for 2016 cost-specific details. Your Part B costs The Medicare Part B premium will remain the same at …

Do I have to pay Medicare Part B premium?

2016 Medicare Part A Skilled Nursing: $161. After 20 days in a skilled nursing facility, the per-day Medicare Part A skilled nursing co-payment in 2016 will be $161, or $3.50 more than in 2015 rate of $157.50. Medicare Part B in 2016 2016 Medicare Part B Premium: $104.90. The standard 2016 Medicare Part B premium will remain at $104.90 per month, the same rate as in 2015. Higher …

Does Medicaid pay for Part B premium?

Aug 25, 2016 · If you were enrolled in Medicare Part B prior to 2016, your 2016 monthly premium is generally $104.90. Your 2016 monthly premium is typically $121.80 if any of the following is true for you: You enrolled in Medicare Part B in 2016 for the first time. You don’t receive Social Security benefits. You get a bill for the Part B premium.

What was the monthly cost of Medicare in 2016?

What was the cost of Medicare in 2017?

What was the cost of Medicare Part B in 2015?

What was the Medicare Part A deductible for 2016?

What was the Medicare Part B premium for 2018?

What is the Medicare Part B deductible 2018?

What is the Medicare Part B deductible for 2017?

What was the Medicare deductible in 2014?

What is the Medicare Part B deductible for 2020?

What is Medicare Part B 2015?

What is the Irmaa for 2017?

| If Your Yearly Income Is | 2017 Medicare Part B IRMAA | |

|---|---|---|

| $85,000 or below | $170,000 or below | $0.00 |

| $85,001 - $107,000 | $170,000 - $214,000 | $53.50 |

| $107,001 - $160,000 | $214,000 - $320,000 | $133.90 |

| $160,001 - $214,000 | $320,000 - $428,000 | $214.30 |

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

How much is Medicare Part B?

The Medicare Part B premium will remain the same at $104.90 per month for most individuals. The Social Security Administration recently announced that there will be no cost of living increase for 2016.

Will Medicare increase in 2016?

Medicare beneficiar ies will face higher Medicare costs in 2016. Several costs, including the Part A deductible, the Part A inpatient hospital stay co-insurance, and the Part B deductible will increase in 2016, according to a Centers for Medicare & Medicaid Services (CMS) news release .

What is the Medicare premium for 2016?

The standard 2016 Medicare Part B premium will remain at $104.90 per month , the same rate as in 2015. Higher Part B premium rates for people with higher incomes will also remain at 2015 levels.

When did Medicare Part B and A changes take effect?

The Medicare administration has announced Medicare Part A and Part B rates for 2016, with changes taking effect Jan. 1, 2016.

What is Medicare Supplement Plan F?

An excellent, budget-friendly solution is Medicare Supplement Plan F, which covers all Medicare-approved costs not covered by Medicare Part A and Medicare Part B. With fixed premiums that can easily fit into your budget, Plan F covers all Medicare Part A and Part B deductibles along with “excess charges” you would otherwise have to pay out of pocket. Excess charges are the difference between what Medicare pays and what your medical provider charges—and they can add up fast without the protection Plan F provides! To learn more about how Medicare supplement plans can save you money, request a free Medigap quote from one of our licensed Medicare supplement insurance representatives or call MedicareMall toll-free at (877) 413-1556.

How much did Medicare pay in 2016?

In 2016, you pay: $0 for the first 20 days of each benefit period. $161 per day for days 21-100 of each benefit period. All costs for each day after day 100 of the benefit period. If you don’t qualify for premium-free Medicare Part A, you can enroll in Part A for $226 per month if you’ve worked and paid Social Security taxes for 30 to 39 quarters, ...

Do you have to pay for Medicare Part A?

Most people don’t have to pay a premium for Medicare Part A. They do, however, have to factor in the following Medicare Part A costs for inpatient hospital stays for each benefit period. Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient.

How long is a benefit period for Medicare?

Medicare considers a benefit period to start the day that a hospital or skilled nursing facility (SNF) admits you as an inpatient. The end of the benefit period occurs when you haven’t received any inpatient hospital care (or skilled care in an SNF) for 60 consecutive days. Deductible: $1,288.

Is Medicare dual eligible?

You quality for both Medicare and Medicaid benefits, and Medicaid pays for your premiums. This is called being “dual-eligible.”. Your income exceeds a certain dollar amount. Your premium could be higher than the amount listed above, as there are different premiums for different income levels.

What is Medicare Supplement Plan?

Costs for Medicare Supplement (Medigap) Those who need help paying for such health-care costs as deductibles, premiums, and other Original Medicare expenses may want to purchase a Medicare Supplement plan, also known as Medigap plan.

How to contact Medicare directly?

To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800 -MEDICARE (1-800-633-4227) , TTY users 1-877-486-2048; 24 hours a day, 7 days a week.

Will Medicare Part B premiums increase in 2016?

2016 Part B Premium. As the Social Security Administration previously announced, there will no Social Security cost of living increase for 2016. As a result, by law, most people with Medicare Part B will be "held harmless" from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

What is the Medicare deductible for 2016?

The Medicare Part A deductible for all Medicare beneficiaries is $1,288. If you aren’t eligible for premium-free Part A, you may be able to buy Part A if you meet one of the following conditions:

How much is Medicare Part A deductible?

The Medicare Part A deductible for all Medicare beneficiaries is $1,288. You’re 65 or older, and you have (or are enrolling in) Part B and meet the citizenship and residency requirements. You’re under 65, disabled, and your premium-free Part A coverage ended because you returned to work.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the "hold harmless" provision are: those not collecting Social Security benefits, those who will enroll in Part B for the first time in 2016, dual eligible beneficiaries who have their premiums paid by Medicaid, and.

Will Social Security increase in 2016?

As the Social Security Administration previously announced, there will no Social Security cost of living increase for 2016. As a result, by law, most people with Medicare Part B will be "held harmless" from any increase in premiums in 2016 and will pay the same monthly premium as last year, which is $104.90.

What is Medicare Part B?

Medicare Part B covers services and supplies considered medically necessary to treat a disease or condition.

How much did Medicare pay in 2015?

But because of a law that ties Medicare increases to cost-of-living adjustments for Social Security, the majority of existing participants will pay the $104.90 monthly premium they paid in 2015. Image source: Getty Images.

Why do retirees need Medicare?

Retirees rely on Medicare to help them with their healthcare expenses, but getting a better understanding of how the program's different components can be challenging. Medicare Part B plays a key role in the everyday aspects of healthcare, and below, you'll learn more of the specifics of how much Part B costs and what it covers. ...

What does Part B cover?

In most cases, if you choose to buy Part A, you must also: Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

How much will Medicare premiums be in 2021?

People who buy Part A will pay a premium of either $259 or $471 each month in 2021 depending on how long they or their spouse worked and paid Medicare taxes. If you choose NOT to buy Part A, you can still buy Part B. In most cases, if you choose to buy Part A, you must also: Have. Medicare Part B (Medical Insurance)

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for. Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is Part B insurance?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Pay monthly premiums for both Part A and Part B. Contact Social Security for more information about the Part A premium. Learn how and when you can sign up for Part A. Find out what Part A covers.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. from Social Security or the Railroad Retirement Board.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is Medicare Part B excess charge?

Part B excess charges. If you receive services or items covered by Medicare Part B from a health care provider who does not accept Medicare assignment (meaning they do not accept Medicare as full payment), they reserve the right to charge you up to 15 percent more than the Medicare-approved amount.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

Does Medicare Part A require coinsurance?

Part A also requires coinsurance for hospice care and skilled nursing facility care. Part A hospice care coinsurance or copayment. Medicare Part A requires a copayment for prescription drugs used during hospice care. You might also be charged a 5 percent coinsurance for inpatient respite care costs.

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What is a Medicare donut hole?

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a “donut hole” or “coverage gap,” which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.